Running an investment fund is no easy feat. It requires a lot of planning, legal and tax advice, and a solid business strategy. The first step is to define your business strategy and differentiate your financial plan from competitors. This involves significant research into the market or sector you plan to target. You will also need to establish a business plan, including cash flow expectations and a timeline for raising capital and exiting from portfolio investments.

The next step is to incorporate your business and register with the relevant agencies and state government. In the US, this involves registering with the Securities and Exchange Commission (SEC) and the Investment Advisor Registration Depository (IARD). You will also need to establish a fee structure, with private equity managers typically receiving an annual management fee of 2% of committed capital from investors.

One of the toughest steps is raising capital, where fund managers are expected to contribute 1-3% of the fund's capital. You will need to pitch your fund to potential investors and build a track record of successful investments. It is also essential to establish an external team of consultants, including independent accountants, attorneys, and industry consultants.

Running an investment fund is a demanding and stressful endeavour, but with the right preparation and strategy, it can be a successful and rewarding venture.

| Characteristics | Values |

|---|---|

| Business strategy | Picking which sectors to target |

| Business plan | Calculate cash flow expectations, establish a timeline, and outline a marketing plan |

| Operations setup | Establish an external team of consultants, set up an advisory board, and explore disaster recovery strategies |

| Investment vehicle | Establish the fund's legal structure, e.g. a limited partnership or a limited liability firm |

| Fee structure | Determine provisions related to management fees, carried interest, and hurdle rates |

| Raising capital | Prepare to invest your own money, use a "friends and family" approach, or target high-net-worth individuals |

| Paperwork and legal/corporate structure | Set up office space, hire service providers, and consult a good attorney |

| Hiring a team | Look for people who are willing to get any task done no matter how random or ridiculous it is |

| Marketing | Share quality content on social media, offer to give seminars to community groups, and hone your pitch |

What You'll Learn

Raising capital

- Invest your own money: Fund managers are typically expected to contribute between 1% to 3% of the fund's total capital commitments. New managers with less capital can likely succeed with a commitment of 1% to 2% for their first fund.

- Define your target investors: Identify the types of investors you plan to target, such as institutional investors (insurance firms, sovereign wealth funds, financial institutions, pension programs, etc.) or accredited investors (individuals meeting specific annual income or net worth thresholds).

- Develop a strong pitch: Craft a compelling story and pitch that showcases your investment process, strategy, and track record. Ensure your pitch is specific, repeatable, and understandable.

- Build relationships: Cultivate a strong network and seek introductions to potential investors through fund managers, trustees, prime brokerage providers, or other connections.

- Prepare for due diligence: Expect potential investors to conduct thorough due diligence, including background checks and in-depth presentations. Be prepared to answer questions about your strategy, decision-making process, risk management, team, and past investments.

- Focus on smaller investors: While large institutional investors may have more capital, approaching smaller family offices and high-net-worth individuals can be a faster way to raise capital. However, it will require more meetings and individual investors to reach a critical mass of capital.

- Demonstrate skin in the game: Many investors will only commit if they see that you are also putting a significant portion of your net worth into the fund.

- Build a solid team: Investors will also evaluate your team's expertise and experience. Ensure you have a capable team in place, including investment professionals, support staff, and outsourced service providers.

Remember, raising capital is a challenging and time-consuming process. Be prepared for setbacks and focus on building relationships and showcasing your unique value proposition.

