Cash flow statements are one of the three key financial statements that a business uses to understand its financial health. They report the cash generated and spent during a specific period and serve as a bridge between the income statement and the balance sheet. One of the sections of the cash flow statement is cash flow from investing activities, which includes the acquisition and disposal of long-term assets and other investments not included in cash equivalents. These activities primarily involve the purchase and sale of physical assets, investments in securities, or the sale of securities or assets.

| Characteristics | Values |

|---|---|

| Definition | A section of a company's cash flow statement that displays how much money has been used in or generated from making investments during a specific time period. |

| Types of Activities | Purchase of long-term assets, acquisitions of other businesses, and investments in marketable securities (stocks and bonds). |

| Importance | Shows how a company is allocating cash for the long term and indicates whether the company is investing in assets, research, or other long-term development activities. |

| Calculation | Cash flow = Total Investment Sum - Losses + Notional Gains. |

| Sections | Operating cash flow, investing cash flow, and financing cash flow. |

What You'll Learn

Cash flow from investing activities

Investing activities encompass the purchase and sale of physical assets, such as property, plant, and equipment (PP&E), as well as investments in marketable securities like stocks and bonds. It's important to note that the purchase of PP&E, also known as capital expenditures (CapEx), is a significant aspect of investing activities. These investments are necessary for the company's operations and are considered a cash outflow, impacting the net increase in cash from all activities.

The calculation of cash flow from investing activities is straightforward. You add the purchases or sales of property, equipment, other businesses, and marketable securities. This calculation provides a comprehensive view of the company's investment-related cash flow.

It's worth noting that negative cash flow from investing activities doesn't always indicate poor financial performance. Instead, it may suggest that the company is investing in long-term strategies, such as research and development, that will contribute to its future success.

Overall, understanding cash flow from investing activities is crucial for stakeholders to assess a company's capital expenditure strategies, investment performance, and long-term financial health.

Best Places to Invest Your Cash Today

You may want to see also

Acquisition and disposal of long-term assets

The acquisition and disposal of long-term assets, also known as non-current assets, are included in the cash flow from investing activities (CFI) section of a company's cash flow statement. This section provides an overview of the company's investment performance and capital allocation decisions, specifically relating to long-term assets such as property, plant, and equipment (PP&E).

When a company purchases long-term assets, it is considered a cash outflow from investing activities. On the other hand, when a company sells or disposes of long-term assets, it is considered a cash inflow from investing activities. These transactions can include the acquisition or disposal of physical assets, investments in securities, or the sale of securities or assets.

It is important to note that if a company disposes of a long-term asset for an amount different from its book value (the asset's value in the company's accounting records), an adjustment must be made to the net income appearing on the statement of cash flows (SCF). The entire proceeds from the sale of a long-term asset must be reported in the CFI section of the SCF. However, any gain or loss on the sale of the asset is included in the net income shown in the SCF section of operating activities. Therefore, each gain is deducted from net income, and each loss is added to net income in the operating activities section.

The acquisition and disposal of long-term assets are crucial aspects of a company's growth and capital management. These activities provide insights into the company's capital expenditures and investment strategies, allowing stakeholders to assess the company's ability to invest in growth opportunities, acquire assets, and manage its long-term financial health.

Unlocking Investment Strategies: Determining Cash Availability

You may want to see also

Impact on cash flow

Cash flow statements are one of the three main financial statements a business uses, alongside the balance sheet and income statement. They are important because they show how much cash a company has generated and spent over a specific period, and they can indicate whether a company is in a strong financial position.

