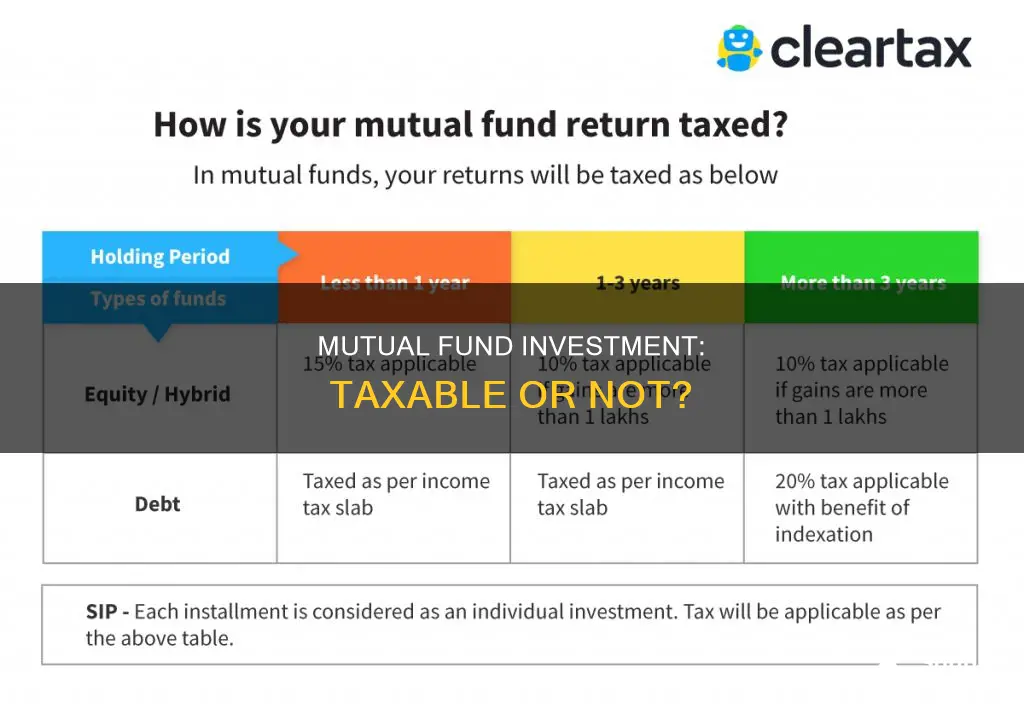

Mutual funds are a great way to grow your money, but it's important to understand the tax implications of your investments. Mutual funds are indeed taxable, but the amount of tax you pay depends on several factors. Firstly, the type of mutual fund you invest in matters: equity funds, which focus on stocks, are taxed differently from debt funds, which invest in fixed-interest securities. Secondly, the length of your investment also determines the tax rate. For example, debt funds held for more than 36 months typically incur a higher tax rate on gains compared to longer holding periods. For equity funds, the holding period is shorter, at 12 months. When you sell your mutual fund units, you may have to pay taxes on the gains, known as capital gains taxes, which can be different for short-term and long-term gains. It's worth noting that you may also owe taxes if the fund realises a gain by selling a security for a higher price than it was bought for, even if you haven't personally sold any shares. Additionally, dividends received from mutual funds are also subject to taxes, and the fund company usually deducts a dividend distribution tax (DDT) before distributing dividends to investors. So, while mutual funds are a great investment vehicle, understanding the tax implications is crucial to making informed decisions and maximising your returns.

| Characteristics | Values |

|---|---|

| Definition | A mutual fund is a pooled collection of assets that invests in stocks, bonds, and other securities. |

| Benefits | Diversification, affordability, liquidity, professional management |

| Investment types | Stock funds, bond funds, money market funds, target date funds |

| Investment strategies | Actively managed funds, index funds |

| How to make money | Dividend payments, capital gains distributions, increased NAV |

| Risks | Loss of money invested, volatility, management risk, market risk, interest rate risk |

| How to buy | Directly from the company, through a broker, or with a traditional financial advisor |

| Fees | Operating expense ratio, load, brokerage trading fee, expense ratio, redemption fee |

What You'll Learn

Mutual fund distributions and taxes

Mutual funds are investment companies that pool together the contributions of their shareholders to invest in numerous securities, known as portfolios.

Distributions from mutual funds occur for several reasons and are subject to different tax rates. Most distributions you receive from a mutual fund must be declared as investment income on your yearly taxes. However, the type of distribution, how long the fund has held the investment, and the type of investment itself are all factors in determining how much tax you pay.

For example, if you receive a distribution from the sale of a security that the fund held for six months, that distribution is taxed as ordinary income. If the fund held the security for several years, however, it is subject to the capital gains tax, which is usually lower than the ordinary income tax rate.

Mutual funds must distribute any dividends and net realised capital gains earned on their holdings over the prior 12 months, and these distributions are taxable income even if the money is reinvested in shares in the fund. If you hold shares in a taxable account, you are required to pay taxes on mutual fund distributions, whether the distributions are paid out in cash or reinvested.

