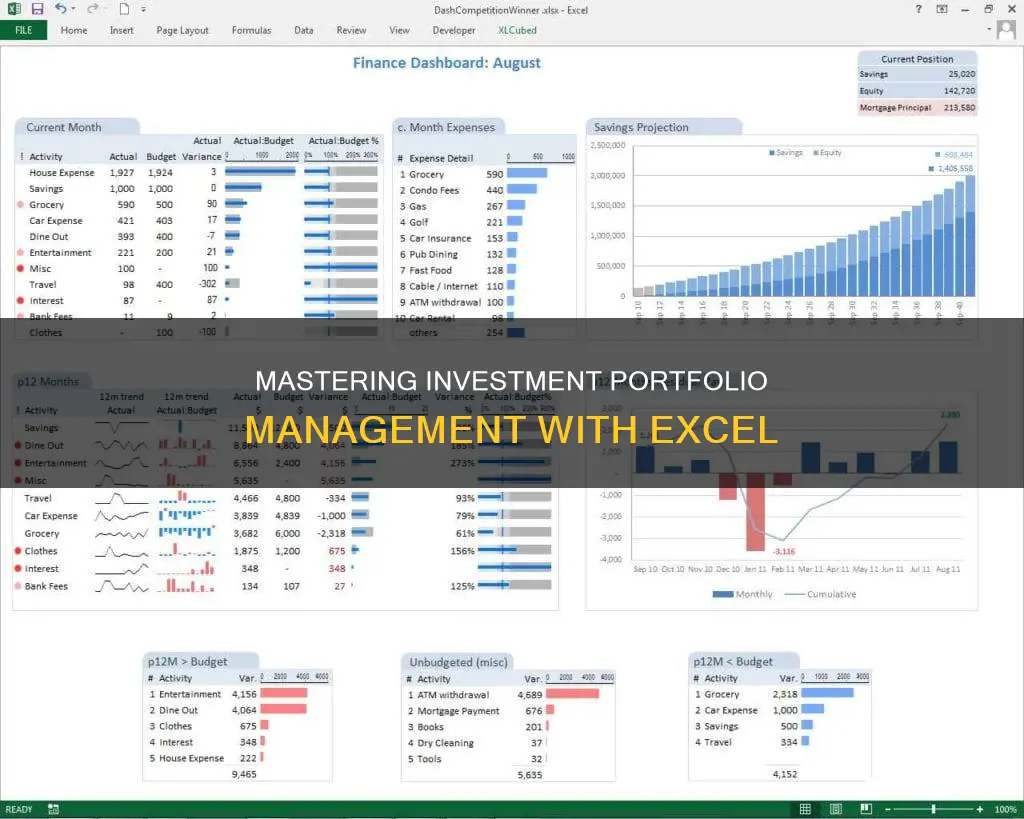

Managing your investment portfolio in Excel is a great way to keep track of your account's performance. With Excel, you can perform a comprehensive range of risk and return analysis functions, calculate historical monthly returns, and even simulate efficient frontier and Monte Carlo scenarios to optimise your portfolio. You can also use Excel to graph your portfolio's performance and calculate the profit and loss of your trades. This allows you to visualise your daily portfolio value and percentage changes over time. Additionally, Excel enables you to download your transaction history and open positions, making it easy to access and analyse your data. By utilising the various functions and features available in Excel, you can make informed decisions about your investment portfolio and implement your own investment strategies.

| Characteristics | Values |

|---|---|

| Risk-Return Analysis | Comprehensive list of risk and return analysis functions |

| Portfolio Optimisations | Efficient frontier, Monte Carlo simulation |

| Basic Analysis Metrics | Monthly returns, efficient frontier, wealth index, beta, volatility |

| Data | Copy and paste from other sources, or download directly as an Excel file |

| Graphs | Line graphs, bar charts, pie charts |

What You'll Learn

Risk-return analysis

Data Preparation:

Firstly, you need to organise your data in Excel. Enter relevant data labels such as Portfolio Value, Investment Name, Investment Value, Investment Return Rate, Investment Weight, and Total Expected Return in the cells across the top of your spreadsheet (e.g., A1 through F1). In the rows below, input the current value and expected rate of return for each investment. You can also indicate the weight of each investment, which represents the proportion of your portfolio allocated to each asset.

Calculating Total Expected Return:

To calculate the overall portfolio rate of return, you can use the following formula in Excel:

- Investment Weight: In cell E2, enter the formula =(C2/A2) to calculate the weight of the first investment. Repeat this formula in subsequent cells to find the weight of each investment, always dividing by the value in cell A2 (the total portfolio value).

- Total Expected Return: In cell F2, input the formula =(D2*E2)+(D3*E3)+... to calculate the total expected return. Multiply the expected return rate of each investment (D2, D3, etc.) by its respective weight (E2, E3, etc.) and sum them up.

Using Functions for Portfolio Return:

Excel provides functions like AVERAGE and SUMPRODUCT to streamline your calculations:

- Average Realised Returns: Use the AVERAGE function to find the average realised returns for each investment. For instance, if your returns for Tesla, Amazon, and Netflix are in cells H2, I2, and J2, enter =AVERAGE(H2:J2) to calculate the average.

