Financial ratios are an essential tool for investors to gain an understanding of a company's financial health and potential for success. They are used to analyse a company's balance sheet and income statement, tracking its performance, liquidity, operational efficiency, and profitability. By comparing ratios from different companies in the same industry, investors can make more informed decisions about where to invest their money. While there are dozens of financial ratios that can be used, this article will cover the most common and important ones, including the price-to-earnings (P/E) ratio, debt-to-equity (D/E) ratio, return on equity (ROE), and more.

| Characteristics | Values |

|---|---|

| Purpose | To decide whether to invest in a company |

| Ratio Types | Profitability, Liquidity, Solvency, and Valuation |

| Examples | Price-Earnings Ratio (PE), Price-to-Sales Ratio (PS), Debt-to-Equity Ratio (D/E), Return on Equity (ROE), Return on Assets (ROA), Dividend Payout Ratio |

What You'll Learn

Price-Earnings Ratio (PE)

The price-to-earnings (P/E) ratio is a widely used metric for investors and analysts to determine a stock's valuation and potential for growth. It is calculated by dividing a company's current stock price by its earnings per share (EPS). A high P/E ratio could indicate that a stock is overvalued or that investors expect high growth rates, whereas a low P/E ratio could suggest that a stock is undervalued or that the company is performing exceptionally well.

The P/E ratio is a valuable tool for comparing the relative value of companies within the same industry or sector, as companies across different sectors will naturally have varying P/E ratios. For example, technology companies, which typically grow faster than average, tend to have higher P/E ratios. Additionally, the P/E ratio can be used to compare a company's current valuation with its historical performance or a broader market benchmark like the S&P 500 Index.

It is important to note that the P/E ratio has some limitations. It does not account for future earnings growth and can be influenced by accounting practices and earnings guidance, which may be overly optimistic or pessimistic. Additionally, it may not be directly comparable across different industries due to variations in growth rates and valuation. To address these limitations, investors often use other ratios in conjunction with the P/E ratio, such as the price/earnings-to-growth (PEG) ratio, which incorporates a company's expected growth rate.

In summary, the P/E ratio is a valuable tool for investors and analysts to assess a stock's valuation and growth potential. However, it should be used in conjunction with other financial metrics and ratios to make a comprehensive investment decision.

Non-Cash Investing Activities: Understanding the Intangible Investments

You may want to see also

Return on Equity (ROE)

ROE is expressed as a percentage and can be calculated for any company if net income and equity are both positive numbers. Net income is calculated before dividends paid to common shareholders and after dividends to preferred shareholders and interest to lenders.

A higher ROE indicates that a company is more efficient at generating income and growth from its equity financing. However, ROE should be used in combination with other ratios to gain a comprehensive picture of a company's financial health. It is also important to compare ROE across companies in the same industry, as ROE varies across sectors.

ROE can be used to estimate a company's growth rate and the growth rate of its dividends. It can also be used to identify risks, as an extremely high ROE can indicate inconsistent profits or excessive debt.

A good ROE will depend on the company's industry and competitors. A good rule of thumb is to target an ROE that is equal to or just above the average for the company's sector.

Invest Cash Safely: Strategies for Secure Financial Growth

You may want to see also

Price-to-Book (P/B) Ratio

The price-to-book (P/B) ratio is a financial ratio used to compare a company's market capitalization to its book value. It is calculated by dividing the company's current stock price per share by its book value per share. The P/B ratio is often used by value investors to identify undervalued companies with high growth potential.

A P/B ratio of less than 1.0 is typically considered favourable and may indicate that a company's shares are undervalued. However, a closer examination is required before making any investment decisions. A low P/B ratio can also be a "red flag", indicating potential problems with the company that could lead to value deterioration in the future.

On the other hand, a P/B ratio greater than 1.0 could be a result of recent positive performance and a more optimistic outlook on the company's future.

