Investing in a retirement plan is an important step towards achieving a secure and comfortable retirement. It ensures that you have the financial means to fund your future and accomplish your retirement goals. By starting early and taking advantage of the power of compounding, you can build a solid retirement plan that evolves with you over time.

Retirement planning involves defining your retirement goals and understanding the different types of retirement accounts available to help you raise the necessary funds. It is crucial to invest your savings to enable them to grow, and there are various investment options to choose from, each with its own advantages and disadvantages.

By investing in a retirement plan, you can benefit from tax advantages, employer-matching contributions, and a diverse range of investment choices. It is important to consider your risk tolerance and time horizon when deciding how to allocate your investments.

Additionally, seeking advice from a qualified financial planner can be beneficial in creating a retirement plan tailored to your needs and goals. They can guide you through the complex world of investments and help you navigate factors such as risk tolerance, time horizon, and tax implications.

Overall, investing in a retirement plan is a crucial step in securing your financial future and ensuring a comfortable retirement. It is important to start early, be consistent with your contributions, and seek professional guidance when needed to make the most of your retirement savings.

| Characteristics | Values |

|---|---|

| Compounding | The longer you wait to start saving for retirement, the more you'll have to save each year to reach your goal. |

| Tax advantages | You can put your retirement money into a retirement account offered by your employer, such as a 401(k) or 403(b) plan, or into a tax-advantaged retirement account of your own, such as an IRA. |

| Control | You can choose the bank or brokerage and make all the investment decisions, or hire someone to make them for you. |

| Flexibility | You can choose between a Roth and a traditional IRA, depending on your eligibility and what your tax situation will be when you start drawing from the account. |

| Peace of mind | You can set up automatic transfers from your checking account to your retirement account so you don't forget to save. |

| Emergency funds | Having a separate emergency account will allow you to cover any unexpected costs without throwing your retirement plans. |

| Debt | One goal for everyone should be to reach retirement debt-free. |

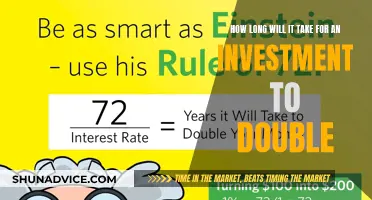

Compounding interest

Here's an example to illustrate the power of compounding interest: Let's say you invest $10,000 in a high-yield savings account with a 5% annual yield, compounded daily. In the first year, you'll earn $512.67 in interest. If you leave your money in the account for another year, you'll earn $538.96 in interest in the second year, resulting in a total of $1,051.63 in interest over two years. The interest earned in the second year is calculated on the initial deposit plus the interest from the first year, demonstrating the power of compounding.

Now, let's consider the impact of regular contributions. If you start with $10,000 and contribute an additional $100 at the end of each month into your savings account, you'll end up with $32,023.26 after 10 years, assuming daily compounding. The interest earned will be $10,023.26 on total deposits of $22,000.

The key to maximizing compounding interest is to start early and maintain consistency. The more time your money has to grow, the bigger the payoff. Additionally, it's important to remember that different investment options, such as certificates of deposit (CDs), high-yield savings accounts, bonds, and dividend stocks, offer varying rates of compounding interest. Choosing the right investment vehicles that align with your risk tolerance and financial goals is crucial for effective retirement planning.

Retirement Investment Strategies: Navigating Your Options

You may want to see also

Tax advantages

Investing in a retirement plan offers several tax advantages. Here are some of the key benefits:

Tax-Deferred Growth

Traditional 401(k) plans allow you to make pre-tax contributions, which means your contributions are deducted from your taxable income for the year. This can lower your overall tax burden and potentially put you in a lower tax bracket. The money in your 401(k) then grows tax-deferred until you withdraw it in retirement. If you expect to be in a lower tax bracket during retirement, this can result in significant tax savings.

Tax-Free Withdrawals with Roth Options

Roth 401(k) plans offer the advantage of tax-free withdrawals in retirement. With a Roth 401(k), you contribute after-tax dollars, but the earnings grow tax-free. This can be especially beneficial if you expect to be in a higher tax bracket during retirement, as you avoid paying taxes at the higher rate. Roth options are also ideal for high earners who don't qualify for Roth IRAs due to income restrictions.

Employer Matching Contributions

Many employers offer matching contributions to your 401(k) plan, which is essentially free money added to your retirement savings. This employer match further enhances the tax advantages of your retirement plan, as the matching funds also grow tax-deferred or tax-free, depending on the type of plan.

Higher Contribution Limits

K) plans typically offer higher contribution limits compared to individual retirement accounts (IRAs). For 2024, the contribution limit for a 401(k) is $23,000, compared to $7,000 for an IRA. This allows you to set aside a larger portion of your income for retirement on a tax-advantaged basis.

