Microsoft Excel is a powerful tool for creating and tracking investments. It can be used to calculate the average returns and standard deviation of returns for a single stock or a portfolio of stocks, helping investors understand the risk and volatility of their investments. With Excel, you can create a simple Profit and Loss (P&L) spreadsheet to monitor your investments and make informed decisions. This involves downloading a free Excel template or creating your own spreadsheet to input data such as entry and closing prices, returns, and the number of shares. You can then use formulas to calculate metrics like profit and loss, percentage return, and standard deviation, providing valuable insights for investment strategies.

| Characteristics | Values |

|---|---|

| Purpose | To keep track of investments and calculate performance and degree of volatility |

| Data to Include | Date, entry, size (number of shares), closing prices for the dates specified, the difference between the closing price and the entry price, the percentage return, profit and loss for each periodic closing price, and the standard deviation |

| Sections | Revenue, Expenses, and Summary |

| Formulae | SUM function, Profit and Loss formula, Percent Return formula, etc. |

| Tools | Microsoft Excel, Vertex42, ClickUp, etc. |

| Tips | Use categories that work for your business, create a consistent file naming system, save individual Excel files for each reporting period over the fiscal year within a folder, etc. |

What You'll Learn

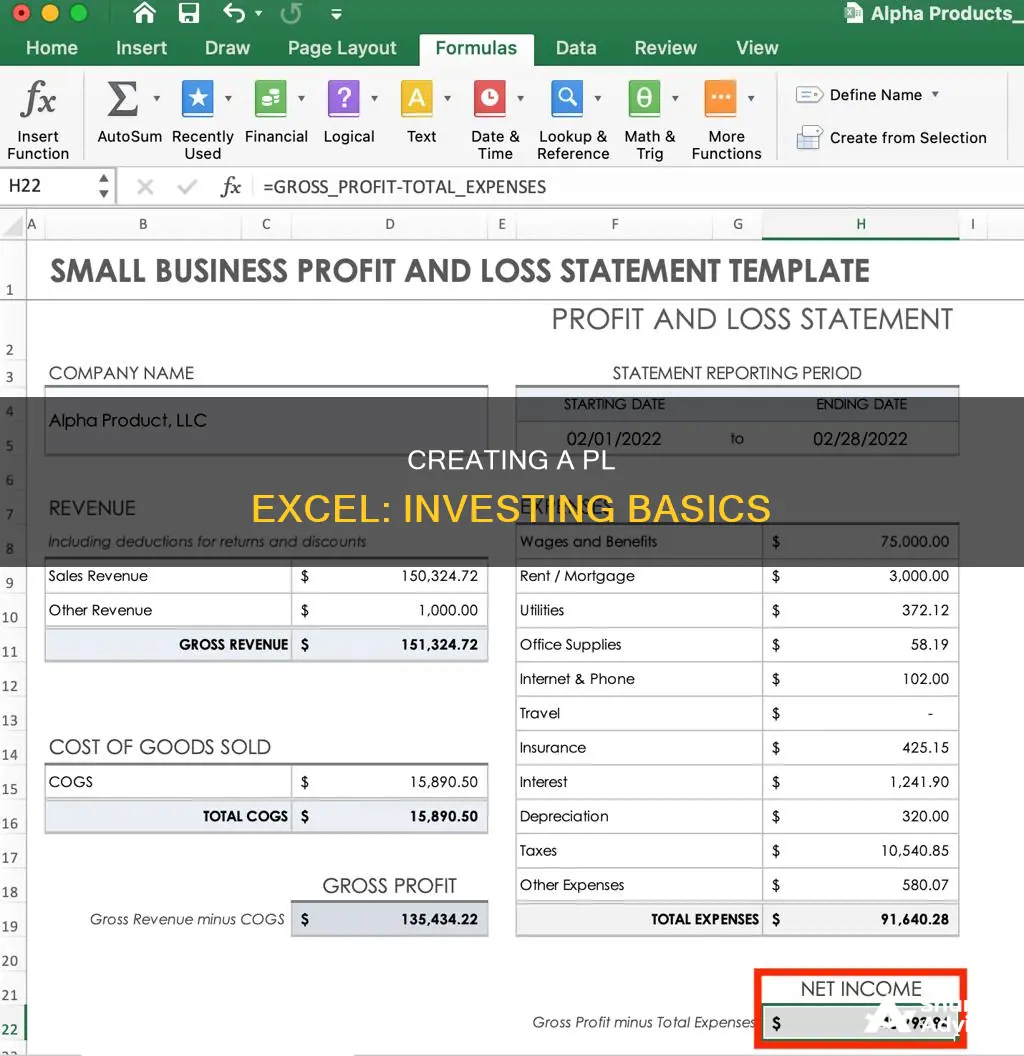

Creating a basic profit and loss statement

To create a basic profit and loss statement, you should first insert a heading and the period for which you are preparing the report. This will be followed by three sections: Revenue, Expenses, and Summary.

In the Revenue section, you will list all your revenue streams, such as service revenue, interest revenue, and sales revenue. You will then need to sum up all these revenues using the SUM function in Excel.

Similarly, in the Expenses section, you will list and total up all your expenses, such as advertisement costs and employee wages.

Finally, in the Summary section, you will calculate your net profit or loss using the formula: Net Profit/Loss = Net Revenue – Total Expenditures.

This basic profit and loss statement structure can be easily adapted to suit your specific needs and the complexity of your business. You can add or remove categories and line items as required.

Additionally, Excel offers various built-in functions to automate financial calculations, such as the Stocks feature, which keeps your stock prices updated. You can also utilise formulas to calculate metrics like the percentage return on an asset and profit and loss.

By using Excel's templates and functions, you can efficiently create and maintain a basic profit and loss statement to gain valuable insights into your business's financial performance.

Understanding Aaron's Portfolio: Equal Investment, Beta Calculation

You may want to see also

