When it comes to investing in mutual funds, it is essential to have a well-balanced investment portfolio. One key decision that investors often struggle with is how to allocate their investments between different funds. The aim of diversification is to spread risk. If you invest too much in one company's stock, you are at great risk. If something happens to that company, a significant portion of your money could be lost. To mitigate this risk, you can buy shares in many companies and across different industries. However, it is possible to over-diversify, which can prevent you from making good gains. So, how should you split your mutual fund investment?

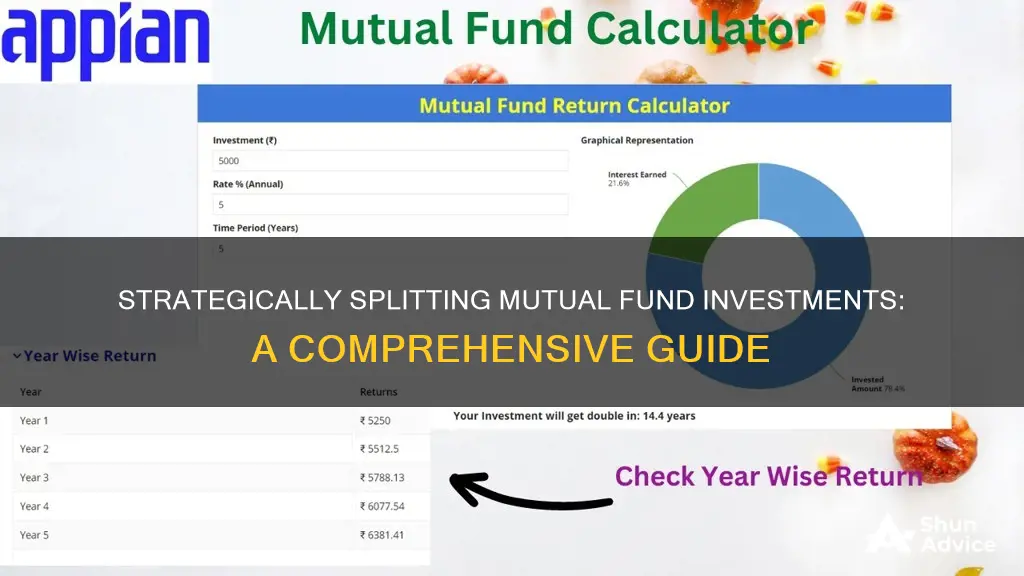

| Characteristics | Values |

|---|---|

| Number of mutual funds to own | 8 (or +/- 2) |

| Large Cap Mutual Funds | Up to 2 or 3 |

| Mid Cap Mutual Funds | Up to 2 |

| Small Cap Mutual Funds | Up to 2 |

| Debt Funds | 1 or 2 |

| Sectoral Mutual Funds | Number of industries you have knowledge about |

| Lumpsum investments | Higher growth rate but subject to market timing risks |

| SIPs | Mitigate volatility and promote disciplined investing |

| Mutual fund splits | Make the fund more attractive to individual investors |

What You'll Learn

Lump sum vs. SIP

There are two main ways to invest in mutual funds: Lump Sum and Systematic Investment Plans (SIPs). Both methods have their own advantages and disadvantages, and the best option for an investor will depend on their personal financial situation and goals.

Lump Sum

Lump sum investments allow investors to purchase a large number of units all at once. This method is typically chosen by investors who have a large amount of capital available and are looking to create extra wealth and liquidity. Lump sum investments make use of market timing strategies, which can be risky due to market volatility. However, if the timing is right, lump sum investments can result in higher returns compared to SIPs.

Advantages of Lump Sum:

- Investment of a large amount

- Ideal for long-term investment

- Convenient one-time payment

SIPs

SIPs, on the other hand, involve investing a fixed sum of money at regular intervals, usually monthly. This amount is directly deducted from the investor's bank account. SIPs are a more disciplined approach to investing, as they automate the investment process and mitigate the risk of market timing. With SIPs, investors buy more units when the market is low and fewer units when the market is high, resulting in higher returns over time.

Advantages of SIPs:

- Investment discipline

- Mitigation of risk

- Ability to invest with a smaller amount of money at regular intervals

Comparing Lump Sum and SIP

Comparing lump sum and SIP investments is not always straightforward, as it depends on various factors such as market conditions, investment horizon, and the investor's financial situation. However, here are some key considerations:

- Lump sum investments may be preferable if an investor has a large amount of capital available, while SIPs are more suitable for investors with regular income who can automate their investments.

