Investing while working abroad can be a challenging but rewarding endeavor. It requires careful planning and consideration of various factors, such as tax laws, currency fluctuations, and the availability of investment opportunities in your host country. This guide will provide a comprehensive overview of the key steps and strategies to help you navigate the process effectively. From understanding the local financial landscape to exploring investment options and managing your portfolio, we'll cover essential aspects to ensure your financial goals are met despite the geographical distance. Whether you're looking to build wealth, plan for retirement, or save for specific milestones, this article will offer valuable insights to empower you in your investment journey while living and working abroad.

What You'll Learn

- Understanding Local Financial Markets: Research and understand the financial markets in your host country

- Tax Implications: Familiarize yourself with tax laws to optimize your investment strategy

- Choose Investment Vehicles: Select suitable investment options like stocks, bonds, or mutual funds

- Online Brokerage Accounts: Utilize online platforms to manage investments remotely

- Diversify and Monitor: Diversify your portfolio and regularly review performance

Understanding Local Financial Markets: Research and understand the financial markets in your host country

When investing while working abroad, understanding the local financial markets is crucial for making informed decisions and maximizing your investment potential. Here's a detailed guide on how to approach this:

Research the Market Dynamics: Begin by thoroughly researching the financial markets of your host country. This includes studying the stock exchanges, commodity markets, and any unique financial instruments specific to that region. Understand the historical performance of these markets, including trends, volatility, and key events that have influenced their movements. For instance, if you're in a country with a thriving tech industry, explore the performance of technology-focused stocks and the factors driving their growth.

Study Local Investment Vehicles: Familiarize yourself with the investment options available in your host country. This could include local stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other securities. Each country has its own set of investment vehicles, and understanding their characteristics, regulations, and tax implications is essential. For example, you might discover that certain countries offer unique investment trusts or real estate investment funds that align with your investment strategy.

Analyze Economic Indicators: Dive into the economic indicators specific to your host country. These indicators provide valuable insights into the overall health and direction of the economy. Study factors such as GDP growth, inflation rates, unemployment data, interest rates set by the central bank, and trade balances. Understanding these indicators will help you assess the potential risks and opportunities within the local financial markets. For instance, a country with consistently low unemployment and high GDP growth might present attractive investment prospects.

Stay Informed about Local Regulations: Investing abroad often involves navigating different regulatory frameworks. Research and understand the legal and tax regulations governing foreign investments in your host country. This includes knowing any restrictions on foreign ownership, tax treaties, and reporting requirements. Compliance with local regulations is essential to avoid legal issues and ensure the smooth operation of your investments.

Utilize Local Resources: Leverage local resources and tools to gain a deeper understanding of the financial markets. This could include financial news outlets, market research reports, and regulatory body publications specific to your host country. Local financial advisors or investment consultants can also provide valuable insights tailored to your region. Engaging with these resources will help you stay updated on market developments and make more informed investment choices.

Stash Invest: Will It Ever Make the Leap to Desktop?

You may want to see also

Tax Implications: Familiarize yourself with tax laws to optimize your investment strategy

When investing while working abroad, understanding the tax implications is crucial to ensure compliance and optimize your financial strategy. Tax laws can vary significantly across different countries, and what may be considered standard in one jurisdiction could be entirely different in another. Here's a guide to help you navigate this complex aspect:

Research Local Tax Laws: Begin by thoroughly researching the tax laws of your host country. Each country has its own set of regulations regarding income tax, capital gains tax, and other relevant taxes. For instance, some countries may offer tax incentives for foreign investors, while others might impose higher tax rates on foreign-sourced income. Understanding these laws will enable you to make informed decisions about your investments.

Exemptions and Deductions: Familiarize yourself with the tax treaties and agreements between your home country and the country of residence. These treaties often provide guidelines for taxing foreign-earned income and can help prevent double taxation. Look for provisions related to tax exemptions, credits, or deductions that may apply to your investment activities. For example, certain countries might allow tax credits for foreign tax payments, which can significantly reduce your overall tax liability.

Reporting Requirements: Be aware of the reporting obligations associated with your investments. In some cases, you may need to file additional tax forms or reports to disclose your foreign assets and income. Stay informed about the deadlines and requirements to avoid penalties. It's essential to keep detailed records of your investments, including any transactions, gains, or losses, to ensure accurate reporting.

Consultation with Tax Professionals: Given the complexity of international tax laws, consulting a qualified tax advisor or accountant who specializes in cross-border taxation is highly recommended. They can provide personalized advice based on your specific circumstances. These professionals can help you structure your investments in a way that minimizes tax exposure and ensures compliance with all applicable laws.

