Private equity is an increasingly popular alternative investment option for those looking to diversify their portfolios. Private equity funds are a form of investment that takes place outside of the public stock market, where investors gain an ownership stake in private companies. Private equity funds are typically managed by private equity firms that make strategic decisions about how to invest the pooled money of investors.

There are three key types of private equity strategies: venture capital, which is an investment in an early-stage startup; growth equity, which is an investment in a middle-stage company's growth; and buyouts, where a mature company is purchased with the goal of internal improvement before being sold on at a profit.

Private equity investments are not easily accessible for the average investor. Most private equity firms typically look for investors who are willing to commit large sums of money, with minimum investments often as high as $25 million. However, some firms have dropped their minimum investment requirements to $250,000 or even $25,000.

To invest in private equity, individuals need to become accredited investors, which requires having a net worth of over $1 million or an annual income of over $200,000 in each of the last two years. Once accredited, individuals can then research and select a private equity firm that aligns with their interests and investment restrictions.

| Characteristics | Values |

|---|---|

| Minimum Investment | $25 million, though some firms have lowered this to $250,000 or even $25,000 |

| Investment Types | Venture Capital, Growth Equity, Leveraged Buyouts |

| Investment Period | 10-12 years |

| Investor Type | Institutional investors, wealthy individuals, pension plans, family offices |

| Investor Requirements | Accredited investor status, net worth over $1 million, income over $200,000 |

| Investment Process | Pool money from investors, invest in private companies, collaborate with company management, sell company for profit |

| Benefits | High returns, low correlation to public indexes, portfolio diversification |

| Risks | Illiquidity, fees, lack of disclosure, conflicts of interest |

What You'll Learn

Private Equity: High Returns, High Risk

Private equity is an increasingly popular alternative investment option for those looking to diversify their portfolios. Private equity investments are made into private companies, which are not listed on public exchanges. Private equity funds are a pooled investment offered by a private equity firm that allows a group of investors to combine their assets to invest, typically in a company or business.

How it Works

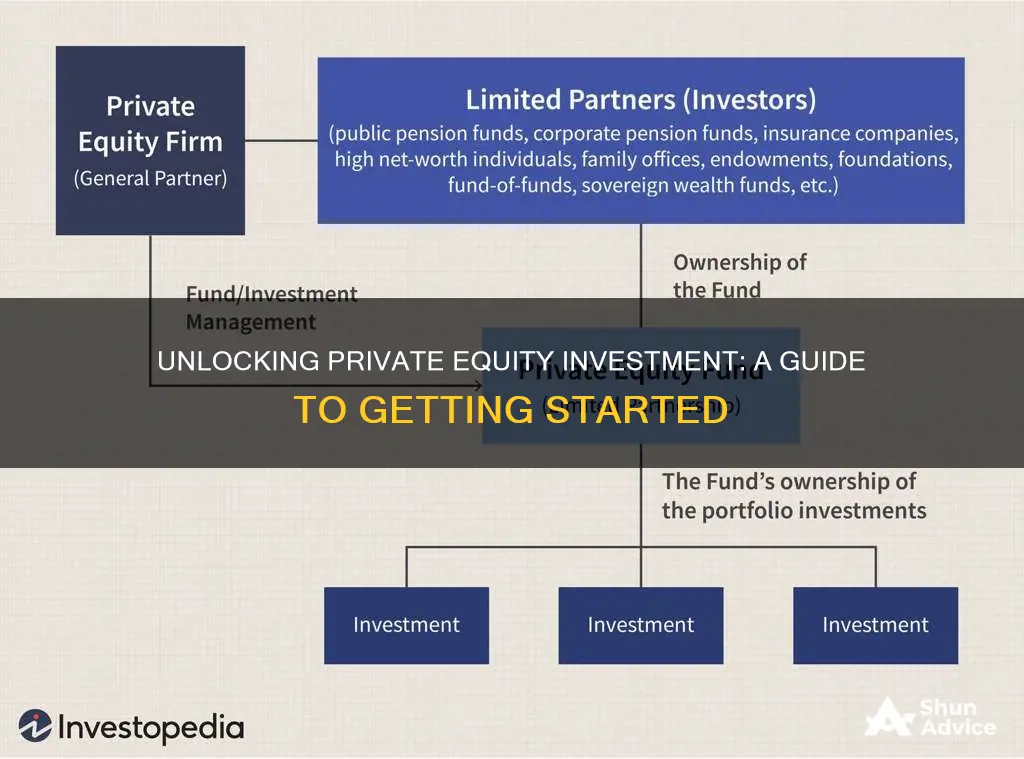

Private equity involves three parties: investors who supply the capital, the private equity firm that manages and invests that money, and the companies the private equity firm invests in.

