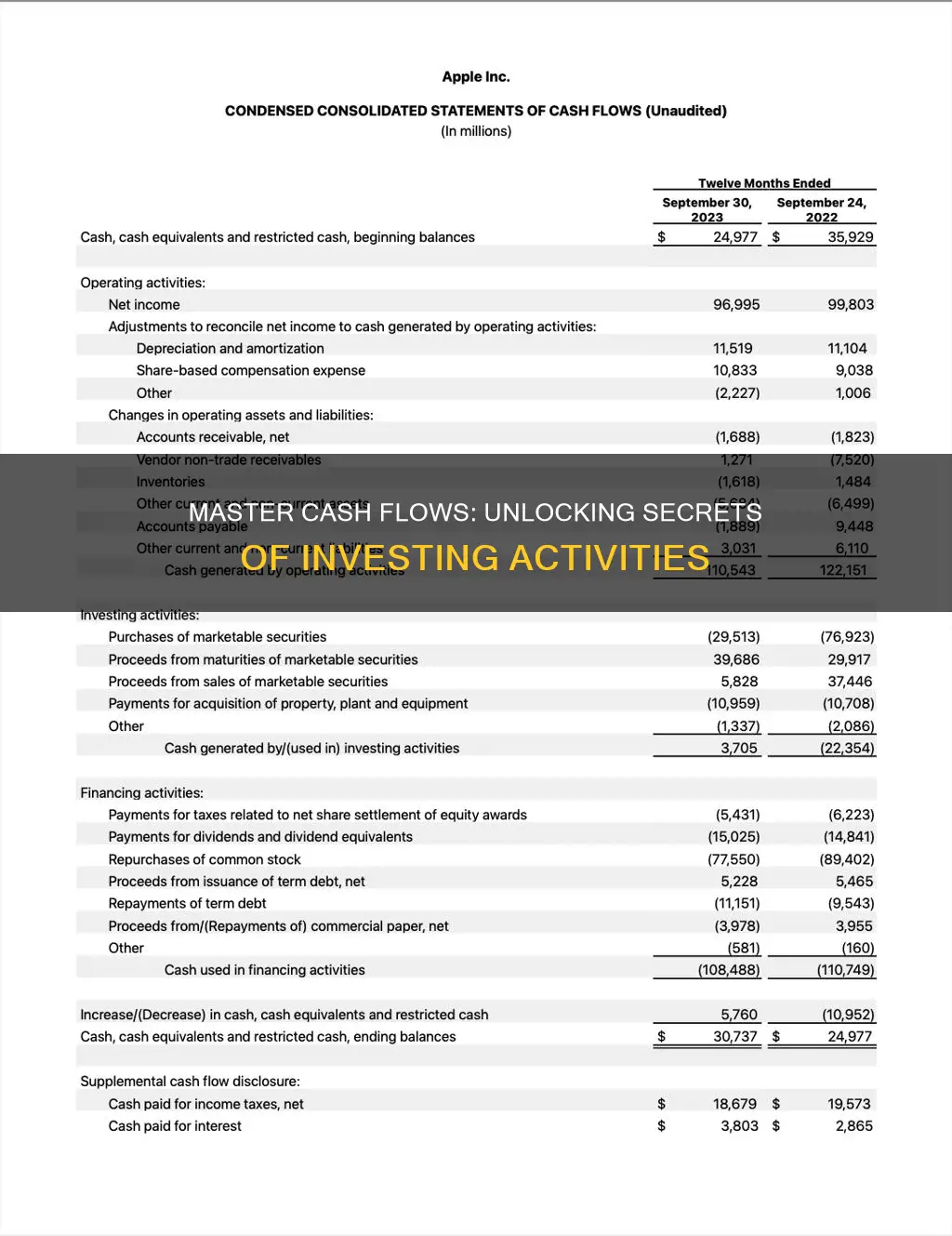

Understanding cash flows from investing activities is crucial for assessing a company's financial health and investment strategies. This section of a company's financial statements reveals how much cash is generated or used in the purchase and sale of long-term assets, such as property, plant, and equipment, as well as investments in other companies. By analyzing these cash flows, investors and analysts can gain insights into a company's capital expenditure decisions, investment in growth, and overall financial flexibility. This guide will provide a step-by-step approach to deciphering these cash flows, ensuring a comprehensive understanding of a company's financial activities and their impact on its cash position.

