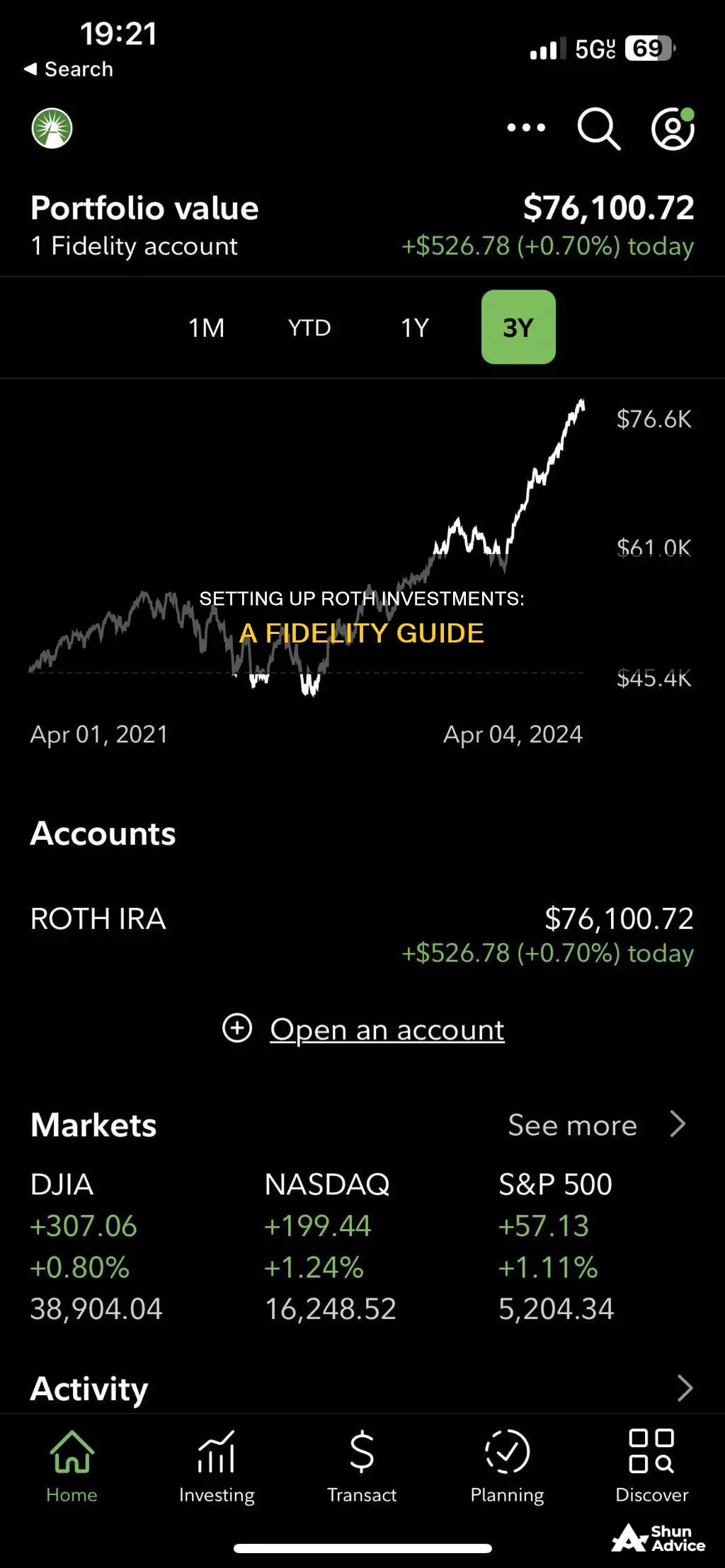

Setting up recurring Roth investments with Fidelity is a straightforward process that can help you save and invest more effectively. Automating your investments can reduce the temptation to spend, lower your stress levels, and ensure that you invest regularly, regardless of market fluctuations. To get started, you'll need to log in to your Fidelity account and follow these steps:

1. Go to https://www.fidelity.com/cash-management/automatic-investments.

2. Click the Set up Automatic Investments button, which will take you to https://digital.fidelity.com/ftgw/digital/auto-invest, where you can view a list of your accounts.

3. Set up an automatic transfer or investment by selecting the account you want to configure for automatic investing.

4. Choose from the following options: transfer funds, transfer and invest funds, or invest funds from the core position.

5. Follow the subsequent instructions to configure your auto-investing schedule, including the amount and frequency of transfers.

