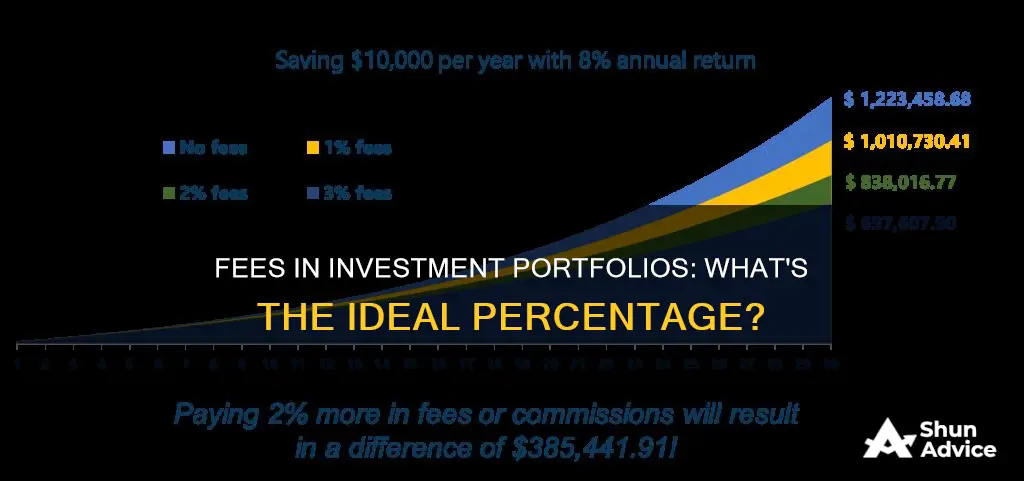

Investment fees can have a significant impact on your overall returns, and it's important to understand the costs associated with investing. While fees might seem small, they can add up over time and eat into your profits. For example, an annual fee of 0.5% on a $100,000 portfolio can reduce its value by $10,000 over 20 years. So, what percentage of your investment portfolio should fees represent? Let's explore this topic further and uncover some strategies for minimising fees and maximising your investment returns.

| Characteristics | Values |

|---|---|

| Average expense ratio for actively-managed equity mutual funds | 1.2% |

| Investment grade bond funds expense ratio | 0.9% |

| Average combined expense ratio for 60% global stock and 40% bond fund portfolio | 1.1% |

| Typical investment adviser fee | 1.0% per year on the first $1 million of assets under management |

| Combined mutual fund expense and adviser fee | Below 0.7% annually |

| Total cost for quality one-on-one advice | 0.5% |

| Management or advisory fee | 1% of total assets each year |

| Trading fees range | 0.20% - 2.00% |

| Expense ratio | 1% |

| Sales charge (or load) fees range | 5% |

| Account fees | Monthly maintenance fees, inactivity fees, fees for not keeping a minimum account balance |

| Transfer fees range | $0 - $100 |

| Account closure fee range | $50 - $100 |

Management or advisory fees

There are several types of advisor fees. Firstly, transaction-based fee structures involve paying commissions or 'loads' to purchase products or trade in the market. Secondly, asset-based fees are based on a straightforward percentage charge of assets under management (AUM), such as 1% or more per year. Thirdly, fee-based advisors charge a flat fee or hourly rate that involves neither commissions nor asset-based fees.

Financial advisors may offer several different cost structures, including annual AUM fees, a flat annual or monthly fee, an hourly rate, a one-time financial plan fee, or, for some advisors, commissions. AUM fees can range from 0.25% to 1% per year, with robo-advisors typically charging at the lower end of this range. Retainers typically cost $2,000 to $7,500 annually, while hourly rates range from $200 to $400. One-time financial plans often cost between $1,000 and $3,000, and commissions may be 3% to 6% of an investment.

It is important to understand the incentives created by different cost structures. Commission-based advisors may be under pressure to generate commissions and may not give advice that is in the best interest of the client. Therefore, it is recommended to hire a fee-based advisor, not a commission-based one, to ensure unbiased financial advice.

