Investing in an index fund is a great way to build wealth over time. Index funds are a group of stocks that mirror the performance of an existing stock market index, such as the S&P 500. An index fund will be made up of the same investments that make up the index it tracks, allowing investors to gain broad exposure to the constituent stocks in the index.

Index funds are a passive investment strategy, meaning they don't require active management. This makes them a low-cost investment option, as they are cheaper to run than actively managed funds. Vanguard, the world's leading originator of index funds, is a good place to start when considering investing in index funds.

Before investing in an index fund, it's important to do your research and understand the basics of risk and return. You should also consider what your investment goals are and choose an investment account that aligns with those goals.

| Characteristics | Values |

|---|---|

| Initial minimum investment | $1,000 to $3,000 |

| Expense ratio range | 0.04% to 1.8% |

| Average expense ratio | 0.05% |

| Industry average expense ratio | 0.18% |

| Historical performance | 83% of Vanguard index funds have performed better than their peer-group averages over the last 10 years |

| Investment options | Stocks, bonds, ETFs, mutual funds |

| Account types | Traditional IRA, Roth IRA, taxable account |

What You'll Learn

What is a Vanguard index fund?

A Vanguard index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500 or Nasdaq. Vanguard index funds are designed to match the performance of a stock market benchmark rather than trying to beat it. This passive investment strategy allows for simplified diversification when building a portfolio.

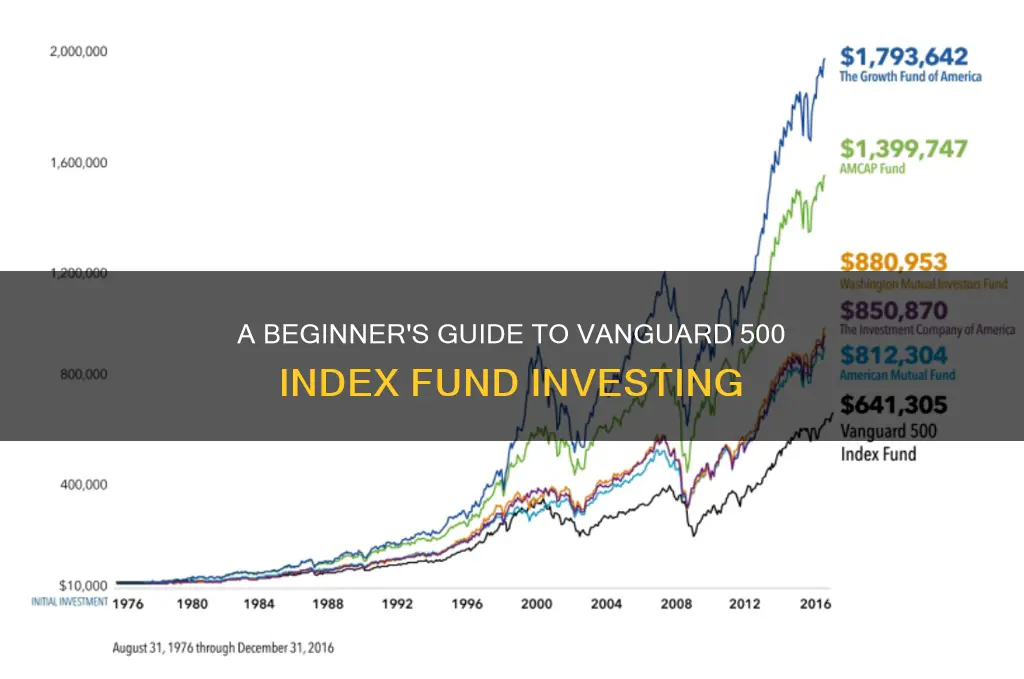

Vanguard's first index fund, created in 1976, was the Vanguard 500 Index Fund Investor Shares (VFINX). This fund tracks the S&P 500 index, which includes the 500 largest companies in the U.S. Vanguard has since expanded its offerings and, as of late 2022, offered more than 100 index mutual and exchange-traded funds.

