Goldman Sachs is an American multinational investment bank and financial services company, ranked as the second largest investment bank in the world by revenue. As such, it pays its employees well, with the average employee making $404,000 in 2021. However, this figure includes high-level executive compensation, and so is not an accurate reflection of non-executive pay.

In 2021, Goldman Sachs raised salaries considerably due to revenue increases and inflation. The company pays well even at the bottom of the pyramid, with summer interns making 50% more than the median household income in New York City.

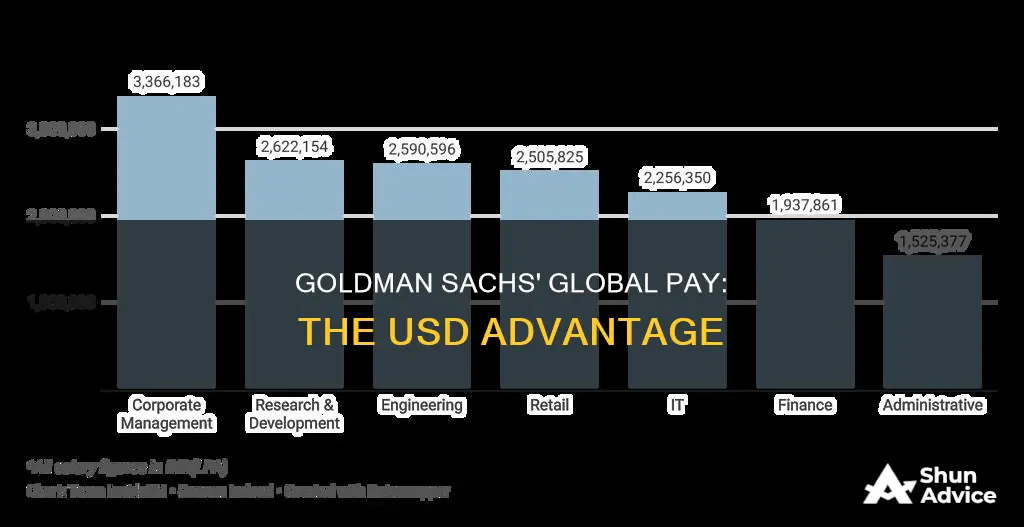

In terms of global USD salaries, Goldman Sachs has offices in Seattle, Los Angeles, and San Francisco, where front-office analyst salaries start at $65,000. In London, the salary range for analysts is £100,000-£130,000 GBP, which is approximately $126,000-$163,000 USD.

| Characteristics | Values |

|---|---|

| Company | Goldman Sachs |

| Average Salary | $404,000 in 2021 |

| First-Year Analyst Salary | $110,000 in 2021 |

| Second-Year Analyst Salary | $125,000 in 2021 |

| First-Year Associate Salary | $150,000 in 2021 |

| Investment Banker Salary Range | $144,000 - $384,000+ |

| Investment Banker Median Salary | $110,000 |

| Vice President Salary Range | $325,000 - $900,000 |

| Managing Director Salary Range | $500,000 - $1,000,000+ |

| Partner Salary | $950,000+ |

What You'll Learn

Goldman Sachs salaries are highest for New Yorkers in the front office

Goldman Sachs is an American multinational investment bank and financial services company, founded in 1869 and headquartered in Lower Manhattan, New York City. It is the second-largest investment bank in the world by revenue and ranked 55th on the Fortune 500 list of the largest US corporations by total revenue.

It is important to note that bonuses are a significant component of compensation for front-office roles and can be multiples of an employee's salary. These bonuses are not included in the publicly available H1B salary data.

While New York may offer the highest salaries for front-office roles, Goldman Sachs also has offices in other cities, including Seattle, Los Angeles, and San Francisco on the West Coast, as well as Dallas and Salt Lake City. The salaries for front-office roles in these locations are generally lower than in New York. For example, front-office analyst roles in California start at $65,000, which is $15,000 less than the same position in New York.

In addition to geographical variations, it is worth noting that non-revenue-generating roles at Goldman Sachs, often referred to as middle- and back-office positions, tend to have lower salaries compared to front-office roles. These positions include functions such as compliance, risk, operations, tax, and legal roles. However, there are exceptions, such as engineers at the analyst level, who are paid better than their back-office peers and some revenue-generating analysts.

AMC Stock: Invest or Avoid?

You may want to see also

The average Goldman Sachs employee made $404,000 in 2021

The average yearly salary for a Goldman Sachs employee in 2021 was $404,000. However, it is important to note that this figure includes the salaries of high-level executives, which skews the average upwards. In fact, the median yearly total compensation for a Goldman Sachs employee is $151,797.

