Transferring your investment Health Savings Account (HSA) to savings can be done in a few different ways. You can move your HSA to a different company at any time, which may help you earn more tax-free money to cover medical bills. This is known as an HSA rollover, where you move money from one HSA provider to another, keeping the funds in your HSA in-kind. This process can be done once per year and must follow IRS regulations to remain compliant. Alternatively, you can do a trustee-to-trustee transfer, where you direct your new HSA provider to contact your current provider and facilitate the transfer without issuing a check. There is no limit to how many trustee-to-trustee transfers you can do in a year, and this method avoids the risk of a taxable event. If your HSA is invested in stocks, mutual funds, or exchange-traded funds, you will need to check your provider's transfer rules, as some allow for in-kind transfers while others require liquidation of investment funds.

| Characteristics | Values |

|---|---|

| How to transfer | Request a transfer online, then the new provider will ask for your assets and contact your old provider on your behalf. Your old provider will then send your assets to the new provider, which will take 2-5 weeks. |

| How often you can transfer | You can transfer funds from one HSA to another without any limitations. However, you can only rollover funds (i.e. close the account and move the money to a new provider) once every 12 months. |

| Tax implications | Transferring funds from one HSA to another is a non-reportable transfer and will not be taxed. However, if you fail to reinvest the money in your new HSA account within 60 days, the IRS will consider it a taxable distribution. |

| Investment implications | If your HSA money is invested, you may be able to do an in-kind transfer into a self-directed HSA, which allows your new provider to transfer both your cash balance and your investments. However, some providers do not allow this, in which case you will need to liquidate your investments before moving the money. |

What You'll Learn

- HSA rollovers can be done once per year without tax implications

- Trustee-to-trustee transfers are safer than check-based methods

- In-kind transfers are possible if your HSA is invested in stocks, mutual funds, or ETFs

- HSA transfers are free and unlimited

- HSA rollovers can only be done once every 12 months

HSA rollovers can be done once per year without tax implications

If you have multiple Health Savings Accounts (HSAs), you can transfer or consolidate your existing accounts into a single account. This can be done through an HSA rollover, which can be performed once per year without tax implications.

An HSA rollover involves moving funds from one HSA provider to another. This process keeps the funds in your HSA in-kind and is not considered a taxable event or liable for early withdrawal penalties. It is important to note that HSA rollovers must follow IRS regulations to remain compliant.

There are two common methods for performing an HSA rollover. The first method is to inform your current HSA provider of your intention to close the account and transfer the funds to another provider. The provider will then issue you a check, which you are responsible for depositing into your new HSA account within 60 days. It is important to note that you are only allowed to perform this type of HSA rollover once every 12 months. Failing to deposit the check into your new HSA account within the 60-day timeframe will result in the IRS considering it a taxable distribution, subjecting the funds to income tax and an additional 20% penalty.

The second method is a trustee-to-trustee HSA transfer, where you direct your new HSA provider to contact your current provider and facilitate the transfer without issuing a check to you. This method is safer, as the funds are transferred directly between the HSA providers without your involvement, eliminating the risk of a taxable event. Additionally, there is no limit to the number of trustee-to-trustee transfers you can perform in a year, allowing you to consolidate multiple HSAs if desired.

It is important to understand the investment status of your current HSA before initiating a rollover. If your HSA is invested in stocks, mutual funds, or exchange-traded funds, you should check the transfer rules of your providers. Some HSA providers allow in-kind transfers, where your investments are moved directly to your new provider. If in-kind transfers are not permitted, you may need to liquidate your investment accounts and perform a trustee-to-trustee transfer.

HSA rollovers offer several advantages, including lower investment costs, reduced account fees, and simplified account management by consolidating multiple HSAs into a single account. However, it is important to carefully consider the fees, investment options, and customer service of your current HSA provider before initiating a rollover. Additionally, you may have limited access to your HSA funds during the transfer process, so it is advisable to check with your provider about the expected duration of the rollover.

A Safe Investment: Post Office Savings Schemes

You may want to see also

Trustee-to-trustee transfers are safer than check-based methods

Trustee-to-trustee transfers are a safer method of transferring your Health Savings Account (HSA) than check-based methods. This is because, with a trustee-to-trustee transfer, there is no risk of the transfer becoming a taxable event. The money moves directly from one HSA to another without the individual receiving the money, so there is no risk of it being considered a taxable distribution. This is not the case with a check-based method, where the individual must receive a check from their old HSA and reinvest all the money in their new HSA account within 60 days. If they fail to do so, the IRS will consider it a taxable distribution, and every dollar will be subject to income tax, with an additional 20% penalty.

Another advantage of trustee-to-trustee transfers is that there is no limit to how many of these transfers you can do in a given year, meaning you can consolidate multiple HSAs if you wish to. This is in contrast to check-based methods, which can only be done once every 12 months.

