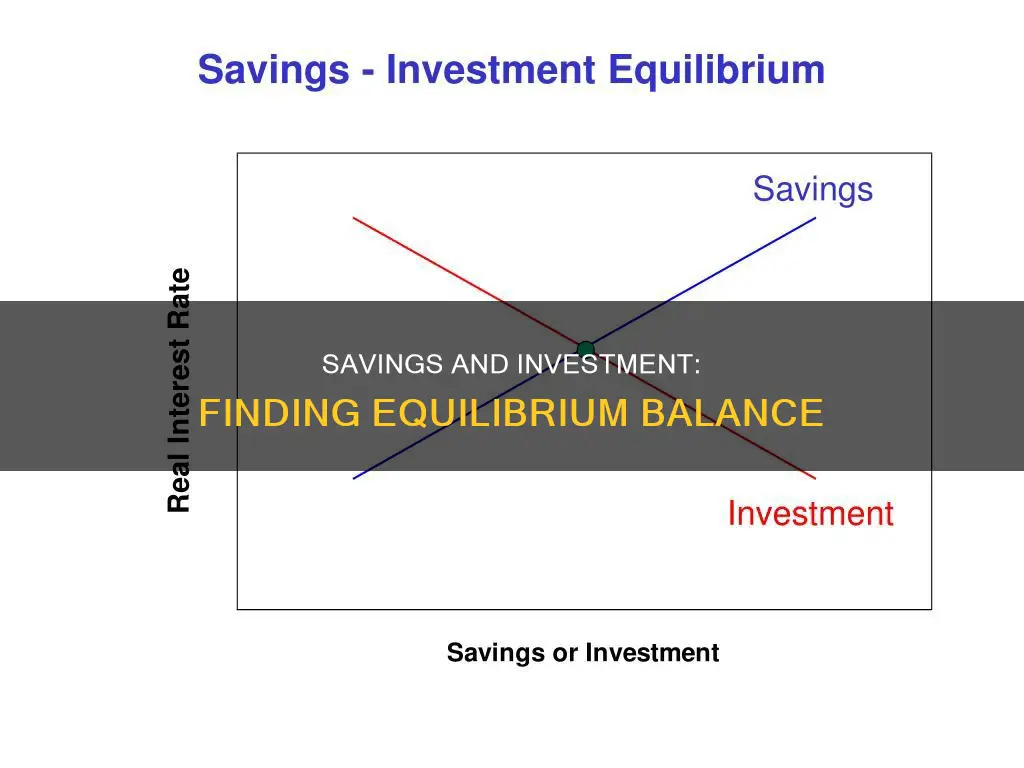

Economic equilibrium is a state in which market supply and demand balance each other, resulting in stable prices. The equilibrium quantity is the amount supplied that exactly equals the demand, resulting in neither an oversupply nor a shortage. In the context of savings and investment, equilibrium is reached when investment equals savings, as there is no tendency for income and output to change at this level. This is because the flow into financial markets (public and private savings) must equal the flow out of financial markets (investment). The interaction of the savings and investment curves determines the equilibrium interest rate, where households' desires to save balance firms' desires to invest.

| Characteristics | Values |

|---|---|

| When equilibrium is reached | When Investment(I) equals Savings(S) |

| What happens when equilibrium is reached | There is no tendency for income and output to change |

| What happens when savings are more than investment | The planned inventory would fall below the desired level |

| What happens when savings are less than investment | The planned inventory rises above the desired level |

| What happens when S=I | Equilibrium takes place |

| Classical economists' view on the economy's equilibrium | The economy’s equilibrium is at full employment level |

| Classical economists' view on the variable that brings about equality between savings and investment | The rate of interest is the equilibrating variable |

| Keynes' view on the variable that brings about equality between savings and investment | Income is the equilibrating variable |

What You'll Learn

- Equilibrium is reached when savings and investment are equal

- Classical economists believe the economy's equilibrium is at full employment

- Keynesian theory suggests that equilibrium is at less than full employment

- Interest rates affect the equilibrium of savings and investment

- National savings is the sum of private and public savings

Equilibrium is reached when savings and investment are equal

The concept of equilibrium is central to economic theory, and it can be applied to the relationship between savings and investment. In this context, equilibrium is reached when the savings in an economy are equal to the investment. This state of balance is significant as it indicates a point where there is no tendency for income and output to change.

The equilibrium level of savings and investment is a key concept in understanding the dynamics of an economy. When savings are greater than investment, the planned inventory falls below the desired level. To address this, producers expand output, leading to increased income. This, in turn, results in a rise in savings until they equal investment. Conversely, when savings are less than investment, the planned inventory rises above the desired level, and firms reduce output to bring savings and investment back into balance.