The P/B ratio is more suitable for mature, asset-heavy companies, such as those in manufacturing and industrials. It is generally not used for companies composed mostly of intangible assets, such as software companies, as their value is tied to intangible assets that are not recorded on the company's books.

While the P/B ratio is a useful tool for identifying undervalued stocks, it should be supplemented with other financial ratios and in-depth analyses of the underlying value drivers.

Understanding the Ideal Cash-to-Investment Ratio for Your Business

You may want to see also

Debt-to-Equity (D/E) Ratio

The debt-to-equity ratio is a key financial metric that measures a company's financial leverage, indicating the extent to which it funds its operations through debt rather than equity. It is calculated by dividing a company's total liabilities by its shareholder equity.

A higher debt-to-equity ratio suggests that a company relies more on borrowed money to finance its operations, which may expose it to higher financial risk. This is because debt comes with interest and repayment obligations, and failure to meet these obligations can lead to financial distress or bankruptcy.

On the other hand, a lower ratio indicates that a company primarily uses equity financing, which does not require repayment but may dilute ownership by issuing more shares.

The ideal debt-to-equity ratio varies across industries, as some sectors are more capital-intensive and require more debt to finance their operations. Generally, a ratio of less than 1 is considered healthy, while a ratio above 2 is often seen as risky.

When interpreting the debt-to-equity ratio, it is important to consider industry norms and the company's financial strategy. This ratio should be used in conjunction with other financial metrics to gain a comprehensive understanding of the company's financial health.

Using the Debt-to-Equity Ratio for Investment Decisions

The debt-to-equity ratio is a valuable tool for investors as it provides insights into a company's financial stability and risk profile. It helps investors assess the level of financial risk a company is taking on by using debt to finance its operations.

A high debt-to-equity ratio may indicate that a company is heavily reliant on debt, which could pose a risk to shareholders if profits slow. In contrast, a low ratio may suggest that a company is more financially stable and has lower financial risk.

However, it is important to note that a low ratio may also indicate that a company is not maximising its growth potential by utilising available credit. Therefore, investors should consider the company's industry and growth stage when evaluating this ratio.

Additionally, investors can compare the debt-to-equity ratios of different companies within the same industry to identify those with lower financial risk and potentially more attractive investment opportunities.

In conclusion, the debt-to-equity ratio is a crucial metric for understanding a company's financial health and risk exposure. By analysing this ratio in conjunction with other financial metrics, investors can make more informed decisions about potential investment opportunities.

A Beginner's Guide to Investing via Binance

You may want to see also

Price-to-Sales Ratio (PS)

The price-to-sales ratio (PS), also known as the P/S ratio or PSR, is a valuation metric for stocks. It is calculated by dividing a company's market capitalization by its revenue in the most recent year, or by dividing the per-share stock price by the per-share revenue. The P/S ratio expresses how much it costs to purchase one share of a corporation in relation to how much revenue it generates. It is a useful measure for comparing stocks and can be used to determine whether a stock is valued properly.

The P/S ratio can be particularly effective in valuing growth stocks that have yet to turn a profit or have suffered a temporary setback. For example, if a company is not making earnings yet, investors can use the P/S ratio to determine whether the stock is undervalued or overvalued. If the P/S ratio is lower than that of comparable companies in the same industry, investors might consider buying the stock as it could be undervalued. This presents an opportunity for higher returns when the stock is correctly valued by the market in the future.

However, it is important to note that the P/S ratio should be used in conjunction with other financial ratios and metrics when determining whether a stock is valued properly. Additionally, the P/S ratio does not account for the debt on a company's balance sheet. Therefore, it is important to consider a company's debt levels when interpreting the P/S ratio.

Generally, a smaller P/S ratio (i.e., less than 1.0) is considered a better investment, as the investor is paying less for each unit of sales. However, sales alone do not reveal the full picture, as a company may be unprofitable despite having a low P/S ratio. Companies with a P/S ratio of 0.75 to 1.5 are typically regarded as strong buys, while those with a PSR greater than three are considered high-risk.

