A Fidelity Statement is a financial document that provides a detailed summary of your account balance, investment holdings, and transaction history. It is a crucial tool for individuals and businesses to track their financial assets and evaluate investment performance. By understanding how to read and interpret a Fidelity Statement, investors can make informed decisions about their financial strategies and ensure they stay on course to meet their financial goals. This involves decoding complex financial terms, grasping investment concepts, and analyzing the various sections of the statement, such as account information, performance summaries, holdings and transactions, and fees. In this article, we will provide a comprehensive guide on how to navigate your Fidelity Statement, empowering you to track your financial progress and make strategic choices to optimize your investment outcomes.

| Characteristics | Values |

|---|---|

| Purpose | To provide a detailed summary of your account balance, investment holdings, and transaction history |

| Type of Information | Account balance, investment holdings, transaction history, fund performance, transaction history, asset allocation, fees, interest rates, dividend payments, market volatility, etc. |

| Frequency | Monthly, quarterly, and year-end statements are available |

| Format | PDF or online |

| Security | Encrypted connections and multi-factor authentication |

What You'll Learn

Monthly and quarterly account statements

These account statements offer a detailed summary of your financial holdings, including account balances, interest rates, dividend payments, and other key financial details. They enable you to monitor any fluctuations in your total account balance, reflecting the overall performance and health of your investments.

The statements also provide valuable insights into interest rates, which influence the growth of your funds over time. They show the annual percentage yield earned on your investments, impacting the long-term growth of your portfolio. Additionally, dividend payments from stocks or mutual funds are included in the statements, revealing the income generated by your investments.

By reviewing the monthly and quarterly account statements, you can make informed decisions to achieve your financial goals. These statements empower you to assess the health of your portfolio and take necessary actions to align with your investment objectives. They provide a clear picture of your financial standing and help you stay updated on retirement planning strategies.

It is recommended to regularly review these statements to monitor account balances, track retirement savings progress, and enhance your investment knowledge. This consistent review ensures that your financial goals remain in sync with the performance of your investment portfolio.

Mutual Fund Investment: Taxable or Not?

You may want to see also

Year-end investment reports

One of the key sections of a year-end investment report is the financial report, which includes financial statements such as the profit and loss statement, balance sheet, statement of changes in equity, and statement of cash flows. The profit and loss statement offers insights into the company's revenue and expenses during the reporting period, while the balance sheet presents the assets, liabilities, and obligations of the company. The statement of changes in equity details any equity-related changes, such as the issuance of new shares, and the statement of cash flows illustrates the cash inflows and outflows over the same period.

Another important aspect of the year-end investment report is the directors' report, which contains valuable information for shareholders and potential investors. This section typically includes details about the company's operations, financial position, business strategies, and future prospects. It provides a narrative that complements the financial data, offering a more holistic understanding of the company's performance and direction.

Additionally, the annual report may include a letter from the Chief Executive Officer (CEO) or other high-level executives, market segment information, new product plans, and research and development updates. It is also common for annual reports to contain graphical representations, such as tables, charts, or graphs, that illustrate the company's financial data and holdings by category.

It is worth noting that annual reports are subject to specific regulations and accounting rules, ensuring transparency and compliance. In some jurisdictions, companies are required to prepare and disseminate their annual reports within a specified timeframe, making them publicly available to shareholders and other stakeholders.

By carefully reviewing the various sections of a year-end investment report, investors can gain valuable insights into a company's financial health, strategic direction, and potential risks or opportunities. This information empowers investors to make well-informed decisions regarding their investment portfolios and financial strategies.

How Real Estate Investment Fund Managers Make Money

You may want to see also

Interested party statements

To add an interested party, you must first provide their contact information, including their full name, mobile phone number, email address, and mailing address. You can then select which accounts you would like to share documents from, and whether the interested party should receive statements, trade confirmations, or both.

It is important to note that you cannot share documents with an entity, only with an individual within an entity organisation. The interested party must also provide a US phone number and address.

To remove an interested party's access to shared documents, you can select the "Remove access to shared documents" option on the Share Documents page. You will then need to select the interested party and the accounts that they will no longer receive new shared documents from. The process takes 1-2 days, and the interested party will continue to have access to previously shared documents.

Social Security Funds: Risky Business or Smart Investing?

You may want to see also

Prospectuses and financial reports

If you are unable to see your account documents online, it may be due to one of the following reasons:

- Your Social Security Number (SSN) is not listed as an owner on the account. Only owners of an account and persons given authority by the owner can view the documents online.

- There was no reportable information on your account(s).

- The document is not yet or no longer available online.

- You do not own the mutual fund you are looking for in that account. Try selecting another account or viewing all accounts.

- You are trying to view interested party statements, and your SSN is not listed on your interested party profile.

- You have an account that is not eligible for online documents.

