The ASX 200 is a share market index representing 200 large-cap companies listed on the Australian Securities Exchange (ASX). The easiest way to invest in the ASX 200 is through Exchange-Traded Funds (ETFs), which can be bought and sold like shares on the ASX. ETFs are a low-cost way to gain exposure to a broad market index, such as the ASX 200. BetaShares Australia 200 ETF (ASX: A200) and Vanguard Australian Share ETF (ASX: VAS) are two popular options, with low management fees of 0.07% and 0.14% per annum, respectively.

Another way to invest in the ASX 200 is through Listed Investment Companies (LICs), such as Australian Foundation Investment Co. Ltd. (ASX: AFI) and Argo Investments Limited (ASX: ARG), which invest in large-cap shares with similar weightings to the index.

It is important to remember that share prices fluctuate, and the value of your investments can decrease as well as increase.

| Characteristics | Values |

|---|---|

| Number of companies tracked | 200 |

| Companies tracked | Largest and most actively traded Australian companies |

| Trading hours | 10am-4pm, Monday to Friday |

| Trading options | ETFs, LICs, individual shares, CFDs, options trading |

| Examples of ETFs | BetaShares Australia 200 ETF, Vanguard Australian Share ETF, iShares MSCI Australia UCITS ETF, Amundi Australia S&P/ASX 200 UCITS ETF Dist, Xtrackers S&P/ASX 200 UCITS ETF 1D |

| Examples of LICs | Australian Foundation Investment Co. Ltd., Argo Investments Limited, MFF Capital Investments Ltd |

| Annual cost | BetaShares: 0.07% per annum; Vanguard: 0.14% per annum; Australian Foundation Investment Co. Ltd.: 0.14% per annum; Argo Investments Limited: 0.15% per annum |

What You'll Learn

Exchange-Traded Funds (ETFs)