Goldman Sachs is an American multinational investment bank and financial services company, ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. As such, it is known for paying its staff well, particularly those in revenue-generating or "front-office" roles. These include jobs in investment banking, sales, trading, and wealth and asset management.

In 2021, Goldman Sachs raised its salaries due to revenue increases and inflation. A first-year analyst at the company now starts at $110,000, a nearly 30% increase from the previous starting salary of $85,000. The company also offers competitive salaries to attract talent away from the tech sector and other startups.

The specific salary a person earns at Goldman Sachs depends on their role and location. For example, a Vice President in Dallas or Salt Lake City might earn $159,000 or $132,000, respectively, while a Vice President in New York could make $190,000. Managing Directors at the company tend to earn a salary of $400,000, while Partners, an elite group of senior financiers, reportedly earn a salary of $950,000, in addition to various perks and bonuses.

Geographic location also impacts Goldman Sachs salaries. Employees in New York and San Francisco are paid the highest average salaries, at $120,026 and $113,229 per year, respectively. This is due to the higher costs of living and competition in these states.

Black Wealth: Investing Strategies

You may want to see also

Goldman Sachs salaries are moderate for front office Californians

Goldman Sachs is a multinational investment bank and financial services company headquartered in New York City, with regional headquarters in many international financial centres. It is known for paying its front-office staff high salaries, but these salaries are not equal across the globe.

Goldman Sachs recently disclosed salary breakdowns for its analysts and associates in New York, Jersey City, California, and Washington. The highest salaries are paid to those in revenue-generating or front-office roles, including investment banking, sales, trading, and asset and wealth management.

While Goldman Sachs salaries for front-office staff in New York range from $80,000 to $110,000 for analysts and $130,000 to $175,000 for associates, the company's front-office staff in California earn notably less. Front-office analysts in California earn a starting salary of $65,000, which is $15,000 less than their New York counterparts. The salary ceiling for front-office analysts and associates in California is the same as in New York, with associates earning between $130,000 and $175,000.

The lower salaries for front-office staff in California may be due to the fact that New York is the company's head office. However, it is important to note that summer analysts and interns in California are paid salaries that are only slightly lower than their East Coast colleagues.

In addition to their base salaries, Goldman Sachs employees also receive bonuses, which can significantly increase their total compensation. These bonuses vary depending on the role and location.

Overall, while Goldman Sachs is known for paying high salaries to its front-office staff, the salaries for front-office Californians are moderate in comparison to their New York counterparts. This disparity may be due to the location of the head office and the resulting differences in the cost of living and competition for talent.

Young Investors: Where to Begin?

You may want to see also

Goldman Sachs salaries in the back office

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company headquartered in Lower Manhattan, New York City. It is the second-largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue.

Goldman Sachs salaries are highest for those in revenue-generating or front-office roles, including investment banking, sales, and trading. These roles typically command salaries ranging from $80k to $175k, with New York-based employees earning the highest wages.

In contrast, it is the people in non-revenue-generating or back-office roles at Goldman Sachs who have the lowest salaries. These roles encompass functions such as compliance, risk, operations, tax, and legal. While specific salary figures for back-office roles are not readily available, it is known that engineers at the analyst level are an exception and are paid better than their back-office peers.

In terms of bonuses, Goldman Sachs is known to pay out substantial bonuses to its employees, especially in the operations divisions. For instance, the company paid its UK back-office staff an average bonus of £21k, which is nearly seven times higher than the lowest bonuses paid out by some competitors.

Additionally, vice presidents (VPs) and managing directors (MDs) at Goldman Sachs exhibit a wide range of salaries depending on their location and specific role. VPs in New York tend to have higher salaries, with financial managers and investment analysts earning among the highest. Meanwhile, MDs across the company typically earn a salary of $400k.

While information on USD salaries for back-office roles at Goldman Sachs Investment Partners specifically is limited, it is evident that the company offers competitive remuneration packages that vary based on geographical location and the revenue-generating nature of the position.

Invest or Hold Cash: Now What?

You may want to see also

Goldman Sachs salaries for analyst engineers

Analyst engineer salaries at Goldman Sachs vary depending on the role and location. In the United States, the salary range for analyst engineers is $114,000 to $238,000 per year, with a median compensation package totalling $165,000. The highest paying salary package reported for a software engineer role in the US is $266,000 per year, including base salary, stock compensation and bonuses.

In the New York City area, the salary range for analyst software engineers is $100,000 to $144,000 per year.

The median yearly total compensation reported at Goldman Sachs is $151,797, with the lowest-paid roles earning $5,143 in total compensation per year and the highest-paid roles, such as Software Engineering Managers, earning up to $682,143 per year.

Vodafone Idea: Right Issue Investment Guide

You may want to see also