Investment funds are a way of investing money alongside other investors to benefit from the inherent advantages of working as part of a group, such as reducing investment risk and transaction costs. There are several types of investment funds, including mutual funds, hedge funds, and private equity funds. When setting up an investment fund, there are numerous factors to consider, including regulatory, tax, business operations, and commercial aspects. The fund's structure will depend on the type of fund, the underlying asset class, investment strategies, target markets, and investor base, among other variables. Financial institutions such as funds are heavily regulated, and fund managers assume significant legal liability related to fundraising, investment strategies, investor relationships, and reporting requirements.

One key consideration when structuring an investment fund is whether to set it up as an open-ended or closed-ended fund. Open-ended funds allow investors to make periodic redemptions and issue shares on demand, while closed-ended funds typically have a fixed investment period and do not issue new fund units. Another important aspect is the targeted investors and markets, as different jurisdictions have different regulatory requirements for funds targeting retail or institutional investors.

Additionally, the fund's structure may depend on whether it invests in liquid or illiquid assets. Funds that invest in liquid assets, such as publicly listed stocks or bonds, are usually structured as open-ended funds, while funds that invest in illiquid assets, such as venture capital, private equity, or real estate, are often structured as closed-ended funds.

When structuring an investment fund, it is crucial to seek professional legal and tax advice to ensure compliance with the applicable laws and regulations.

| Characteristics | Values |

|---|---|

| Type | Investment funds can be public or private. |

| Structure | Investment funds can be open-ended or closed-ended. |

| Investment strategy | Investment funds can invest in liquid or illiquid assets. |

| Investor base | Investment funds can be targeted at retail investors or institutional investors. |

| Regulatory requirements | Regulatory requirements depend on the type of fund, the underlying asset class, investment strategies, target markets, and investor base. |

| Tax implications | Investment funds can be structured as tax-transparent entities or as corporations subject to corporate income tax. |

| Investment management | Investment funds are managed by fund managers who make investment decisions and may also oversee the fund's operations. |

| Fund administration | Fund administrators handle trading, reconciliations, valuation, and unit pricing. |

| Compliance and reporting | Investment funds are subject to regulatory compliance and reporting requirements, including KYC/AML, FATCA, and CRS. |

| Investment objectives | Investment funds have defined investment goals, such as income or growth, and may target specific geographic regions or industry sectors. |

| Investment style | Investment funds can be actively managed, with dynamic portfolio strategies, or passively managed, with a fixed portfolio strategy. |

What You'll Learn

Open-ended vs closed-ended funds

Open-ended funds and closed-ended funds are terms used to describe the operation of mutual funds and exchange-traded funds (ETFs). While they have a lot in common, there are some key differences between the two.

Open-ended funds

Open-ended funds do not have a limit on the number of shares issued. They create new shares when someone makes a purchase and remove shares from circulation when someone makes a sale. There is no cap on the number of shares that can be issued. Most mutual funds are open-ended and can be purchased through an online broker or directly from the fund company. They are bought and sold at their net asset value (NAV), calculated at the end of each trading day. This means that open-ended funds can only be bought and sold at the end of each day.

Closed-ended funds

Closed-ended funds, on the other hand, have a fixed number of shares that are traded among investors on an exchange. They are usually bought and sold on a stock exchange, but no new shares will be created, and no new money will flow into the fund. Closed-ended funds are actively managed and typically concentrate on a single industry, sector, or region. Their share prices are determined by supply and demand and often trade at a discount or premium to their NAVs. Closed-ended funds are generally priced by their net asset value, but prices fluctuate throughout the trading day due to active trading.

Key differences

The main differences between open-ended and closed-ended funds lie in their structure, pricing, and sales. Open-ended funds are bought and sold at the end of the trading day at the fund's NAV, while closed-ended funds trade based on supply and demand throughout the day and can trade at a premium or discount to the fund's NAV. Open-ended funds are also more common and widely accessible to investors, while closed-ended funds are generally a one-time offering with limited shares.

