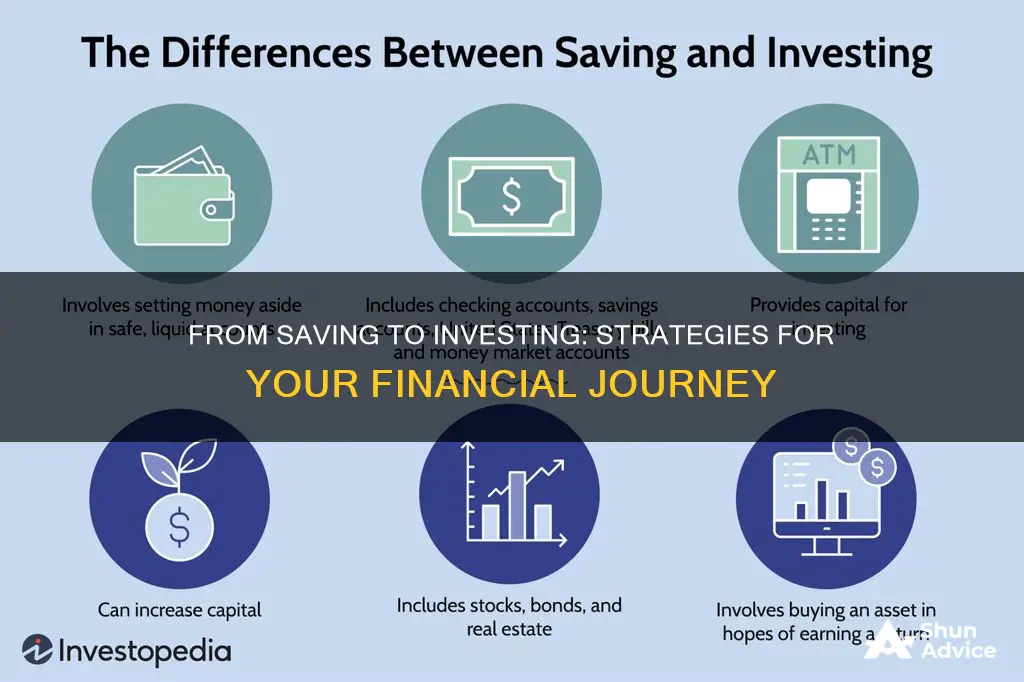

Saving and investing are both important components of a healthy financial plan. While saving is an excellent way to meet short-term financial goals, investing has the potential for higher long-term returns. Saving typically results in lower returns but with virtually no risk, whereas investing allows for higher returns but comes with the risk of loss. It is crucial to understand the differences between saving and investing to make informed decisions about when to switch from one to the other.

| Characteristics | Values |

|---|---|

| Risk | Saving is safer and has a lower risk of losing money. |

| Returns | Saving has lower returns than investing. |

| Time horizon | Saving is for the short-term, investing is for the long-term. |

| Goals | Saving is for emergency funds, unexpected situations, and short-term goals. Investing is for retirement, college funds, and long-term goals. |

| Liquidity | Saving provides more liquidity as you can access funds quickly. |

| Complexity | Saving is straightforward and easy to do. Investing is more complex and may require research. |

| Accessibility | Saving is accessible to everyone. Investing may not be an option for those with low income or high-interest debt. |

What You'll Learn

Understand the differences between saving and investing

Saving and investing are both important concepts for building a sound financial foundation. While both can help you achieve a more comfortable financial future, it is important to understand their differences and when it is best to save or invest. Here are the key differences between saving and investing:

The Level of Risk

The biggest difference between saving and investing is the level of risk involved. Saving typically results in lower returns but with minimal to no risk. On the other hand, investing offers the opportunity for higher returns but comes with the risk of losing some or all of your investment.

Types of Assets

Saving typically involves putting money into secure accounts such as savings accounts, money market accounts, or certificates of deposit (CDs). Investing, on the other hand, involves purchasing various types of assets such as stocks, bonds, exchange-traded funds (ETFs), or mutual funds. These investments are often tied to the performance of financial markets and can fluctuate in value.

Time Horizon

Saving is generally used for short-term financial goals or emergencies. It is suitable when you need access to your money within a short time frame, typically less than five years. Investing, on the other hand, is usually done for longer-term goals, such as retirement or saving for college. Investing requires a longer time horizon, typically five years or more, to ride out the ups and downs of the market.

Returns and Inflation

While saving offers guaranteed returns in the form of interest on your savings account, these returns are often low and may not keep up with inflation. Investing, on the other hand, offers the potential for much higher returns but does not guarantee against losses. However, investing in a diversified portfolio of assets can help reduce the risk of loss.