6. Review and finalize your schedule.

By following these steps, you'll be able to set up recurring Roth investments with Fidelity and take advantage of the benefits of automated investing.

| Characteristics | Values |

|---|---|

| First step | Set up the transfer of funds into your IRA |

| Second step | Set up an automatic investment schedule into a mutual fund that you already own |

| Minimum amount to auto-invest | $10 |

| Investment schedule | Monthly or quarterly, but can be customised to daily or weekly |

| Transfer from | Select which bank you wish to transfer money from |

| Transfer to | Brokerage Core Account or Mutual funds you own |

What You'll Learn

Setting up automatic investments

Step 1: Understand Automatic Investing

Firstly, it's important to understand how automatic investing works. This involves contributing money to your investment accounts on a regular basis through direct deposits from your paycheck or recurring bank transfers. The idea is to establish a routine of saving and investing regularly with no extra effort.

Step 2: Create a Financial Plan

Before setting up automatic investments, it's helpful to create a financial plan. This plan should outline how much you want to save and how you want to invest to reach your goals. You can determine how much to save and how to invest to align with your financial objectives.

Step 3: Login to Fidelity Account

To begin setting up automatic investments, log in to your Fidelity account and go to the following link: https://www.fidelity.com/cash-management/automatic-investments. This will direct you to a page where you can start the process of setting up your automatic investments.

Step 4: Click "Set up Automatic Investments"

On the page, you will find a button that says "Set up Automatic Investments." Click on this button, and it will take you to a new page where you can view a list of your accounts.

Step 5: Choose the Account for Automatic Investing

From the list of accounts, select the specific account for which you want to set up automatic investing. This could be a brokerage account, retirement account, or another eligible Fidelity account.

Step 6: Set Up Automatic Transfer or Investment

After selecting the account, you will see several options for setting up an automatic transfer or investment. You can choose to transfer funds from an external bank account or transfer and invest funds from an external bank account. If you already have funds in your investment account, you can choose to invest from your core position.

Step 7: Configure Your Auto-Investing Schedule

Once you've selected the option that suits your needs, Fidelity will guide you through configuring your auto-investing schedule. You will be able to choose the frequency of your automatic investments, such as monthly or quarterly. If you prefer daily or weekly investments, you can set up multiple schedules.

Step 8: Finalize Your Schedule

After reviewing your schedule, you can finalize it and make any necessary adjustments. You may also have the option to skip specific months if needed.

Step 9: Monitor and Adjust

Once you've set up your automatic investments, remember to monitor your investments periodically. You can track the performance of your mutual funds and make any necessary adjustments to your investment strategy over time.

By following these steps, you can efficiently set up automatic recurring Roth investments with Fidelity. Automatic investing can help you save and invest consistently, potentially leading to significant growth in your net worth over the long term.

Mortgage Investment Funds: How to Invest in Real Estate

You may want to see also

Transferring funds from an external bank account

To set up recurring Roth investments with Fidelity, you must first transfer funds from an external bank account. Here is a step-by-step guide:

- Log in to your Fidelity account and go to https://www.fidelity.com/cash-management/automatic-investments.

- Click the "Set up Automatic Investments" button, which will take you to https://digital.fidelity.com/ftgw/digital/auto-invest, where a list of your accounts will appear.

- Set up an automatic transfer or investment by clicking on the account you wish to set up automatic investments for. A dialog box will appear with several options, including the option to "Transfer funds from an external bank account." This will allow you to transfer money from your bank account to your investment account, but it will not invest that cash upon transfer.

- If you want to transfer funds from a bank account that you haven't used previously with Fidelity, you'll need to follow the step-by-step instructions by clicking on the "Set up Electronic Funds Transfer" link. Once the new account has been added, return to the previous page.

- Select the bank you wish to transfer money from.

- Choose where you would like the money to be transferred to. You can select your Brokerage Core Account, in which case the money will be transferred into your investment account but won't be automatically invested. Alternatively, you can choose to transfer to Mutual funds you own, which will automatically invest your transferred funds.

- Enter the amount you want to automatically transfer and invest from your bank account. The minimum amount you can auto-invest is $10.

- Customize your auto-investing schedule. The frequencies available are monthly or quarterly, but you can also set up multiple schedules to achieve daily or weekly investments.

- Review and finalize your schedule. After finalization, you can review, edit, and even skip specific months if needed.

By following these steps, you will successfully set up automatic transfers from an external bank account to fund your recurring Roth investments with Fidelity.

Crowdfunding: Invest Your Money Wisely to Make a Profit

You may want to see also

Reinvesting dividends

Fidelity offers several options for reinvesting dividends, including reinvesting into the same stock, a different stock, or a money market fund. Each option has its own benefits, so be sure to research and choose the one that aligns with your investment goals.