Fidelity Proof of Funds: Accessing Investment Account Verification

You may want to see also

Setting up the paperwork and legal/corporate structure

Choose a Legal Structure

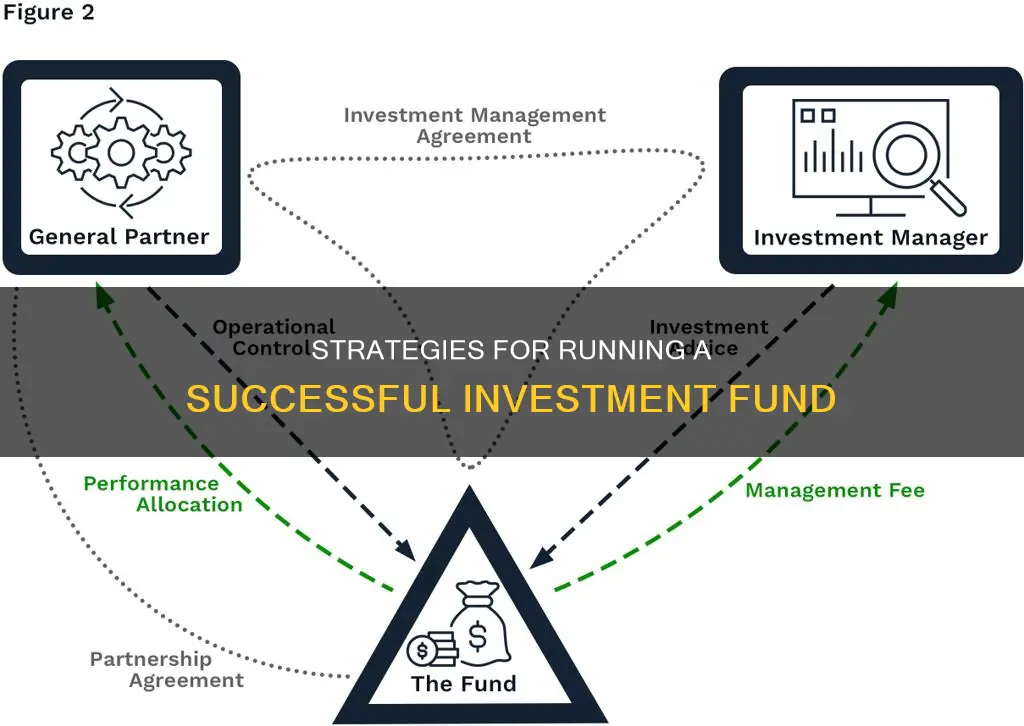

The legal structure of your investment fund will depend on the type of fund you are establishing and the jurisdiction in which it will operate. In the United States, for example, a fund typically assumes the form of a limited partnership or a limited liability company. It is important to understand the legal requirements specific to your location.

Engage Professional Services

Retain the services of qualified professionals, including lawyers, accountants, and tax advisors. Their expertise will be invaluable in ensuring your fund is established in compliance with the relevant laws and regulations. A good attorney should be your first call, as they will help you draft the necessary documentation and advise on the legal structure.

Prepare the Necessary Paperwork

Work with your legal and tax advisors to prepare the required documentation, which may include articles of incorporation, operating agreements, and private placement memorandums. The specific paperwork will depend on the type of fund and the jurisdiction.

Register with Relevant Authorities

Register your investment fund with the appropriate regulatory bodies. In the US, for instance, investment companies must register with the Securities and Exchange Commission (SEC) and the Investment Advisor Registration Depository (IARD). Additionally, you may need to register with a self-regulatory organization (SRO) such as the Financial Industry Regulatory Authority (FINRA).

Establish Compliance and Risk Guidelines

Before launching your fund, establish clear compliance and risk guidelines. These guidelines will help ensure that your fund operates within the boundaries set by regulatory bodies and protects the interests of your investors.

Determine the Fee Structure

Decide on the fee structure for your fund, including management fees and performance fees. The industry trend is towards lower management fees and a greater emphasis on performance fees. Ensure that your fee structure is competitive and aligns with the expectations of potential investors.

Prepare Offering Documents

Prepare the offering documents that will be provided to potential investors. These documents may include an offering memorandum, subscription agreement, partnership terms, custodial agreement, and due diligence questionnaires. It is essential to provide comprehensive and transparent information to investors.

Obtain Marketing Materials

Obtain marketing materials from the funds and investment companies you plan to represent. These materials will help you promote their products and services to your clients. Additionally, create your own marketing collateral, such as brochures, websites, business cards, and advertisements, to effectively reach your target audience.

Invest in Suntrust Mutual Fund: Secure Your Future

You may want to see also

Hiring a team

- Experience and qualifications: Look for candidates with relevant industry experience and strong educational backgrounds. While not always necessary, a degree in finance, economics, or a related field can be advantageous. Additionally, candidates with professional certifications (e.g., Series 7, 63, and 65 licenses) can bring valuable expertise to your team.

- Willingness to take on diverse tasks: In a startup investment fund, your team members should be adaptable and willing to take on a variety of tasks, regardless of their level of randomness or complexity. Look for individuals who are team players and are committed to the success of the fund.

- Network and referrals: Tap into your professional network and reach out to former co-workers when hiring. Referrals from trusted sources can help you identify reliable and competent candidates.

- Investment knowledge and strategy alignment: Ensure that your investment staff understands the investment strategies and ideas that your fund will be implementing. They should be able to articulate these strategies and convey them to potential investors when necessary.

- Administrative and operational support: Even with external service providers, you will need internal support staff to handle administrative and operational tasks. These individuals will help with legal, accounting, and compliance matters, as well as investor relations and marketing.

- Size of the team: The size of your team will depend on your AUM and the nature of your fund. Quant funds, for example, tend to have larger teams due to greater IT needs, while value-oriented funds may start with a smaller team, including the founder and one person on the investing side.

- Compensation and benefits: Consider offering competitive compensation packages, including profit-sharing programs, bonus structures, and retirement plans, to attract and retain top talent.

- Internships and entry-level positions: Consider hiring interns or entry-level employees to support your team. This can be a cost-effective way to add talented individuals to your team while also providing mentorship and growth opportunities.

Remember, building a strong team is essential for the success of your investment fund. Look for individuals who are not only qualified but also align with your fund's culture and values.

