The equity method is an accounting technique used to record the profits earned by a company through its investment in another company. It is used when the investor company holds significant influence over the company it is investing in, usually owning between 20% and 50% of the stock in the investee company. The equity method allows the investor company to record its share of the investee company's profits or losses in proportion to its percentage of ownership. This is done to ensure that the investor's accounts accurately reflect the investee's profit and loss.

What You'll Learn

- The equity method of accounting is used when an investor holds significant influence over the investee

- The investor company reports the revenue earned by the investee on its income statement

- The investment is recorded at historical cost and adjusted based on the investor's percentage ownership

- Net income of the investee increases the investor's asset value, while loss or dividend payout decreases it

- The equity method acknowledges the substantive economic relationship between two entities

The equity method of accounting is used when an investor holds significant influence over the investee

The equity method of accounting is used to record the profits earned by a company through its investment in another company. It is a technique used to record the profits earned by a company through its investment in another company.

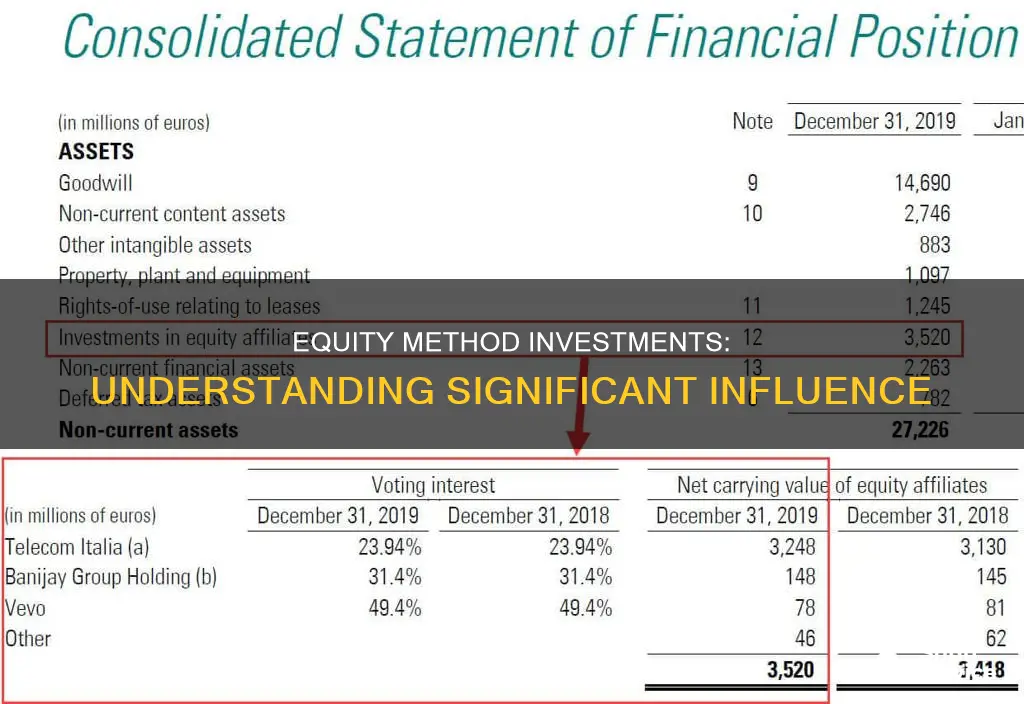

The equity method is generally used when an investor company holds significant influence over the company it is investing in, typically owning between 20% to 50% of the stock in the investee company. This significant influence means that the investor company can impact the value of the investee company, which in turn benefits the investor. As a result, the change in value of that investment must be reported on the investor company's income statement.

The equity method acknowledges the substantive economic relationship between the two entities. The investor records their share of the investee's earnings as revenue from investment on the income statement. For example, if a firm owns 25% of a company with a $1 million net income, the firm reports earnings from its investment of $250,000 under the equity method.

When using the equity method, the initial investment is recorded at historical cost, and adjustments are made to the value based on the investor's percentage ownership in net income, loss, and dividend payouts. Net income of the investee company increases the investor's asset value on their balance sheet, while the investee's loss or dividend payout decreases it.

The equity method is a standard technique used when one company, the investor, has a significant influence over another company, the investee. It is important to note that owning 20% or more of the shares in a company does not automatically grant the investor significant influence. Other factors, such as operating agreements, ongoing litigation, or the presence of other majority shareholders, should also be considered.

In summary, the equity method of accounting is a valuable tool for investors to accurately reflect their ownership and financial interest in another company. It is applied when the investor holds significant influence, typically owning between 20% to 50% of the stock, and allows for proper reporting of the economic relationship between the two entities.

A Guide to Investing in India's Sensex Index

You may want to see also

The investor company reports the revenue earned by the investee on its income statement

The equity method is an accounting technique used by an investor company to record the profits earned from its investment in another company, known as the investee company. This method is typically used when the investor holds significant influence over the investee but does not exercise full control. Significant influence is usually indicated by ownership of 20-50% of the investee company's shares or voting rights, although it can also be defined by other factors such as board representation and involvement in policy development.

When using the equity method, the investor company reports the revenue earned by the investee company on its income statement. This revenue amount is proportional to the percentage of the investor's equity investment in the investee company. For example, if an investor company owns 25% of a company that reports a net income of $1 million, the investor will report earnings of $250,000 from its investment under the equity method.

