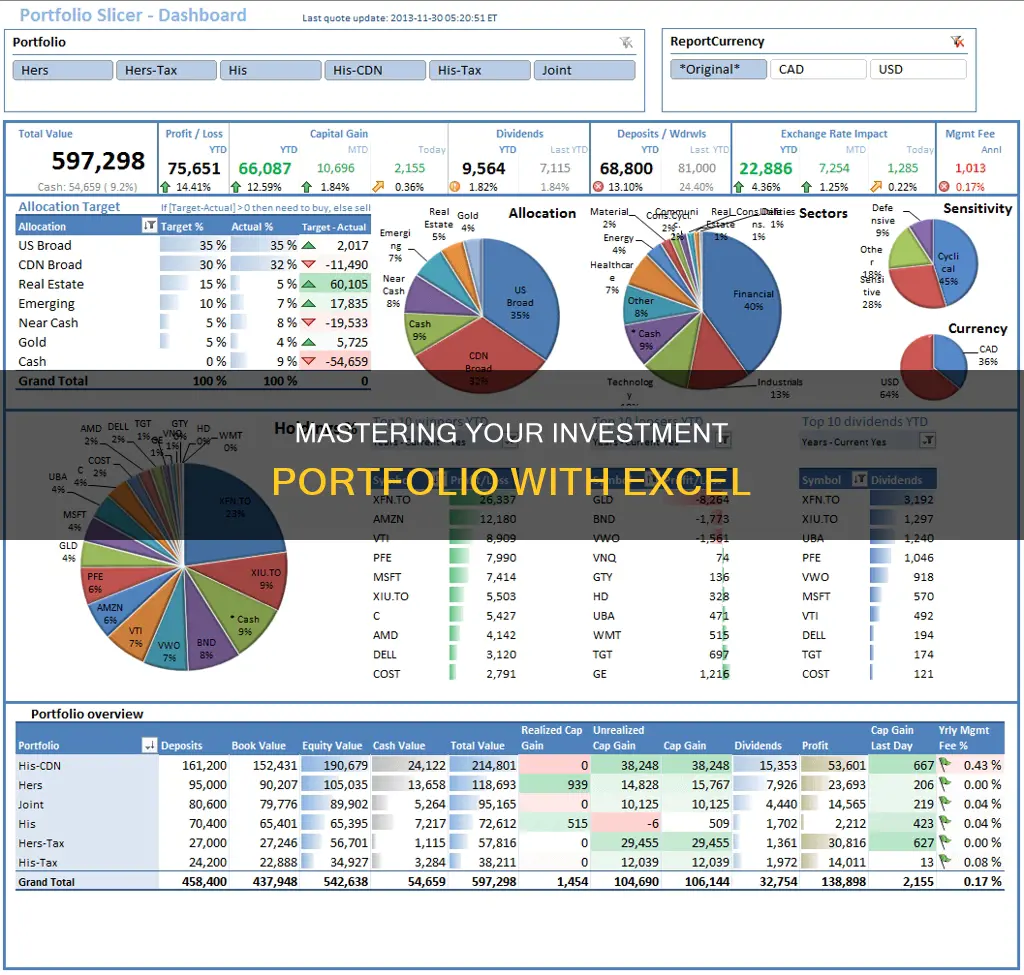

Keeping track of your investments is essential to understanding your financial health and making informed decisions. One way to do this is by using a spreadsheet program like Microsoft Excel, which offers a range of features to help you stay organised. With Excel, you can automatically calculate metrics such as an asset's or portfolio's standard deviation, percentage return, and overall profit and loss. You can also create formulas to calculate the difference between an asset's current and entry price, profit and loss, and more.

Excel's built-in Stocks feature allows you to pull stock data and create rules, spot trends, and compare stocks. Additionally, you can add your own investment information, such as the number of shares purchased and the overall amount spent. By using Excel, you can centralise all your investment data in one location, making it easier to monitor your progress and rebalance your portfolio when needed.