Creditor Protection

K) plans also offer protection from creditors, including the IRS, in certain situations. These plans are set up under the Employee Retirement Income Security Act (ERISA) and are generally protected from judgment creditors. While there are some circumstances where the IRS can seize your retirement account, 401(k) plans provide a level of shelter from creditors that other investment options may not offer.

Shiba Inu: Invest Now?

You may want to see also

Employer matching

An employer match is when your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution. This is usually calculated as a percentage of your salary, so the more you put in, the more your employer will contribute. For example, if you earn $60,000 a year and contribute 6% of your paycheck to your plan, your company will add an additional $1,800. If your salary goes up, your employer's contribution will also increase.

It is important to note that employer matching contributions may be subject to a vesting schedule, which means there is a minimum amount of time you must work for the company before you can claim the full amount. This is usually between one and five years. If you leave the company before the vesting period is up, you may lose some or all of your employer's contributions.

To make the most of your employer's matching contributions, it is recommended that you contribute enough to get the maximum match and that you start contributing as soon as possible. Financial planners suggest contributing 15% between you and your employer to your retirement plan.

Mortgage and Market: Navigating the Investment Dilemma

You may want to see also

Early planning

Compound Interest:

Compound interest is often referred to as the eighth wonder of the world, and early planning allows you to take full advantage of it. By starting early, you can invest smaller amounts regularly and still achieve a substantial corpus compared to someone who delays investing and has to contribute larger sums. The power of compound interest lies in the fact that your investments generate returns, and those returns generate further returns over time, exponentially increasing your wealth.

Peace of Mind:

Retirement planning provides peace of mind, knowing that you are financially secure and prepared for the future. It ensures that you have sufficient funds to maintain your desired standard of living during retirement and can also serve as a safety net in case of emergencies. A well-planned retirement strategy can help you make informed decisions about your career, savings, and investments, giving you greater control over your financial future.

Health and Wellbeing:

Retirement planning is not just about finances; it's also about your health and overall wellbeing. By planning early, you can ensure that you have the necessary funds to maintain a healthy lifestyle, including access to quality healthcare and the ability to make healthy choices. Early retirement can also bring health benefits, as you'll have more time to focus on your physical and mental well-being, reducing work-related stress.

- Achieving Life Goals:

- Supporting Dependants:

Retirement planning isn't just about you; it's also about ensuring the financial security of your loved ones. By planning early, you can provide for your spouse, dependent parents, or children, even in your absence. This includes having adequate life insurance coverage and exploring options like pension plans or retirement policies that can continue to support your family.

In conclusion, early retirement planning is a critical step towards a secure and fulfilling future. It enables you to harness the power of compound interest, provides peace of mind, improves your health and wellbeing, helps you achieve your life goals, and ensures the financial security of your dependants. By starting early, you give yourself the time and flexibility to build a comfortable retirement corpus and make informed decisions about your future.

Retirement Planning: Overcoming Investment Inertia

You may want to see also

Risk management

Retirement plans come with a certain level of risk, and it's important to be aware of these risks and how to manage them. Here are some key considerations for risk management when investing in a retirement plan:

Longevity Risk

One of the biggest risks in retirement planning is the possibility of outliving your savings. With advancements in medical science and healthier lifestyles, people are generally living longer. This means that your retirement assets might need to last for a longer period than you anticipate. To mitigate this risk, consider guaranteed lifetime income sources such as Social Security, pensions, or annuities. Annuities can provide a steady income stream for as long as you live and protect against market risks.

Health Care and Long-Term Care Risk

Unexpected medical bills and long-term care expenses can significantly impact your retirement savings. As you age, your health spending is likely to increase, and Medicare may not fully cover all costs. To prepare for this risk, consider long-term care insurance, health savings accounts (HSAs), or annuities that cover long-term care. Additionally, maintaining good health and staying physically active can help lower the risk of incurring high medical bills.

Market and Sequence-of-Return Risk

Market risk refers to the possibility of incurring losses due to market downturns, interest rate changes, or other economic factors. This risk is particularly significant for retirees, as they have less time for their investments to recover. To manage market risk, it's important to diversify your investments and maintain a balanced portfolio that aligns with your risk tolerance. Consider seeking advice from a financial advisor to ensure your portfolio is appropriately allocated.

Spending Shocks

Spending shocks are unexpected, large expenses that can disrupt your financial plans. These may include home repairs, family care responsibilities, or economic factors such as inflation. To prepare for spending shocks, build a substantial cash reserve that can cover living expenses not covered by guaranteed income sources. Additionally, diversifying your assets can help protect your finances during volatile market conditions.

Planning and Professional Advice

Advance planning is crucial for effective risk management in retirement. Start planning for retirement as early as possible to take advantage of compound interest and maximize your savings. Regularly review and update your retirement plan to ensure it aligns with your changing circumstances and goals. Consider working with a financial advisor or retirement professional who can provide personalized advice and help you navigate the complexities of retirement planning.

Black Wealth: Investing Strategies

You may want to see also