Retirement is a time when you leave the workforce behind and start living off your retirement income and investment earnings. To be prepared for this, you need to have a firm idea of your spending needs and track your budget. There are many ways to do this, from using a template or spreadsheet to utilising different credit cards or bank accounts for different types of expenses. You can also use one of the many online tools and apps available, such as Mint, which allow you to link your financial accounts and aggregate your data. Additionally, you can use a budgeting app, create a spreadsheet, or simply use pen and paper to record your finances.

| Characteristics | Values |

|---|---|

| Utilize a template | Kiplinger's household budget worksheet, Mint, Microsoft Office templates |

| Use an online tracking tool or app | Mint, Fidelity Retirement Score, Maximize My Social Security, Empower Personal Wealth |

| Use a single credit card | Most credit card companies will track and categorize expenses |

| Utilize different credit cards for different types of expenses | Summarize total expenditure for a particular category |

| Utilize different bank accounts | Many banks offer robust tracking tools within their websites |

What You'll Learn

Utilise a template

There are many free online resources that offer templates to help you track your retirement investments on a budget.

Kiplinger, for example, offers a household budget worksheet template. Mint is another option, offering a free template that allows you to link your financial accounts and aggregate your data. Microsoft Office users can also access a variety of templates, including a household expense budget, holiday budget planner, and event budget.

Google Sheets is another great option, offering pre-made templates such as an annual budget and monthly budget. Google Sheets also provides annual business budget templates for entrepreneurs.