The classical economists, including Adam Smith, believed that the economy would naturally tend towards equilibrium, with the rate of interest acting as a strategic variable to bring about equality between savings and investment. They argued that if savings and investment were equal, any changes in the rate of savings would be automatically offset by adjustments in the interest rate, maintaining the equilibrium.

However, John Maynard Keynes, in his "General Theory", proposed a different perspective. He agreed that savings and investment must be equal but disagreed that this would always occur at full employment. Instead, he suggested that income changes were the driving force behind the equality of savings and investment. In other words, income acts as the equilibrating variable, bringing the two into balance. This concept is known as the "accounting equality" of savings and investment.

Keynes also introduced the idea of ""functional equality", which considers the dynamic behaviour of the economy as a whole. In this view, savers and investors react to income variations, and their desire to save and invest is expected to be harmonised through these reactions. For example, if savings exceed investment, income will fall, leading to a contraction in savings until it equals the reduced investment.

In summary, the equilibrium between savings and investment is a critical concept in economics, indicating a state of balance where there is no tendency for income and output to change. Both classical economists and Keynesian theory recognise the importance of this equality, but they differ in their explanations of the mechanisms that bring about this equilibrium.

Retirement Planning: 401(k)s, Investing, or Saving?

You may want to see also

Classical economists believe the economy's equilibrium is at full employment

The classical economic theory, dominant in the 18th and 19th centuries, is based on the belief that the economy is self-regulating and that little to no government intervention is required. Classical economists argue that the economy is always capable of achieving the natural level of real GDP or output, which is the level of real GDP that is obtained when the economy's resources are fully employed. This belief is based on two key ideas: Say's Law and the belief that prices, wages, and interest rates are flexible.

Say's Law states that when an economy produces a certain level of real GDP, it also generates the income needed to purchase that level of real GDP. In other words, the economy can always demand all of the output that its workers and firms produce. This implies that the economy can always achieve the natural level of real GDP. However, classical economists acknowledge that not all income generated will be spent, as some will be saved. If aggregate demand falls below aggregate supply due to aggregate saving, suppliers will reduce their production and employ fewer resources, causing the equilibrium level of real GDP to fall below its natural level.

To address this, classical economists suggest that funds from aggregate saving will be borrowed and turned into investment expenditures, a component of real GDP, thus preventing a reduction in real GDP. They believe that the interest rate will adjust so that the supply of funds from aggregate saving will equal the demand for funds by investors. This adjustment in the interest rate will lead to an increase in investment expenditures and ensure that the economy returns to the natural level of real GDP.

Classical economists visualise equality between saving and investment at a point of full employment only. They believe that if saving and investment are equal, they will soon be brought into equilibrium by automatic changes in the interest rate. Given the rate of investment, if saving increases, the interest rate will fall, leading to a rise in investment demand. Conversely, if saving decreases, the interest rate will rise to boost saving. Thus, classical economists view the interest rate as the equilibrating variable between saving and investment.

Overall, classical economists argue that the economy will naturally adjust to achieve full employment and that government intervention is not necessary. They believe in the economy's ability to self-regulate and correct any imbalances.

Creating a Schedule for Investment Savings

You may want to see also

Keynesian theory suggests that equilibrium is at less than full employment

The equilibrium quantity of savings and investment is reached when savings and investment are equal. This is because, at this level, there is no tendency for income and output to change.

Keynesian theory, developed by British economist John Maynard Keynes, takes a different view from classical economics. Keynesian economics is a macroeconomic theory of total spending in the economy and its effects on output, employment, and inflation. It was formulated in the 1930s in response to the Great Depression.

Keynes' theory suggests that equality between savings and investment is a condition of equilibrium at any level of employment, but that this is usually at less than full employment. This is because, according to Keynes, free markets do not automatically provide full employment. Instead, he argues that inadequate overall demand can lead to prolonged periods of high unemployment.

Keynesian economics stresses that government intervention is necessary to moderate the booms and busts of the business cycle. This is because private sector decisions can sometimes lead to adverse macroeconomic outcomes, such as reduced consumer spending during a recession. Therefore, Keynesian economics supports a mixed economy guided mainly by the private sector but with some government involvement.

Keynesian economists believe that government intervention can result in full employment and price stability. They advocate using active government policy to manage aggregate demand to address or prevent economic recessions. They argue that wages and employment are slow to respond to market needs and require government intervention to stay on track.

In summary, Keynesian theory suggests that equilibrium is usually reached at less than full employment because of the potential for high unemployment due to inadequate overall demand, which can be mitigated through government intervention.