What You'll Learn

- Identify Investment Transactions: Track all investments, sales, and purchases

- Calculate Cash Inflows/Outflows: Determine cash received or paid from investments

- Analyze Investment Timing: Understand when cash flows occur

- Categorize Non-Cash Items: Exclude non-cash transactions like depreciation

- Verify Accuracy: Review and reconcile cash flow data

Identify Investment Transactions: Track all investments, sales, and purchases

To effectively calculate cash flows from investing activities, it's crucial to meticulously track all investment-related transactions. This includes both purchases and sales of assets, as well as any other financial moves that impact your cash position. Here's a step-by-step guide to help you identify and record these transactions accurately:

Maintain a Comprehensive Investment Record:

- List All Investments: Create a detailed list of all your investments, including the type (e.g., stocks, bonds, real estate), the purchase price, the date of acquisition, and any associated costs (commissions, fees).

- Track Sales and Dispositions: Keep records of all sales or disposals of investments. Record the sale price, date of sale, and any gains or losses realized.

- Monitor Market Value Changes: Even if you haven't sold an investment, track its market value fluctuations. This information is essential for understanding the impact on your cash flow.

Categorize Transactions:

- Capital Transactions: These involve the purchase or sale of long-term assets like property, plant, and equipment, or long-term investments. Capital transactions typically result in significant cash outflows or inflows and are recorded at historical cost.

- Financial Transactions: These include buying and selling financial assets like stocks, bonds, and derivatives. Financial transactions often involve smaller cash flows and are recorded at fair value.

Use a Consistent Accounting Method:

- Cash Basis vs. Accrual Basis: Choose an accounting method that aligns with your business needs. Cash basis accounting records transactions when cash is exchanged, while accrual basis accounting recognizes transactions when they are incurred, regardless of cash flow.

- Consistency is Key: Once you choose a method, stick to it consistently to ensure accurate comparisons over time.

Utilize Accounting Software or Spreadsheets:

- Automation: Consider using accounting software or spreadsheets to streamline the tracking process. These tools can help you organize data, generate reports, and identify trends.

- Features to Look For: Look for features like:

- General Ledger: To record all transactions.

- Subledgers: To categorize investments and transactions.

- Financial Reports: To generate cash flow statements and analyze your investing activities.

Regularly Review and Analyze:

- Cash Flow Statements: Prepare cash flow statements regularly to visualize the flow of cash in and out of your investing activities. This will help you identify patterns, assess liquidity, and make informed decisions.

- Compare with Financial Goals: Regularly review your investment transactions against your financial goals and risk tolerance. This will help you stay on track and make adjustments as needed.

Child's First Investment: How to Start Saving and Sharing Early

You may want to see also

Calculate Cash Inflows/Outflows: Determine cash received or paid from investments

To calculate cash flows from investing activities, it's crucial to focus on the specific cash movements related to your investments. This involves identifying and categorizing various transactions to ensure an accurate representation of your cash position. Here's a step-by-step guide to help you determine cash inflows and outflows from investments:

- Identify Investment Transactions: Begin by listing all the investment-related transactions that occurred during the period you're analyzing. This includes buying or selling securities, acquiring or disposing of property, and any other investment-specific activities. For example, if you purchased stocks, bonds, or real estate, these transactions should be included.

- Cash Inflows: Cash inflows from investing activities are the amounts of money received or the reduction in cash due to these transactions. This can be calculated by adding up the proceeds from the sale of assets, interest received, and any other income generated by your investments. For instance, if you sold stocks for $50,000 and received $5,000 in interest, your cash inflow would be $55,000.

- Cash Outflows: Cash outflows are the payments made or the increase in cash due to investing activities. This includes the purchase of assets, principal payments on investments, and any other expenses related to your investments. For example, if you bought stocks for $30,000 and made a principal payment of $2,000, your cash outflow would be $32,000.

- Categorize and Summarize: Organize your identified transactions into cash inflows and outflows categories. Ensure that each transaction is correctly allocated to the appropriate category. Then, calculate the total cash inflow and outflow for the period. This will provide a clear picture of the net cash impact of your investing activities.