How to Use Ratios to Decide to Invest

Financial ratios are invaluable tools for investors when deciding which companies to invest in. They provide a comprehensive view of a company's performance and help identify potential red flags. By using a combination of ratios, investors can gain a fuller picture of a company's financial health and make more informed investment decisions.

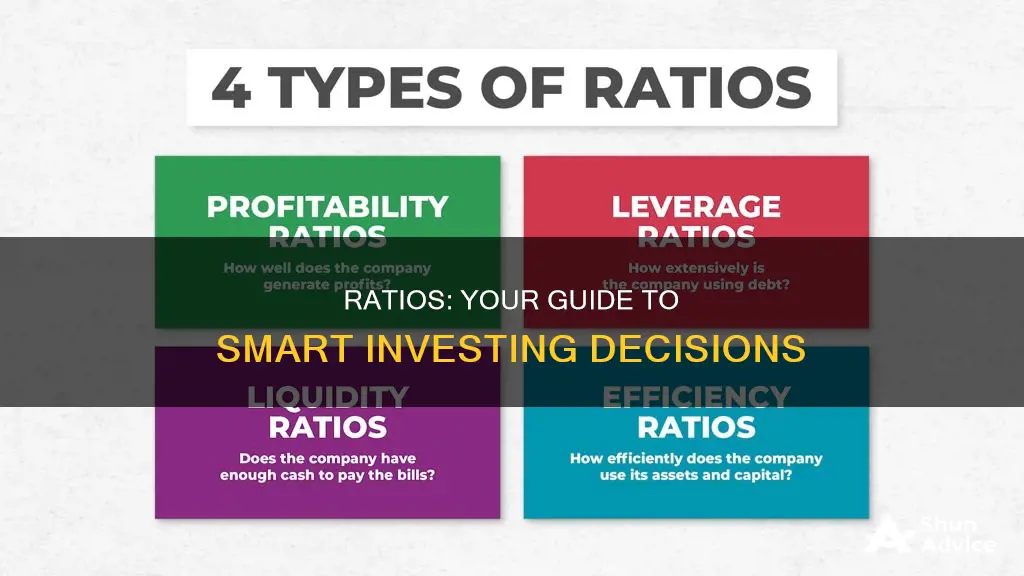

Some common financial ratios include profitability ratios, liquidity ratios, solvency ratios, and valuation ratios. Profitability ratios assess a company's ability to generate earnings relative to its revenue, operating costs, assets, and shareholders' equity. Liquidity ratios give investors an idea of a company's operational efficiency and short-term liquidity. Solvency ratios, or leverage ratios, help investors understand how well a company can manage its long-term financial obligations and debt levels. Valuation ratios, such as the P/S ratio, are often used to analyze the attractiveness of an investment and give investors an understanding of how inexpensive or expensive a stock is relative to the market.

It is important to compare ratios across companies within the same sector or industry, as ratios can vary significantly between different sectors. Additionally, investors should consider a company's historical performance and industry averages when interpreting financial ratios. By using a variety of ratios and conducting thorough research, investors can make more confident and informed investment decisions.

Screening for Value: Strategies for Finding Profitable Investments

You may want to see also

Frequently asked questions

There is no definitive answer to this question as it depends on various factors, but generally, a higher ROE is considered better as it indicates the company's efficiency at generating profits from shareholder investments.

The P/E ratio is calculated by dividing a company's current stock price by its earnings per share. It is used to determine the stock's potential for growth and whether it is undervalued or overvalued.

The D/E ratio gives an overview of a company's debts and equity. It indicates how much the company is relying on loans versus owned funds. A high D/E ratio suggests higher debt.

The P/B ratio compares a company's market value (market capitalization) to its book value. A low P/B ratio suggests a company is undervalued, while a high P/B ratio indicates it is overvalued.

The EPS ratio measures a company's profitability and is calculated by dividing net income by the total number of shares outstanding. It is important for investors to understand a company's profitability and the value of their investment.