A Guide to Investing in the Philequity PSE Index Fund

You may want to see also

Marketing strategy

Marketing is an essential aspect of running an investment fund, as it helps to attract investors and set your fund apart from the competition. Here are some key components of a marketing strategy for an investment fund:

Know Your Target Market

Understanding your target audience is crucial. Develop detailed client profiles that consider factors such as age, income, financial situation, risk tolerance, and investment goals. This will help you tailor your marketing messages and distribute them through the most effective channels.

Content Creation

Create high-quality, compliant content that showcases your fund's unique value proposition. Develop a content pillar, such as an eBook or white paper, that provides an in-depth description of your fund. Then, create derivative content pieces for different stages of the buyer's journey, from awareness to consideration and, finally, to the decision stage. Ensure your content is accurate, clear, fair, and compliant with regulatory requirements.

Utilize Various Marketing Channels

Use a combination of marketing channels to reach your target audience effectively. This includes social media, email marketing, blogs, articles, webinars, and paid advertising. Leverage social media platforms to connect with potential investors, especially younger, high-net-worth individuals. Ensure your website is informative and engaging, providing valuable insights and establishing your fund's expertise.

Build a Strong Online Presence

In today's digital age, having a robust online presence is crucial. Optimize your website and social media profiles to make them informative and engaging. Use search engine optimization (SEO) techniques to ensure your website appears high in search engine results. Share valuable content, such as blog posts, articles, and videos, to establish your fund's expertise and build trust with potential investors.

Leverage Data and Technology

Use data analytics to target your marketing efforts effectively. Collect and analyze data on your target audience's behaviour and preferences to create targeted marketing campaigns. Utilize technology to connect with investors, distribute data and thought leadership content, and ensure compliance with regulatory requirements.

Measure and Optimize

Regularly measure the effectiveness of your marketing campaigns by tracking relevant metrics and key performance indicators (KPIs). Analyze website analytics, email open rates, social media engagement, and other relevant data. Compare the results with previous campaigns and industry benchmarks to identify areas for improvement. Optimize your marketing strategy based on the insights gained to continuously improve your fund's marketing performance.

Index Funds: Best Time to Invest and Maximize Returns

You may want to see also

Business plan

A business plan is a crucial step in setting up an investment fund. Here are the key components to include when writing a comprehensive business plan:

Marketing Plan

Decide on the target audience for your investment fund. Will you focus on business owners, high-net-worth individuals, or middle-income households? Develop detailed marketing strategies to reach your chosen target audience and convince them to become your clients. Utilise social media platforms to share valuable content about investments and personal finance to attract and retain clients. Consider offering seminars or presentations to community groups to establish yourself as a knowledgeable and trustworthy source of information.

Investment Strategy

Clearly articulate your investment strategy and the sectors or geographic regions you plan to target. Define whether your fund will focus on one specific region or industry in a particular country, or if it will take a broader approach. Determine the purpose of each investment—is it to grow capital for mergers and acquisitions, or to enable existing owners to sell their positions in the firm?

Timeline

Establish a timeline for your investment fund, including the period for raising capital and exiting from portfolio investments. Typically, investment funds have a lifespan of around 10 years, but this can be adjusted at the manager's discretion.

Growth Strategy

Outline a strategy for how the fund will grow over time. This should include plans for expanding your client base, as well as strategies for increasing the value of the fund and generating higher returns for investors.

Executive Summary

Provide an executive summary that ties together all the sections of your business plan. This should highlight the key aspects of your fund, including its unique value proposition, investment strategy, target audience, and expected growth trajectory.

External Team

Consider establishing an external team of consultants, including independent accountants, attorneys, and industry consultants. This team can provide valuable insights into the industries and companies that your fund will invest in. Additionally, explore disaster recovery strategies to prepare for potential challenges such as cyberattacks or market downturns.

Management Team

Define the roles and titles within your management team, such as CEO, CFO, Chief Information Security Officer, and Chief Compliance Officer. If you are a first-time fund manager, having a team with diverse expertise and experience can significantly enhance your credibility and attract more investors.

Strategies for Investing Your Six-Month Emergency Fund Wisely

You may want to see also

Frequently asked questions

You will need a business plan, a strategy, and a clear idea of the sectors you want to target. You will also need to decide on a business structure, establish a fee structure, and raise capital.

You will need to register with the Securities and Exchange Commission (SEC) and the Investment Advisor Registration Depository (IARD). You will also need to register with a self-regulatory organisation (SRO) such as the Financial Industry Regulatory Authority (FINRA).

Running an investment fund is a demanding task that requires long-term planning. You will need to hire a team, manage relationships with investors, and deal with the stress of making investment decisions.

You will need a solid track record in investment management, a well-defined investment strategy, and a strong network of connections. It is also important to have a clear understanding of the regulatory environment and to ensure compliance with legal and tax requirements.