Hedge Funds: Higher Returns, Lower Risk than Mutual Funds

You may want to see also

Investment fund regulatory aspects

The regulatory aspects of investment funds vary depending on the type of fund, the underlying asset class, investment strategies, target markets, and investor base, among other variables. Financial institutions such as funds are generally heavily regulated, and fund managers assume significant legal liability related to fundraising, investment strategies, investor relationships, and reporting requirements.

In terms of fund structure, regulatory requirements differ between open-ended and closed-ended funds. Closed-ended funds, which invest in illiquid assets such as venture capital, private equity, or real estate, typically have investors' capital locked in for a fixed long-term period, with redemptions at the discretion of the fund manager. On the other hand, funds that invest in liquid assets, such as publicly listed stocks or bonds, are usually structured as open-ended funds, allowing periodic redemptions and the issuance of shares on demand.

The targeted investors and markets are crucial factors in determining the regulatory requirements of a fund. For example, in the European Union, retail funds are subject to the Undertakings for Collective Investment in Transferable Securities Directive (UCITS), which imposes stringent investor protection requirements. Non-EU funds or EU funds managed by non-EU fund managers are generally not eligible for UCITS and are therefore restricted from marketing to retail investors.

Alternative Investment Funds (AIF), on the other hand, are typically targeted at professional investors. While the fund itself is directly regulated at the jurisdictional level, its fund manager may be subject to the Alternative Investment Fund Manager (AIFM) directive. An example of this is Reserved Alternative Investment Funds (RAIF), which are indirectly regulated via the alternative investment fund manager.

The geographic target market also plays a role in fund regulation. For instance, an AIF with an EU fund manager that complies with the AIFM directive can qualify for an EU 'marketing passport' and be marketed across the EU while being registered in only one EU member state.

Funds targeting US accredited investors may do so through a securities offering under Rule 506(b) of Regulation D of the Securities Act, which is a private placement offering exempt from registration with the SEC. Additionally, foreign funds targeting US investors may be subject to the Investment Company Act, which regulates the activities of investment companies.

The regulatory landscape for investment funds is complex and varies across jurisdictions. It is essential for fund managers to seek professional advice and carefully consider the regulatory implications when structuring their funds.

Vanguard Mutual Funds: Are They Worth the Investment?

You may want to see also

Tax, business operations, and commercial aspects

When structuring investment funds, there are several tax, business operation, and commercial aspects to consider. Firstly, the choice of business structure has significant legal and tax implications. Different structures offer varying levels of personal liability protection, tax benefits, and operational complexity. Here are some common business structures and their respective tax and operational considerations:

Sole Proprietorship

A sole proprietorship is the simplest business structure, where the owner is entitled to all profits but is also responsible for all debts and liabilities. This structure has no legal distinction between the business and the owner, resulting in unlimited personal liability. Sole proprietorships have no startup costs and are easy to maintain, but they offer no tax benefits, and obtaining business financing may be challenging. This structure is suitable for small businesses or side hustles.

Partnership

Partnerships can be general, limited, or limited liability partnerships (LLP). In a general partnership, all partners share liability and responsibility equally and are involved in day-to-day operations. Limited partnerships have general partners with unlimited liability and limited partners who invest capital but have limited liability and no voting rights. LLPs provide limited liability for all partners, and they can determine their management structure. Partnerships may offer liability protections but have more complex tax requirements, and they must file their own tax returns.

Limited Liability Company (LLC)

An LLC offers liability protection for its owners and flexibility in federal tax treatment. Single-member LLCs can be taxed as sole proprietorships or corporations, while multi-member LLCs can choose between pass-through taxation and S Corp taxation. LLCs have formation and maintenance costs and more intricate tax requirements, especially with S Corp taxation.