Vanguard creates index funds by purchasing securities that represent companies across an entire stock index or targeted to specific groups, such as industry sectors or similarly-sized companies. Individual investors then purchase shares of the fund, claiming a slice of its returns.

Vanguard index funds are known for their low investment minimums, below-average expense ratios, and broad diversification. The company's unique structure, in which the funds own the company and investors own the funds, allows for greater savings to be passed on to investors.

Vanguard also offers index funds that mirror the bond markets, investing in government and corporate debt. These funds are considered safer but typically have smaller returns.

Mutual Funds: Diversify Your Investments, Secure Your Future

You may want to see also

How do Vanguard index funds work?

Vanguard index funds are a form of passive investment strategy, meaning they aim to replicate the performance of a market index, such as the S&P 500 or Nasdaq 100, rather than trying to beat it. This is different from active management, where a fund manager attempts to outperform the index. Vanguard, founded by John Bogle, launched the first index fund in 1976, which tracked the S&P 500.

Vanguard index funds work by buying securities that represent companies across an entire stock index or targeted to specific groups, such as industry sectors, similarly-sized companies, or firms in the same region. Individual investors then purchase shares of the fund, claiming a slice of its returns.

Vanguard also offers index funds that mirror the bond markets, which are considered safer investments but tend to have smaller returns. These funds buy and sell government and corporate debt.

Vanguard is able to keep its fees low by specialising in passively managed index funds, which have low overhead and turnover. Little money is spent on research and analysis as the funds replicate existing indexes. Vanguard also benefits from large economies of scale, which lowers total costs for the company, and these savings are passed on to its customers.

Vanguard funds are known for having the lowest expense ratios in the industry. The expense ratio is calculated by taking the fund's operating costs and dividing them by the assets under management (AUM). Vanguard's expense ratios are generally 82% less than the industry average.

Vanguard offers a range of funds to choose from, depending on your portfolio mix and what you can afford based on account minimums and fees. Some examples include:

- Vanguard 500 Index Fund Admiral Shares (VFIAX)

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

- Vanguard Growth Index Fund Admiral Shares (VIGAX)

- Vanguard Small-Cap Index Fund Admiral Shares (VSMAX)

- Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX)

- Vanguard Balanced Index Fund Admiral Shares (VBIAX)

- Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

Short-Term Debt Funds: A Smart Investment Strategy

You may want to see also

What are the best Vanguard index funds?

Vanguard index funds are a great way to invest in the stock market, and there are several top-rated funds to choose from. Here are some of the best Vanguard index funds to consider:

- Vanguard 500 Index Fund Admiral Shares (VFIAX): This fund is also known as the Vanguard S&P 500 Index fund, giving investors exposure to 500 of the largest US companies, which make up 75% of the US stock market's total value. It has an expense ratio of 0.04%.

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX): This fund covers the entire US equity market, including small-, mid-, and large-cap growth and value stocks. It has a minimum initial investment requirement of $3,000 and an expense ratio of 0.04%.

- Vanguard Growth Index Fund Admiral Shares (VIGAX): This fund focuses on stocks in large US companies in sectors with higher growth potential, such as technology, consumer services, and financial services.

- Vanguard Small-Cap Index Fund Admiral Shares (VSMAX): This fund targets smaller publicly held companies, allowing investors to diversify their investments beyond large public companies.

- Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX): This fund provides exposure to US investment-grade bonds, investing about 30% in corporate bonds and 70% in US government bonds.

- Vanguard Balanced Index Fund Admiral Shares (VBIAX): This fund balances investments in stocks (roughly 60%) and bonds (about 40%) to provide both growth and stability.

- Vanguard Total International Stock Index Fund Admiral Shares (VTIAX): This fund offers exposure to stock indexes in developed and emerging markets outside the US. It has a minimum investment requirement of $3,000 and an expense ratio of 0.12%.

