Paying investors in an investment fund interest is a complex topic that requires a good understanding of the different types of investments, their associated risks, and tax implications. When it comes to paying investors interest, there are several options to consider, each with its own set of advantages and disadvantages.

One option is to invest in mutual funds, which can provide interest payments to investors. However, not all mutual funds pay interest, and it depends on the types of assets held in the fund's portfolio. Bond funds, money market funds, and balanced funds are more likely to pay interest due to the coupon-bearing debt securities they invest in. It is important to note that mutual funds are not required to pay interest, and the decision to distribute interest lies with the fund itself.

Another option for paying investors interest is through fixed-income securities such as certificates of deposit (CDs) and bonds. These investments typically offer a preset interest rate until the security matures. Demand deposit accounts, such as savings and money market accounts, also offer interest, though the rates may fluctuate based on changes in market interest rates.

Additionally, investors can consider investing in dividend-paying stocks or funds. Dividends are portions of a company's profits distributed to shareholders, usually on a quarterly basis. While not all stocks pay dividends, they can provide a steady income stream for investors.

It is important to note that the tax implications of these interest payments can vary. In some cases, interest income from investments may be treated as ordinary income for tax purposes, while capital gains taxes may apply depending on the holding period of the investment.

Before making any investment decisions, it is crucial to carefully consider your financial goals, risk tolerance, time horizon, and investment knowledge. Consulting with a qualified financial advisor can help individuals make informed decisions about their investment strategies and understand the tax implications of their choices.

| Characteristics | Values |

|---|---|

| Interest paid by investment funds | Can be called a distribution |

| Paid out quarterly or yearly | |

| Interest is a form of income | |

| Types of investment funds that pay interest | Bond funds |

| Money market funds | |

| Balanced funds | |

| Mutual funds | |

| Fixed-income securities | |

| Demand deposit accounts | |

| Fixed annuities | |

| Seller-financed mortgages | |

| Tax-deferred accounts | |

| Rental housing |

What You'll Learn

Interest from fixed-income securities

Fixed-income securities pay investors a fixed interest or dividend payment until maturity. At maturity, investors are repaid the principal amount they originally invested. The interest payments are typically distributed semi-annually, and the principal is returned to the investor at maturity.

The most common type of fixed-income security is a bond, which can be issued by companies or government entities. Bonds are typically issued by governments or corporations seeking to finance projects or operations. They are considered loans from investors to the issuer, with the promise of repayment of the principal amount at maturity and regular coupon payments representing interest paid on the loan.

Fixed-income securities can also take the form of money market instruments, such as commercial paper, banker's acceptances, certificates of deposit, repurchase agreements, and US government treasury bills. These instruments are considered short-term debt and are usually issued with maturities of one year or less.

Another example of fixed-income securities is asset-backed securities (ABS), which are backed by financial assets such as credit card receivables, auto loans, or home equity loans. ABS are packaged together as a single fixed-income security, offering investors an alternative to investing in corporate debt.

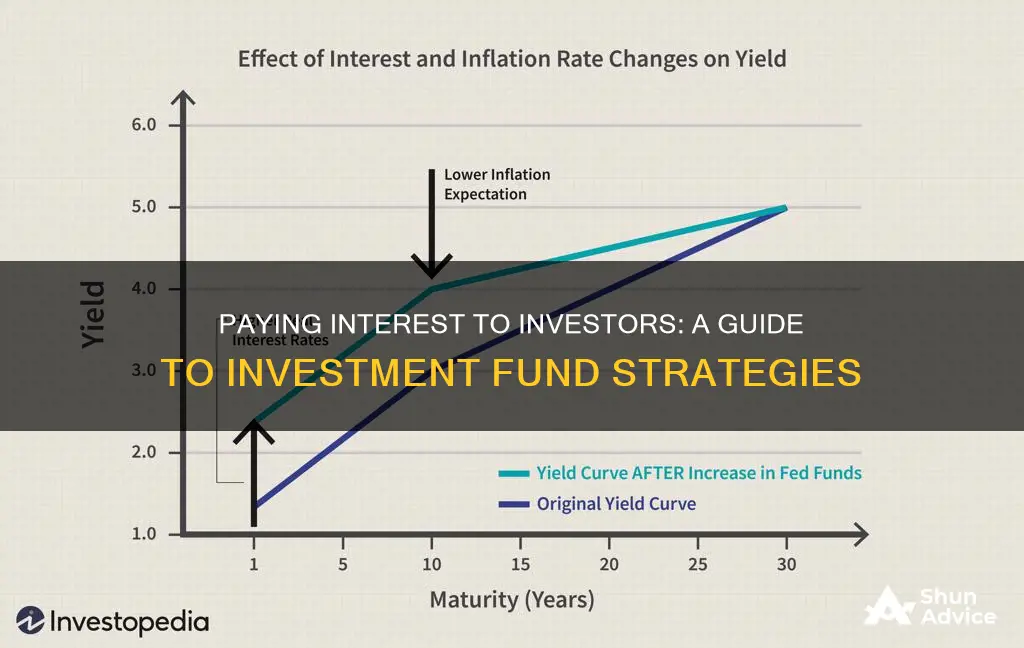

Fixed-income securities provide investors with a predictable cash flow and diversification from stocks and other asset classes. The interest payments received by investors are based on the creditworthiness of the borrower and current interest rates. Generally, fixed-income securities such as bonds pay higher interest rates for longer maturities.

Overall, fixed-income securities offer a steady stream of income over the life of the bond or debt instrument, making them a popular choice for retirement portfolios.