The private equity firm puts investors' money into a private equity fund, along with money from other investors. They then invest this pool of money in various private equity instruments, such as buyouts or venture capital.

Who Can Invest?

Most private equity investing is reserved for institutional investors (such as pension funds or private equity firms) or high-net-worth individuals. To invest in private equity, you'll need to meet the minimum investment requirements, which can range from a few hundred thousand to several million dollars. You'll also need to be an accredited investor, meaning your net worth, alone or with a spouse, is over $1 million, or your annual income was higher than $200,000 in each of the last two years.

Advantages

Private equity can be appealing to investors as it gives them access to deals not available on the public market. The potential for high returns is a big draw, and data shows that private market returns have consistently exceeded those of the public market.

Disadvantages

Private equity investing can be very risky. There is no guarantee that the companies you invest in will succeed, and there are few protections if they fail. Private equity investments are also highly illiquid, with investors typically committing their capital for a lengthy period, around 10-12 years.

Ways to Invest

There are a few ways to invest in private equity:

- Private equity funds: These funds pool money from many investors to invest in private companies and make use of fund managers' industry expertise.

- Exchange-traded funds (ETFs): ETFs offer exposure to publicly listed private equity companies and are a way for those who want to take part in private equity but aren't accredited investors or can't meet the minimum investment requirements.

- Special Purpose Acquisition Companies (SPACs): SPACs are publicly listed companies designed to acquire a private company or companies.

- Crowdfunding: This involves private companies raising money from investors online.

Risks

As with any investment, it's important to consider your risk and return profile before investing in private equity. Private equity funds are not registered or regulated as investment securities, so there may be a lack of transparency, and fund managers may have less information to determine the strength of their investments. There may also be conflicts of interest, as private equity firms often belong to multiple funds and companies.

Life Insurance: An Investment Portfolio Essential?

You may want to see also

Venture Capital: Seed Funding for Startups

Seed funding is a crucial step for startups to raise capital in their earliest stages, often representing the first external cash injection for the business. It is intended to give founding teams the financial resources to pursue a certain idea or market and prove that the concept works.

Sources of Seed Funding

Friends and Family

The most common method of seed funding comes from friends and family. Many startup founders have friends or family members who also own businesses or are investors. However, not all founders are well-connected, so other avenues for funding are necessary.

Angel Investors

Angel investors are individuals with a high net worth who prefer to work with startups. They can be found through angel-finding websites or platforms that connect people directly with angels.

Incubators

Incubators are mentorship programs that provide a workspace, funding, networking, training, and resources to help startups succeed. Founders with just an idea, but without an actionable product or service, can benefit from joining an incubator. This option usually involves giving away a percentage of the company.

Accelerators

Accelerators support growth-driven startups with financing, mentorship, and product development in a short, intensive period. Accelerators generally involve giving away some equity and joining multiple businesses accelerating simultaneously.

Venture Capital

Venture capital firms provide funding for startups with high-risk, high-reward potential. They are a good option for startups with experienced founders who want a hands-off approach to raising initial funding.

Tips for Raising Seed Capital

- Have a system and process in place for raising capital, similar to a traditional sales and marketing funnel.

- Understand who the right investors are for your business and how you fit into their vision.

- Decide how much seed funding you should raise based on your business needs and goals.

- Utilise crowdfunding platforms or non-traditional firms offering alternative financing instruments.

- Consider corporate seed funding, where large corporations deploy capital across seed-stage companies that fit their thesis or growth plans.

- Expect the process of raising seed capital to take several months, including building investor lists, pitching, and due diligence.

Investing in Meta: A Guide for Indians

You may want to see also

Growth Equity: Investing in Established Companies

Growth equity is a type of investment opportunity in relatively mature companies that are undergoing some sort of transformational event in their life cycle. These companies have already obtained traction in their respective markets but still need additional capital to reach the next level.

Growth equity funds target companies with high organic growth rates and established business models. They usually take a minority stake with the intention of growing the business as much as possible and exiting at a higher multiple.

Growth equity investors tend to prefer companies with low leverage or no debt. They also seek companies with a proven business model, a pathway towards profitability, and a target market and customer profile identified.

Growth equity managers add value to companies by providing capital for growth and expansion, including areas like production capacity, new products, and sales efforts. They also provide strategic advice to management teams and help scale operations.

The returns from a growth equity investment come predominantly from the growth of the equity itself. Investors benefit from the high growth potential and moderate risk of the investments.

Growth equity is considered to have a lower holding period compared to venture capital investments. This is because early-stage companies need more time to realize their potential relative to more mature companies.

Growth equity deals generally imply minority investments, which are commonly executed using preferred shares. The source of returns for growth equity investments is the company's ability to scale its operations, resulting in significant revenue and profitability growth.