- SIPs are generally considered safer in volatile markets due to their ability to average out market fluctuations.

- Lump sum investments can be riskier, as they expose investors to market timing risk. However, if the timing is right, lump sum investments may result in higher returns.

- SIPs encourage a disciplined investment approach and are a good option for investors who want to save regularly without the mental load of deciding when to invest.

In conclusion, both lump sum and SIP have their merits and demerits, and the best option depends on the investor's financial situation, goals, and risk appetite. Investors should carefully consider their options and seek advice from financial advisors before making investment decisions.

DSP Blackrock Micro Cap Fund: A Guide to Investing

You may want to see also

Diversification

Spread the Wealth

Consider Mutual Funds

Mutual funds are an excellent way to achieve diversification and asset allocation without requiring in-depth knowledge of each asset class. Equity mutual funds invest in the equity market, offering options like large-cap, mid-cap, small-cap, and multi-cap funds. Debt mutual funds invest in debt securities such as corporate bonds, money market instruments, and treasury bills, providing higher liquidity and potential for higher returns than traditional fixed deposits. Balanced mutual funds are hybrid funds that invest in both equity and debt, making them ideal for novice investors seeking a diversified, low-risk option.

Number of Funds

The ideal number of funds depends on factors like your investable amount, investment goals, and risk tolerance. For equity mutual funds, it is recommended to hold no more than 3-5 funds in your portfolio, spread across different market segments and fund management styles. Investing in too many funds can make it challenging to monitor them effectively and may result in stock overlap, undermining the benefits of diversification.

Regularly Review Your Portfolio

It is important to review your mutual fund portfolio at least once a year. You can start, stop, or adjust SIPs as needed. If you wish to increase your SIP amount, you will need to submit a new auto-debit form to the AMC, along with a cheque for the additional amount.

Know When to Get Out

While buying and holding are sound strategies, staying informed about your investments and overall market conditions is crucial. Keep track of the companies you invest in to know when it's time to cut losses, sell, and move on to the next investment.

In summary, diversification is a powerful tool for investors to manage risk and maximise returns. By spreading your investments across different asset classes, sectors, and companies, you can reduce the impact of any single negative event and increase your potential for gains. Mutual funds offer an accessible way to achieve diversification, allowing you to invest in a variety of industries and asset classes. Remember to regularly review your portfolio, stay informed, and make adjustments as necessary to align with your investment goals and risk tolerance.

Mutual Fund Tax Strategies: Secrets to Tax-Free Investing

You may want to see also

Mutual fund splits

For example, a 2:1 split would double the number of shares and halve the price per share. Similarly, a 3:1 split would triple the number of shares and reduce the price per share to a third of its original value. It is important to note that while a mutual fund split may make the fund seem more affordable, the total value of an investment remains the same, whether it is made before or after the split.

When considering how to split your investment in different mutual funds, it is crucial to diversify your portfolio to safeguard your investments from sudden risks. However, overdiversification can also be detrimental, as it may prevent you from maximising your gains. Therefore, it is generally recommended to have a well-diversified portfolio of 8 (+/- 2) mutual funds, including:

- Large-cap mutual funds: Up to 2 or 3.

- Mid-cap mutual funds: Up to 2.

- Small-cap mutual funds: Up to 2, due to higher risk.

- Debt funds: Ideally 1, but 2 is also good.

- Sectoral mutual funds: Invest only if you have good knowledge of the specific sector.

Additionally, when allocating your investments, you can choose between lumpsum and Systematic Investment Plans (SIPs). Lumpsum investments allow for higher potential growth but carry market timing risks, whereas SIPs mitigate volatility by investing smaller amounts regularly over time.

Unconstrained Bond Funds: Diversifying Your Investment Portfolio

You may want to see also

Choosing the right number of mutual funds

Diversification

Diversification is a crucial aspect of investing, as it helps to spread risk and protect your capital. However, it is possible to over-diversify, which can hinder your potential gains. While mutual funds themselves provide diversification by investing in multiple companies across different industries, you should still aim for a balanced portfolio. Consider investing in a mix of large-cap, mid-cap, and small-cap funds, as well as debt funds and sectoral funds, to achieve diversification without diluting your returns.

Investment Objectives and Risk Tolerance

Clearly define your investment objectives, such as saving for retirement, education, or a dream vacation. Different mutual fund categories cater to diverse goals, with varying levels of risk and expected returns. For instance, equity funds are suitable for long-term goals (over five years) due to their higher return potential, while debt funds are better for shorter horizons (one day to five years) and offer lower risk. Understanding your risk tolerance is essential, as it ensures your investment strategy aligns with your comfort level.