Tracking investments

To get started, decide on the data you want to include in your spreadsheet. This could include the date, entry, size (number of shares), closing prices for specified dates, the difference between the closing and entry price, the percentage return, profit and loss, and the standard deviation. You can also include more basic information such as the account name, stock ticker symbol, name of the investment, and the category it falls into.

Once you have your data, you can start creating formulas to automate some of the calculations. For example, to calculate the difference between an asset's current price and its entry price, you can use the formula: =current price-entry price. To calculate the percentage return, you can use the formula: =(price-entry)/entry.

For profit and loss, the formula is the difference multiplied by the number of shares, so =difference*number of shares.

One particularly useful feature of Excel is its ability to calculate standard deviation, which is a complex formula used to assess the risk of an investment. To find the standard deviation of a dataset, you can use the STDEV function under the Formulas heading in Excel.

Additionally, Excel can be connected to real-time stock tracking information, allowing you to always see the current value of your stocks. To get a stock quote, type in the ticker symbol, then select Data > Stocks. Excel will then convert your cells to the stocks data type, displaying live stock information.

With Excel, you can also calculate the break-even point of a stock, which is the price at which it will ensure a net income of zero. Anything beyond that point is pure profit. The formula for this is: =(((Buying Price*Shares Purchased+(Commission*2))/Shares Purchased)-Tax Rate*Buying Price)/(1-Tax Rate).

By using these tips and formulas, you can effectively track your investments and make more informed financial decisions.

Equities for Seniors: A Risky Retirement Gamble?

You may want to see also

Creating difference formulas

To calculate the difference between two values, you must first ensure that the two fields contain the same data type. For example, if you have "8" in one column and try to subtract "four" from it in another column, Excel will not be able to perform the calculation. You can ensure that both columns are the same data type by highlighting the columns and selecting a data type from the "Number" drop-down box on the "Home" tab of the Ribbon.

Once you have confirmed that the data types are the same, you can input the formula into a new, blank cell. If A1 and B1 are both numeric values, the formula would be:

=A1-B1

You can also use the formula =[B1-A1] to calculate a different value.

If you want to calculate the difference between two times, you can use a simple subtraction operation, such as =C1-A1, and select the custom format "h:mm" from the Format Cells options. Alternatively, you can use the TEXT() function, such as =TEXT(C1-A1,"h:mm"), which tells Excel to display the result in the hour:minute format.