The average fee for a financial advisor's services is around 1% of assets under management (AUM) annually, although this can vary depending on the size of the account and the type of management strategy employed. Actively managed portfolios, which involve a team of investment professionals buying and selling holdings, typically incur higher fees than passively managed portfolios.

When determining the appropriate management or advisory fees for an investment portfolio, it is essential to consider the level of service provided, the geographic area, and other factors. While there is no one-size-fits-all answer, understanding the different fee structures and negotiating fees can help ensure that you are getting the best value for your money.

Exploring Private Savings and Investment Spending Dynamics

You may want to see also

Trading fees

Types of Trading Fees

- Trade commissions: Charged when buying or selling stocks, options, or exchange-traded funds (ETFs). These fees typically range from $3 to $7 per trade, depending on the broker.

- Mutual fund transaction fees: Charged by brokers when buying or selling mutual funds. These fees can range from $10 to $75 per transaction.

- Expense ratios: Annual fees charged by mutual funds, index funds, and ETFs as a percentage of your investment. These fees cover operating costs, including management and administrative expenses.

- Sales loads: Sales charges or commissions on some mutual funds, paid to the broker or salesperson who sold the fund. These fees can range from 3% to 8.5% and can be structured as front-end loads (upfront fees), back-end loads (fees charged when shares are sold), or level loads (a combination of upfront and back-end fees).

- Management or advisory fees: Fees paid to financial advisors or robo-advisors for managing your investments. These fees are typically a percentage of assets under management, a flat fee, an hourly fee, or a retainer. Financial advisors may charge around 1% of assets under management, while robo-advisors often charge lower fees, such as 0.25%.

- Account fees: Some brokers charge annual fees, inactivity fees, maintenance fees, or paper statement fees. These fees can vary depending on the broker and can often be avoided by choosing a different broker or opting for electronic statements.

Impact of Trading Fees on Investment Returns

Minimizing Trading Fees

It is important to carefully consider the fees associated with your investments and choose brokers and investment products that align with your financial goals and budget. Here are some ways to minimize trading fees:

- Compare brokers: Shop around and compare the fees charged by different brokers. Some brokers offer commission-free trading for certain types of investments or provide discounts for high-volume traders.

- Choose no-load funds: Mutual funds with sales loads incur additional sales charges. By choosing no-load funds, you can avoid these extra fees, and these funds tend to outperform load funds over time.

- Consider index funds and ETFs: Actively managed funds often charge higher fees but may not provide better returns. Index funds and ETFs track market performance for a lower cost, typically around 0.2% per year.

- Opt for robo-advisors: Traditional financial advisors can be more expensive, charging around 1% of assets under management. Robo-advisors use algorithms to provide automated financial planning and investment management for lower fees, typically between 0.20% and 0.30% annually.

- Review fee schedules: Before opening an account with a broker, carefully review their fee schedule to understand all the fees you may be charged. Ask questions and read the fine print to avoid unexpected costs.

Tilt Your Investment Portfolio: Value and Small-Cap Focus

You may want to see also

Expense ratios

When investing in mutual funds or exchange-traded funds (ETFs), one of the most critical factors to consider is the expense ratio. The expense ratio is the cost of owning a mutual fund or ETF, essentially a management fee paid to the fund company for the benefit of owning the fund. It is calculated by dividing a fund's net expenses by its net assets, or its operating expenses by its net assets. The expense ratio is usually expressed as a percentage of the fund's average net assets, although it can also be calculated as a flat dollar amount. For example, a fund with a 0.30% expense ratio will charge $30 per year for every $10,000 invested.

The expense ratio of a fund is influenced by its operating expenses, including management fees, advertising and promotion expenses (referred to as 12b-1 fees), and other relevant operating fees such as accounting, auditing, and legal fees. These expenses reduce the fund's assets and, consequently, the return to investors because the expense ratio is deducted from the fund's gross return.

