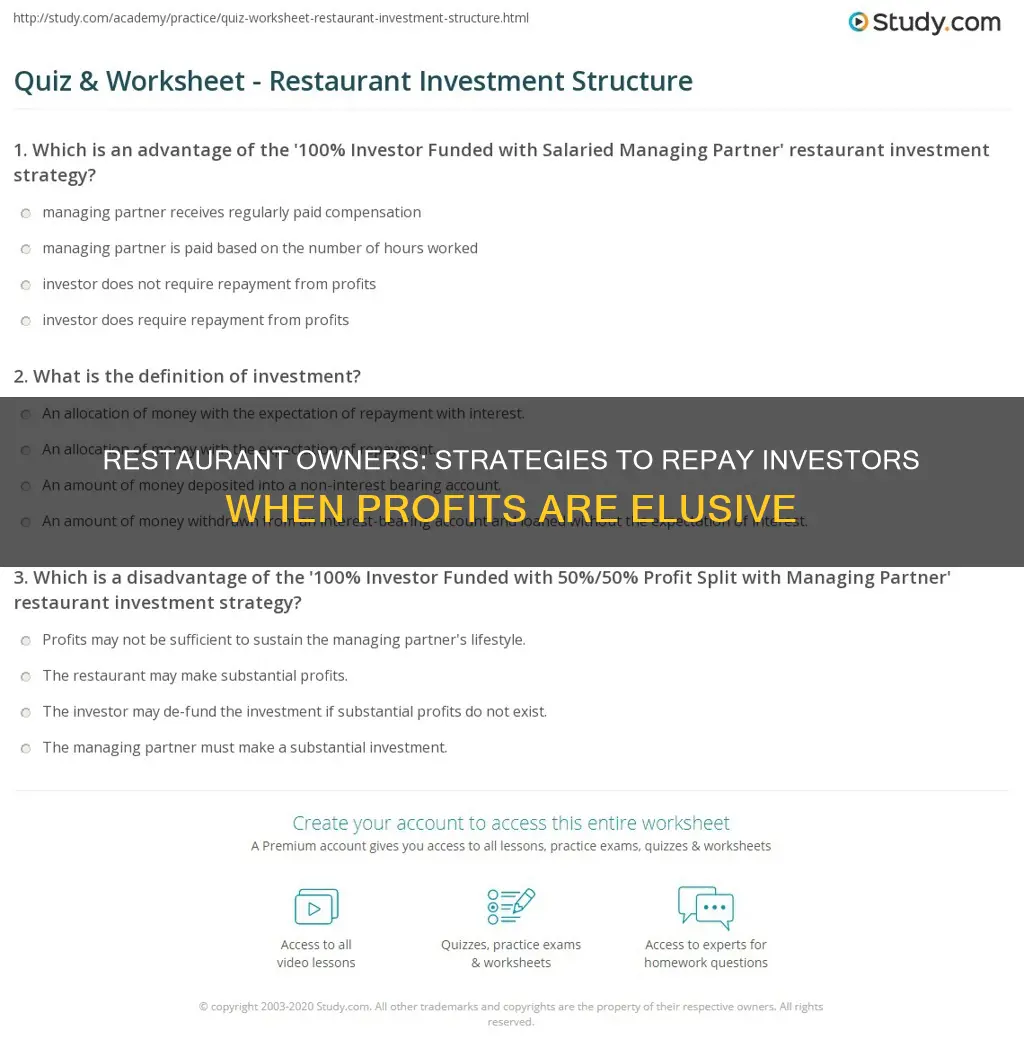

Paying investors when your restaurant is not profitable can be a tricky situation. The first step is to understand the type of investors you are dealing with. There are typically three types of investors: friends and family, angel investors, and venture capital firms. Friends and family often invest based on trust and may not expect the same level of financial returns as other investors. Angel investors are wealthy individuals who may have expertise in the industry and can offer guidance, while venture capital firms typically invest in startups and small businesses with high profit potential.

Once you understand the type of investors you are working with, you can explore different options for repayment. One option is to offer a portion of the restaurant's ownership in exchange for their investment. This means that the investors will have a stake in the business and will share in the profits once the restaurant becomes profitable. Another option is to create a detailed repayment plan that outlines how and when you will repay their investment, even if the restaurant is not yet turning a profit. This may involve negotiating extended repayment terms or offering alternative forms of compensation, such as perks or incentives.