Corporation

Corporations are recognized as separate legal entities from their owners, providing extensive liability protection. They can be classified as C corporations (C corps) or S corporations (S corps). C corps are the default designation, subject to double taxation at the corporate and personal income levels. S corps, on the other hand, are pass-through entities, avoiding double taxation. However, S corps have strict standards, such as a maximum of 100 shareholders, who must be US citizens or residents. Both types of corporations have detailed ongoing requirements, higher formation and maintenance costs, and more regulation and oversight.

When structuring investment funds, it is crucial to consider the tax implications of each business structure. Consult with legal and tax professionals to ensure compliance with local, state, and federal laws and to choose the structure that aligns with your long-term goals and operational needs.

A Guide to Investing in Other Funds with Fidelity

You may want to see also

Investment fund legal structures

The legal structure of an investment fund will depend on the type of fund and the jurisdiction in which it is established. In Ireland, for example, investment funds are established as either UCITS (Undertakings for Collective Investment in Transferable Securities) or AIFs (Alternative Investment Funds). UCITS funds are designed for retail consumers, ensuring appropriate levels of protection for investors, while AIFs cater to a wider range of investment strategies.

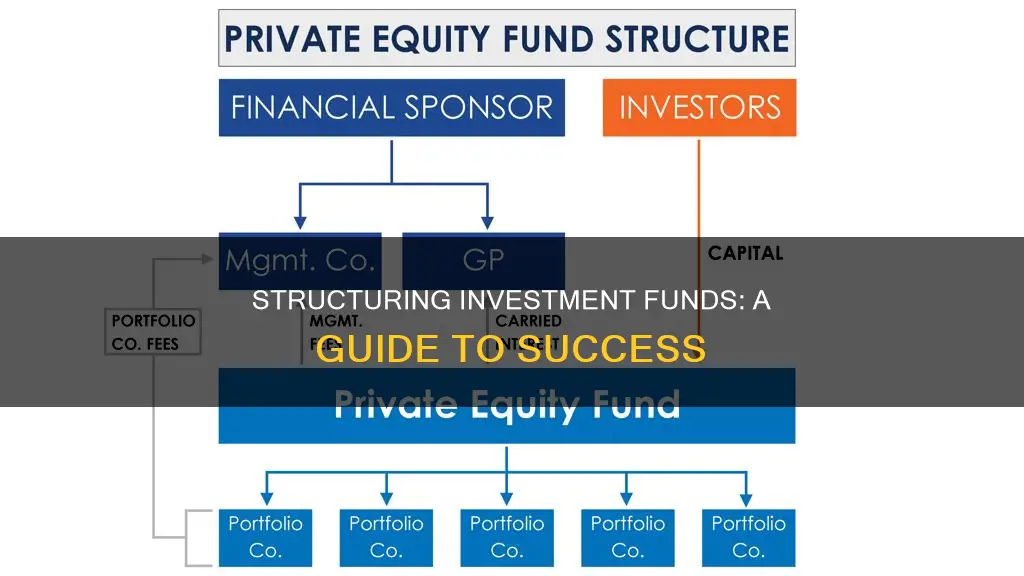

Private investment funds, on the other hand, are typically structured as limited partnerships (LPs) or limited liability companies (LLCs). This is because these entities can be taxed as partnerships to avoid double taxation. In some states, such as Delaware and Florida, funds can also register as limited liability limited partnerships (LLLPs).

Limited partnerships are made up of at least one general partner (GP) and at least one limited partner (LP) who do business together. The GP manages the partnership and has unlimited liability for its business operations, while the LP is the investor who supplies the capital and has limited liability. The limited partnership agreement (LPA) spells out the rules and rights of the GPs and LPs in the partnership.

Limited liability companies (LLCs), on the other hand, have members instead of partners. LLCs provide members with pass-through taxation and limited liability protection. The terms governing the LLC and its members are set out in a limited liability company agreement or operating agreement.