Liquidity

Savings accounts offer high liquidity, allowing you to withdraw your money quickly and easily, although there may be penalties for early withdrawals on certain types of accounts. Investments, on the other hand, may take longer to convert into cash, especially for assets like real estate.

Fees and Complexity

Saving is generally a straightforward and low-cost endeavour, with minimal fees associated with maintaining a savings account. Investing, especially in brokerage accounts or through financial advisors, may incur higher fees and can be more complex, requiring research and a basic understanding of the market.

In conclusion, both saving and investing play important roles in achieving financial security. Saving is ideal for short-term goals and emergencies, offering low-risk and quick access to your money. Investing, on the other hand, is suitable for longer-term goals and offers the potential for higher returns, but it comes with the risk of losing money. A well-rounded financial plan includes both saving and investing, balancing the need for liquidity and low risk with the potential for higher returns.

Savings Investment Strategies: Accessibility and Growth

You may want to see also

Know when to save and when to invest

Knowing when to save and when to invest is a crucial aspect of financial planning. Here are some detailed guidelines to help you make informed decisions:

Saving:

- Emergency Fund: It is recommended to prioritize saving if you don't have an emergency fund. Aim to save at least three to six months' worth of living expenses to cover unexpected costs, such as medical bills or car repairs.

- Short-Term Goals: Saving is ideal for short-term financial goals that you want to achieve within the next five years. For example, saving for a new phone, laptop, vacation, or a down payment on a house.

- Accessibility and Low Risk: Savings provide easy access to your money, and you can withdraw funds whenever needed. Additionally, savings accounts have a low risk of losing value, making them a safe option for your financial cushion.

- High-Interest Debt: If you have high-interest debt, such as credit card balances, focus on paying it off before investing. The interest expenses on these debts can outweigh the potential returns from investing.

- Financial Stability: If you have minimal cash savings and limited income, start by building a consistent saving habit. This will provide you with financial stability and a foundation for future investments.

Investing:

- Long-Term Goals: Investing is suitable for long-term financial goals, typically with a horizon of five years or more. This includes retirement planning, saving for college, or achieving other long-term aspirations.

- Higher Returns: While investing carries the risk of losing money, it also offers the potential for higher returns compared to savings accounts. Over time, investing in stocks, bonds, or mutual funds can provide more significant growth.

- Employer Match: If your employer offers a 401(k) or similar retirement savings plan with a matching contribution, take advantage of it. Contributing to this plan is an effective way to boost your retirement savings with "free money."

- Inflation Protection: Investing in a diversified portfolio of stocks can help you beat inflation and increase your purchasing power over the long term.

- Compounding Returns: Investing allows you to benefit from compounding returns, where your earnings generate additional earnings over time. This can significantly expedite wealth creation.

Remember, both saving and investing play vital roles in achieving financial security. Assess your financial situation, goals, and risk tolerance to determine the right balance between saving and investing for your specific needs.

Investing My Daughter's Savings: Strategies for Long-Term Growth

You may want to see also

Choose the right savings account

Choosing the right savings account is an important step in achieving your financial goals. Here are some key factors to consider when selecting a savings account:

- Annual Percentage Yield (APY): The APY is the interest rate that the bank pays you for keeping your money in the savings account. Look for high-yield savings accounts that offer competitive APYs, preferably above 5%. This will help your savings grow faster.

- Fees: Avoid accounts with unnecessary fees, such as monthly maintenance fees. Some accounts may offer ways to waive these fees, such as setting up direct deposits or maintaining a certain minimum balance. Be sure to read the fine print and understand all the fees associated with the account.

- Withdrawal limits and access: Some savings accounts restrict the number of withdrawals you can make per month, so check for any such limitations. Also, consider whether the account provides easy access to your money, such as through ATM or debit card withdrawals.

- FDIC insurance: Ensure that your chosen bank or credit union is FDIC-insured, which protects your money in case the institution fails. This insurance covers up to $250,000 per depositor, per bank, and ownership category.

- Minimum deposit and balance requirements: Some banks may require a minimum deposit to open an account or maintain a certain balance to earn the highest APY. Be sure to understand these requirements to avoid any penalties.

- Mobile banking features: Compare the mobile banking features offered by different institutions, such as the ability to track your savings and spending in one place. User reviews of the bank's app can also provide valuable insights.

- Customer service and convenience: Consider the hours of customer service availability and the number of free ATMs in the bank's network. You may also prefer a brick-and-mortar bank for in-person services or a convenient location.