To initiate a trustee-to-trustee transfer, you first need to open a new HSA account. Then, you instruct the new provider to make the transfer happen, and they will handle the rest. With a check-based method, you must inform your current HSA provider that you intend to close the account and move your HSA to another provider. They will then cut you a check, and it is your responsibility to get that money reinvested at your new HSA provider.

In addition to the reduced risk of tax implications, trustee-to-trustee transfers can also save time and effort. With a check-based method, you must go through the process of requesting and receiving a check from your old HSA provider and then depositing it into your new HSA account within the 60-day time limit. This can be a hassle, especially if you have multiple HSAs that you want to consolidate. With a trustee-to-trustee transfer, on the other hand, the new HSA provider handles the transfer process for you, making it a more convenient option.

Overall, trustee-to-trustee transfers are a safer and more convenient option for transferring your HSA than check-based methods. They eliminate the risk of taxable distributions, allow for unlimited transfers in a given year, and save time and effort by having the new HSA provider handle the transfer process.

Maximizing Your Savings Account: A Guide to Smart Investing

You may want to see also

In-kind transfers are possible if your HSA is invested in stocks, mutual funds, or ETFs

If your HSA is invested in stocks, mutual funds, or ETFs, you can perform an in-kind transfer to move your investments to a new provider. However, not all investments are eligible for in-kind transfers, and some HSA providers may require the liquidation of investment funds. If you are transferring to a self-directed HSA, you may be able to transfer both your cash balance and your investments.

To perform an in-kind transfer, you will need to follow these steps:

- Sign up for a new Health Savings Account (HSA).

- Enroll in HSA Invest in your online account.

- Fill out the Investment Account Transfer Form.

- Send the Investment Account Transfer Form to your new HSA provider along with a copy of your previous investment statements.

- Your new HSA provider will then initiate the in-kind transfer.

The time it takes to complete the in-kind transfer process can vary. If you are eligible for the Automated Account Transfer Service (ACATS), the process may take as little as 3-5 business days. Without ACATS, the process may take up to two months.

Social Security Investment Strategies: Maximizing Your Savings

You may want to see also

HSA transfers are free and unlimited

If you have more than one Health Savings Account (HSA), you can transfer or rollover your existing HSA into a single account. HSA transfers are free and unlimited.