The equity method acknowledges the economic relationship between the investor and the investee. The investor's share of the investee's earnings is recorded as revenue from investment on the income statement. This revenue amount is calculated by multiplying the investee's net income by the investor's ownership percentage. This process is known as the "equity pickup".

The equity method also requires the investor to record the initial investment amount as an asset on its balance sheet, typically at the historical cost. The investment's value is then periodically adjusted to reflect changes in the investee's income or losses. These adjustments are made based on the investor's percentage ownership in the investee's net income, losses, and dividend payouts. Net income of the investee increases the investor's asset value on their balance sheet, while losses or dividend payouts decrease it.

The equity method ensures proper reporting of the financial situation for both the investor and the investee, given their economic relationship. It provides a more complete and accurate picture of the investor's economic interest in the investee and allows for more consistent financial reporting over time.

Investing Wisely: The Importance of a Diverse Portfolio

You may want to see also

The investment is recorded at historical cost and adjusted based on the investor's percentage ownership

The equity method is an accounting technique used to record the profits of a company that has investments in another company. It is used when the investor company has significant influence over the company it is investing in, typically owning 20-50% of the stock.

The initial investment is recorded at historical cost, and adjustments are made to the value based on the investor's percentage ownership in net income, loss, and dividend payouts. Net income of the investee company increases the investor's asset value, while loss or dividend payout decreases it.

For example, if Company A buys 25% of Company B's shares for $200,000, it records a debit of $200,000 to "Investment in Company B" and a credit to cash for the same amount. If Company B reports a net income of $50,000 and pays $10,000 in dividends to its shareholders, Company A records a debit of $12,500 (25% of the net income) to "Investment in Company B" and a credit of $2,500 (25% of the dividends) to cash. The net income increases the asset value, while the dividend payout decreases it. The new balance in the "Investment in Company B" account is $210,000.

The equity method ensures that the investor's accounts accurately reflect the profit and loss of the company it has invested in. It also acknowledges the substantive economic relationship between the two entities.

Pre-IPO Investing: A Guide to India's Private Markets

You may want to see also

Net income of the investee increases the investor's asset value, while loss or dividend payout decreases it

The equity method of accounting is a technique used to record the profits earned by a company through its investment in another company. It is generally used when the investor company holds significant influence over the company it is investing in, usually owning 20-50% of the investee company's stock.

When an investor company has a significant influence over the investee company, it can impact the value of the investee, which in turn benefits the investor. This change in value must be reflected on the investor's balance sheet and income statement. The initial investment is recorded at historical cost, and adjustments are made based on the investor's percentage ownership in net income, loss, and dividend payouts.

Net income of the investee company increases the investor's asset value on their balance sheet, while the investee's loss or dividend payout decreases it. For example, if an investor company owns 25% of a company that reports a net income of $1,000,000 and pays $200,000 in dividends, the investor will record a $250,000 increase in their investment value and a $50,000 decrease due to the dividend payout.

The investor company also records the percentage of the investee's net income or loss on their income statement. This is done to provide a more complete and accurate picture of the economic interest between the two companies and to reflect how the investee's finances can impact the investor.

Equity Research and Investment Management: Two Sides of Finance

You may want to see also

The equity method acknowledges the substantive economic relationship between two entities

The equity method is an accounting technique used to record the profits of a company through its investment in another company. It is used when an investor company has a significant influence on the company it is investing in, usually owning 20% or more of the company's stock. This significant influence means that the investor company can impact the value of the investee company, which in turn benefits the investor.

The equity method acknowledges the substantive economic relationship between the two entities. The investor records their share of the investee's earnings as revenue from investment on the income statement. For example, if a firm owns 25% of a company with a $1 million net income, the firm reports earnings from its investment of $250,000 under the equity method.

The equity method is a way to accurately reflect the ownership of one company in another entity. It allows investors to record profits or losses in proportion to their ownership percentage. It makes periodic adjustments to the asset's value on the investor's balance sheet to account for this ownership. The purpose of equity accounting is to ensure that the investor's accounts accurately reflect the investee's profit and loss. A recognised profit increases the investment's worth, while a recognised loss decreases its value accordingly.

The equity method is used when the investor holds significant influence over the investee but does not exercise full control over it, as in the relationship between a parent company and its subsidiary. In this case, the terminology of "parent" and "subsidiary" is not used. Instead, the investee is often referred to as an "associate" or "affiliate". The equity method is a standard technique used when one company, the investor, has a significant influence over another company, the investee.

Savings-Investment Spending Identity: Lessons for the Economy

You may want to see also

Frequently asked questions

The equity method of accounting is a technique used to record the profits earned by a company through its investment in another company. The investor company reports the revenue earned by the investee company on its income statement, proportional to its percentage of equity investment.

The equity method is used when an investor company holds significant influence over the company it is investing in, typically owning 20-50% of the stock.

The initial investment is recorded as an asset on the investor company's balance sheet. The value of this asset is adjusted over time to reflect the investor's share of the investee company's profits and losses. These profit and loss figures are recorded on the income statement.

The equity method differs from consolidation accounting, which is used when the investor exerts full control over the investee company, creating a parent-subsidiary relationship. The equity method also differs from the cost method, which is used when an investor owns less than 20% of the investee company, with no significant influence.