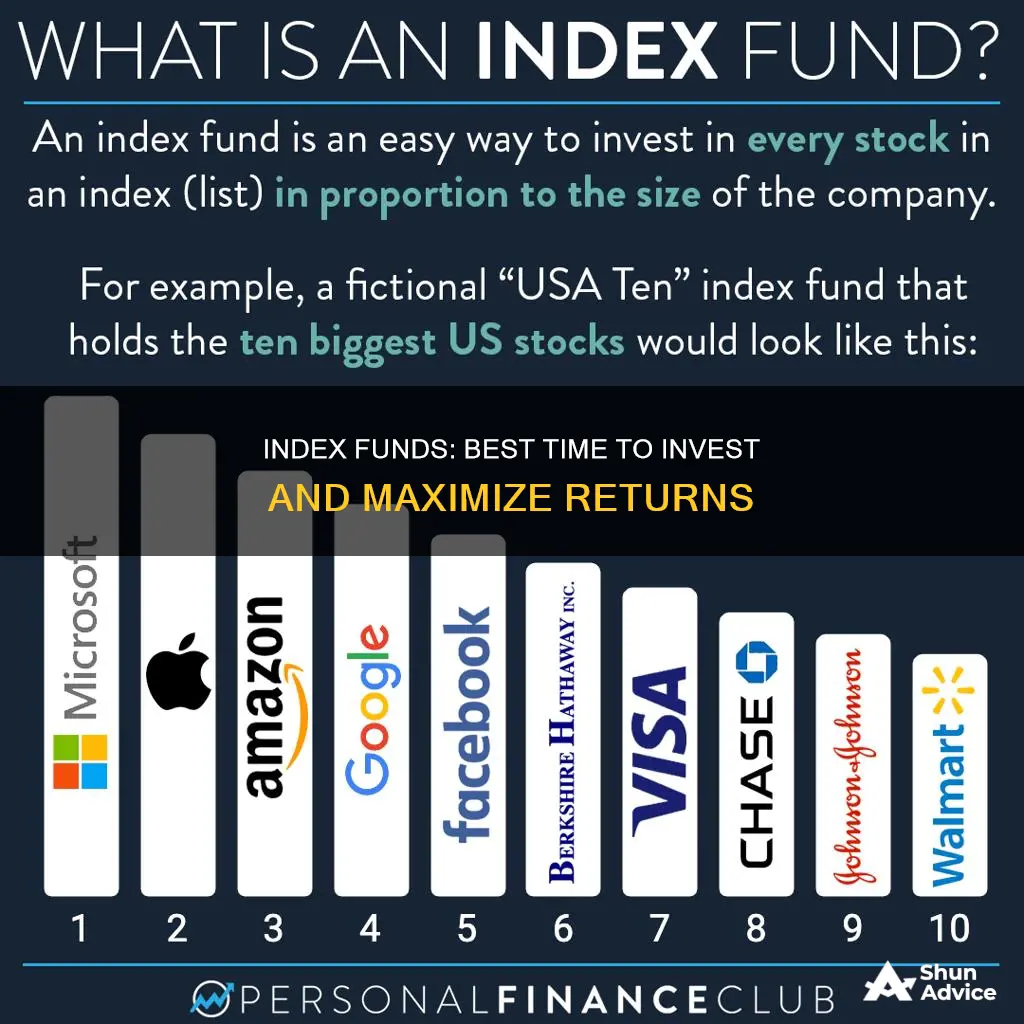

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are a low-cost, easy way to build wealth and are popular with retirement investors. Index funds are less expensive than actively managed funds and typically carry less risk than individual stocks.

Index funds are considered a passive investment strategy, meaning they don't require active management or frequent trades, which helps keep costs low. The funds are designed to mirror the performance of the index they track, so if the index goes up, the fund goes up, and vice versa.

When it comes to investing in index funds, it's important to consider factors such as the fund's expenses, taxes, investment minimums, and long-term performance. It's also crucial to have a long-term investment horizon, as index funds tend to perform well over the long term.