If you sell a mutual fund investment and the proceeds exceed your adjusted cost base, you realise a capital gain, which must be reported in the year of the sale. If the proceeds are less than your adjusted cost base, you realise a capital loss, which can be applied against capital gains to reduce the amount of tax payable.

Calculating the taxes owed on mutual fund income and distributions can be complex, and it is recommended to consult a tax professional to ensure you are properly reporting all your investment income.

M1 Finance: Invest in One Fund for Easy Diversification

You may want to see also

Capital gains and taxes

When it comes to mutual funds, there are a variety of distributions, each with its own tax implications.

Capital gains taxes are incurred when you sell a mutual fund investment and the proceeds exceed your adjusted cost base. Capital gains are taxed more favourably than interest, dividends, and foreign income. Only 50% of a capital gain is taxable. You must report realised capital gains for tax purposes in the year of the sale.

If the proceeds from the sale of a mutual fund are less than your adjusted cost base, you realise a capital loss. Capital losses can be applied to reduce the amount of tax payable on capital gains. If there are no capital gains in the year a loss is realised, the loss can be carried back and applied to taxable capital gains from the previous three years. Capital losses can also be carried forward indefinitely to offset gains in future years.

Capital gains taxes are incurred when a mutual fund sells a security it has held for more than a year. If a fund sells a security it has held for less than a year, the distribution is taxed at your ordinary income tax rate.

The difference between your ordinary income tax rate and your long-term capital gains tax rate can be significant. For example, in 2022, those in the 10% and 12% income tax brackets were not required to pay any income tax on long-term capital gains, whereas those in the highest income tax bracket of 37% were subject to a 20% capital gains tax.

Types of Distributions and Their Tax Implications

There are five types of distributions from mutual funds, each with different tax implications:

- Ordinary dividends: The most common type of dividend, these are distributions from a mutual fund's earnings and profits. Ordinary dividends are taxed at the same rates as ordinary income (up to 37%).

- Capital gains distributions: These are paid from a fund's net realised long-term capital gains and are taxed as long-term capital gains, regardless of how long you have owned shares in the fund.

- Exempt-interest dividends: These are paid from tax-exempt interest earned by the fund and are not taxable.

- Non-dividend distributions: These are distributions that are not from earnings and profits but are instead a return of your investment in the fund. This type of distribution reduces the cost basis of your shares and must be reported as a capital gain if your basis is zero.

- Reinvestment of distributions: Most mutual funds allow shareholders to automatically reinvest distributions in more shares in the fund. Reinvested amounts are reported the same way as if they were received in cash.

TSP Fund Choices: Navigating Your Investment Options

You may want to see also

Dividend distributions and taxes

When a mutual fund declares a dividend, it also announces the ex-dividend date and the date of record. The date of record is when the fund reviews its list of shareholders who will receive the dividend payment. The ex-dividend date is the day after, and any sale of shares after this date still receives the dividend, even if the investor no longer holds the shares.

Dividends paid by mutual funds are generally considered ordinary income and are taxed at the investor's regular income tax rate. However, there are two important exceptions: qualified dividends and tax-free interest.

Qualified dividends are those paid by stocks issued by US or qualified foreign corporations, and the fund must have held the stock for more than 60 days within a specific period. These dividends are taxed at the lower capital gains rate.

Tax-free interest is generated by investing in government and municipal bonds, which are exempt from federal income tax, though they may be subject to state and local income taxes.

It is important to note that mutual fund distributions are not always dividends. They can also include capital gains, which are taxed at different rates depending on the duration of the investment holding. Long-term capital gains are generally taxed at lower rates than short-term capital gains.

The timing of purchases and sales relative to distributions is a crucial tax strategy. Buying shares just before a distribution occurs means the investor will have to pay tax on gains for the entire year, not just the period they owned the shares. Selling a fund prior to a distribution generally results in a greater capital gain or a smaller loss.

Additionally, the fund's turnover rate should be considered, as funds that trade securities frequently may accumulate more taxable gains and incur higher trading fees.

Overall, understanding the tax implications of dividend distributions is essential for investors in mutual funds, and consulting a tax professional is always advisable.

Invest in Tesla: Top Mutual Funds to Consider

You may want to see also

Tax-efficient investing strategies

When it comes to investing in mutual funds, there are a few strategies you can use to minimise your tax burden and maximise your returns.

Firstly, it's important to understand the difference between ordinary income and capital gains. Ordinary income is generally taxed at a higher rate than capital gains. Capital gains are only considered as such if the investment has been held for more than a year. If you sell a mutual fund investment and make a profit, or capital gain, you will need to pay tax on this profit, so it's important to keep track of your investments and the tax obligations associated with them.

There are two main types of investment accounts: taxable and tax-advantaged. Taxable accounts, such as brokerage accounts, offer more flexibility than tax-advantaged accounts but are taxed depending on how long the asset was held for. Tax-advantaged accounts can be tax-deferred, like traditional IRAs and 401(k)s, where you pay taxes when you withdraw the money, or tax-exempt, like Roth IRAs and Roth 401(k)s, where contributions are made with after-tax dollars but investments grow tax-free.