Excel also offers the flexibility to create a simple or complex spreadsheet depending on your preferences and needs. Whether you're a seasoned investor or just starting, Excel can be a valuable tool for tracking and managing your investments.

| Characteristics | Values |

|---|---|

| Purpose | To keep track of investments in an organized manner |

| Data to Include | Date, entry, size (number of shares), closing prices for specified dates, difference between closing price and entry price, percentage return, profit and loss for each periodic closing price, standard deviation |

| Additional Data | Number of shares purchased, overall amount spent, current value of each stock, target price, charts and diagrams to understand distribution of investment portfolio |

| Formulas | Difference formulas, percent return formulas, profit/loss formulas, standard deviation formulas |

| Benefits | Single location to store all investment data, shows entire record of purchases, sells, dividends, return of capital transactions, and splits, easy to use with automatic calculations, helps with financial decision-making, can be used for international assets, makes rebalancing easier |

| Tools | "Stocks" feature to pull information, "Data Types" to convert corporation names into stocks and generate relevant stock information, "Insert Function" option under "Formulas" heading to calculate standard deviation |

What You'll Learn

Record transactions with 'Investment' and 'Sales' ledgers

Recording transactions with Investment and Sales ledgers is a crucial step in effectively managing your investment portfolio. This process involves meticulously documenting your investment activities, including purchases and sales, to maintain an accurate record of your financial journey. Here's a detailed guide on how to record transactions using Investment and Sales ledgers:

Investment Ledger:

The Investment Ledger serves as the foundation of your portfolio tracking system. It is where you record the initial details of your investments. Here are the steps to create an Investment Ledger:

- Transaction Date: Begin by entering the date of the transaction when you purchased the securities.

- Security Name: In this column, input the name of the security you are investing in. For example, if you are buying stocks, you would enter the name of the company, such as Alphabet Inc. (GOOG).

- Number of Shares: Record the quantity of shares you have acquired for each security.

- Unit Price: Note down the price per share at the time of purchase.

- Trade Fee and Commission: If applicable, include any trade fees or commissions associated with the transaction. Trade fees are typically fixed sums, while commissions are calculated as a percentage of the purchase price.

Sales Ledger:

The Sales Ledger complements your Investment Ledger by tracking the sales or disposals of your investments. This ledger helps you monitor the performance of your investment decisions and provides a clear record of your transactions:

- Sale Date: Start by entering the date on which you sold the securities.

- Security Sold: In this column, select the security you have sold from a dropdown menu. This menu will be populated based on your previous inputs in the Investment Ledger, making it easy to choose the relevant security.

- Number of Units Sold: Record the quantity of units or shares that you sold for each security.

- Sale Price: Note down the price per share at which you sold the securities.

- Fees or Commissions: Similar to the Investment Ledger, include any applicable fees or commissions associated with the sale transaction.

By maintaining comprehensive Investment and Sales ledgers, you will have a detailed record of all your investment activities. This information will empower you to make informed decisions, track the success of your investment strategies, and gain valuable insights into your financial journey.

Savings and Investment: Finding Equilibrium Balance

You may want to see also

Track portfolio performance

Tracking portfolio performance is essential for understanding the health of your investments and making informed decisions. Here are some steps to effectively track your portfolio's performance using Microsoft Excel or Google Sheets:

Record Investment Data:

Start by creating a new spreadsheet and listing the stocks you own or plan to purchase. You can use the company's full business name, traded name, or ticker symbol. Include the number of shares purchased and the amount spent on each stock. This data will serve as the foundation for your portfolio tracking.

Convert Data to Stocks:

Excel and Google Sheets allow you to convert corporation names into stocks, which will generate relevant stock information. Select the data range, go to the "Data" tab, and choose "Stocks." This will convert the company names into their full business names, along with their traded names.

Generate Relevant Information:

Click on any cell containing a stock name in your portfolio. You will find an icon that, when clicked, displays a drop-down list. From this list, select the information you want to generate, such as stock price, market capitalization, and percentage change. Typically, traders prefer to monitor these types of data.

Calculate Current Value:

Multiply the number of shares (column G) by the current stock price (column B) to calculate the current value of each investment. This step is crucial for understanding the worth of your investments at any given time.

Analyze Performance:

Add a new column to indicate whether you are gaining or losing on each stock. Set conditional formatting to visually represent the gain or loss. You can calculate this by subtracting the initial investment from the current value of each investment. Additionally, consider adding charts and diagrams to visualize the distribution of your portfolio and the composition of your overall returns.

Monitor Dividend Payments:

If your stocks offer dividend payments, add this information to your portfolio. Unfortunately, Excel does not have an automatic function for this, so you will need to manually check the yearly yield of each stock and add a table for the amounts received.

Utilize Additional Tools:

Explore the various formulas and functions available in Excel to enhance your portfolio tracking. For example, you can calculate the difference between the current and entry prices, percentage return, profit and loss, and standard deviation to assess volatility and risk.