Regular Review and Adaptation: Tax laws and regulations can change over time, so it's essential to stay updated. Regularly review your investment strategy and tax situation to make any necessary adjustments. This proactive approach will help you take advantage of new tax benefits or avoid potential pitfalls.

Invest in Yourself: Why Don't They?

You may want to see also

Choose Investment Vehicles: Select suitable investment options like stocks, bonds, or mutual funds

When investing while working abroad, it's crucial to choose investment vehicles that align with your financial goals, risk tolerance, and the local market conditions. Here's a detailed guide on selecting suitable investment options:

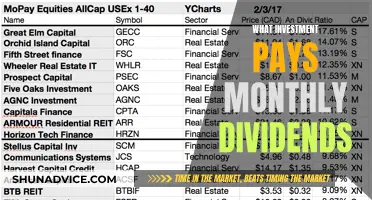

Stocks: Investing in stocks is a popular choice for many investors. When working abroad, you can consider investing in the local stock market or even explore international stocks listed on global exchanges. Research the local stock exchange and understand the listing requirements and regulations. Look for companies with strong fundamentals, growth potential, and a history of performance in the specific market you're investing in. Diversification is key; consider a mix of large-cap, mid-cap, and small-cap stocks to spread risk. You can also explore exchange-traded funds (ETFs) that track specific sectors or indexes, offering diversification within a single investment.

Bonds: Bonds are a more conservative investment option and can be a valuable addition to your portfolio. Local government bonds or corporate bonds issued by companies in the country where you work can be considered. Assess the creditworthiness of the issuer and the interest rate offered. Bonds provide regular income through interest payments, which can be particularly useful if you're saving for specific financial goals or need a steady cash flow. Remember that bond prices fluctuate, so consider the duration and risk profile of the bond before investing.

Mutual Funds: Mutual funds are a great way to invest in a diversified portfolio without the hassle of picking individual stocks or bonds. These funds pool money from multiple investors to invest in a carefully curated selection of securities. When working abroad, you can look for mutual funds that focus on the local market or specific sectors relevant to your region. Mutual funds managed by reputable fund managers can provide professional oversight, ensuring your investments are well-diversified and aligned with your risk appetite.

Consider Local Market Dynamics: Before making any investment decisions, thoroughly research the local market dynamics. Understand the economic environment, political stability, and any specific regulations or tax implications for foreign investors. Local financial advisors or consultants can provide valuable insights tailored to your situation. They can help you navigate the complexities of investing in a foreign market and ensure compliance with any legal requirements.

Remember, the key to successful investing while working abroad is diversification and a long-term perspective. Build a well-rounded portfolio that suits your financial objectives and regularly review and adjust your investments as needed.

Apple: Invest Now or Miss Out?

You may want to see also

Online Brokerage Accounts: Utilize online platforms to manage investments remotely

When it comes to investing while working abroad, online brokerage accounts have become an invaluable tool for expats and remote workers. These digital platforms offer a convenient and accessible way to manage your investments, providing a sense of control and flexibility in an otherwise challenging situation. Here's a guide on how to utilize online brokerage accounts to your advantage:

Choose a Reputable Online Brokerage: The first step is to select a reliable online brokerage firm that caters to international clients. Research companies that offer services tailored to expats, as they will provide the necessary support and resources to navigate the complexities of investing from a distance. Look for firms with a strong online presence, user-friendly interfaces, and a range of investment options. Many well-known brokerage houses now offer online platforms, ensuring you can access the markets from anywhere in the world.

Set Up an Account and Fund It: Once you've chosen your preferred brokerage, the process of opening an account is typically straightforward. You'll need to provide personal and financial information, and some may require additional documentation for verification. After setting up, you can fund your account using various methods, such as bank transfers, credit/debit cards, or even cryptocurrency, depending on the platform's offerings. Ensure you understand any fees associated with deposits and withdrawals to manage your finances effectively.

Explore Investment Opportunities: Online brokerage accounts provide access to a vast array of investment options. You can invest in stocks, bonds, mutual funds, exchange-traded funds (ETFs), and even derivatives. Research and analyze different assets to build a diversified portfolio that aligns with your financial goals and risk tolerance. Many platforms offer educational resources and market insights to help you make informed decisions. Consider starting with a small amount and gradually increasing your investments as you become more comfortable with the process.

Utilize Research and Trading Tools: Online brokerages often provide powerful research and trading tools to assist investors. These tools can include real-time market data, charting platforms, news feeds, and analytical reports. Utilize these resources to stay updated on market trends, identify potential investment opportunities, and make timely trading decisions. Some platforms also offer automated trading features, allowing you to execute trades based on predefined criteria, which can be useful for disciplined investors.