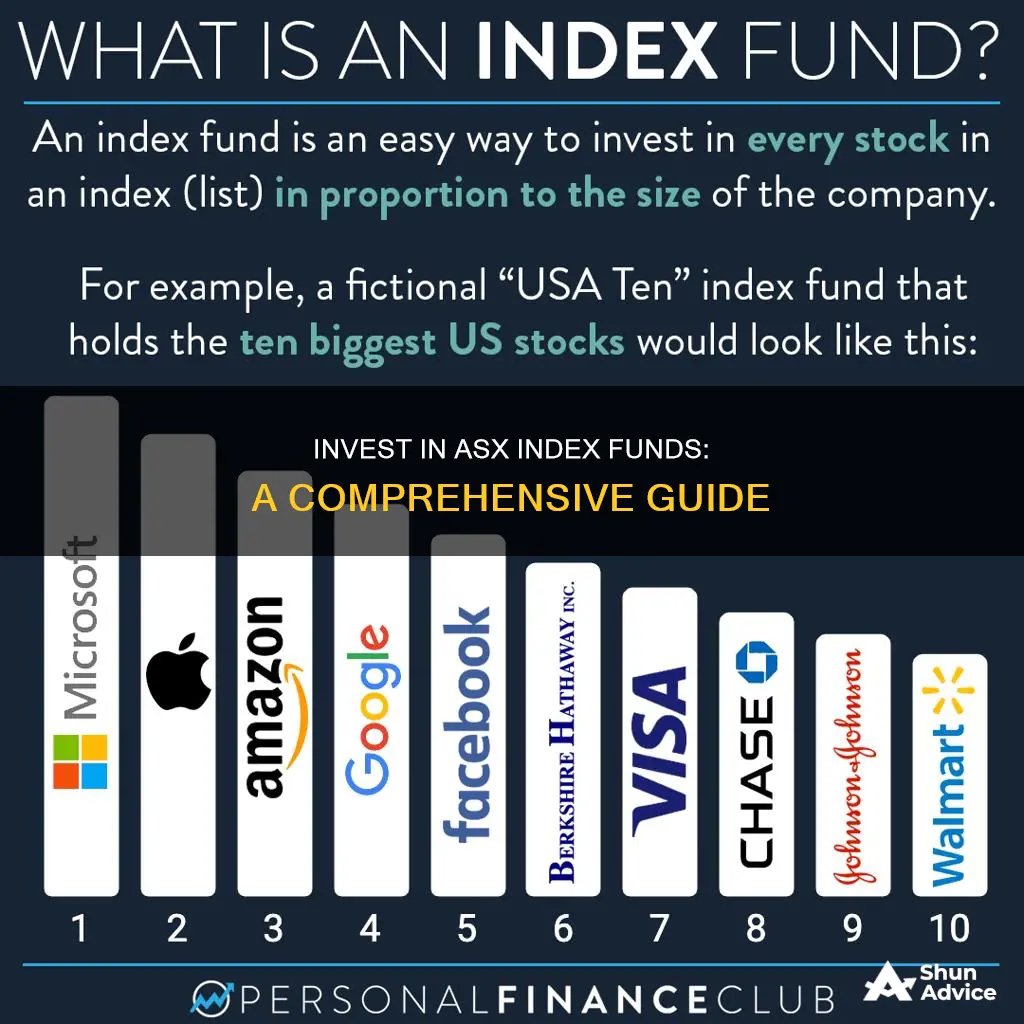

ETFs are a great way to gain exposure to an entire component of the market through a single share transaction. Most ETFs track a benchmark of some sort (e.g. index, sector, commodity, etc.).

- SPDR S&P/ASX 200 Fund (STW): This ETF aims to replicate the performance of the S&P/ASX 200 index by purchasing all its 200 constituents in a similar weighting.

- BetaShares Australia 200 ETF (ASX: A200): BetaShares claims this to be the lowest-costing Australian-focused ETF on the ASX with a management fee of only 0.07% per annum.

- Vanguard Australian Share ETF (ASX: VAS): This ETF seeks to track the ASX 300 and will likely offer similar returns to the ASX 200. Its annual cost is 0.14% per annum.

- IShares Core S&P/ASX 200 ETF (IOZ): This ETF aims to provide investors with the performance of the S&P/ASX 200 Accumulation Index, before fees and expenses.

You can buy and sell ETFs on the ASX just like ordinary shares through your existing brokerage account.

Index Funds: A Beginner's Guide to Investing

You may want to see also

Individual shares

The ASX is Australia's main share trading service, listing over 2,200 companies from Australia and across the globe. Investing in individual shares is a popular wealth creation strategy for Australians, but not everyone feels confident about navigating the stock exchange.

You can invest directly in companies of your choice via a broker or online platform. The decision to own individual shares will depend on your investment goals and your knowledge of the market. For instance, you may want to invest in specific sectors, or you believe the returns from owning certain stocks will be more favourable than an ETF.

You can trade shares in any of the companies listed on the ASX, but you might also decide to buy individual shares as part of:

- An IPO (initial public offering) where you gain access to a prospectus with information about the company's operations, finances and risks.

- A crowd-sourced funding (CSF) offering from a startup seeking to finance their business (this is not the same as crowdfunding sites like GoFundMe).

- An employee share scheme, where you get a chance to invest in the company where you work.

There's no easy answer when it comes to deciding which companies to invest in, how many shares of a stock to buy, or how many different types of stocks to own. This is a reason to seek independent advice through a financial advisor or broker.

The bare minimum required to invest in shares or ETFs via the ASX is $500. Some online trading applications make it possible to start with smaller investments.

How to Invest in Individual Shares

To invest in individual shares, you'll need to decide whether you want to do so through a full-service broker or an online broker platform or app. You could also choose to invest via a managed fund, where your fund manager will decide what to invest in and make the share trades.