Life Cycle Theory: Savings and Investment Strategies Explored

You may want to see also

Interest rates affect the equilibrium of savings and investment

Interest rates play a pivotal role in influencing the equilibrium of savings and investment, as altering interest rates can impact savings and investment levels. Classical economists believe that the economy's equilibrium is achieved at full employment, with saving-investment equality facilitated by interest rate adjustments. When savings surpass or fall short of investments, interest rates serve as a strategic variable to restore balance.

For instance, if savings increase relative to a given investment rate, the interest rate will decline. This, in turn, stimulates investment demand while curbing savings. As a result, there is an expansion in investment and a contraction in savings, ultimately leading to equality between the two. Conversely, when savings decrease, interest rates rise to encourage more savings and curtail investments, thereby restoring equilibrium.

However, Keynesian economics offers a different perspective. According to Keynes, equality between savings and investments is a condition of equilibrium at any level of employment, not necessarily full employment. He challenges the classical view of interest rates as the strategic variable, instead suggesting that income changes bring about savings and investment equality. In the Keynesian model, savings and investments are stable and predictable, while investments are unpredictable, unstable, and autonomous.

Keynes' approach introduces income as the equilibrating variable, where shifts in income levels harmonise the desire to save and invest. When savings exceed investments, income falls, leading to a contraction in savings until equality is restored. Conversely, when investments exceed savings, income rises, resulting in a new equilibrium at a higher income level.

The impact of interest rates on savings and investment equilibrium is also evident in the money market. Here, the interaction between institutions supplying money and those demanding it determines the equilibrium interest rate, which is reached when the quantity of money demanded equals the quantity supplied. Changes in interest rates can shift the demand for money, influencing the equilibrium interest rate. When interest rates rise, people tend to hold less money, while lower interest rates encourage higher money holdings.

In summary, interest rates are a key factor in the dynamics of savings and investment equilibrium. Classical economists advocate for interest rate adjustments to achieve equality between savings and investments, while Keynesian economics emphasises income changes as the equilibrating factor. The money market also illustrates the influence of interest rates on the equilibrium, showcasing their role in shaping savings and investment behaviour.

Savings-Investment Spending Identity: Lessons for the Economy

You may want to see also

National savings is the sum of private and public savings

The concept of "equilibrium quantity of savings and investment" is based on the idea that a balance must be achieved between savings and investments for a stable economy. This equilibrium is reached when the investment (I) equals savings (S) because, at this level, income and output tend to remain constant.

Now, let's delve into the components of national savings, which is indeed the sum of private and public savings.

Private Savings

Private savings refer to the money that households and businesses choose to set aside rather than spend on consumption. This includes funds in bank accounts, retirement funds, and profits reinvested into businesses. Private savings are influenced by factors such as income, wealth, debt, interest rates, inflation, and government policies. Higher income and wealth tend to result in higher private savings, while debt and high interest rates may deter savings. Private savings act as a domestic supply of loanable funds, providing capital for investments in businesses, infrastructure, and other projects, which ultimately drives economic growth.

Public Savings

Public savings, on the other hand, represent the money left over after the government has paid all its expenses. It is calculated as the difference between tax revenue and government spending. When tax revenue exceeds government spending, the government has a budget surplus, resulting in positive public savings. Conversely, when spending surpasses revenue, the government experiences a fiscal deficit, leading to negative public savings or dissaving.

National Savings

National savings is the sum of these private and public savings. It represents the total amount of money saved within a country, acting as a pool of funds that fuels economic growth. A healthy level of national savings provides the resources needed for crucial investments. For instance, businesses can borrow from this pool to expand their operations or develop new products. Additionally, high national savings can lead to lower interest rates, making borrowing more accessible for businesses and individuals, thus encouraging investment in new equipment, technology, and ventures. This increased investment activity stimulates job creation and contributes to overall economic growth.

In summary, national savings encompass both private and public savings, and a balance between these components is crucial for maintaining economic stability and promoting growth.

Home Purchase: Investment or Saving Strategy?

You may want to see also

Frequently asked questions

Equilibrium is the state in which market supply and demand balance each other, resulting in stable prices.

Equilibrium is reached when investment equals savings (I=S), as there is no tendency for income and output to change at this level.

When savings are greater than investment, the planned inventory falls below the desired level. Producers then expand output to bring the inventory back to the desired level, which increases income and, in turn, savings until they are equal to investment.

The interest rate is the cost of borrowing and the return on lending in financial markets. It adjusts to bring savings and investment into balance. When the interest rate is higher, more people tend to save as the return is greater, which results in an increase in the equilibrium quantity of investment.