Growth equity is a high-risk investment and it is unlikely that you will be protected if something goes wrong. Therefore, only invest what you are prepared to lose.

Savings and Investments: Equation for Financial Success

You may want to see also

Buyouts: Taking Companies Private

Buyouts, or leveraged buyouts, are a common form of private equity investment. This is when a private equity firm buys a controlling stake in a public company, taking it private, and then works to improve the company with the aim of selling it on for a profit.

The process starts with the private equity company raising funds from investors and institutional entities, such as insurance companies or pension funds. The target company is then chosen, often because it is undervalued or could benefit from restructuring. The private equity company will then work closely with the company's management to improve its operations and performance. This process can take several years.

Buyouts can be called "management buyouts" when the firm's management buys the stake in the public company, or "leveraged buyouts" when significant debt is used to make the purchase.

Criticisms of buyouts include the fact that they can lead to layoffs and furloughs for workers, and that they can negatively impact a company's customers.

Buyouts are one of three different stages of involvement in private equity, the others being venture capital and growth equity.

Investing in US IPOs: A Guide for Indians

You may want to see also

Becoming an Accredited Investor

Private equity is a form of investment that occurs outside of the public stock market, where investors gain ownership stakes in private companies. It is a high-stakes world where investors try to add value to the companies they invest in by bringing in new management or selling off underperforming parts of the business.

To participate in private equity investment, one generally needs to be an accredited investor. An accredited investor is a person or entity that is allowed to invest in securities that are not registered with the Securities and Exchange Commission (SEC). They are wealthy individuals with access to lucrative investments that others cannot access.

To become an accredited investor, one must meet certain income and net worth guidelines. The SEC defines an accredited investor through the confines of income and net worth in two ways:

- An individual with an income exceeding $200,000 in each of the last two years or joint income with a spouse exceeding $300,000 for those years, with a reasonable expectation of the same income level in the current year.

- An individual who has an individual net worth, or joint net worth with a spouse, that exceeds $1 million at the time of the purchase, excluding the value of their primary residence.

It is important to note that there is no formal process, certification exam, or accreditation body for becoming an accredited investor. The onus is on the companies issuing unregistered securities to determine a potential investor's status through due diligence.

Pros and Cons of Being an Accredited Investor:

Being an accredited investor comes with several advantages and disadvantages.

Pros:

- Access to unique and restricted investments: Accredited investors can invest in private equity, private placements, hedge funds, venture capital, and equity crowdfunding.

- High returns: These investments often offer higher returns than public market investments.

- Increased diversification: Accredited investors can diversify their portfolios by investing in high-risk, high-return opportunities.

Cons:

- High risk: The strategies used by many funds carry a higher risk to achieve the goal of beating the market.

- High minimum investment amounts: Accredited investors typically need to commit large sums of money, often ranging from a few hundred thousand to several million dollars.

- High fees: Accredited investor investments often come with performance fees of 15-20% in addition to management fees.

- Illiquidity: Accredited investor investments tend to have long capital lock-up periods, ranging from one to five years or more.

Other Ways to Invest in Private Equity:

While becoming an accredited investor provides access to certain private equity opportunities, there are also other ways to invest in private equity that do not require accreditation:

- Mutual funds: While mutual funds have restrictions on investing in private equity due to SEC rules, they can indirectly invest through fund-of-funds structures.

- Exchange-traded funds (ETFs): Individuals can purchase shares of ETFs that track an index of publicly traded companies investing in private equities, without the need for high minimum investments.

- Special Purpose Acquisition Companies (SPACs): These are publicly traded shell companies that make private equity investments in undervalued private companies, but they can be risky due to a lack of diversification.

- Crowdfunding: This is a recent development where individuals can contribute small amounts to private equity ventures through online platforms, but it is highly risky.

In summary, becoming an accredited investor provides access to lucrative private equity opportunities. However, it is important to carefully consider the pros and cons before pursuing accreditation, and there are also alternative ways to invest in private equity that do not require accreditation.

Strive Asset Management: A Guide to Investing

You may want to see also

Frequently asked questions

Private equity is a form of investment that takes place outside of the public stock market. Investors gain an ownership stake in private companies.

Private equity investments typically have very high minimum investment requirements, ranging from a few hundred thousand to several million dollars. As such, most private equity investing is reserved for institutional investors or high-net-worth individuals.

To be considered an accredited investor by the United States Securities and Exchange Commission (SEC), you must either have a net worth of over $1 million (excluding your primary residence) or an annual income of $200,000+ ($300,000 if with a spouse) for the last two years.

Private equity investments can be very risky. They are illiquid, with long time horizons (typically a minimum of 10 years). There is also a lack of transparency and regulation, and potential conflicts of interest.

Research firms that align with your interests and investment restrictions. Consider their minimum investment requirements, strategy, specialisations, and their track record of returns.