Remember, the right savings account will depend on your unique financial goals and needs. Taking the time to compare different options and considering the above factors will help you make an informed decision.

Equity Saving Schemes: A Guide to Investing Wisely

You may want to see also

Pick a good brokerage account

Picking a good brokerage account is an important step in your investment journey. Here are some key factors to consider when choosing a brokerage account:

Fees and Trading Costs

One of the main reasons people switch brokerages is that the fees are too high. While fees may seem small at first glance, they can add up over time and eat into your investment returns. Look for a brokerage that offers competitive fees and low trading costs. Some brokerages charge high fees, such as full-service brokerages, which can charge over $100 per trade. On the other hand, discount brokers often offer commission-free trading.

Investment Selection

Consider the range of investments offered by the brokerage. Different brokerages may offer different types of investments, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and options. Choose a brokerage that provides access to a diverse selection of investments that align with your investment goals and risk tolerance.

Research Tools and Resources

Look for a brokerage that offers comprehensive research tools and educational materials to support your investment decisions. This can include market analysis, investment recommendations, and budgeting apps. These resources can help you make more informed choices and improve your investment strategy.

Customer Support

The quality of customer support can vary across brokerages. Consider how important it is to you to have easy access to knowledgeable customer service representatives who can answer your questions and address any issues promptly and effectively.

Ease of Use

Choose a brokerage with a user-friendly interface that is easy to navigate and suits your level of investment experience. Some brokerages offer robust technology and easy-to-use platforms, making it more convenient to manage your investments.

Transfer Fees

If you're transferring your account from one brokerage to another, be aware of potential transfer fees. Automated Customer Account Transfer (ACAT) fees are typically charged by your existing broker when you decide to move your account. However, some new brokerages may offer to reimburse these transfer costs as an incentive.

Minimum Deposits and Investment Minimums

Pay attention to any minimum deposit or investment requirements. While many brokerages allow you to open an account with no upfront deposit, there may be minimum investment amounts for specific assets or mutual funds. Ensure that you understand the minimum requirements before committing to a brokerage.

Remember, the right brokerage for you will depend on your individual needs and investment goals. Compare different brokerages, research their offerings, and consider taking advantage of any free resources or trials they provide to help you make an informed decision.

Invest Wisely: A Guide to Savings in Australia

You may want to see also

Prioritise paying off debt

Paying off debt should be a priority over investing for several reasons.

Firstly, it is essential to establish a solid financial foundation before investing. This includes ensuring you have an emergency fund, maximising any employer-matched retirement contributions, and paying off any high-interest credit card debt. Credit card debt can be particularly detrimental, with interest rates hovering around 20%, making it challenging to eliminate. By focusing on paying off such debt first, you can avoid the burden of accumulating interest.

Secondly, your credit score is a crucial factor in determining your ability to borrow money in the future. A low credit score can hinder your chances of securing loans, renting an apartment, or even getting hired for a job. One of the factors influencing your credit score is your credit utilisation ratio, which is the amount of credit you are currently using compared to your total available credit. By paying off your debts, especially credit card debt, you can improve this ratio and make yourself appear less risky to creditors.

Thirdly, investing carries the risk of losing money, whereas paying off debt provides a guaranteed return by sparing you from future interest expenses. While investing in the stock market may offer higher potential returns, it is also volatile and uncertain. In contrast, paying off debt, especially high-interest debt, is a safer option that can provide peace of mind and improve your financial stability.

Finally, investing should be viewed as a long-term strategy. It is generally recommended to invest money for retirement or other long-term goals with a time horizon of at least five years. If you are nearing retirement, it is advisable to prioritise paying off high-interest debt to avoid carrying that burden into your retirement years.

In conclusion, while investing is an important tool for building wealth, it should not be pursued at the expense of neglecting your existing debts. By prioritising debt repayment, you can improve your financial security, enhance your creditworthiness, and create a more solid foundation for future investments.

Invest Wisely for Your Grandchild's Future: A Guide

You may want to see also

Frequently asked questions

Saving is putting money away in a secure place, like a bank account, for future use. Investing, on the other hand, involves taking risks by buying assets that are expected to increase in value over time, providing higher returns than simply saving.

It is recommended to start investing when you have a sufficient emergency fund (covering 3-6 months' worth of living expenses) and no high-interest debt. Additionally, ensure that you are investing for the long term (at least 5 years) and are comfortable with the associated risks.

It is important to diversify your investments to reduce risk. You can invest in stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, cryptocurrency, and collectibles. Robo-advisors are a good option for beginners as they offer diversification, low costs, and automatic rebalancing.