Here's a step-by-step guide on how to change your dividend reinvestment settings with Fidelity:

- Log in to your Fidelity account.

- Navigate to your investment portfolio and select the option to change your dividend reinvestment.

- Choose your preferred reinvestment option. Remember that you can choose to reinvest in the same or a different security, or opt for a money market fund.

- Review your investment goals, consider the tax implications, and monitor your portfolio regularly.

It's important to note that there may be associated fees for changing your dividend reinvestment settings, so be sure to check with Fidelity beforehand.

By reinvesting your dividends, you can potentially boost your returns and have more control over your investments. This strategy allows you to harness the power of compounding, where your reinvested dividends generate their own dividends over time.

Fidelity also offers different reinvestment options, including Full Reinvestment, Partial Reinvestment, and No Reinvestment, each catering to different investor preferences and financial goals. Full Reinvestment maximises returns by reinvesting all dividends, while Partial Reinvestment offers a balance between reinvestment and cash flow. On the other hand, No Reinvestment provides immediate liquidity and control over cash flow.

Changing your dividend reinvestment settings with Fidelity gives you greater control over your investments, the potential for higher returns, and enhanced flexibility in managing your portfolio. You can leverage Fidelity's diverse investment options, tools, and resources to make informed decisions and adapt your investment holdings based on market trends and personal preferences.

Index Funds: Buy, Hold, and Prosper

You may want to see also

Dollar-cost averaging

Setting up recurring Roth IRA contributions is a great way to automate your savings and ensure you're investing regularly. Fidelity offers a variety of automated investment options, including Roth IRAs, which can help you save for retirement. Here's an overview of how to set up recurring Roth investments with Fidelity and some information about dollar-cost averaging as an investment strategy:

How it Works:

Benefits:

Drawbacks:

One drawback of dollar-cost averaging is the potential opportunity cost. If the investment's price rises consistently, you may end up with fewer shares than if you had made a lump-sum investment at the outset. Additionally, the funds you set aside for future investments may earn very low returns while waiting to be deployed. It's important to note that dollar-cost averaging does not guarantee profits or protect against losses in declining markets.

Considerations:

Mutual Fund SIP: A Guide to Getting Started

You may want to see also

Automatic investment plans

Setting up automatic investments with Fidelity is a straightforward process. Firstly, it's important to note that you can currently only auto-invest in mutual funds that you already own. So, if you don't own any mutual funds, you'll need to make a minimum investment in at least one mutual fund before setting up automatic investments.

Once you've done that, follow these steps:

Step 1:

Log in to your Fidelity account and go to https://www.fidelity.com/cash-management/automatic-investments.

Step 2:

Click the "Set up Automatic Investments" button. This should take you to https://digital.fidelity.com/ftgw/digital/auto-invest, where you will see a list of your accounts.

Step 3:

Set up an automatic transfer or investment by clicking on the link for the account you wish to set up automatic investing for. A dialog box should appear with several options:

- Transfer funds from an external bank account: This will transfer money from your bank account to your investment account but will not invest that cash upon transfer.

- Transfer and then invest funds from an external bank account: This option will transfer money from your bank account and automatically invest it in a mutual fund for you.

- Invest funds from the core position: This option will auto-invest funds already sitting in your investment account.

Step 4:

Select the option that best suits your needs. For example, if you want to transfer and invest funds from an external bank account, choose option "b". Fidelity will then take you to a page to configure your auto-investing schedule.

Step 5:

Follow the instructions on the page to set up your auto-investing schedule, including the frequency of transfers (monthly or quarterly), the amount you want to transfer and invest, and the mutual fund(s) you want to invest in.

Step 6:

Review and finalize your schedule. After finalization, you can review, edit, or skip specific months if needed.

And that's it! You've successfully set up your automatic investments with Fidelity. This process should help you save and invest more efficiently, reducing the temptation to spend and ensuring your savings plan stays on track.

Fidelity Roth: Index Funds and Auto-Investing Strategies

You may want to see also

Frequently asked questions

First, you'll need to set up the transfer of funds into your IRA by clicking on the link below and using the steps that follow.

Scheduled Transfers (Login Required)

On this page, select "Set up a recurring transfer" under "Recurring transfers and withdrawals". Choose the "From" account and the "To" account.

The frequencies available for your choosing only indicate monthly or quarterly, but you can actually get this down to daily or weekly by setting up multiple schedules.

Automating your investments can help you save and invest more. It reduces the temptation to spend, lessens the likelihood that you will overreact to market ups and downs, and frees up your time and lowers your overall stress.

You can set up automatic investments into funds you already own in your brokerage, retirement, 529 savings, or other eligible retail Fidelity accounts.