It is worth noting that expense ratios have been declining over the years due to increased competition for investor dollars. Many passive funds have expense ratios below 0.10%, and some even have ratios of 0%. Actively managed funds tend to have higher expense ratios than passively managed funds, as they require a team of portfolio managers to operate the fund.

When evaluating a fund, it is crucial to consider both the expense ratio and the expected portfolio return. While a low expense ratio is generally favourable, it is essential to balance it with the potential returns. Additionally, investors should be mindful of other fees and costs associated with investing, such as trading commissions and account service fees, which can impact their overall investment portfolio.

Diversifying Savings and Investments: A Smart Money Move

You may want to see also

Sales charge fees

Investment fees can have a significant impact on your portfolio over time, so it's important to understand the different types of fees you may encounter. One such fee is the sales charge fee, which is a commission paid by investors on an investment in a mutual fund. This fee is paid to the financial intermediary, such as a broker, financial planner, or investment advisor, who facilitates the transaction.

It's important to note that sales charges do not factor into the gross and net expense ratio of a fund. Instead, they are paid to financial intermediaries for their role in selling the fund. Investors should be mindful of these charges and understand the fees associated with their investments, as they can eat into their returns.

To minimise or avoid sales charge fees, investors can consider seeking out no-load funds or exchange-traded funds (ETFs). It's worth noting that while sales charges can be avoided, other costs such as the bid-ask spread on ETFs may still apply.

When considering investment fees, it's important to remember that minimising fees can often maximise performance over time. However, it's also crucial not to let fees dominate your investment decision-making process exclusively. Different investment products carry different inherent fees, with derivatives and other esoteric assets tending to carry higher fees, while indexed ETFs and bond funds often have lower fees.

As with any investment decision, it's essential to ask questions and understand all the associated fees and costs. By doing so, investors can make more informed choices and potentially improve their overall investment performance.

Strategies for Taking Control of Your Investment Portfolio

You may want to see also

Account fees

For example, let's say you have an investment portfolio worth $100,000 and you are charged an annual account maintenance fee of 0.5%. That's $500 a year, or $4500 over nine years. Now, suppose that instead of paying a flat rate, you're charged a percentage-based fee of 1% of your total assets each year. That's $1000 a year, or $9000 over nine years—a significant difference.

It's worth noting that not all financial institutions charge account fees, so it's important to shop around and compare different brokers and financial institutions before deciding where to open an investment account. Additionally, some firms may charge a higher rate for one type of fee and a lower rate for another, so it's essential to review the fee schedule and understand all the costs involved.

While it's important to be mindful of account fees, they shouldn't be the only factor in your investment decision-making process. Finding the right balance between fees and the value provided by the financial institution is crucial.

Investing Wisely: Choosing the Right Portfolio for You

You may want to see also

Frequently asked questions

There is no definitive answer to this question as it depends on a number of factors, including the type of investment account, the financial institution, and the portfolio balance. However, experts recommend keeping fees to a minimum as they can significantly impact overall returns. For example, an annual fee of 0.5% on a $100,000 portfolio can reduce its value by $10,000 over 20 years.

There are several types of fees that may be incurred when investing, including management or advisory fees, trading fees, expense ratios, sales charges, account fees, transfer fees, and account closure fees.

Here are some strategies to reduce investment fees:

- Review your investment statements to understand how fees are impacting your returns.

- Reduce your trading activity or use a commission-free broker.

- Choose lower-cost investments, such as index funds, which have lower expense ratios than actively managed funds.

- Use tax-advantaged accounts or tax-loss harvesting strategies to minimize taxes.

- Consider using a robo-advisor, which tends to be less costly than a human advisor.

- Shop around and compare fees across different financial institutions.

- Negotiate with your advisor to reduce certain investment costs.

The frequency of investment fees depends on the type of fee. Some fees are ongoing and charged monthly or annually, while others are charged per transaction or when buying or selling specific assets.