Jollibee's Mutual Fund Investment Guide for Beginners

You may want to see also

Interest from demand deposit accounts

Demand deposit accounts are a type of bank account that offers convenient access to funds and typically pay interest on deposited amounts. These accounts are suitable for investors who want to earn interest on their money while maintaining easy access to their funds.

When considering demand deposit accounts, it is essential to understand the different types available. These include checking accounts, savings accounts, and money market accounts. Checking accounts are transactional accounts that allow for frequent deposits and withdrawals, making them suitable for everyday expenses. Savings accounts usually offer higher interest rates than checking accounts but may have restrictions on the number of transactions allowed. Money market accounts often provide higher interest rates and offer check-writing capabilities, combining features of both checking and savings accounts.

Interest rates on demand deposit accounts can vary depending on the financial institution and market conditions. It is important to compare interest rates offered by different banks and credit unions to find the most competitive rates. Additionally, some demand deposit accounts may require a minimum balance to earn interest or avoid monthly fees.

It is worth noting that demand deposit accounts are considered low-risk investments, but they may not offer the highest interest rates compared to other investment options. The interest rates on these accounts can fluctuate based on changes in the market interest rates. Therefore, investors should carefully review the account terms and conditions, including any fees, minimum balance requirements, and withdrawal restrictions.

Overall, demand deposit accounts can be a suitable option for investors seeking a combination of liquidity and interest income. By understanding the features and terms of these accounts, investors can make informed decisions about where to place their funds to meet their financial goals.

A Beginner's Guide to UAE Mutual Fund Investing

You may want to see also

Interest from fixed annuities

Fixed annuities are a type of insurance contract that provides a guaranteed, fixed interest rate for a specified period of time. This guarantees an income stream in retirement, making them a popular option for retirement planning.

The value of a fixed annuity grows at a set interest rate, which is often a more appealing prospect than a variable annuity, where the value is dependent on market performance. With a fixed annuity, the initial rate is guaranteed for a certain portion of the contract, providing predictability and stability for retirement plans.

A fixed annuity can be purchased with a lump sum or a series of premium payments. The annuity's value then grows at the fixed interest rate, with earnings being tax-deferred. This means taxes are not paid until the annuitant begins receiving income payments, at which point the money is subject to income tax.

There are two types of fixed annuities: immediate and deferred. An immediate fixed annuity starts payouts shortly after the money is put in, whereas a deferred fixed annuity has a waiting period before payouts begin. Deferred annuities are often used as part of an overall retirement strategy, as they allow time for earnings to accumulate and increase the size of income payments.

Fixed annuities offer several benefits, including predictable investment returns, tax-deferred growth, and the potential to pass money on to heirs. They are a relatively low-risk product due to the guaranteed income stream and fixed interest rate. However, it is important to consider the fees associated with annuities, such as the surrender charge, and the illiquid nature of these investments.

IRA Funds: TD Ameritrade Investment Strategies for Beginners

You may want to see also

Interest from seller-financed mortgages

Seller financing is a type of real estate agreement where the seller handles the mortgage process instead of a financial institution. In this arrangement, the buyer pays the seller in instalments rather than using a traditional mortgage from a bank or credit union. This type of financing is also known as a purchase-money mortgage or owner financing.

In a seller-financed mortgage, the seller acts as the lender, providing the buyer with direct financing. The buyer enters into a mortgage transaction directly with the seller, agreeing to an interest rate, payment schedule, and consequences for defaulting on payments. This type of financing typically runs for a shorter period than a traditional mortgage and may include a balloon payment due at the end of the term.

One of the advantages of seller-financed mortgages is that they can be quicker and cheaper than conventional mortgages. There are no bank fees or origination charges, and closing costs are generally lower. Additionally, buyers may enjoy more flexible agreement terms and greater access to financing opportunities, especially those with poor credit or low income.

However, there are also disadvantages to seller-financed mortgages. Buyers may face higher interest rates and larger down payment requirements. The lack of regulations and protections can leave buyers vulnerable, and sellers face the risk of borrower default.

When considering a seller-financed mortgage, it is important for both parties to consult with qualified professionals and seek legal advice to ensure a fair and secure agreement.

A Beginner's Guide to Index Funds in South Africa

You may want to see also

Interest from mutual funds

Interest paid by mutual funds is typically distributed quarterly or yearly. Mutual funds are required to pass on all net income to shareholders at least once a year to avoid paying taxes on earnings. However, if the assets in the fund's portfolio pay interest more frequently, such as monthly or quarterly, the fund will likely make dividend distributions to match this schedule.

The interest paid by a bond fund is a direct result of the coupon payments generated by the bonds in its portfolio. Money market funds invest in short-term debt issuances that mature in less than a year, primarily investing in government bills and notes or highly-rated corporate debt with maturity dates under three months. Balanced funds, which include both debt and equity securities, make dividend distributions comprised of interest from debt assets and dividend payments from stock market investments.

Index Funds in Australia: Best Investment Options

You may want to see also

Frequently asked questions

Term deposits and bonds are defensive assets that are generally low-risk. High-yield savings accounts and long-term certificates of deposit (CDs) are also considered safe and offer higher interest rates than traditional savings accounts.

Understand what the company or bank plans to do with your money, and read the prospectus or product disclosure statement for key information about the investment. Remember that a "secured" investment may not be guaranteed.

Bond funds, money market funds, and balanced funds pay interest due to the coupon-bearing debt securities in their portfolios.

Mutual funds distribute interest as dividend distributions. Interest is usually paid out quarterly or yearly.

Yes, you can generally deduct interest paid on money borrowed for investments, but there are restrictions on the amount you can deduct and which investments qualify.