To calculate the difference between two dates, you can use a simple subtraction formula, such as =B2-A2, to find the number of days between those two calendar dates. You can also calculate the number of weekdays between two calendar dates using the NETWORKDAYS() function, for example, =NETWORKDAYS(B2,A2).

To find the absolute difference between two numbers, you can use the ABS() function, which returns the value absent its sign. For example, if you have the numbers "3" and "5" in cells A1 and B1, respectively, the formula would be =ABS(A1,B1).

By using difference formulas in Excel, you can quickly and accurately calculate the difference between various values, making it a valuable tool for financial analysis and other calculations.

Equities to Target in the Late Expansion Phase

You may want to see also

Creating percent return formulas

Microsoft Excel is a powerful tool that can be used to track investments and calculate metrics such as the percentage return on an asset. The percentage return formula in Excel is used to calculate the difference between the current price of an asset and its entry price, divided by the entry price. This can be done by following these steps:

- Click on the cell where you want the percentage return value to appear.

- Type an equal sign (=) to begin the formula.

- Type an open parenthesis and click on the cell that contains the current price of the asset.

- Type a minus sign (-) to subtract the entry price.

- Click on the cell that contains the entry price of the asset.

- Type a closing parenthesis.

- Type a forward slash (/) to represent division.

- Click on the cell that contains the entry price again.

- Press enter, and the percent return will appear in the selected cell.

Note that you may need to format the cell to display the value as a percentage. This can be done by highlighting the column, right-clicking, and selecting "Format Cells", then selecting "Percentage" under the "Number" tab.

Additionally, Excel can also calculate the percentage of change between two values. The generic formula for this calculation is:

Percent Change = (New Value - Old Value) / Old Value

For example, if you want to calculate the percentage increase or decrease between two values, you can use the following formulas:

- Percentage increase = (New Value - Old Value) / Old Value

- Percentage decrease = (Old Value - New Value) / Old Value

These formulas can be applied to various scenarios, such as calculating discounts, interest rates, or investment returns.

Overall, creating percent return formulas in Excel is a valuable skill for tracking investments and making informed financial decisions.

Revisiting Investment Portfolio: Strategies for Staying Ahead

You may want to see also

Creating standard deviation formulas

Here's a step-by-step guide to creating standard deviation formulas in Excel:

- Select the Cell: Click on the cell where you want the standard deviation value to appear.

- Choose the Formula: Under the "Formulas" heading in Excel, select "Insert Function" (fx).

- Select "STDEV": In the "Insert Function" box, choose "Statistical" from the categories, and then scroll down and select "STDEV". Click "OK".

- Highlight the Cells: Highlight the cells for which you want to find the standard deviation. Be careful to select only the cells containing the return values and not any headers or labels.

- Calculate: Click "OK", and the standard deviation calculation will appear in the selected cell.

It's important to note that Excel offers different functions to calculate standard deviation, depending on whether you are working with a sample or the entire population of data. For a sample, use "STDEV.S" in Excel 2010 and later, or "STDEV" in Excel 2007 and earlier. For the entire population, use "STDEV.P" in Excel 2010 and later, or "STDEVP" in Excel 2007 and earlier.

Additionally, if your dataset includes logical (TRUE or FALSE) values or text, you can use "STDEVA" for a sample or "STDEVPA" for the entire population. These formulas treat FALSE as 0 and TRUE as 1 in the calculations.

Standard deviation is a powerful tool for assessing investment risk and volatility. It is a key component of modern portfolio theory, helping investors make informed decisions by understanding the risk and variability of returns.

Savings, Spending, and Investment: Understanding the Interplay

You may want to see also

Frequently asked questions

The simplest way to create a PL Excel for investing is to download a free template online and input your data. These templates are easy to use and can be modified to suit your needs.

To calculate the average return on your investment, use the formula =(Ending Price - Starting Price) / Starting Price. This will give you the average monthly return, which you can then annualise to get the annual average return.

Excel is a versatile and powerful tool that can help you keep track of your investments in an organised manner. It allows you to view and sort positions, including entry price, periodic closing prices, and returns. Additionally, Excel can automatically calculate metrics such as standard deviation, percentage return, and profit and loss.