Mutual funds are a popular investment option for those looking to achieve their financial goals. They are also tax-efficient investment vehicles, with some funds offering tax benefits. However, it is important to note that not all mutual fund investments are tax-free. The tax treatment depends on various factors such as the type of mutual fund, holding period, and the investor's tax slab. Understanding the taxation rules of mutual funds is crucial for investors to make informed decisions and optimise their tax liabilities.

What You'll Learn

- Mutual funds invested in government or municipal bonds are often referred to as tax-exempt funds

- Mutual fund taxation depends on the holding period

- Mutual funds are classified into two categories for taxation: equity and debt-oriented funds

- Mutual funds are not tax-free except for ELSS (equity-linked savings schemes or tax-saving funds) and some retirement funds

- Mutual funds in retirement and college savings accounts are tax-advantaged

Mutual funds invested in government or municipal bonds are often referred to as tax-exempt funds

Mutual funds are a highly liquid security that is popular among retail investors. They are a type of investment company that allows investors to pool their money and leverage their combined investing power. While mutual funds are often considered tax-efficient investment vehicles, not all mutual fund investments are tax-free.

Mutual funds invested in government or municipal bonds, also called munis, are often referred to as tax-exempt funds. The interest generated by these bonds is typically not subject to income tax, making them attractive for investors looking to reduce their tax burden. This is especially beneficial for investors in higher tax brackets.

However, it is important to note that not all bonds are exempt from all taxes. While the interest on government and municipal bonds may be exempt from state or local income tax, it may still be subject to federal income tax, as is the case with Treasury bonds. Additionally, any capital gains realized when the bond is sold at a premium are generally not tax-exempt.

Tax-exempt mutual funds tend to have lower rates of return compared to funds that include more volatile securities due to their risk-free nature. As such, investors should carefully consider their income tax rate and potential earnings in a taxable fund before investing in tax-exempt funds.

Overall, while mutual funds invested in government or municipal bonds offer tax advantages, it is crucial to understand the specific tax implications of each fund to avoid unexpected tax bills.