- Portfolio Return: As a portfolio's return is the weighted average of returns from individual assets, use the SUMPRODUCT function. In this case, the formula would be =SUMPRODUCT(H2:J2, H3:J3), where H2:J2 contains the investment weights, and H3:J3 contains the average realised returns.

Calculating Portfolio Risk:

Portfolio risk represents the combined risk of each individual investment. Standard deviation is commonly used as a proxy for portfolio risk. Excel offers functions to calculate portfolio risk:

- Variance-Covariance Matrix: You can construct a variance-covariance matrix to calculate portfolio risk. This includes variances of each investment and covariances of each investment pair. Use VAR.S to compute variances and COVARIANCE.S for covariances.

- Portfolio Risk Formula: Finally, apply the portfolio risk formula to compute the risk: =SQRT(H2^2*H6+I2^2*I7+J2^2*J8+2*H2*I2*I6+2*H2*J2*J6+2*I2*J2*J7), where H2, I2, J2 are investment weights, H6, I7, J8 are variances, and I6, J6, J7 are covariances. The SQRT function provides the return volatility or standard deviation.

Alternative Method:

As an alternative, you can add a column for the portfolio's monthly returns and calculate the portfolio return and risk directly using the standard deviation function (STDEV.S). This method is faster as it bypasses the need to construct the variance-covariance matrix.

By utilising these Excel functions and formulas, you can effectively perform risk-return analysis on your investment portfolio, aiding in decision-making and optimising your investment strategy.

Savings or Investments: The Best Way to Utilize Your 100K

You may want to see also

Portfolio optimisations

Portfolio optimisation is a key part of investment portfolio management in Excel. There are several methods and models to optimise your portfolio, depending on your goals and constraints.

One method is to use the Excel Solver function, which can be used to optimise an investment portfolio based on total yield or auto loans. The Solver Parameters dialog box allows you to set your objective value, select the Max or Min option, and fill in the field for variable cells. You can also add constraints and select a solving method.

Another approach is to use the Excel Portfolio Optimisation Template, which helps establish optimal capital weightings for portfolios of financial investments or business assets. This template allows for flexibility and customisation, accommodating up to 100 securities or business cash flow data. It also enables you to adjust risk assessment options and portfolio dynamics to align with specific business requirements and preferences. The template provides a simple data input workflow and integrated help information.

Additionally, you can utilise the various functions and features offered by MarketXLS, which include risk-return analysis, portfolio optimisation, and basic analysis metrics. With MarketXLS, you can calculate the efficient frontier, perform Monte Carlo simulations, and determine the best returns on your portfolio at the lowest risk.

Other portfolio optimisation models available in Excel include the Markowitz Model, Efficient Frontier, Sharpe Model (CAPM), and Bond Portfolio Management scenarios. These models help allocate funds to stocks, optimise for minimum risk and target rates of return, and ensure portfolio duration matches the investment horizon.

By leveraging these tools and techniques, you can effectively optimise your investment portfolio in Excel, maximising returns while minimising risks and making informed investment decisions.

Understanding Your Total Investment Portfolio

You may want to see also

Basic analysis metrics

Excel is a powerful tool for managing your investment portfolio. It can be used to track investments, calculate performance, and assess volatility. One of its key features is the ability to automatically calculate metrics such as standard deviation, percentage return, and profit and loss.

To get started, decide on the data you want to include in your spreadsheet. This may include the date, entry, size (number of shares), closing prices for specified dates, the difference between the closing and entry price, percentage return, profit and loss, and standard deviation.

You can create formulas in Excel to calculate the difference between an asset's current price and its entry price. For example, to find the difference, click on the cell where you want the difference to appear, type an equals sign, click on the cell with the current price, type a minus sign, and then click on the cell with the entry price. Press enter, and the difference will appear. You can then drag the formula to other cells to calculate the difference for each dataset.

To calculate the percentage return, follow a similar process: select the cell, type an equals sign, then an open parenthesis, click on the cell with the current price, type a minus sign, then click on the cell with the entry price, and close the parenthesis. Next, type a forward slash to indicate division and click on the entry price cell again. Press enter, and the percentage return will appear. You may need to format the cells to display the values as percentages.

The profit and loss formula is the difference multiplied by the number of shares. To calculate this, select the cell, type an equals sign, click on the cell with the difference, type an asterisk to indicate multiplication, and then click on the cell with the number of shares. Press enter, and the profit or loss for that data point will appear. You can then format the column to display the values in your desired currency.

Excel also allows you to calculate the standard deviation of a dataset, which is a measure of volatility and risk. To do this, click on the cell where you want the standard deviation to appear, go to the Formulas tab, select the Insert Function option, choose "Statistical" under Select a Category, and then select STDEV. Highlight the cells for which you want to find the standard deviation, and press enter.

These basic analysis metrics will help you track and evaluate the performance of your investment portfolio in Excel.