If you are still unable to view your documents online, you can contact a Fidelity representative for further assistance.

T. Rowe Price: Mutual Fund Investment Strategies

You may want to see also

Quarterly performance reports

When reviewing your quarterly performance report, it's important to analyze the following key aspects:

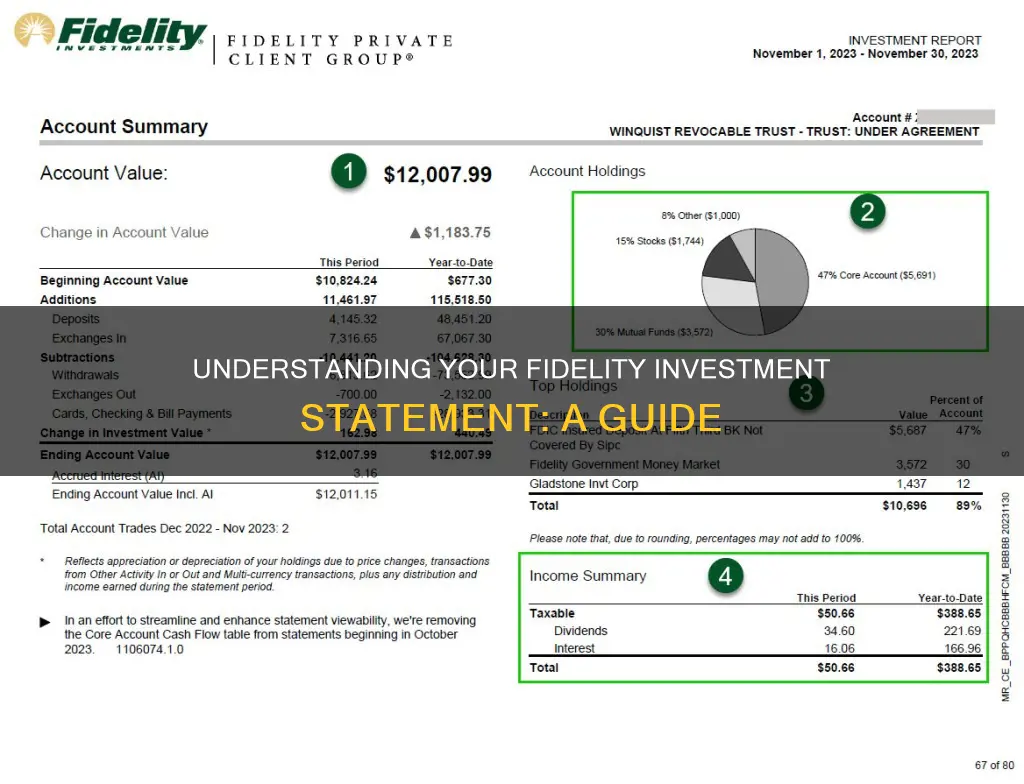

- Account Summary: This section provides a concise overview of your account details, including account balances, interest rates, dividend payments, and other key financial information. Understanding these figures helps you assess the health of your portfolio and track progress towards your financial goals.

- Fund Performance: Evaluating the performance of your investments is essential. Compare the returns of your investments against industry benchmarks to gauge their relative success. Consider factors like market volatility and how different asset classes impact your portfolio's performance.

- Investment Returns: Assess the investment returns outlined in the report. Analyze how your investments have grown or declined over the quarter and consider the impact of fees and expenses.

- Market Analysis: Consider the market trends and analysis provided in the report. Understanding market movements and their potential impact on your investments is crucial for making informed decisions.

- Holdings and Transactions: Review the details of your portfolio holdings, transaction history, investment products, and capital gains. This information provides insights into the composition and performance of your investments.

- Fees and Expenses: Pay close attention to the fees and expenses outlined in the report. Understand the expense ratios, investment fees, and account management costs to grasp the overall cost of maintaining your investment portfolio.

By regularly reviewing your quarterly performance reports and analyzing these key aspects, you can make informed decisions about your investment strategies, adjust your financial plans, and work towards optimizing your investment outcomes. Remember to compare your quarterly performance reports with previous statements to track progress and make strategic decisions accordingly.

Best Mutual Funds to Invest in the USA

You may want to see also

Frequently asked questions

A Fidelity Statement is a document provided by a financial institution that contains essential information about your investment accounts, including account balances, fund performance, transaction history, and more. It is a comprehensive summary of your financial dealings.

Reading a Fidelity Statement helps investors understand their financial standing and track the performance of their investments. It allows them to identify any unexpected changes and ensure their financial goals are on track. By staying informed about fees and returns, investors can make better decisions about their investment strategies.

It is recommended to review your Fidelity Statement regularly to monitor account balances, track progress towards retirement savings goals, and stay updated on retirement planning strategies. Regular reviews ensure your financial goals align with the performance of your investment portfolio.