Stay Informed and Monitor Your Portfolio: Regularly reviewing your investments is crucial, especially when working remotely. Set up alerts and notifications to stay informed about market movements and significant events that may impact your holdings. Monitor your portfolio's performance and make adjustments as necessary. Online brokerages often provide portfolio analysis tools to help you track your investment returns, tax implications, and overall asset allocation. This information is vital for making strategic investment choices and ensuring your financial goals remain on track.

By utilizing online brokerage accounts, you can take control of your investments and make informed decisions, regardless of your physical location. It empowers you to build and manage a diversified portfolio, providing financial security and the potential for long-term growth. Remember, staying informed and regularly reviewing your investments is key to success in the ever-changing global financial markets.

Is Buying a House in Puerto Rico a Smart Investment?

You may want to see also

Diversify and Monitor: Diversify your portfolio and regularly review performance

When investing while working abroad, diversification is a key strategy to manage risk and optimize returns. This involves spreading your investments across various asset classes, sectors, and geographic regions. By not putting all your eggs in one basket, you reduce the impact of any single investment's performance on your overall portfolio. For instance, consider allocating a portion of your funds to stocks, bonds, real estate, commodities, and even alternative investments like derivatives or cryptocurrencies. Each asset class has its own unique characteristics and risk-return profile, so diversifying ensures that your portfolio is not overly exposed to any one market or type of investment.

One effective way to diversify is by investing in exchange-traded funds (ETFs) or mutual funds that track specific indices or sectors. ETFs and mutual funds offer instant diversification as they hold a basket of securities, providing exposure to multiple companies or asset classes. For example, you could invest in an ETF that tracks the S&P 500, which would give you a diversified position in 500 large U.S. companies, or a mutual fund focused on emerging market stocks for international exposure. This approach simplifies the diversification process and allows you to benefit from the expertise of fund managers who make investment decisions on your behalf.

In addition to asset allocation, consider diversifying your portfolio by investing in different countries and regions. International investing can provide access to new markets and opportunities, but it also comes with increased complexity and risk. By allocating a portion of your portfolio to international stocks, bonds, or real estate, you can benefit from global economic growth while also managing the risks associated with foreign markets. This could involve investing in developed markets like the U.S. or Europe, or exploring emerging markets in Asia, Africa, or Latin America, each offering unique growth prospects and challenges.

Regular monitoring and review of your investment performance are essential to ensure that your diversification strategy is working effectively. Market conditions and economic trends can change rapidly, and your investment choices should adapt accordingly. Schedule periodic reviews, such as monthly or quarterly, to assess the performance of your investments and the overall health of your portfolio. During these reviews, analyze the returns of each asset class and sector, and compare them to your initial investment goals and risk tolerance. This process allows you to make informed decisions about rebalancing your portfolio, which involves buying or selling assets to maintain your desired allocation.

Rebalancing is crucial to maintaining your investment strategy, especially when markets fluctuate. For instance, if stocks have outperformed bonds, you might need to sell some stock holdings and buy more bonds to restore the original balance. Regular reviews also help you identify any underperforming investments or sectors that may require adjustment or replacement. By staying proactive and responsive to market changes, you can ensure that your portfolio remains aligned with your financial objectives and risk preferences, even while working and investing from a distance.

Black Americans: Investors or Not?

You may want to see also

Frequently asked questions

Investing in your home country's stock market from abroad is possible through various methods. You can open a brokerage account with a local or international online broker that offers access to your home market. Many brokers provide services for expats, allowing you to trade stocks, bonds, and other securities online. Alternatively, consider using a trusted financial advisor who can guide you through the process and help you navigate any legal or regulatory requirements associated with cross-border investing.

Tax rules can be complex when investing internationally, especially for expats. It's essential to understand the tax laws in both your host country and your home country. In many cases, you may be subject to tax on any investment income or capital gains in your home country, even if you are not a resident there. Consult a tax professional who specializes in international tax matters to ensure compliance with tax regulations and explore potential tax-efficient strategies.

Yes, there are certain risks to consider when investing remotely. Firstly, you might face higher transaction costs and fees due to international money transfers and currency conversions. Secondly, market volatility and geopolitical events can impact your investments more significantly when you are not physically present in the market. Additionally, language barriers and a lack of local market knowledge could affect your decision-making. It's crucial to diversify your portfolio, stay informed about global economic trends, and regularly review your investments to manage these risks effectively.