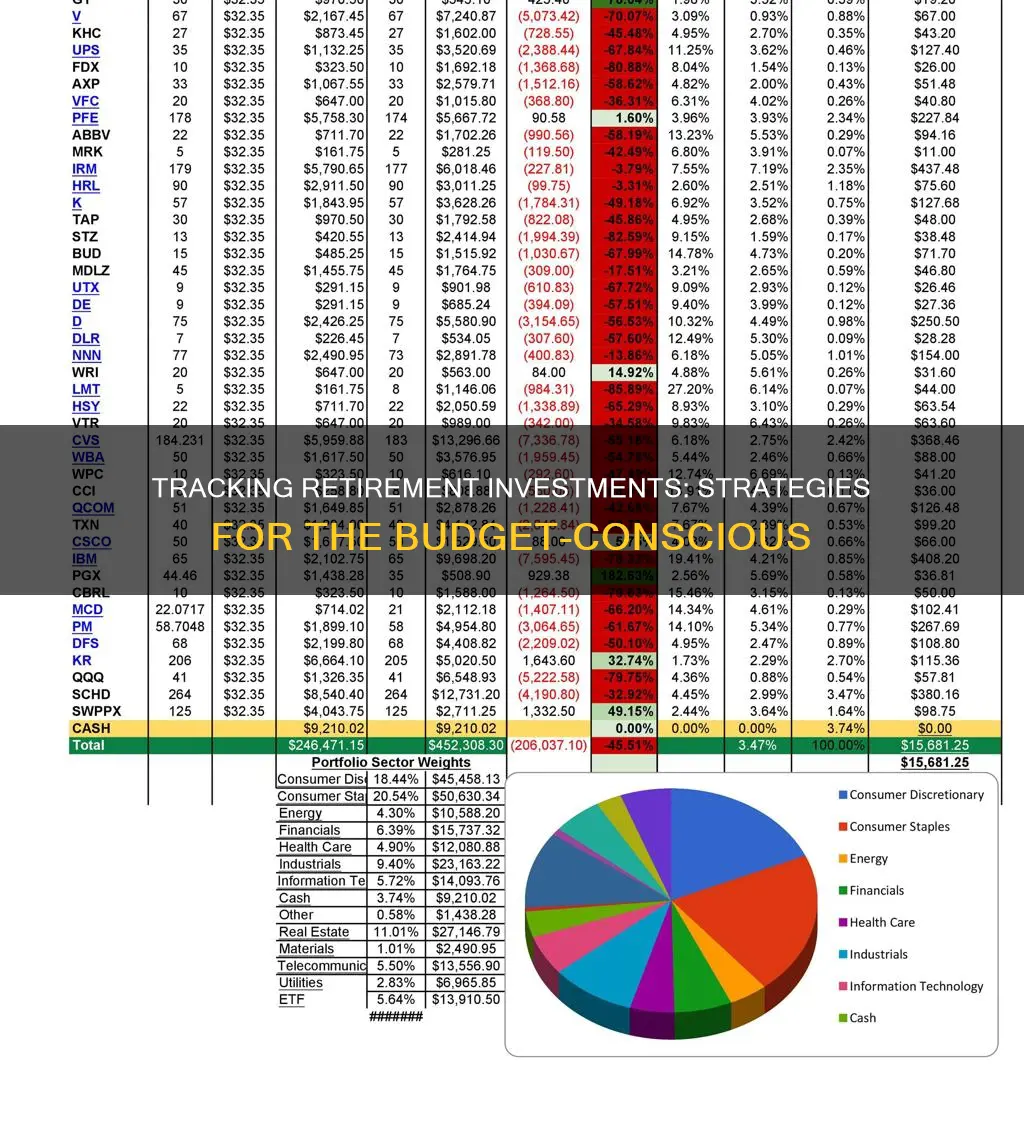

If you're looking for a more detailed template, you might want to consider a retirement planning spreadsheet. These spreadsheets can help you estimate the value of your savings and investments, experiment with different growth rate scenarios, and project outcomes. Tiller, for instance, offers a Retirement Planning Spreadsheet for Google Sheets that pulls in your daily spending, balances, and transactions to show your progress toward your retirement goals.

Retirement planning spreadsheets can also help you identify areas where you may need to cut back to meet your long-term goals. They are a useful tool to help you stay organised and make more informed financial decisions.

Shiba Inu: Invest or Avoid?

You may want to see also

Use an online tracking tool or app

There are several online tools and apps that can help you track your retirement investments on a budget. These tools and apps can help you monitor your retirement savings and plan for the future. Here are some of the best options:

Mint

Mint is a popular app that allows you to link your financial accounts into one program and aggregate your financial data. While you still need to put in some work to link your accounts and classify expenses, Mint gives you a comprehensive view of your monthly inflows and outflows. Mint offers a free template to help you get started with budgeting.

Fidelity Retirement Score

Fidelity Retirement Score is a free app that provides an estimate of your likely retirement income based on six simple questions, including your current savings, monthly savings, and investment style. The app also allows you to see how changing certain variables, such as retirement age or investment strategy, would impact your retirement income.

Maximize My Social Security

Maximize My Social Security is an app that helps you decide when and how to collect your Social Security benefits to achieve the highest lifetime benefit. It costs $49 per year for a household license and encrypts your data. This app is especially useful as Social Security represents a major source of retirement income for many Americans.

Empower Personal Wealth

Empower Personal Wealth is a robo-advisor that offers a free personal finance app with a retirement planner tool. The app syncs with your financial accounts, allowing you to see all your investments in one place. It also has a sophisticated dashboard that lets you model how major financial events, such as receiving an inheritance or buying a home, could affect your retirement planning.

Personal Capital

Personal Capital is a free app that connects your financial accounts, including 401(k), IRA, taxable investment accounts, bank accounts, credit cards, student loans, and mortgages. It provides a wealth of information, such as the value of each investment, asset allocation, and the fees charged by each mutual fund. Personal Capital also offers cash flow tools that track your spending by category, allowing you to create customised charts and graphs.

Morningstar

Morningstar is a robust investment tracker that provides detailed data about individual investments and your overall portfolio. It requires manual entry of investment data and has a learning curve, but it is a valuable tool for those who want to enter account data manually. Morningstar offers both a free and a premium account for $199 per year.

Google Sheets

For those who want complete control over their data, Google Sheets is a great option. While it doesn't provide the same level of analysis as other investment tools, it allows you to use Google finance functions to pull information about investments, including price and expense ratios. You can also create custom spreadsheets to track and rebalance your portfolio.

Is Now the Time to Be All In?

You may want to see also

Use a single credit card

Using a single credit card is a great way to track your retirement investments on a budget, especially if you are someone who is disciplined about paying off your credit card bills in full each month.

Most credit card companies will track and categorise your expenses for you. Many will also allow you to export your transactions to a spreadsheet or even to accounting software. This means you can easily keep a record of your monthly expenses and identify areas where you may need to cut back to meet your long-term goals.

Using a credit card also means you can accrue cash back rewards, which you can then deposit into a bank account and transfer to a brokerage account. You can then invest this money in securities such as stocks and ETFs. For example, you could invest in an index that tracks the S&P 500, which has had an average annual return of 10% over the last 50 years.