It is important to remember that working with investors comes with challenges and a certain level of risk. Communicating openly and transparently with your investors, seeking legal and financial advice, and having a well-thought-out business plan can help mitigate these risks and set clear expectations for all parties involved.

| Characteristics | Values |

|---|---|

| Types of Investors | Friends and family, angel investors, venture capital firms |

| Investor Expectations | Expertise, connections, passion for the concept, ownership stake |

| Investor Returns | Dividends, selling shares |

| Investor Search Strategies | Networking events, LinkedIn, incubators, peers and colleagues |

| Pitching to Investors | Business plan, pitch deck, financial projections, growth forecast |

| Business Structure | Sole proprietorship, partnerships, corporations, LLCs |

| Investor Payback | Preferred return, profit division based on ownership structure |

| Investor Relations | Regular updates, investor perks, managing expectations |

What You'll Learn

Friends and family are a common source of investment

However, friends and family who invest a significant amount may ask for an ownership stake in the business. This means that they will be paid back in relation to their equity in the company, or the amount of the business that they own based on their investment. This can be repaid strictly based on the amount that they own, or by preferred payments. Preferred payments occur when investors are repaid at a higher rate than the amount of the company they own. For example, if a business gets 80% of its capital from investors but the owner keeps 50% of the equity, investors may be paid back at a rate of 80/20 until their investment is repaid.

It's important to note that preferred payments are not allowed for all business types, such as S Corporations.

Chinese Investors: Where They Put Their Money

You may want to see also

Angel investors are wealthy individuals who invest when others won't

Angel investors are wealthy individuals who are willing to take on risky investments that other investors would avoid. They are often successful entrepreneurs themselves, or professionals such as lawyers, doctors, or financial advisors, who have an abundance of business knowledge and experience. Angel investors usually fund startups with intriguing ideas, providing their own money to help develop these businesses further.

Angel investors are not in the loan business. They are investing in an idea they like, with the expectation of a reward only if the business succeeds. This is a risky strategy, and angel investors usually limit their investments to no more than 10% of their portfolio. They are also not looking for favourable returns on a loan. Instead, they often seek an equity stake and a seat on the board, with the opportunity to guide startups as they take their first steps.

Angel investors are typically private investors who use their own net worth to finance small business ventures. They are usually more patient than venture capitalists, and are open to providing smaller amounts of money over a longer period. However, they do want to see an exit strategy where they can pocket their profits, often through a public offering or acquisition.

Angel investors are often willing to invest when a business is not yet profitable, as long as it has shown promise. They can be highly motivated to help these businesses succeed through mentoring or direct management help. However, angel investors usually want a significant stake in the company in exchange for funding, which can result in business owners losing control. It is important to carefully consider how much equity you are willing to give away to an investor, as this will impact your ownership and control over the business.

Angel investors can be found through online platforms, such as Angel List and Angel Investment Network, or through professional social networks like LinkedIn. Local business groups or schools can also be a good source of funding, as well as industry associations and digital platforms.

UPRO: Why Investors Are Not Buying

You may want to see also

Venture capital firms invest in startups and small businesses

Venture capital (VC) firms are a form of private equity financing that invest in startup, early-stage, and emerging companies with high growth potential. They provide funding, expertise, and connections in exchange for an ownership stake in the business.

VC firms raise money from limited partners (LPs) to invest in promising startups. They typically invest in companies with innovative technology or business models, often in high-tech industries such as information technology, clean technology, or biotechnology.

VC investments are usually structured as equity deals, where the firm receives an ownership stake in the company. They take on the risk of financing startups, hoping that some of these companies will become successful. Due to the high uncertainty associated with startups, VC investments carry a high risk of failure.

VC firms play a crucial role in providing capital to new businesses that may not have access to other sources of funding, such as bank loans or capital markets. They fill a niche in the capital markets by catering to the needs of institutional investors seeking high returns and entrepreneurs seeking funding.

VC firms not only provide financial backing but also offer strategic advice, mentorship, and networking opportunities to the companies they invest in. They assist in various stages of a company's development, from early-stage funding to growth capital and exit.