By following these steps, you will be able to effectively track your portfolio's performance, make informed investment decisions, and visualize your capital's performance over time.

Diversifying Your Investment Portfolio: Strategies for Success

You may want to see also

Monitor potential investments with a watchlist

Monitoring potential investments with a watchlist is a crucial aspect of effective portfolio management. Here's a detailed guide on how to set up and utilize a watchlist in Excel to stay informed about potential investment opportunities:

Step 1: Creating the Watchlist

Start by opening a new Excel spreadsheet and inserting the stocks you're interested in monitoring. You can list the companies by their business name, traded name, or ticker symbol. For instance, if you're interested in tracking stocks like Amazon, Google, Microsoft, Walmart, and Capital One, simply type their names or ticker symbols in the first column.

Step 2: Converting Data into Stocks

Once you've listed the stocks, highlight the data and navigate to the "Data" section in the toolbar. Click on "Data Types" and select "Stocks." This action will convert the company names or ticker symbols into stock data types, and you'll see the full business name and traded name appear alongside each entry.

Step 3: Generating Relevant Information

Now, click on any cell containing a stock name in your watchlist. A small icon will appear, and when clicked, it will display a drop-down list of information options. Select the data you want to generate, typically including stock price, market capitalization, and percentage change. This information will automatically populate your watchlist.

Note that Excel updates stock information once daily, after the market's closing hour, so you won't see hourly changes.

Step 4: Analyzing Historical Performance

Excel's watchlist feature also allows you to analyze the historical performance of the stocks on your watchlist. You can select a specific stock, define a time period, and choose an interval type (daily, weekly, or monthly). Excel will then generate a dynamic chart that tracks the stock's performance over the chosen timeframe, helping you identify trends and patterns.

Step 5: Setting Target Prices

You can also set customizable target prices for buying or selling stocks on your watchlist. This feature enables you to make informed decisions by setting thresholds that align with your investment goals and strategies.

Step 6: Visualizing Data with Charts

To gain a clearer understanding of your watchlist's performance, consider inserting charts and diagrams. These visual tools help you see the distribution of your potential investments and identify the main contributors to your overall returns.

Step 7: Staying Informed and Seizing Opportunities

By regularly maintaining and reviewing your watchlist, you can make proactive investment decisions. Just like Jordan Belfort from "The Wolf of Wall Street," you can quickly identify potential opportunities, such as a potential rise in a particular stock, and decide whether it's the right time to invest.

In conclusion, a watchlist in Excel is a powerful tool for investors, providing an organized space to monitor potential investments, analyze historical data, and make strategic decisions. It empowers you to stay ahead in the dynamic world of investing by offering timely information and insights.

Maximizing Your Savings Account: A Guide to Smart Investing

You may want to see also

Analyse historical data and performance

Historical data and performance analysis is a crucial aspect of portfolio management, enabling you to make informed decisions about your investments. Here are some detailed instructions on how to analyse historical data and performance using Microsoft Excel or Google Sheets:

Record Historical Data:

Firstly, ensure you have recorded the historical data for each investment in your portfolio. This includes the purchase date, number of shares acquired, unit price, trade fees, and any other relevant information. Maintaining a comprehensive record of this data will provide a solid foundation for your analysis.

Calculate Key Metrics:

Excel offers various functions to calculate important metrics for each investment. For example, you can calculate the difference between the current price and the entry price, the percentage return, profit and loss, and standard deviation. These calculations provide insights into the performance and volatility of each investment.

Visualise Data with Charts:

Utilise the charting capabilities of Excel or Google Sheets to create visual representations of your historical data. Generate line charts, bar graphs, or other relevant chart types to track how your investments have trended over time. Visualising data makes it easier to identify patterns and compare the performance of different investments.

Compare Performance to Benchmarks:

Compare the performance of your investments against relevant benchmarks, such as market indices or other portfolio models. For example, you can use the SPDR S&P 500 ETF as a benchmark to ensure your investments are on track with your financial goals. This comparison provides context and helps you evaluate the relative performance of your portfolio.

Backtest Your Portfolio:

Backtesting involves simulating your investment strategy using historical data to analyse how well your portfolio would have performed in the past. This process allows you to assess the risk and return associated with your investment strategy and make adjustments as needed. There are tools available, such as Portfolio Visualizer, that can assist with backtesting and provide sophisticated analytical insights.