When choosing a Vanguard index fund, it's important to consider your portfolio mix, investment goals, and fees. Additionally, while past performance doesn't guarantee future results, checking the fund's historical performance can be informative. Vanguard index funds are known for their low costs, instant diversification, and long-term returns, making them a popular choice for investors.

A Safe Mutual Fund Investment: Strategies for Beginners

You may want to see also

How much does it cost to buy Vanguard index fund shares?

The cost of buying Vanguard index fund shares depends on the type of shares you choose. There are two types of Vanguard index fund shares available to individual investors: Investor Shares and Admiral Shares. The minimum investment for Investor Shares is between $1,000 and $3,000, with an expense ratio ranging from 0.08% to 1.8%. Meanwhile, Admiral Shares have a minimum investment of $3,000 and an expense ratio ranging from 0.04% to 0.62%.

It's worth noting that most Vanguard index funds no longer offer access to Investor Shares to new investors. Additionally, Vanguard doesn't charge commissions for buying or selling Vanguard mutual funds and ETFs online. However, there is an annual account and service fee of $25 for each brokerage and mutual-fund-only account.

Vanguard's low-cost approach is designed to help investors make the most of their money. The average Vanguard mutual fund and ETF (exchange-traded fund) expense ratio is 82% less than the industry average. This means that for every $10,000 invested, you could be saving hundreds of dollars in fees compared to other investment companies.

When investing in Vanguard index funds, it's important to consider your portfolio mix, account minimums, and fees. Additionally, while past performance doesn't guarantee future results, reviewing a fund's historical performance can provide valuable insights.

Another way to invest in Vanguard index funds is through exchange-traded funds (ETFs). ETFs have no minimum investment requirement and can be bought and sold throughout the trading day, similar to stocks. They are also known for being more tax-efficient than index funds.

Overall, Vanguard offers a cost-effective way to invest in index funds, providing investors with a range of options to suit their financial goals and risk tolerance.

Invest in ASX Index Funds: A Comprehensive Guide

You may want to see also

How to purchase Vanguard index funds

There are a few ways to purchase Vanguard index funds. Firstly, you can buy directly from Vanguard or through another broker. If you're buying directly from Vanguard, go to the Vanguard homepage and search for "Buy funds" or go to the Buy funds page. Log in, then scroll to find the account you want to use for your purchase and select that account.

Next, select the checkbox next to an existing fund. If you are buying a new fund, choose the checkbox next to "Add another Vanguard mutual fund". Once you select a checkbox, a text box will appear where you can enter the fund name, fund ticker symbol, or fund number. Select the fund you want to buy, then enter the dollar amount you want to purchase.

After this, choose your funding method and click "Continue". Review the details of your transaction and, when you're ready to proceed, click "Submit". You'll then be taken to a confirmation screen that will show the details of your transaction.

If you're buying through a broker, you'll need to open a brokerage account with them and fund it. You can then use those funds to purchase Vanguard index funds.

There are two types of Vanguard index fund shares available to individual investors:

- Investor Shares: Minimum investment of $1,000 to $3,000 and an expense ratio range of 0.08% to 1.8%.

- Admiral Shares: Minimum investment of $3,000 and an expense ratio range of 0.04% to 0.62%.

A Guide to Investing in Index Tracking Funds

You may want to see also

Frequently asked questions

A Vanguard 500 Index Fund is an index fund that tracks the performance of the S&P 500 index, which includes 500 of the largest US companies by market capitalization. This type of fund allows investors to gain exposure to a diverse range of stocks within the index, such as Apple, Microsoft, and Amazon.

Investing in a Vanguard 500 Index Fund offers several advantages, including broad exposure to the constituent stocks in the S&P 500 index, low costs compared to other funds, and passive investment management. Additionally, Vanguard, the company offering this fund, is known for its unique structure that passes more savings directly to investors.

To start investing in a Vanguard 500 Index Fund, you can open a brokerage account or an individual retirement account (IRA) with a broker or directly through Vanguard. Compare the fees and features offered by different brokers to find the most suitable option for you. Once you have an account, you can purchase shares of the Vanguard 500 Index Fund.