However, it's important to remember that this strategy should not be your main retirement savings strategy. While it can be a great way to bolster your current contributions, you should also ensure you are saving at least 15% of your gross income for retirement through other means.

Investing While in Debt: Why You Shouldn't Press Pause on Your Financial Future

You may want to see also

Use different credit cards for different expenses

Using different credit cards for different expenses is a great way to track your spending and maximize rewards. Here are some tips to help you make the most of this strategy:

Understand the benefits of multiple credit cards

The average American has around four credit cards, and it's not uncommon for some to have even more. Using multiple credit cards can help you earn more rewards and take advantage of various benefits like travel insurance and annual credits. However, it also means more work to manage your finances effectively.

Keep a list of your cards and their features

Create a system to keep track of your credit cards and their features. You can use a personal finance app, a spreadsheet, a note-taking app, or even a handwritten list. Include information such as the date you opened the card, annual fees and when they are charged, remaining balance, and rewards program details. This will help you stay organized and make the most of each card's benefits.

Give each card a purpose

Think of your credit cards as a toolbox, where each card has a specific purpose. For example, use one card for dining and earning rewards on restaurant expenses, and another for travel to take advantage of travel insurance and rewards. Refer to your list of cards and their features to decide which card to use for each type of expense.

Keep only the frequently used cards with you

If you only use a particular card for specific purposes, such as booking flights, there's no need to keep it in your wallet all the time. Save space in your wallet for the cards you use the most, and keep the others in a safe place. This also improves security, as you reduce the number of cards that need to be replaced if your wallet is lost or stolen.

Simplify your payment due dates

Having multiple payment due dates can be confusing and increase the risk of missing a payment. Try to get all your cards on the same schedule by requesting specific payment due dates from the card issuers. You can also set up automatic payments and credit card alerts to help you stay on top of your bills.

Paying for the Present or Investing for the Future: Which Path Should You Choose?

You may want to see also

Use different bank accounts

Using different bank accounts is an excellent strategy for tracking retirement investments on a budget. Here are some tips to implement this method effectively:

Firstly, identify the types of expenses you incur. Categorize them into fixed expenses, such as debt repayments, and variable expenses, like entertainment and travel. You can also create sub-categories within these groups to further break down your spending. For example, within fixed expenses, you may want to separate debt repayments from regular bills.

Next, open multiple bank accounts to match these categories. You can use one account for fixed expenses, another for long-term savings, and perhaps a third for your "wants." This will help you stay organized and ensure that your essential expenses are covered.

When setting up these accounts, take advantage of the tools that banks offer. Many banks now provide robust tracking tools on their websites or apps. These tools can help you view your spending categories in different report formats and download transactions into a spreadsheet for further analysis.

By using different accounts for different types of expenses, you'll easily be able to monitor your spending and identify areas where you may need to cut back. For example, if your "wants" account starts to run low, you'll know you're close to hitting your budget limit for discretionary spending.

This method is especially useful if you're not comfortable charging everything to your credit cards or if you have trouble paying off your credit card balances in full each month. It gives you a clear overview of your financial situation and helps you stay disciplined with your retirement budget.

Remember, tracking your budget is like developing any other new habit. It may not be easy at first, but with time and consistency, it will become a valuable tool for managing your retirement finances effectively.

MLS: The Next Big Investment Opportunity?

You may want to see also

Frequently asked questions

There are many online tools and apps that can help you monitor your retirement savings. These include Fidelity Retirement Score, Maximize My Social Security, and Empower Personal Wealth.

To create a retirement budget, you will need to calculate your retirement income goal, list your expected spending, identify expenses that may change, and factor in any lifestyle changes. You will also need to review financial statements such as your pay stub, Social Security statement, pension plan statement, and retirement plan statements.

It is often suggested that retirees estimate 70% to 80% of their pre-retirement income as a good retirement budget. For example, if your salary is $100,000 per year, you may estimate that you will need $70,000 to $80,000 annually in retirement.

Your retirement budget should include essential expenses such as housing, food, and healthcare, as well as discretionary spending. About 50% of your budget should be allocated to needs, 30% to wants, and 20% to goals.

If you have lost track of an old 401(k) account, you can try contacting your ex-employer, using your Social Security number to search for it in databases, or searching unclaimed property databases if the company terminated its retirement plan.