Overall, index funds offer investors a simple, cost-effective way to gain exposure to a diversified portfolio of stocks or bonds, making them a suitable investment option for beginners and experienced investors alike.

| Characteristics | Values |

|---|---|

| Best time of year to invest | Any time, if your investment horizon is a decade or more |

| Best investment platforms | Vanguard, TD Ameritrade, Fidelity |

| Best index funds | S&P 500, Dow Jones Industrial Average, Nasdaq Composite, Russell 2000 Index, Wilshire 5000 Total Market Index, MSCI EAFE Index |

| Best brokers for mutual funds | Vanguard, TD Ameritrade, Fidelity, E*TRADE |

| Best low-cost index funds | Vanguard S&P 500 ETF, Vanguard Large-Cap ETF, Schwab U.S. Large-Cap ETF, Vanguard Mid-Cap ETF, Schwab U.S. Mid-Cap ETF, Vanguard Small-Cap ETF, iShares Core S&P Small-Cap ETF, Schwab U.S. Broad Market, iShares Core S&P Total US Stock Market, Vanguard Total Stock Market |

What You'll Learn

Index funds are a type of mutual fund or exchange-traded fund (ETF)

Index funds are considered a passive management strategy as they don't need to actively decide which investments to buy or sell. They are designed to be the market by buying stocks of every firm listed on a market index to match the performance of the index as a whole. This means that index funds are often used to help balance the risk in an investor's portfolio, as market swings tend to be less volatile across an index compared to individual stocks.

Index funds are available across a variety of asset classes, and investors can buy funds that focus on companies with small, medium, or large capital values, or on specific sectors like technology or energy.

Index funds are often cheaper than actively managed funds as they require less work. Actively managed funds tend to have higher fees as they require more work and have larger staffs. Index funds are also more tax-efficient than active funds since they tend to take more of a buy-and-hold approach, minimising taxable events.

The primary advantage that index funds have over actively managed funds is lower fees. Actively managed funds rarely beat the market, and if they do, it's unlikely that they will continue to do so over the long term. As such, passively managed index funds typically bring better returns over the long term.

Index funds are a popular choice for investors seeking low-cost, diversified, and passive investments that tend to outperform many higher-fee, actively traded funds. They are ideal for long-term investing, such as retirement accounts.

Index Funds vs Roth IRA: Where Should You Invest?

You may want to see also

They aim to mirror the performance of a designated index

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a designated market index, such as the S&P 500, by holding a representative sample of the same stocks or bonds. They are passively managed, meaning they aim to mirror the performance of the index they track, rather than trying to beat the market. This means they are designed to replicate the performance of financial market indexes, and they are ideal for long-term investing, such as retirement accounts.

Index funds have become an increasingly popular investment choice, particularly for those seeking low-cost, diversified, and passive investments. They offer investors a simple, cost-effective, and relatively low-risk way to invest in the stock market, without the need for extensive financial knowledge or active management. By investing in an index fund, individuals can benefit from broad market exposure and diversification across various sectors and asset classes.

The performance of an index fund is closely linked to its designated index. When the market is performing well, index funds can provide attractive returns as the market rises. However, during market downturns, index funds can also experience significant losses. This inherent lack of flexibility is one of the limitations of index funds. Their passive nature means they cannot pivot or actively adjust their holdings to take advantage of market opportunities or avoid potential downturns.

Despite this, index funds have generally outperformed actively managed funds over the long term. They tend to have lower fees and generate less taxable income due to reduced trading activity. Additionally, their broad diversification and long-term solid returns make them a stable investment choice.

When considering investing in index funds, it is important to evaluate the fund's performance history, management fees, and the specific index it tracks. It is also crucial to align your investment goals and risk tolerance with the characteristics of the index fund.

Index Funds: How Much Should You Invest?

You may want to see also

Index funds have lower fees than actively managed funds

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are passive investments, meaning that a portfolio manager is not actively stock-picking by buying and selling securities for the fund. Instead, a fund manager selects a combination of assets for a portfolio intended to mimic an index.

As a result of their lower fees, index funds can be a more cost-effective investment option. Many index funds have fees of less than 0.4%, while actively managed funds often charge fees of more than 0.77%. For example, the Vanguard 500 Index Admiral Shares fund (VFIAX), which tracks the stocks of 500 of the largest U.S. companies, charges a 0.04% expense ratio as of April 26, 2024.