International Fund Investment: Strategies for Global Portfolio Success

You may want to see also

Mutual fund taxation depends on the holding period

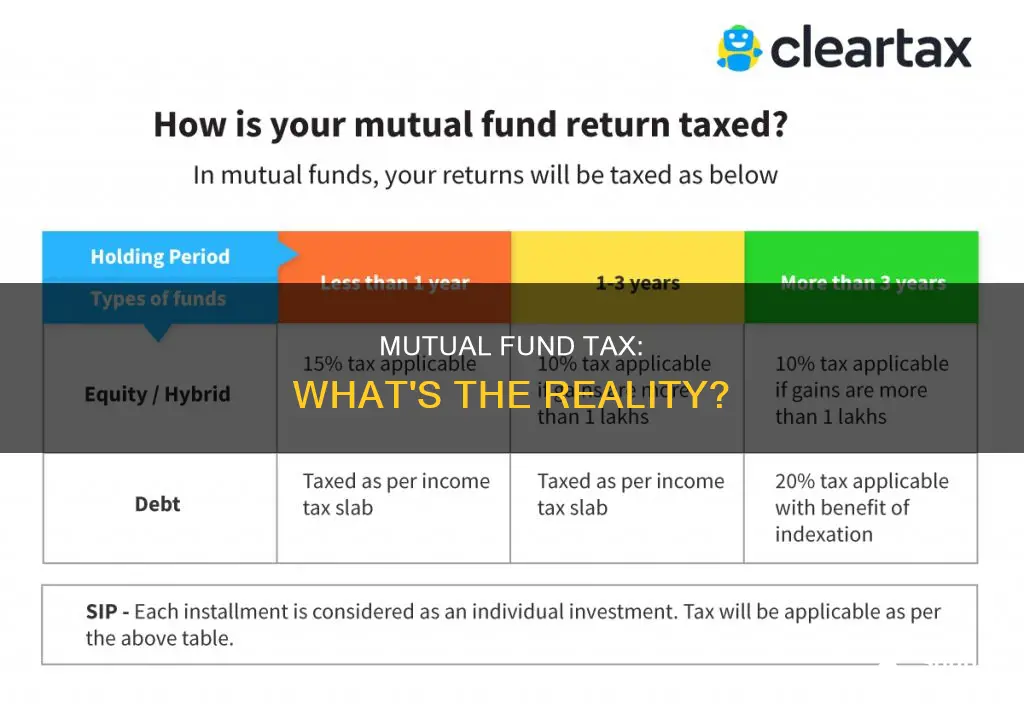

The holding period is the time between the date of purchase and sale of mutual fund units. The holding period influences the tax rate payable on your capital gains. The longer your holding period, the less tax you are liable to pay. This is because India's income tax laws encourage longer holding times, so keeping your investment for longer lowers your tax burden.

Taxation of Capital Gains Offered by Mutual Funds

The taxation rate of capital gains of mutual funds depends on the holding period and type of mutual fund. Capital gains realised on selling units of mutual funds are categorised as follows:

- Short-term capital gains

- Long-term capital gains

- Shorter than 12 months

- 12 months and longer

Taxation of Capital Gains of Equity Funds

Equity funds are those mutual funds where more than 65% of the total fund amount is invested in equity shares of companies. You realise short-term capital gains if you redeem your equity fund units within a year. These gains are taxed at a flat rate of 15%, irrespective of your income tax bracket.

You make long-term capital gains on selling your equity fund units after holding them for over a year. These capital gains of up to Rs 1 lakh a year are tax-exempt. Any long-term capital gains exceeding this limit attract LTCG tax at 10%, without indexation benefit.

Taxation of Capital Gains of Debt Funds

Debt funds are those mutual funds whose portfolio's debt exposure is in excess of 65% and equity exposure is not more than 35%. Starting April 1, 2023, the debt funds will no longer receive indexation benefit and will be deemed short-term capital gain. Therefore, the gains from debt funds will now be added to your taxable income and taxed at the slab rate.

Taxation of Capital Gains of Hybrid Fund

The rate of taxation of capital gains on hybrid or balanced funds is dependent on the equity exposure of the portfolio. If the equity exposure exceeds 65%, then the fund scheme is taxed like an equity fund. If not, the rules of taxation of debt funds apply.

Securities Transaction Tax (STT)

Apart from the tax on dividends and capital gains, there is another tax called the Securities Transaction Tax (STT). An STT of 0.001% is levied by the government when you decide to buy or sell mutual fund units of an equity fund or a hybrid equity-oriented fund. There is no STT on the sale of debt fund units.

A Guide to Investing in Institutional Funds

You may want to see also

Mutual funds are classified into two categories for taxation: equity and debt-oriented funds

Equity Mutual Funds

Equity mutual funds invest a significant portion of their assets in equity and equity-related instruments, typically at least 65% of their total fund amount. These funds aim to generate high returns by capitalising on the growth potential of the companies they invest in. The value of investments in equity funds can fluctuate due to market conditions.

Debt Mutual Funds

Debt mutual funds, on the other hand, focus on investing in fixed-income instruments such as bonds, government securities, and money market instruments. These funds aim to provide stable returns while preserving capital. They are often chosen by conservative investors or those nearing financial goals.

Taxation of Equity and Debt Funds

The taxation of mutual funds depends on the type of fund and the holding period. Short-term capital gains (STCG) and long-term capital gains (LTCG) are taxed differently for equity and debt funds.

For equity funds, STCG applies when the fund units are sold within a year, and LTCG applies when they are sold after a year. The specific tax rates may vary depending on the country and region, but generally, STCG is taxed at a higher rate than LTCG.

Debt funds, on the other hand, have different holding period requirements to qualify for LTCG. For example, in some countries, debt investments must be held for more than three years to be considered LTCG. The tax rates for STCG and LTCG also differ between equity and debt funds, with debt funds typically having higher tax rates for STCG.

It is important to note that the tax rules for mutual funds may change over time, and it is essential to stay updated on the latest regulations to make informed investment decisions.