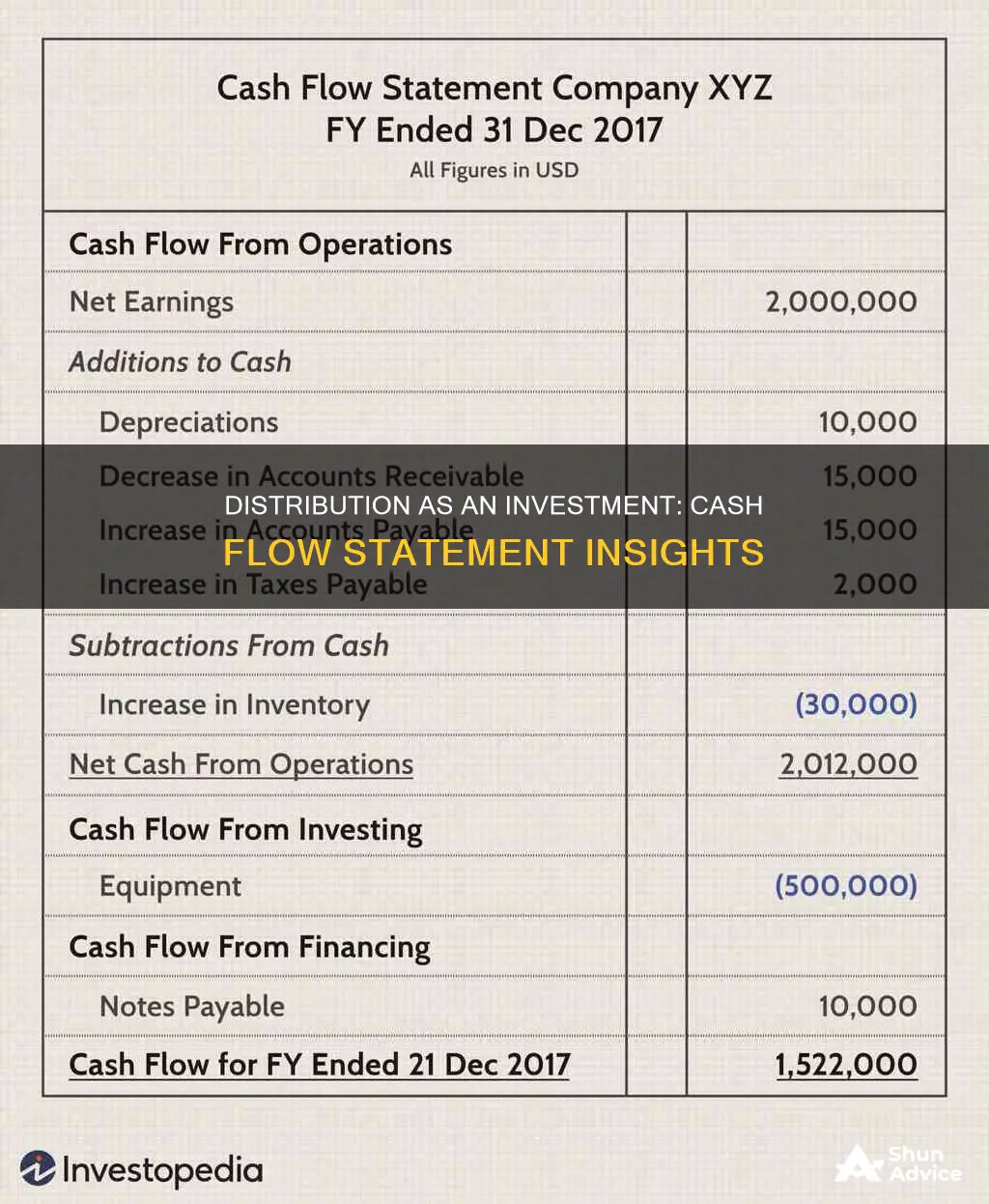

The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities.

Investing activities include the purchase and sale of long-term assets, such as property, plant, and equipment, as well as the acquisition of other businesses and investments in securities (e.g. stocks and bonds). These activities can have a significant impact on a company's cash flow.

When a company purchases long-term assets, it reduces cash flow from assets, while the sale of these assets increases cash flow. This is because the purchase of long-term assets involves a large outflow of cash, while the sale of assets involves a large inflow of cash.

For example, if a company buys a new machine, its output will increase, improving cash flow and gross profits. Similarly, investing in acquisitions can increase revenue by improving efficiency.

However, negative cash flow from investing activities does not always indicate poor company performance. It could mean that the company is investing in the long-term health of the business, such as through research and development.

It is also important to note that the impact of investing activities on cash flow depends on the age and type of the company. For example, a young and fast-growing company may have a negative net cash flow as it invests to remain competitive and develop its business.

Overall, investing activities are crucial for the growth and capital of a business, and they can have a significant impact on cash flow. They can either increase or decrease cash flow, depending on the nature of the activities, and they are an important factor for analysts and investors to consider when evaluating a company's financial health.

