Co-investment funds are a type of private equity investment where investors partner with general partners (GPs) to invest directly alongside them in individual deals. This allows investors to back specific deals alongside managers, rather than investing in blind pool private equity funds. Co-investments are typically made by institutional or high-net-worth investors who invest alongside private equity or venture capital firms. These deals may also attract certain high-net-worth individuals (HNWI).

| Characteristics | Values |

|---|---|

| Definition | A co-investment is an investment in a specific transaction made by limited partners (LPs) of a main private equity (PE) fund alongside, but not through, such main PE fund. |

| Investor Type | Co-investors are typically institutional or high-net-worth investors. |

| Investor Benefits | Co-investments offer investors more control, visibility, and diversification, and reduced fees. |

| Fund Benefits | Co-investments allow funds to gain access to supplementary capital and make larger single investments. |

| Risk | Co-investments are high-risk investments and investors stand to lose all capital invested. |

| Due Diligence | Co-investments require careful consideration and additional resources and experience to assess individual deals. |

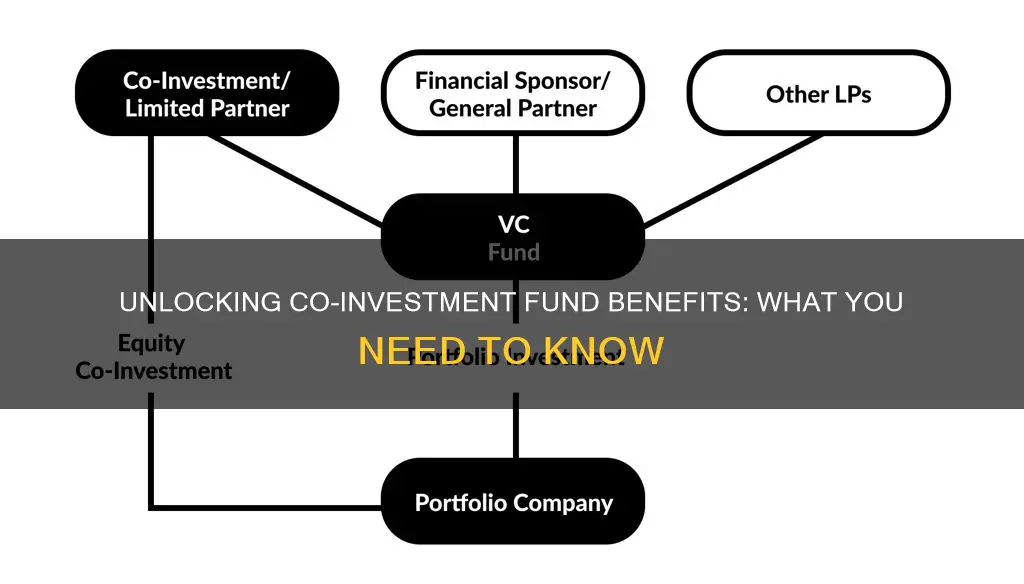

| Fund Structure | Co-investments are often accomplished through a separately structured co-investment vehicle which is governed by a separate set of agreements. |

| Fundraising | Fundraising for co-investment-focused funds has quadrupled over the last decade, climbing from $5 billion in 2010 to more than $20 billion in 2021. |

What You'll Learn

- Co-investments are a type of minority investment in a company made by investors alongside a private equity fund manager or venture capital (VC) firm

- They are often made by institutional investors

- Co-investors have no decision-making power

- Co-investments are associated with reduced fees

- They can be a tool to improve risk-adjusted returns

Co-investments are a type of minority investment in a company made by investors alongside a private equity fund manager or venture capital (VC) firm

Co-investments allow investors to back individual deals alongside managers, rather than investing in blind pool private equity funds. This provides investors with more control, visibility and diversification across their portfolios. It also enables them to gain exposure to new markets and alternative investment options that would otherwise be inaccessible.

Co-investors are typically institutional or high-net-worth investors who pay reduced fees for the investment and receive ownership privileges equal to the percentage of their investment. The majority of the money invested usually comes from the private equity or VC firm, which retains control over how the fund is managed.

Co-investments can be structured in various ways, including through a separately managed account or a "sidecar" vehicle alongside a main private equity fund. They are often used by investors to gain faster and greater exposure to attractive assets at better terms, potentially resulting in more attractive returns.

However, co-investments also come with certain risks. Investors need to have additional resources and experience to assess individual deals and make quick decisions. There may also be a lack of visibility regarding the quality of deals that come forward as opportunities.

A Guide to Index Fund Investing in Australia

You may want to see also

They are often made by institutional investors

Co-investments are often made by institutional investors such as pension funds and insurance companies. They are also attractive to high-net-worth individuals. These investors make their investments alongside private equity or venture capital firms.

Institutional investors are attracted to co-investments because they offer the potential for higher expected returns, lower fees, and greater exposure to attractive assets. Co-investments also allow institutional investors to have more control over their portfolios. For example, investors with specific geographical or sector insight can leverage their knowledge by choosing deals that map onto their areas of expertise.

Co-investments are typically made through one of the following five approaches:

- Internally managed, with dedicated staff: This is the most cost-efficient option but it is also the most resource-intensive as it requires a dedicated in-house team with specialized skills.