If you want to invest in individual shares, you need to open an account with a broker or online platform. You'll typically need to provide personal and financial details and complete a KYC (Know Your Customer) procedure. You'll also need to have easy access to your government-issued ID along with financial information such as your Tax File Number (TFN).

Once you've decided on a platform, you can start researching different shares to invest in. It's crucial to understand financial markets to determine which shares will align best with your investment strategy.

When it comes to buying individual shares, you can place a "buy" order through your broker or online platform.

Benefits and Risks of Investing in Individual Shares

Investing in individual shares can offer higher returns than index funds, as your portfolio is not diluted by average or lower-performing stocks. You also have more control over your investments and can make more specific decisions about your financial goals.

However, investing in individual shares also comes with higher risks. If one of the companies you've invested in performs poorly or goes bankrupt, you could lose a significant portion of your investment.

Summary

Investing in individual shares on the ASX can be a great way to create wealth and achieve your financial goals. It offers higher potential returns and more control over your investments. However, it also comes with higher risks and may require more time and research to manage effectively. As always, be sure to do your own research or consult a financial advisor before investing.

Super Funds: Where Your Money is Invested

You may want to see also

Trading on the ASX 200's value

The S&P/ASX 200 index tracks the performance of the 200 largest companies listed on the Australian Securities Exchange (ASX) by market capitalisation. It is used as a benchmark to measure the combined performance of their shares.

Exchange-Traded Funds (ETFs) are a great way to gain exposure to the ASX 200 index. ETFs are managed funds that trade on the ASX like ordinary shares. As of June 2024, there were over 350 ASX-listed ETFs to choose from.

- BetaShares Australia 200 ETF (ASX: A200): BetaShares claims it has the lowest-cost Australian-focused ETF on the ASX, with management fees of only 0.07% per annum.

- Vanguard Australian Share ETF (ASX: VAS): This ETF seeks to track the ASX 300, which will offer very similar returns to the ASX 200. Its annual cost is 0.14% per annum.

- SPDR S&P/ASX 200 Fund (STW): This ETF aims to replicate the performance of the S&P/ASX 200 index by purchasing all its 200 constituents, with a similar weighting to the index. It has a low management fee of 0.05% per annum.

When investing in the ASX 200, it is important to remember that the share market can fall as well as rise, and your money can decline in value. Always consider your investment goals and personal circumstances before making any decisions.

ESG Funds: Smart Investment, Sustainable Future

You may want to see also

Trading plans

Time Horizons:

Firstly, decide whether you are a short-term or long-term trader. This will impact your trading strategies and risk management approaches. Short-term traders often focus on intraday or swing trading, aiming to capitalise on short-term price movements. On the other hand, long-term traders typically adopt a buy-and-hold strategy, investing in strong companies over an extended period, allowing their investments to grow over time.

Trading Strategies:

Choose a trading style that aligns with your risk tolerance and preferences. Some popular strategies include scalping, day trading, and swing trading. Scalping involves taking small, quick profits from minor price changes, often within a single day. Day trading focuses on profiting from intraday price movements, and traders usually close out all positions by the end of the trading day. Swing trading, on the other hand, involves holding positions for a more extended period, typically a few days to a few weeks, aiming to capture larger price movements.

Risk Management:

Risk management is a critical component of any trading plan. Decide on your risk tolerance and the strategies you will employ to manage risk. Consider using stop-loss orders to limit potential losses, and always remember that while leverage can amplify profits, it can also lead to more significant losses. Diversification is another essential risk management strategy, spreading your investments across various assets or sectors to reduce the impact of any single negative event.

Market Analysis:

Develop a robust understanding of market dynamics and the factors influencing the ASX 200's price movements. Study price charts and conduct technical analysis to identify patterns and trends. Utilise trading signals to notify you of significant price movements or predetermined conditions. Stay informed about economic events, news, and company earnings reports, as these can impact the index's value.