Portfolio Theory: Investment Analysis Fundamentals Explained

You may want to see also

Portfolio beta and volatility

Beta and volatility are important metrics for assessing the riskiness of an investment portfolio. Beta measures the sensitivity of an asset's returns to changes in the overall market, with a value of 1 indicating that the asset's returns move in line with the market, a value above 1 indicating greater volatility than the market, and a value below 1 suggesting lower volatility. Volatility, meanwhile, measures the degree of variation in an asset's returns over time, with higher volatility indicating greater risk.

Calculating the beta of a portfolio in Excel requires a few steps. First, you need to gather historical price data for each asset in your portfolio and for the benchmark index you want to use (commonly the S&P 500). You can find this data on financial websites like Yahoo Finance or Google Finance. Once you have the data, calculate the percentage change in prices for each asset and the benchmark over the same period. Next, find the variance of the benchmark using the VAR.S function in Excel, and then calculate the covariance of each asset to the benchmark using the COVARIANCE.S function. Finally, you can calculate the portfolio beta by dividing the covariance of each asset by the variance of the benchmark.

It's important to note that the time frame you choose for your calculations can impact the results, as beta and volatility are time-dependent metrics. Additionally, the index you use as a benchmark can also affect your beta calculations, especially if your portfolio includes international assets. By calculating beta in Excel, you have the flexibility to choose the time frame and benchmark that best suit your investment needs.

Volatility can be calculated similarly to beta. First, calculate the percentage change in prices for each asset in your portfolio over the desired time period. Then, use Excel's VAR.S function to calculate the variance of these percentage changes, which will give you the volatility of each asset. You can also weigh each asset's volatility by its proportion in your portfolio to get a weighted average volatility for the entire portfolio.

By understanding the beta and volatility of your investment portfolio, you can make more informed decisions about risk and return. A portfolio with high-beta stocks is likely to experience larger swings in value, while a portfolio with low-beta stocks may offer more downside protection during market downturns. Volatility can also help you gauge the potential for gains or losses over time. Remember that investing carries inherent risks, and past performance does not guarantee future results.

Strategies for Maintaining a Healthy Investment Portfolio

You may want to see also

Calculating profit and loss

Understanding Gains and Losses

Before delving into calculations, it's essential to understand the concept of gains and losses. A gain occurs when the market value of an asset exceeds its purchase price. Conversely, an investor incurs a loss when the current value of an asset is lower than the price at which it was purchased. Portfolios often include a mix of domestic and international stocks, bonds, and cash, making it crucial to calculate gains and losses accurately.

Calculating Percentage Gain or Loss

To find the percentage gain or loss for a particular stock, use the following formula: Percentage Gain/Loss = [(Current Price - Purchase Price) / Purchase Price] x 100. For example, if you buy a stock for $50 and its value increases to $52, your percentage gain is 4% ([$52 - $50] / $50) x 100.

Determining Net Gain or Loss

To calculate the net gain or loss for your portfolio, you need to consider the total value of your portfolio. This involves evaluating the individual gains and losses for each asset and then aggregating them. Here's a simple formula to calculate the net gain or loss: Net Gain/Loss = (Total Value of Portfolio at the End - Total Value of Portfolio at the Beginning) / Total Value of Portfolio at the Beginning.

Using Excel Functions

Excel provides a range of functions that can assist in calculating profit and loss. For instance, the SUMPRODUCT function can be used to calculate the average cost of shares when there are multiple buy and sell actions. This function multiplies the buy quantities with the cost, adds the result to the sell quantities multiplied by the cost, and then divides that sum by the total quantities bought and sold.

Utilizing Templates

Excel also offers various templates specifically designed for creating profit and loss statements. These templates can be highly beneficial for small businesses or individuals looking to streamline the process. The templates often include built-in formulas that automatically calculate gross revenue, gross profit, and net income when relevant data is inputted.

Visualizing Data

To make informed decisions, it's helpful to visualize your profit and loss data. Excel enables you to create graphs and charts that represent changes in your portfolio's performance over time. This visualization can help you identify trends, make forecasts, and adjust your investment strategies accordingly.

In summary, calculating profit and loss for your investment portfolio in Excel involves understanding gains and losses, determining percentage changes, and utilizing Excel functions and templates. By following these steps and customizing the calculations to fit your portfolio, you can effectively manage and analyze your investment portfolio's performance.

Investing Savings Wisely: Your Path to Home Ownership

You may want to see also

Frequently asked questions

First, you need to get your historical portfolio values. You can find these on the "Graph My Portfolio" page of your investment account. Copy and paste them into Excel.

You will need your historical portfolio values, historical stock prices, transaction history, and open positions.

Go to the quotes page and search for the stock using the old quotes tool. Click on the "Historical" tab, and change the "Start" and "End" dates to the desired time period. Copy and paste the data into Excel.

First, sort your transaction history by ticker symbol and date. Then, for each trade, calculate the total cost of the shares you sold by multiplying the purchase price by the number of shares sold. Add this number to the "Total Amount" from when you sold your shares to get your profit or loss.