When deciding whether to invest, VC firms consider factors such as the business situation, industry, growth potential, and management team. They conduct extensive due diligence before making investment decisions.

VC firms are selective in their investments, and the process of securing VC funding can be challenging. Companies seeking VC investment must demonstrate excellent growth potential, a solid business plan, a capable management team, and a clear path to exit the investment.

In summary, VC firms play a vital role in supporting startups and small businesses by providing capital, expertise, and connections. They take on the risk of investing in early-stage companies, aiming for high returns, and play a crucial role in fostering innovation and economic development.

Toxic People: Invest Time Wisely

You may want to see also

Investors may take partial ownership of your business

When you bring investors on board, you will likely have to give up some ownership of your restaurant. This means that you will have to consult your investors on business decisions, which can be tricky if you don't retain the majority of ownership.

Determining how much ownership to give up can be difficult. Typically, ownership interests are based primarily on asset contribution, but other factors are also worth considering. For example, owners are usually required to invest their personal time and resources in the success of the restaurant, so their ownership interests will be higher than those of investors. When assessing ownership interests, consider factors such as business know-how, expertise in the restaurant industry, and how each individual's skills have contributed to the restaurant's success.

If you add investors to your restaurant after incorporation, you will need to edit your articles or operating agreement to reflect the new ownership interests.

There are three main types of investors: friends and family, angel investors, and venture capital firms. Friends and family tend to be happier to give loans without high interest rates because the loans are based on trust. They may ask for an ownership stake if they invest a significant amount. Angel investors are wealthy individuals who have money to invest when others find it too risky. A good angel investor will have expertise in the industry and can offer guidance on business decisions. Venture capital firms invest in startups and small businesses that they think will make big profits. Their investment should come with resources such as connections, marketing support, or supply chain recommendations.

Green Energy's Golden Promise: Worth the Investment?

You may want to see also

Investors can be paid through dividends or selling shares

Investors can be paid through dividends or by selling shares. Here's how it works:

Dividends

Dividends are regular payments of profit made to investors who own a company's stock. They are a way of sharing a company's profits with its investors and are usually paid out quarterly. Dividends can be paid in cash or additional shares, depending on the company's decision. The amount of dividend is decided by the company's board of directors based on the company's most recent earnings. Dividends provide investors with a recurring income and are often seen as a sign of a company's stable cash flow and profitability.

Selling Shares

Selling shares is another way to pay investors. Shares represent a unit of ownership in a company, and when you sell shares, you are selling a piece of your ownership in the company to someone else. The price of shares is determined by supply and demand in the market. Selling shares can help generate significant cash for the business, which can be used to pay off debts, fund investments, or expand the business. It is a strategic move that requires careful planning and consideration of various factors, such as accurately valuing the business and navigating capital gains taxes.

Choosing Between Dividends and Selling Shares

Both options have their advantages and considerations. Dividends provide a steady stream of income for investors, while selling shares can bring in a large sum of money. However, selling shares may result in giving up some control of the business, as investors may acquire partial ownership. Additionally, the process of selling shares can be more complex and time-consuming, involving multiple steps such as determining the business value, creating a marketing strategy, and navigating legal and tax implications.

Bill Gates' Current Investment Focus

You may want to see also

Frequently asked questions

If your restaurant is not yet profitable, you have a few options for paying investors. One option is to offer a preferred return, which uses 90 to 100% of your restaurant's profits in the first few years of operation to pay back their full investment plus interest. Another option is to negotiate new terms with investors, such as extending the repayment period or offering a larger share of ownership in the business. Additionally, you can consider bringing on additional investors to infuse more capital into the business.

Restaurant investors typically get paid through dividends or by selling their shares in the restaurant. Equity investors will earn money from dividends once the restaurant turns a profit, with a portion of the profits divided among shareholders. Investors can also sell their shares to earn money, especially if the restaurant is performing well and their shares have increased in value.

When structuring investor payback and ownership, it's important to work with a lawyer and accountant to determine the best terms for your business. You should also research what investors in your market typically expect in deals. It's recommended to offer a good balance of payback terms and ownership percentage to make the opportunity attractive to investors while ensuring fair terms for yourself. Additionally, be transparent about the benefits of being an investor and set clear expectations for communication and updates on the business's performance.