Invest Cash: Safe, Liquid Strategies for Beginners

You may want to see also

Cash flow statement sections

A cash flow statement is a financial statement that provides data on a company's cash inflows and outflows from its operations and external investment sources. It is one of three fundamental financial statements that provide crucial financial data that informs organisational decision-making, the other two being income statements and balance sheets.

The cash flow statement is divided into three sections:

Cash Flow from Operating Activities

This section covers cash flows from operating activities and includes transactions from all operational business activities. It reports cash inflows and outflows that stem directly from a company’s main business activities, such as buying and selling inventory and supplies, and paying employee salaries.

Cash Flow from Investing Activities

The second section of the cash flow statement looks at cash flows from investing and is the result of investment gains and losses. It includes cash spent on purchasing long-term assets such as property, plants, and equipment. Analysts look to this section to find changes in capital expenditures.

Cash Flow from Financing Activities

The final section of the cash flow statement provides an overview of cash used in business financing and measures cash flow between a company and its owners and creditors. The cash normally comes from debt or equity, such as selling stocks and bonds or borrowing from a bank.

The cash flow statement is an important tool for understanding a company's financial health and operational efficiency. It is also useful for investors, who can use the statement to make better, more informed decisions about their investments.

Investing in Startups: Strategies for Cash-Strapped Investors

You may want to see also

Calculating cash flow

Cash flow is a reflection of how money moves in and out of a business. It is a critical indicator of a company's financial health and can be calculated in several ways.

Net Cash Flow

Net cash flow is the difference between a company's total cash inflows and outflows over a given period.

Net Cash Flow = Total Cash Inflows – Total Cash Outflows

Operating Cash Flow

Operating cash flow (OCF) reflects a company's ability to generate cash from its normal operations.

Operating Cash Flow = Net Income + Non-Cash Expenses – Change in Working Capital

Cash Flow from Financing Activities

Cash flow from financing activities (CFF) reflects the net flow of cash between a company and its owners, creditors, and investors.

Financing Cash Flow = Cash Inflows From Issuing Equity or Debt – (Dividends Paid + Repurchase of Debt and Equity)

Cash Flow from Investing Activities

Cash flow from investing activities (CFI) is a section of a company's cash flow statement that details cash inflows and outflows from investment-related activities, such as purchasing or selling assets, investing in securities, or acquiring other companies.

CFI = CapEx/Purchase of Non-Current Assets + Marketable Securities + Business Acquisitions – Divestitures (Sale of Investments)

Free Cash Flow

Free cash flow is the cash left over after a business has met all its obligations.

Free Cash Flow = Net Income + Non-Cash Expenses – Change in Working Capital – Capital Expenditure

Discounted Cash Flow

The discounted cash flow (DCF) formula is used to determine the expected value of a business based on future cash flows.

DCF = [(cash flow 1) ÷ (1 + r)^1] + [(cash flow 2) ÷ (1 + r)^2] + [(cash flow n) + (1 + r)^n]

Levered Free Cash Flow

Levered free cash flow (LFCF) is the cash flow of a business that has been funded with borrowed capital.

LFCF = Earned Income Before Interest, Taxes, Depreciation and Amortization – Change in Net Working Capital – Capital Expenditures – Mandatory Debt Payments

Unlevered Free Cash Flow

Unlevered free cash flow (UFCF) is a company's cash flow without accounting for any interest payments.

UFCF = Earnings Before Interest, Tax, Depreciation, and Amortization – Capital Expenditures – Working Capital – Taxes

Understanding Net Cash Flow from Investing Activities

You may want to see also

Frequently asked questions

Investing activities refer to the purchase and sale of long-term assets and other business investments within a specific reporting period. This includes the acquisition or disposal of long-term assets such as property, plant, and equipment, as well as investments in securities or marketable securities like stocks and bonds.

Investing activities directly affect a company's cash flow. The purchase of long-term assets reduces cash flow, while the sale of long-term assets or investments increases cash flow. These activities are reported in the investing section of a company's cash flow statement.

The formula for calculating cash flow from investing activities is: Cash Flow = Total Investment Sum - Losses + Notional Gains. This involves adding up the proceeds from sales and subtracting the cost of purchasing long-term assets or investments.