Trading Vehicles:

Decide on the specific trading vehicles you will use to gain exposure to the ASX 200. You can trade the index directly using financial derivatives such as Contracts for Difference (CFDs), allowing you to speculate on the index's price movements without owning the underlying assets. Alternatively, you can buy and sell Exchange-Traded Funds (ETFs) that track the ASX 200, giving you exposure to a basket of the largest Australian companies in a single transaction.

Brokerage Accounts:

Choose a reputable broker and open the necessary accounts for your trading activities. You may need a CFD trading account and/or a share trading account, depending on your chosen trading vehicles. Compare the fees, features, and services offered by different brokers to find one that suits your needs.

Remember, a well-thought-out trading plan is essential for successful investing in the ASX 200 index. It helps you make informed decisions, manage risk effectively, and stay disciplined in your trading approach.

The S&P 500 Index Fund: Where to Invest Your Money?

You may want to see also

CFD trading and share trading accounts

CFD stands for 'contract for difference'. CFD trading is a method of speculating on the underlying price of an asset, such as shares, indices, commodities, or forex, on a trading platform. It is a type of derivative product that enables you to trade the price movements of financial markets without owning the underlying asset. This means you can take advantage of rising and falling markets by going long or short.

When trading CFDs, you are predicting whether an asset's price will rise or fall. If you think the price will go up, you 'buy' (go long), and if you think it will fall, you 'sell' (go short). The outcome of your prediction will determine whether you make a profit or incur a loss. It's important to note that both 'buying' and 'selling' can result in a loss, so make sure you understand how CFDs work before opening a position and take steps to manage your risk.

CFD trading is leveraged, which means you only need to put up a small initial deposit, known as margin, to gain full market exposure. For example, if you want to open a CFD trade on 50 Tesla shares with a share price of $800 each, you only need $8000 as your initial margin to get exposure to a $40,000 position. However, remember that your profits or losses will be calculated on the full position value, not just the margin.

CFD trading is considered a complex and risky investment product. According to IG International, 72% of retail client accounts lose money when trading CFDs with this investment provider. You can lose money rapidly due to leverage, so it's crucial to understand how CFDs work and whether you can afford the high risk of losing money.

Share trading, on the other hand, involves buying and selling shares of a company on a stock exchange, such as the ASX. When you buy shares, you own a small portion of the company, becoming a shareholder. Share trading can be less risky than CFD trading, as you are not using leverage, and you are not subject to the same level of complexity and potential losses from leveraged positions.

To invest in the ASX index, you can consider exchange-traded funds (ETFs) or listed investment companies (LICs). ETFs are a type of investment fund that trades on an exchange like a stock, and LICs are investment companies that invest in a diversified portfolio of assets and trade their shares on a stock exchange. Both options offer exposure to the ASX index and can be purchased through a brokerage account.

Large-Cap Funds: A Smart Investment for Your Money

You may want to see also

Frequently asked questions

The ASX 200 is a share market index that represents 200 large-cap companies listed on the Australian Securities Exchange.

You can gain exposure to the ASX 200 by trading the Australia 200 Cash index CFD, trading Australia 200 index futures CFDs, or trading daily, weekly, monthly or quarterly Australia 200 Option CFDs. Alternatively, you can get exposure to the ASX 200 by buying and selling ASX 200 ETFs or individually-listed ASX 200 shares.

The share market can fall as well as rise, which means your money can decline in value as well as increase. Fees and charges may also apply, and ETFs may not track an index identically.

The ASX 200 offers more diversification than simply owning one or two ASX shares. It offers an attractive dividend yield and hopefully long-term capital growth. Don't forget the bonus of franking credits.

Examples of ASX 200 ETFs include BetaShares Australia 200 ETF (ASX: A200), Vanguard Australian Share ETF (ASX: VAS), iShares MSCI Australia UCITS ETF, Amundi Australia S&P/ASX 200 UCITS ETF Dist, and Xtrackers S&P/ASX 200 UCITS ETF 1D.