- Analyze and Interpret: Review the calculated cash flows to gain insights into your investment performance. A positive cash flow from investing activities indicates that your investments generated more cash than they required, while a negative cash flow suggests the opposite. This analysis can help you make informed decisions about your investment strategy and identify areas for improvement.

Remember, when working with cash flows from investing activities, it's essential to be meticulous and consistent in your calculations. This ensures that your financial reporting accurately reflects the cash movements related to your investments, providing a comprehensive understanding of your financial health and investment performance.

Where to Invest: Personal Preferences

You may want to see also

Analyze Investment Timing: Understand when cash flows occur

Understanding the timing of cash flows from investing activities is crucial for a comprehensive analysis of a company's financial health and investment decisions. When analyzing investment timing, it's essential to recognize that cash flows from investing activities can vary significantly depending on the company's strategic decisions and market conditions.

Cash flows from investing activities primarily arise from the purchase and sale of long-term assets, such as property, plant, and equipment, as well as investments in other companies. These transactions can have a substantial impact on a company's cash position and overall financial performance. For instance, a company might invest in new machinery, which requires an initial cash outflow but can lead to increased productivity and future cash inflows. Conversely, selling a valuable asset can result in a significant cash inflow, improving the company's liquidity.

The timing of these cash flows is critical because it influences the company's short-term and long-term financial strategies. For example, a company might choose to invest in a new project, expecting a positive cash flow in the future. However, if the investment is made during a period of low cash reserves, it could impact the company's ability to meet its short-term obligations. On the other hand, selling assets at a favorable time can provide a much-needed cash boost to support the company's operations.

To analyze investment timing effectively, financial analysts and investors should consider the following:

- Seasonality and Market Trends: Some industries experience seasonal variations in cash flows from investing activities. For instance, a retail company might invest heavily in inventory during the holiday season, leading to a temporary increase in cash outflows. Identifying these patterns can help in understanding the underlying drivers of cash flow timing.

- Strategic Initiatives: Companies often make strategic investments to gain a competitive edge or expand their operations. These decisions can have a significant impact on cash flows. For example, a tech company might invest in research and development, which could lead to future cash inflows but requires an initial cash outflow.

- Market Conditions: Economic cycles and market trends play a vital role in investment timing. During economic downturns, companies might delay investments or sell assets to preserve cash, resulting in different cash flow patterns compared to prosperous times.

By carefully examining these factors, investors can make more informed decisions regarding the timing of investments and their potential impact on a company's financial stability and growth prospects. It allows for a more nuanced understanding of the company's cash flow management and its ability to navigate various market scenarios.

Investing: Why the Fear?

You may want to see also

Categorize Non-Cash Items: Exclude non-cash transactions like depreciation

When calculating cash flows from investing activities, it's crucial to focus on actual cash movements, excluding non-cash transactions. This ensures a clear picture of the business's liquidity and financial health. Here's a step-by-step guide to categorizing non-cash items:

Understand Non-Cash Transactions:

Non-cash transactions refer to exchanges that don't involve immediate cash exchange. These can include:

- Depreciation: The allocation of the cost of tangible assets over their useful lives.

- Amortization: Similar to depreciation, but for intangible assets like patents or trademarks.

- Impairment losses: Write-downs of asset values due to damage, obsolescence, or other factors.

- Stock-based compensation: Payment of employee salaries through company stock instead of cash.

Identify and Exclude:

When analyzing investing activities, identify any transactions that fall under the non-cash category. These should be excluded from the cash flow calculation. For example:

- Purchase/Sale of Assets: If a company sells an asset for cash, the cash received is included in cash flows from investing activities. However, if the asset is sold for a loss (impairment), only the cash received (not the loss) is reported.

- Dividends Received: Cash received from dividends paid by investments is included in cash flows from operating activities, not investing activities.

Focus on Cash Equivalents:

Concentrate on transactions involving cash equivalents, which are assets that can be readily converted into cash within a short period without significant risk. This includes:

- Sales of marketable securities: Proceeds from selling investments that can be quickly liquidated.

- Purchases of short-term investments: Acquisitions of assets that can be easily converted to cash within a year.