Another type of legal structure for investment funds is the unit trust. A unit trust is a contractual fund structure constituted by a trust deed between a trustee and a management company. The trustee acts as the legal owner of the fund's assets on behalf of the investors, while the management company is responsible for managing the fund.

When choosing a legal structure for an investment fund, it is important to consider the tax implications, liability protection, and regulatory requirements. Seeking professional advice can help ensure that the chosen structure aligns with the fund's investment goals and complies with the relevant laws and regulations.

Debt Fund Investment: Timing and Strategy

You may want to see also

Investment fund reporting and compliance requirements

The reporting and compliance requirements for investment funds vary across different jurisdictions. These requirements depend on factors such as the type of fund, the underlying asset class, investment strategies, target markets, and investor base, among others. Here are some key considerations regarding reporting and compliance for investment funds:

- Regulatory Compliance: Investment funds are subject to various regulatory requirements, including financial regulations, anti-money laundering legislation, and securities legislation. Fund managers assume significant legal liability related to fundraising, investment strategies, investor relationships, and reporting.

- Tax Compliance: Investment funds must also comply with tax regulations in the jurisdictions in which they operate. Different countries have different tax rules and exemptions for investment funds, and it is important to structure the fund to minimise tax liabilities.

- Investor Reporting: Investment funds are required to provide periodic reports to their investors, including statements of the Net Asset Value (NAV) of the fund, audits, annual returns, and other financial information. The frequency and specifics of these reports may vary by jurisdiction and the type of regulated fund.

- Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance: Investment funds, as financial institutions, are subject to KYC and AML regulations. This includes customer identification, due diligence, and monitoring to prevent money laundering and terrorist financing.

- Compliance with Investment Restrictions: Investment funds may have restrictions on the types of investments they can make, such as industry type, company size, diversification requirements, and geographic location. Compliance with these restrictions is essential to avoid regulatory penalties.

- Compliance with Investor Requirements: The requirements and restrictions for investors vary across jurisdictions. For example, in the European Union, retail funds must comply with the Undertakings for Collective Investment in Transferable Securities (UCITS) directive, which imposes strict investor protection requirements.

- Registration and Licensing: Investment funds and their managers may be subject to registration and licensing requirements, depending on the jurisdiction. For example, open-ended funds are typically subject to registration with the financial services regulator and must comply with collective investment schemes' legal and reporting requirements.

- Compliance with Broker-Dealer Rules: In some jurisdictions, the distribution of fund units may be restricted to registered broker-dealers or other authorised intermediaries.

- Compliance Officers: Investment funds are generally required to appoint Compliance and Money Laundering Reporting officers to ensure adherence to relevant laws and regulations.

- FATCA and CRS Reporting: Under the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS), investment funds must report certain information to tax authorities, including information on US investors and investors' tax residency, respectively.

Overall, the reporting and compliance landscape for investment funds is complex and varies across jurisdictions. It is essential to seek professional advice to ensure compliance with the applicable laws and regulations in the relevant countries.

The Rich Avoid Index Funds: Why?

You may want to see also

Frequently asked questions

An investment fund will typically have three key players: a General Partner (GP), Limited Partners (LPs), and the fund itself. The GP is responsible for managing the fund and making investment decisions, while the LPs provide the capital for investments. The fund itself is a separate legal entity, usually founded as a Limited Liability Company (LLC) or a Limited Partnership (LP), to reduce liability and provide clear ownership lines.

The General Partner, also known as the fund manager, has legal authority over the fund and is responsible for sourcing Limited Partners and making investment decisions. The GP earns management and performance fees, which are typically around 2% of total assets under management (AUM) and 20% of gross profit, respectively.

Limited Partners are the investors who provide the capital for the fund. LPs are typically institutional investors or high-net-worth individuals who meet certain accreditation criteria. They receive returns on their investments when the fund is liquidated through events such as mergers, acquisitions, or initial public offerings (IPOs).