In addition to lower fees, index funds offer other benefits such as diversification and low maintenance. However, it's important to note that index funds may not always outperform actively managed funds, and they may lack the flexibility to pivot away when the market shifts. When deciding whether to invest in index funds, it's important to consider your financial goals, risk tolerance, and other factors.

Bond Fund Investment: What Percentage is Smart to Invest?

You may want to see also

They are a passive investment strategy

Index funds are passive investment strategies. They are designed to replicate the performance of financial market indexes, like the S&P 500, and are ideal for long-term investing, such as retirement accounts.

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are passive investments, meaning they do not involve actively picking securities or timing the market. Instead, they use a long-term strategy of holding investments tied to an index.

The benefits of index funds as a passive investment strategy include:

- Low costs and fees: Index funds have lower expenses and fees than actively managed funds as they do not require a fund manager to actively decide which investments to buy or sell. Index funds are passively managed, meaning they are automated to follow the shifts in value in an index, and they trade less frequently, resulting in lower transaction fees and commissions.

- Tax advantages: Index funds generate less taxable income than actively managed funds as they trade less frequently. They also have the flexibility to choose from hundreds or thousands of lots when selling a particular security, allowing them to sell the lots with the lowest capital gains and lower tax bills.

- Broad diversification: Index funds provide broad market exposure and diversification across various sectors and asset classes. This diversification leads to reduced risk as investing in an index fund is less risky than owning a few individual stocks.

- Historical performance: Over the long term, index funds have often outperformed actively managed funds, especially after accounting for fees and expenses.

Despite the benefits of passive investment strategies like index funds, there are also some drawbacks to consider:

- Lack of flexibility: Index funds are designed to mirror a specific market, so they will decline in value when the market does, and they cannot pivot away when the market shifts.

- Inclusion of all securities in an index: Index funds may invest in overvalued or weak companies, potentially leading to underperformance compared to active management.

- Market-cap weighting: Many index funds use market-cap weighting, which means companies with higher market capitalisations have a more significant influence on the fund's performance, leading to increased risk if these companies underperform.

Overall, index funds are a passive investment strategy that offers a low-cost, diversified, and hands-off approach to investing. They are ideal for long-term investors seeking broad market exposure and solid returns over time.

Bond of America: State Investment Destinations

You may want to see also

Index funds are a good option for beginners

Index funds are a great option for beginners looking to invest their money. They are a simple, cost-effective way to hold a broad range of stocks or bonds that mimic a specific benchmark index, meaning they are diversified.

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are passive investments, meaning they aim to replicate the performance of a financial market index. This makes them ideal for long-term investing, such as retirement accounts.

Index funds are a low-cost option for beginners as they have lower expense ratios than most actively managed funds, and they often outperform them too. They are also a safer option than investing in individual stocks due to their inherent diversification. If a single company performs poorly, this will have less impact on an index fund than if that company made up a large part of your portfolio.

Index funds are also a good option for beginners as they require minimal research. The fund's portfolio manager will ensure the fund matches the performance of the underlying index over time. This means you don't need to become a stock market expert to invest successfully.

Additionally, index funds are flexible and can be purchased directly from a mutual fund company or a brokerage. They can also be bought through a brokerage account, individual retirement account (IRA), or Roth IRA.

Overall, index funds are an excellent option for beginners due to their simplicity, low cost, diversification, and strong performance relative to other investment options.

IRA Investment Options: Mutual Funds or ETFs?

You may want to see also

Frequently asked questions

Arguably, any time is a good time if you have an investment horizon of a decade or more. Viewed long-term, major equity indexes have robust track records. For example, the S&P 500’s average return is 10.67% annualised since the inception of its modern structure in 1957.

As with all investments, it is possible to lose money in an index fund, but if you invest in an index fund and hold it over the long term, it is likely that your investment will increase in value over time.

If you’re planning to invest for the long term, dips or highs in the market become less relevant. Index funds are also a good option for beginners as they are a simple, cost-effective way to hold a broad range of stocks or bonds that mimic a specific benchmark index.

Yes, since the first index fund was introduced in 1976, index funds have become incredibly popular. Currently, investors are pulling their money out of actively managed funds and investing more heavily in U.S. stock index funds.