- Internally managed with guidance from an advisor: A dedicated external resource assists internal staff with due diligence, but the final investment decision is made by the investor.

- Third-party co-investment manager/co-investment fund: Investors access co-investments through a third-party manager, which is low in administrative burden and internal resource requirements but includes an additional layer of fees and gives the investor less discretion over investment decisions.

- Fund-of-one or separately managed account: The investor creates a fund-of-one or separately managed account with a manager that has a co-investment team. This approach provides the investor with more control over their co-investments relative to the third-party manager approach.

- Overage or co-investment vehicles with manager: The investor invests in a "sidecar" vehicle alongside a main private equity fund, managed by the same general partner. This approach typically has advantageous fees but the investor must rely on the manager to make investment decisions and the investments are limited to the companies that are brought into the main portfolio.

Co-investments are particularly relevant during periods of macroeconomic volatility as they provide investors with the flexibility to temper the pace of deployment in line with their risk appetite.

A Beginner's Guide to Index Fund Investing with Fidelity

You may want to see also

Co-investors have no decision-making power

Co-investors typically have no say in the deal. The success or failure of the deal rests on the acumen of the professionals in charge. Co-investors are usually charged a reduced fee for the investment and receive ownership privileges equal to the percentage of their investment.

Co-investors can gain more control over their private equity portfolios. Investors with specific geographical or sector insight can leverage their knowledge by choosing deals that map onto their expertise.

Co-investments are particularly relevant during periods of macroeconomic volatility by providing flexibility to temper the pace of deployment in line with risk appetite.

Strategies for Withdrawing Money from Index Funds

You may want to see also

Co-investments are associated with reduced fees

Additionally, co-investments offer reduced fees to investors or limited partners (LPs) due to the lower management and performance fees charged by providers. Co-investments also provide risk management benefits, such as additional due diligence and active portfolio construction, which can lead to improved risk-adjusted returns. The improved fee structure in co-investments is further enhanced by the potential for greater exposure to attractive assets, providing the possibility of achieving more attractive returns.

Furthermore, co-investments can be structured through separately managed co-investment vehicles, which are governed by a separate set of agreements. This allows for flexibility in addressing regulatory, tax, and jurisdictional considerations, potentially resulting in additional cost savings for investors.

While co-investments offer reduced fees, it is important to note that there may be a lack of fee transparency in some cases. Private equity firms may not provide detailed information about the fees they charge, and there is a possibility of hidden costs or monitoring fees that are not initially evident. Therefore, co-investors should carefully review the fee structures and conduct thorough due diligence before agreeing to any co-investment opportunities.

HFT Funds: Strategies for Investing in High-Frequency Trading

You may want to see also

They can be a tool to improve risk-adjusted returns

Co-investment funds can be a tool to improve risk-adjusted returns. Here's how:

Reduced Fees and Better Returns

Co-investors are typically charged reduced fees for their investment. Private equity funds, for instance, usually charge a management fee of 2% and carried interest of 20%. In contrast, co-investment deals often incur no management fee or carried interest charges, while investments made via co-investment funds are typically charged a lower fee of 1% and 10% carried interest. This fee structure can lead to improved returns for co-investors.

Risk Mitigation

Co-investments allow both co-investors and the offering firm to lower and share the amount of risk associated with a deal. By opening their funds to co-investments, private equity firms can gain access to more capital without sacrificing decision-making authority, giving them more flexibility in their investment strategies.

Enhanced Due Diligence

Co-investors may gain access to enhanced due diligence materials and insights from general partners (GPs), allowing for a deeper understanding and tailoring of their investment portfolios. This additional layer of due diligence can positively impact performance, depending on the skill of the manager.

Diversification

Co-investments offer investors the opportunity to gain exposure to new markets and alternative investment options that may not be accessible through traditional fund structures. This diversification across deals and sponsors can decrease overall risk and potentially improve risk-adjusted returns.

Portfolio Construction

Co-investments provide investors with more control over their portfolios, allowing them to leverage their specific geographical or sectoral insights by choosing deals that align with their expertise. Additionally, co-investing gives investors the ability to increase their exposure to top-tier managers by investing alongside them on individual deals, further enhancing their portfolio construction capabilities.

J-Curve Mitigation

Co-investments can help mitigate the J-curve effect, which is common in private equity investing, by accelerating capital deployment. This is particularly relevant during periods of macroeconomic volatility, as co-investments provide flexibility in the pace of deployment to match the investor's risk appetite.

Green Funds: Where to Invest and How to Start

You may want to see also

Frequently asked questions

A co-investment fund is a fund in which investors make a minority investment in a company alongside a private equity fund manager or venture capital (VC) firm. Co-investors are typically institutional investors or high-net-worth individuals who pay reduced fees for the investment and receive ownership privileges equal to the percentage of their investment.

Co-investment funds offer several potential benefits, including lower fees, improved net returns, accelerated capital deployment, and diversification. They also provide investors with more control, visibility, and flexibility in their private equity portfolios.

Co-investment funds come with certain risks. As with any investment, there is a possibility of losing all capital invested. Co-investments should only comprise a small percentage of an investor's overall portfolio. Other risks include a lack of visibility into the deal pipeline and the need for quick decision-making, which requires additional resources and experience.