Example:

Imagine a company sells a piece of machinery for $50,000 in cash. This cash flow is included in cash flows from investing activities. However, if the company sold the machinery for $40,000 due to obsolescence (an impairment loss), only the $50,000 cash received would be reported, not the $10,000 loss.

By carefully categorizing and excluding non-cash transactions, you can accurately assess a company's cash flow from investing activities, providing valuable insights into its financial performance and liquidity.

Unleash Market Momentum: Understanding Momentum Investing Strategies

You may want to see also

Verify Accuracy: Review and reconcile cash flow data

When it comes to verifying the accuracy of cash flow data related to investing activities, a meticulous review and reconciliation process is essential. This step is crucial to ensure the integrity of financial statements and provide stakeholders with reliable information. Here's a detailed guide on how to approach this task:

Understanding the Process: Begin by thoroughly understanding the cash flow from investing activities. This category typically includes purchases and sales of long-term assets, investments in marketable securities, and other financial investments. It's important to recognize that these transactions can significantly impact a company's financial health and should be carefully analyzed.

Data Collection and Sources: Gather all relevant data related to investing activities from various sources. This includes internal financial records, bank statements, investment portfolios, and any external reports. Ensure that the data is comprehensive and covers the specific period you are reviewing. Having a centralized and well-documented dataset is key to accurate verification.

Review and Verification: Start by scrutinizing each transaction in the investing activities section. Verify the following:

- Transaction Details: Confirm the date, amount, and nature of each transaction. Check for any discrepancies or errors in recording.

- Supporting Documents: Cross-reference the transactions with supporting documents such as purchase agreements, sales contracts, or investment statements. Ensure that the details match and are accurately reflected.

- Consistency and Trends: Look for any unusual patterns or discrepancies in the cash flow data. Identify if there are sudden spikes or drops in investments and investigate the reasons behind them. Consistency in cash flow is vital for financial stability.

Reconciliation Techniques: Implement reconciliation methods to identify and resolve any discrepancies. Here are some steps to consider:

- Compare with Prior Periods: Analyze the cash flow from investing activities in previous periods to identify any significant changes or anomalies.

- Check for Errors: Look for common errors such as data entry mistakes, rounding issues, or incorrect categorization. Rectify these errors to ensure accuracy.

- Adjustments and Corrections: Make necessary adjustments to the cash flow statement to reflect any discrepancies found during the review. Ensure that all corrections are properly documented.

Documentation and Reporting: Maintain detailed documentation throughout the verification process. Record all findings, adjustments, and explanations for any discrepancies. This documentation will be valuable for future reference and audit purposes. Finally, compile a comprehensive report summarizing the verification process, any issues encountered, and the overall accuracy of the cash flow data.

By following these steps, financial professionals can ensure that the cash flow data related to investing activities is accurate, reliable, and free from material errors. This process is a critical component of financial reporting, providing transparency and confidence to investors and stakeholders.

Federal Retirement Thrift Investment Savings Plan: Maximizing Your Retirement Benefits

You may want to see also

Frequently asked questions

Cash flows from investing activities provide insights into a company's capital expenditure and investment decisions. This section of the cash flow statement helps investors understand how the company allocates its cash to acquire or dispose of long-term assets, such as property, plant, and equipment, or investments in other companies.

To calculate this, you need to consider the following transactions:

- Purchase or sale of long-term assets: This includes buying or selling property, machinery, or other tangible assets.

- Acquisition or disposal of subsidiaries or other businesses: Mergers, acquisitions, or divestitures result in significant cash flows.

- Investment in marketable securities: Buying or selling stocks, bonds, or other financial assets.

- Loan repayments or acquisitions: Lending money to others or acquiring loans.

Investing activities can significantly influence a company's financial position. Large investments in assets or acquisitions may require substantial cash outflows, impacting the company's liquidity. However, successful investments can also generate returns and improve the company's financial performance. It's essential to analyze these activities in conjunction with other financial metrics to gain a comprehensive understanding of the company's overall financial health.

Yes, one challenge is distinguishing between capital expenditures and investments. Capital expenditures are day-to-day spending on assets, while investments are long-term financial commitments. Another pitfall is the potential for manipulation, as companies can choose when to report certain transactions. Therefore, it's crucial to review multiple periods and consider the overall trend in investing activities to make informed financial decisions.