Monitor Performance Indicators:

Calculate and monitor various performance indicators to assess the overall performance of your portfolio. This includes metrics such as the True-Time Weighted Rate of Return and the Internal Rate of Return (IRR). You can use tools like Portfolio Performance to calculate and track these indicators across all your investment accounts.

Update Historical Quotes:

Ensure that you regularly update historical quotes from reliable sources, such as Yahoo Finance, Finnhub.io, Quandl, or AlphaVantage. This allows you to base your analysis on the most current and accurate data available. Alternatively, you can scrape quotes directly from HTML pages or JSON documents.

Analyse Foreign Currency Accounts:

If your portfolio includes foreign currency accounts, utilise the exchange rates published by entities like the European Central Bank (ECB) to monitor and analyse those investments. This ensures that you are considering the impact of exchange rate fluctuations on your overall portfolio performance.

By following these steps and continuously analysing historical data and performance, you will be well-equipped to make data-driven decisions about your investment portfolio and adjust your strategy as necessary to meet your financial goals.

Investing Life Savings: Strategies for Long-Term Financial Growth

You may want to see also

Calculate standard deviation

The standard deviation of a portfolio is a measure of the variability or volatility of returns. It is a complex formula that assesses the risk of an investment. The standard deviation of returns is a more accurate measure than looking at periodic returns because it takes all values into account.

To calculate the standard deviation of a portfolio in Excel, you will need to follow these steps:

- Calculate the standard deviation of each security in the portfolio: You can use a calculator or the Excel function to do this.

- Determine the weights of securities in the portfolio: Calculate the proportion of the total portfolio that each security represents.

- Find the correlation between two securities: Correlation is the statistical measure of how two securities move with respect to each other. Its value lies between -1 and 1. A correlation of -1 means the two securities move in exactly the opposite direction, while a correlation of 1 means they move in the same direction. A correlation of 0 means there is no relation between the movements of the two securities.

- Calculate the variance: Variance is the square of standard deviation. For a portfolio, the formula for variance is:

> =SUMPRODUCT(weights array,MMULT(Covariance matrix,weights array))

Calculate standard deviation: Take the square root of the variance to find the standard deviation.

Let's assume a portfolio with two securities, Security A and Security B. The standard deviations of these securities are 10% and 15%, respectively. We have invested $1,000 in total, with $750 in Security A and $250 in Security B. The weights of the securities are 75% and 25%, respectively. Let's assume a correlation of 0.25 between the two securities.

Using the formula for variance, we calculate:

> (0.75^2)*(0.1^2) + (0.25^2)*(0.15^2) + 2*0.75*0.25*0.1*0.15*0.25 = 0.008438

The standard deviation is the square root of the variance:

> 0.008438^0.5 = 0.09185 = 9.185%

So, the standard deviation of the portfolio is 9.185%.

Interpreting the standard deviation:

Since the standard deviation of the portfolio (9.185%) is less than the standard deviations of the individual securities (10% and 15%), it indicates that the correlation between the securities has a reducing effect on the overall risk of the portfolio. If the correlation were 1, the standard deviation would be higher (11.25%). If the correlation were -1, the standard deviation would be lower (3.75%).

Standard Deviation and Portfolio Risk

A portfolio with a high standard deviation signifies heightened risk and unpredictable returns. On the other hand, a portfolio with a low standard deviation implies lower risk and more stable returns.

Standard deviation is an important tool for matching a client's risk appetite with the risk level of a portfolio. It helps to analyse the stability of returns and is a good measure for evaluating the performance of mutual funds and hedge funds.

Unlocking Your Savings: Reading Investment Statements

You may want to see also

Frequently asked questions

Using Excel to track your investment portfolio is a simple and effective way to monitor the value of your investments over time. It allows you to store all your important investment data in a single location, making it easier to understand the status of your investments and make informed financial decisions.

First, decide on the data you want to include. This could be the date, entry, size (number of shares), closing prices, price change, market capitalization, etc. Then, insert the stocks into Excel by typing the company names, traded names, or ticker symbols. Convert the data into stock data types, and generate the relevant information by selecting the desired data options.

You can use formulas to calculate the difference between an asset's current price and its entry price, the percentage return, profit and loss, and standard deviation (a measure of risk and volatility). These formulas can be easily inserted into cells to automatically calculate the desired metrics.

Excel allows you to add charts and diagrams to understand the distribution of your investment portfolio and identify your overall returns. You can also use conditional formatting to visually highlight the gain/loss values in your spreadsheet.