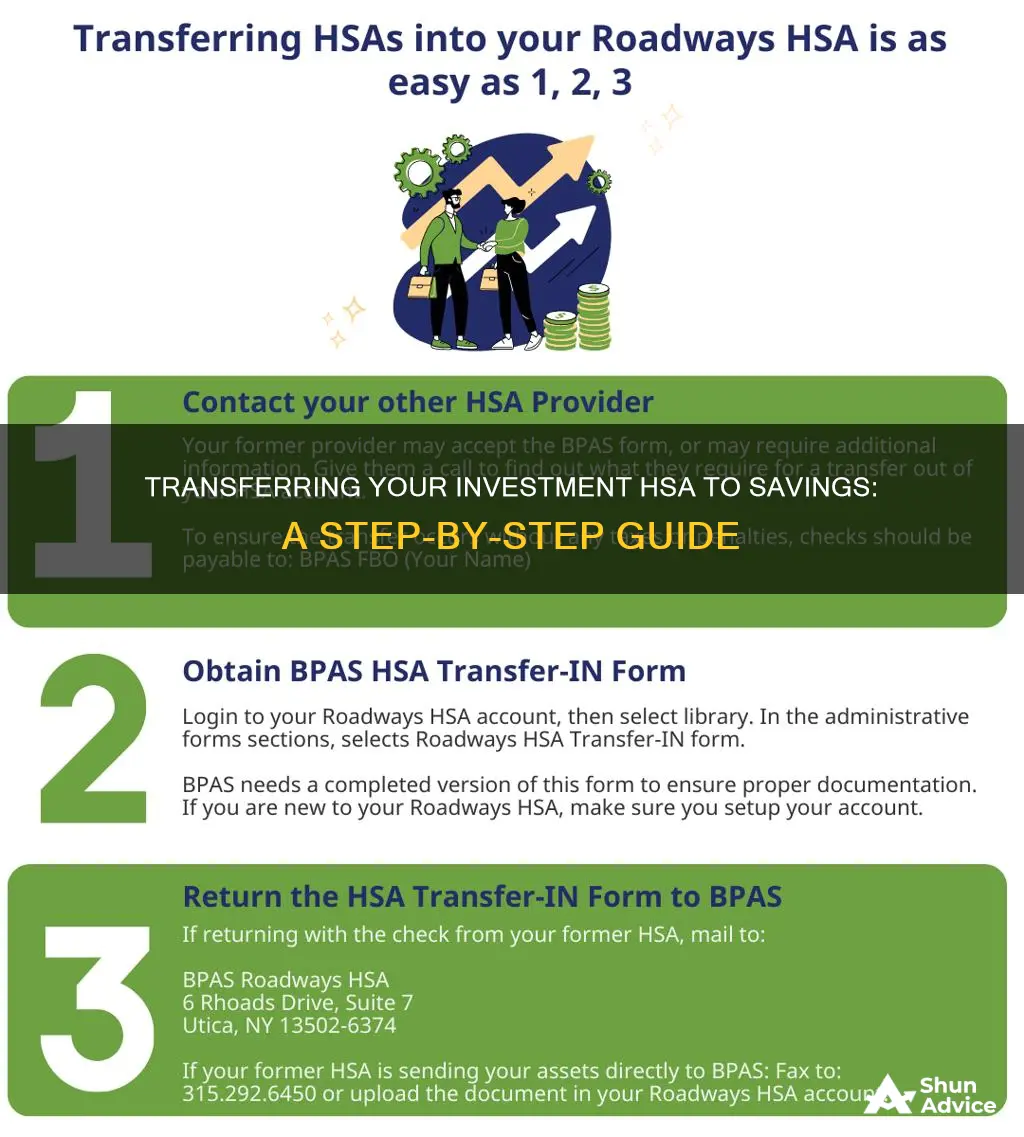

- Sign up for a Health Savings Account with your chosen provider, for example, HSA Bank or Fidelity.

- Fill out and mail the Direct Transfer Request Form to your current custodian.

- Your current custodian will review and process the form.

- Funds will be transferred by check from your current custodian to your new HSA provider.

- Your new HSA provider will accept the funds into your new account.

It is important to note that while HSA transfers are free and unlimited, HSA rollovers are also free but can only be done once within a 12-month period. A rollover involves informing your current HSA provider that you intend to close the account and move your HSA to another provider. They will then issue you a check, and it is your responsibility to get the money reinvested at your new HSA provider within 60 days.

A trustee-to-trustee transfer is another option where you direct your new HSA provider to contact your current provider, and they will handle the transfer without issuing a check to you. There is no limit to the number of trustee-to-trustee transfers you can do in a year, and your funds remain in your HSA in-kind.

If your current HSA is invested in stocks, mutual funds, or exchange-traded funds, you should check your provider's transfer rules. Some HSA providers allow an in-kind transfer, where your investments are moved to your new provider. If this is not allowed, you may need to move your investment accounts into cash before initiating the trustee-to-trustee transfer process.

Maximizing Savings: Strategies to Double Your Money

You may want to see also

HSA rollovers can only be done once every 12 months

When it comes to transferring your investment Health Savings Account (HSA) to savings, there are a few things to keep in mind. Firstly, it's important to understand the difference between an HSA transfer and an HSA rollover. With an HSA transfer, or trustee-to-trustee transfer, the money moves directly from one HSA to another without you having to take possession of the funds. This process is generally safer and can be done multiple times a year without any limit. On the other hand, an HSA rollover occurs when your HSA provider sends you a check, which you must then deposit into a new HSA within a specified timeframe, usually 60 days.

Now, let's focus on the key point: HSA rollovers can only be done once every 12 months. This restriction is important to keep in mind when considering your options. If you opt for the rollover method, you must ensure that you don't initiate another rollover within the next 12 months. This limitation is set by the Internal Revenue Service (IRS) and applies to all HSA account holders.

The reason for this restriction is to maintain the tax advantages associated with HSA accounts. By allowing only one rollover per year, the IRS aims to prevent HSA owners from using the rollover process to gain additional tax benefits. If a rollover is not done correctly, it can be considered a taxable distribution, resulting in income tax and additional penalties. Therefore, it's crucial to follow the guidelines and only perform an HSA rollover once every 12 months.

To initiate an HSA rollover, you need to contact your current HSA provider and inform them of your intention to close the account and move your funds. They will then send you a check for the balance. You must deposit this check into your new HSA account within the specified timeframe, typically 60 days, to avoid any tax consequences. Remembering the 12-month limitation, you can use this method if you prefer a more hands-on approach or if you want to consolidate multiple accounts into one.

Invest Wisely to Secure Your Dream Home

You may want to see also

Frequently asked questions

You can transfer your investment HSA to savings by informing your current HSA provider that you want to close the account and move your funds to a new provider. The current provider will then cut you a check, which you must reinvest with your new HSA provider within 60 days to avoid a taxable distribution.

It may take 2-5 weeks or longer, depending on how quickly your current HSA provider responds.

HSA transfers are free and can be completed without limit. However, your existing provider may charge an account closing fee.

Yes, you can still transfer your HSA to a new account even if you're no longer eligible to contribute to it.

If you have taken possession of the funds, you can process a rollover into the new HSA within 60 days of receiving the funds. This will be reported as a rollover contribution on your taxes.