When deciding which type of account to use, consider that investments that lose less earnings to taxes are better suited to taxable accounts, while those that lose more earnings to taxes are better held in tax-advantaged accounts. You can also use tax-loss harvesting to your advantage, where losses on investments are used to offset taxable capital gains, thus reducing your tax bill.

Additionally, the timing of your purchases and sales can impact your tax bill. For example, if you buy shares in a fund just before a distribution occurs, you will be taxed on the gains for the entire year, not just the period you owned the shares.

Finally, consider the fund's turnover rate. Funds that trade securities frequently may accumulate more taxable gains, so opting for funds with a lower turnover rate may be more tax-efficient.

Remember, investment decisions should be driven primarily by your financial goals, risk tolerance, and time horizon, but incorporating tax-efficiency strategies can help you keep more of your returns.

A Simple Guide to Investing in the S&P 500 Index Funds

You may want to see also

Tax implications of selling or switching mutual funds

Mutual funds are investment companies that invest the collective contributions of their thousands of shareholders in numerous securities, known as portfolios. As with any investment, there are tax considerations related to the purchase and sale of mutual funds.

Tax Implications of Selling Mutual Funds

If you sell a mutual fund investment and make a profit (i.e., the proceeds exceed your adjusted cost base), you realize a capital gain, which must be reported for tax purposes in the year of the sale. Capital gains are taxed more favourably than interest, dividends, and foreign income. Under current tax rules, only 50% of a capital gain is taxable.

On the other hand, if you sell a mutual fund investment at a loss (i.e., the proceeds are less than your adjusted cost base), you realize a capital loss, which can be applied against capital gains to reduce the amount of tax payable. If there are no capital gains to offset the loss, it can be carried back and applied against taxable capital gains from any of the previous three years. Alternatively, the capital loss can be carried forward indefinitely to offset gains in future years.

Tax Implications of Switching Mutual Funds

Switching between mutual fund trusts in a non-registered account is treated as a sale and purchase for tax purposes. If the units you sold are worth more than what you originally purchased them for, the switch will generate a capital gain. Conversely, if the units you sold are worth less than what you originally paid, the switch will generate a capital loss.

In either case, you are required to keep track of your capital gain or loss and include its taxable portion in your taxable income in the year of the sale. It is recommended to consult a financial advisor or qualified tax specialist to understand the tax implications before switching your investments.

Factors Affecting Taxes on Mutual Funds

The tax implications of owning and selling mutual funds depend on various factors, including the type of distribution, the duration of the investment holding, and the type of investment.

- Ordinary Income vs. Capital Gains: Ordinary income is generally taxed at higher rates than capital gains. Capital gains refer to profits from the sale of investments held for more than one year, while ordinary income includes profits from the sale of investments held for one year or less.

- Qualified Dividends: Dividend distributions from mutual funds may be taxed at the lower capital gains rate if they meet certain requirements, such as being paid by a stock issued by a U.S. or qualified foreign corporation.

- Tax-Free Interest: Interest earned on certain types of bonds, such as municipal bonds, may be exempt from federal, state, or local taxes, depending on the specific circumstances.

- Timing of Purchases and Sales: Buying or selling mutual fund shares just before a distribution can have a significant tax impact. It is generally more tax-efficient to sell before a distribution to avoid being taxed on gains for the entire year.

- Fund Turnover Rate: Funds with a high turnover rate, meaning they frequently trade securities, may accumulate more taxable gains and incur higher trading fees.

Tax Reporting and Professional Advice

To assist in tax reporting, fund companies or investment dealers will typically issue a statement of your mutual fund transactions (T5008/Relevé 18) at the end of the year, listing any investments sold or redeemed during the calendar year.

Given the complexity of tax regulations and the potential for significant tax liabilities, it is advisable to consult a qualified tax professional or financial advisor to ensure proper reporting and optimize your tax strategy when dealing with mutual fund investments.

ICICI Bank Debt Funds: A Comprehensive Investment Guide

You may want to see also

Frequently asked questions

Yes, mutual funds are taxable based on the gains earned from them.

The tax on mutual funds is determined by factors such as the type of fund and the holding period of the investment.

Capital gains from mutual funds are taxed based on the holding period of the investment. For example, in the US, if you sell a mutual fund investment and the proceeds exceed your adjusted cost base, you realize a capital gain, which is taxed more favourably than interest or dividend income.

Yes, certain accounts, such as individual retirement and college savings accounts, are tax-advantaged. If you have mutual funds in these types of accounts, you pay taxes only when earnings or pre-tax contributions are withdrawn.

Switching between mutual funds is deemed as selling units of one fund and purchasing units in another. If the units you sold are worth more than what you originally purchased them for, the switch will generate a capital gain. If the units you sold are worth less, the switch will generate a capital loss. In both cases, you are required to keep track of your capital gain or loss and include it in your taxable income for the year of sale.