Investment Strategy and Performance

Consider the investment strategy of the mutual fund, such as growth, dividend, or index funds. Choose funds that align with your investment style and preferences. Evaluate the fund's performance by analysing its returns and risks over time. Look for funds with a history of strong, consistent returns, but remember that past performance does not guarantee future results.

Expenses and Liquidity

Consider the expense ratio, which is the annual fee charged by the mutual fund for managing your money. Choose funds with lower expense ratios to maximise your net returns. Also, assess the liquidity of the mutual fund, including features such as the lock-in period, exit load, and redemption limits. Ensure the fund offers you the flexibility to withdraw your money when needed.

In conclusion, there is no one-size-fits-all answer to the number of mutual funds you should own. It depends on your individual circumstances and investment goals. A good rule of thumb is to own a balanced portfolio of around 8 mutual funds, including a mix of large-cap, mid-cap, small-cap, debt, and sectoral funds. However, you may adjust this number based on your specific needs and risk tolerance. Remember to consult a financial advisor to determine the most suitable allocation for your situation.

A Guide to Aditya Birla's Mutual Fund Investment

You may want to see also

Portfolio construction

Constructing a portfolio of mutual funds is a complex task that requires careful consideration of various factors. Here are some key points to keep in mind when building a portfolio:

Diversification

Diversification is a crucial concept in portfolio construction. It involves spreading your investments across different assets, sectors, and industries to reduce risk. By investing in a variety of mutual funds, you can achieve diversification and lower the impact of any single investment's performance on your overall portfolio. However, it's important to not over-diversify, as it may dilute your returns. Aim for a balanced approach that maximises diversification while maintaining a focused portfolio.

Risk Profile and Investment Horizon

When constructing your portfolio, carefully consider your risk tolerance and investment goals. Different types of mutual funds carry varying levels of risk. For example, large-cap equity funds are generally considered less risky, while small-cap funds offer higher risk and potential returns. Choose funds that align with your risk profile and investment horizon. Diversified equity funds can be a good option as they invest across all market caps and sectors, providing exposure to a wide range of companies.

Number of Mutual Funds

The ideal number of mutual funds in your portfolio depends on your expertise and comfort level. A good rule of thumb is to own up to 2-3 large-cap funds, up to 2 mid-cap funds, up to 2 small-cap funds, 1-2 debt funds, and a number of sectoral funds proportional to your knowledge about specific sectors. This ensures sufficient diversification without excessive overlap or complexity.

Active vs. Passive Management

Mutual funds can be actively or passively managed. Actively managed funds aim to outperform the market by employing various investment strategies, while passively managed funds, such as index funds, aim to replicate the performance of a specific market index. Passively managed funds often have lower fees and can provide broad diversification. Actively managed funds may be more suitable if you believe they can provide superior returns, but they also carry higher fees and may not always outperform the market.

Regular Review and Rebalancing

Portfolios should be regularly reviewed and rebalanced to ensure they remain aligned with your financial goals, risk tolerance, and market conditions. Annually, or when significant changes occur in your finances or investment objectives, review your portfolio's performance and make adjustments as needed. This helps maintain the desired asset allocation and mitigates the risk of unintended deviations from your initial investment strategy.

A Guide to Investing in Money Market Funds

You may want to see also

Frequently asked questions

A lumpsum investment is beneficial when an investor has a large amount of money available to invest. It allows for a higher growth rate as the entire investment is deployed at once, giving the capital more time to benefit from market fluctuations and potential appreciation in the long run. However, lumpsum investments are subject to market timing risks. On the other hand, a SIP (Systematic Investment Plan) allows investors to invest smaller amounts regularly over a period of time, mitigating the impact of market volatility as investments are made at different price points.

The ideal number of mutual funds to invest in depends on your level of knowledge about the markets and mutual funds. Unless you are well-versed in these areas, a good rule of thumb is to own up to 2 large cap mutual funds, up to 2 mid cap mutual funds, up to 2 small cap mutual funds, 1-2 debt funds, and the number of sector mutual funds that correspond to the number of industries you have knowledge about.

Mutual funds split in the same way that individual stocks split, but less often. A split occurs when a mutual fund increases the number of shares outstanding while simultaneously decreasing the price per share by the same factor. For example, in a 2:1 split, the number of shares outstanding is doubled, while the price per share is halved. The total value of any given shareholder's investment does not change, but the price for new shareholders is reduced, along with the ownership stake each share represents.