Structuring Sustainable Investment Funds: Strategies for Long-Term Success

You may want to see also

Mutual funds are not tax-free except for ELSS (equity-linked savings schemes or tax-saving funds) and some retirement funds

Mutual funds are a great way to reach your financial goals, but they are not entirely tax-free. Profits or gains from mutual funds are taxable, just like most other asset classes. However, there are a few exceptions, such as ELSS (Equity-Linked Savings Schemes) and some retirement funds.

ELSS funds are a type of tax-saving mutual fund that offers investors tax benefits under Section 80C of the Indian Income Tax Act, 1961. Investments made in ELSS funds are eligible for tax deductions of up to Rs. 1.5 lakh per financial year, resulting in potential tax savings of up to Rs. 46,800. These funds have a minimum lock-in period of three years, during which investors cannot withdraw their money. ELSS funds primarily invest in the growth-oriented equity market, with a mandatory investment of at least 80% of their net assets in equities.

Retirement funds, such as individual retirement accounts, are also tax-advantaged. Taxes are only payable when earnings or pre-tax contributions are withdrawn from these accounts.

It is important to note that the taxation of mutual funds depends on various factors, including the type of fund, dividend distribution, capital gains, and the holding period. Different types of mutual funds, such as equity-oriented and debt-oriented funds, have different tax implications. Understanding these factors can help investors make informed decisions and plan their investments to minimise their overall tax liability.

Angel Broking: Index Funds Investing Simplified

You may want to see also

Mutual funds in retirement and college savings accounts are tax-advantaged

When it comes to retirement and college savings, mutual funds can be a tax-efficient investment vehicle. Certain accounts, such as individual retirement accounts (IRAs) and college savings accounts, are tax-advantaged. This means that if you hold mutual funds in these types of accounts, you only pay taxes when earnings or pre-tax contributions are withdrawn. This is a significant advantage as it allows your investments to grow tax-free until you need to access the funds.

There are two main types of tax-advantaged accounts: tax-deferred and tax-exempt. Tax-deferred accounts, such as traditional IRAs and 401(k) plans, provide an upfront tax break. You don't pay taxes on your contributions until you withdraw your money in retirement. On the other hand, tax-exempt accounts, such as Roth IRAs and Roth 401(k)s, are funded with after-tax dollars. This means that while you don't get an immediate tax break, the investments grow tax-free, and qualified withdrawals in retirement are tax-free.

It's important to note that tax-advantaged accounts, such as IRAs and 401(k)s, have annual contribution limits and restrictions on withdrawals. For example, in 2024, individuals can contribute up to $7,000 to IRAs, or $8,000 if they're age 50 or older. Additionally, there may be penalties for early withdrawals before reaching retirement age.

By utilizing tax-advantaged accounts for your mutual fund investments, you can maximize your after-tax returns and keep more of your money. This strategy is particularly beneficial for those in a higher tax bracket. However, it's always recommended to consult with a qualified investment planner, financial advisor, or tax specialist to determine the best tax strategy for your individual situation.

Investing in Funds: Diversification, Expertise, and Access

You may want to see also

Frequently asked questions

No, not all mutual fund investments are tax-free. Profits or gains from mutual funds are usually taxable, just like most other asset classes. However, there are certain types of mutual funds that offer tax benefits, such as tax-saving mutual funds or equity-linked savings schemes (ELSS).

Mutual funds are typically taxed on capital gains and dividends. Capital gains tax depends on the holding period and the type of mutual fund, while dividends are usually taxed at the investor's income tax rate.

Tax-saving mutual funds, also known as ELSS, provide tax benefits to investors. These funds have a lock-in period of 3 years, during which withdrawals are not allowed. Investments in ELSS are eligible for tax deductions of up to a certain limit under Section 80C of the Income Tax Act.

You cannot completely avoid paying taxes on mutual funds. However, you can minimize your tax liability by investing in tax-saving mutual funds, holding your investments for a longer period (long-term capital gains are usually taxed at a lower rate), and planning your investments strategically.

Yes, there is a tax called the Securities Transaction Tax (STT) that is levied on the purchase or sale of mutual fund units, specifically for equity funds or hybrid equity-oriented funds. This tax is usually a small percentage of the transaction value.