Triple Net Investments (NNN) are a type of real estate investment that offers investors a steady and relatively secure income stream. This investment strategy involves purchasing a property that generates a consistent income through net leases, where the tenant is responsible for paying all property expenses, including taxes, insurance, and maintenance. The investor benefits from a fixed-income stream, often with long-term lease agreements, providing a stable and predictable return on their investment. Understanding the mechanics of triple net investments is crucial for investors looking to diversify their portfolios and generate consistent cash flow from real estate assets.

What You'll Learn

- Structure: Triple Net (NNN) investments involve tenants paying for taxes, insurance, and maintenance, simplifying ownership

- Lease Terms: Long-term leases with built-in escalators ensure stable cash flow and tenant retention

- Tenant Mix: Diversifying tenants across multiple industries reduces risk and ensures consistent rental income

- Capitalization Rate: NNN properties are valued based on net operating income, offering higher capitalization rates than traditional investments

- Management: Professional management companies handle day-to-day operations, reducing owner burden and ensuring property upkeep

Structure: Triple Net (NNN) investments involve tenants paying for taxes, insurance, and maintenance, simplifying ownership

Triple Net (NNN) investments are a popular and structured approach to commercial real estate ownership, offering a unique way to generate steady income and minimize the responsibilities of the landlord. This investment strategy is particularly attractive to investors seeking a hands-off, long-term investment with predictable cash flow.

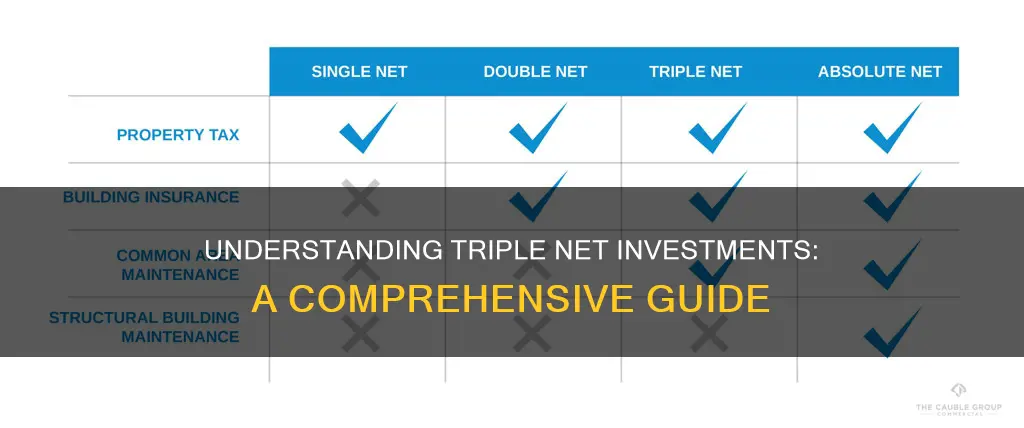

In a Triple Net investment, the tenant is responsible for all the expenses associated with the property, including property taxes, insurance, and maintenance. This is in contrast to a traditional lease agreement where the landlord covers these costs. By transferring these expenses to the tenant, the landlord's role is significantly reduced, making it an ideal structure for those who prefer a more passive investment strategy. The tenant's obligation to pay these 'triple net' expenses is typically included in the lease agreement, ensuring a clear and defined financial responsibility.

The beauty of this structure lies in its simplicity and the potential for consistent cash flow. Investors can own a property without the day-to-day management, as the tenant takes on the burden of maintenance and repairs. This also means that the landlord is not tied to the property's upkeep, allowing for a more relaxed and flexible approach to ownership. As a result, Triple Net investments often provide a steady and reliable income stream for investors, making it an attractive option for those seeking long-term wealth generation.

When considering a Triple Net investment, it is crucial to carefully vet potential tenants. Since the tenant is responsible for all expenses, including any unexpected costs, their financial stability and ability to meet these obligations are essential. A thorough background check and financial assessment can help ensure the tenant's reliability and reduce the risk of default. Additionally, having a well-defined lease agreement that clearly outlines the tenant's responsibilities is vital to protecting the investor's interests.

In summary, Triple Net investments offer a structured and appealing way to invest in commercial real estate. By shifting the burden of property expenses to the tenant, landlords can enjoy a more passive ownership experience with predictable cash flow. This investment strategy is well-suited for those seeking a long-term, hands-off approach to real estate, providing a stable and reliable income stream.

The Battle for Beneficiary: Will vs. Investments

You may want to see also

Lease Terms: Long-term leases with built-in escalators ensure stable cash flow and tenant retention

Long-term leases with built-in escalators are a cornerstone of triple net investments, offering a strategic approach to property management and financial stability. This lease structure is designed to provide a consistent and predictable income stream for investors, ensuring a steady cash flow over the life of the lease. By locking in long-term commitments, typically 10 to 15 years or more, investors can mitigate the risks associated with short-term rentals and market fluctuations.

The built-in escalators within these leases are a critical feature. These escalators are adjustments to the lease rate that occur at regular intervals, often tied to inflation or market indices. This mechanism ensures that the rent increases over time, protecting the investor from the erosion of purchasing power and keeping the property's value aligned with market trends. For example, if the lease rate starts at a fixed amount and escalates by 2% annually, the tenant pays a higher rent each year, reflecting the property's increased value and market demand.

This lease structure also encourages tenant retention, which is vital for maintaining a stable investment. Long-term leases provide tenants with a sense of security and stability, knowing their lease is not subject to frequent changes. As a result, tenants are more likely to maintain the property and make necessary improvements, ensuring it remains in good condition. This, in turn, can lead to lower vacancy rates and reduced turnover costs for the investor.

Additionally, long-term leases with escalators can provide investors with a competitive advantage in the market. When tenants are locked in for an extended period, it becomes a selling point for the property, attracting potential buyers or investors who value stability and predictability. This can result in a higher property value and a more favorable return on investment.

In summary, long-term leases with built-in escalators are a powerful tool for triple net investors, offering stable cash flow, tenant retention, and market resilience. This lease structure provides a solid foundation for investors to build their portfolio and achieve their financial goals, ensuring a consistent and predictable income stream over the long term.

The Prince of Wales: A Future Investiture?

You may want to see also

Tenant Mix: Diversifying tenants across multiple industries reduces risk and ensures consistent rental income

Tenant mix is a critical aspect of triple net investments, and diversifying tenants across multiple industries is a powerful strategy to mitigate risk and ensure a steady income stream. This approach involves carefully selecting a range of tenants from different sectors, each contributing to the overall stability of the investment. By doing so, investors can minimize the impact of potential vacancies or financial downturns in any single industry.

The primary goal is to create a balanced portfolio where no single tenant or industry dominates. For instance, in a triple net lease scenario, an investor might lease space to a tech startup, a retail store, a medical clinic, and a food service provider. Each of these tenants operates in a distinct industry, bringing a unique set of skills, customer base, and revenue streams. If one tenant encounters financial troubles, the presence of others in different sectors can help to offset the impact, ensuring that the investment remains stable.

Diversification across industries also provides a hedge against economic cycles. During economic downturns, some industries may suffer more than others. For example, a retail tenant might struggle during a recession, but a medical clinic or a food service provider could still generate consistent income. This mix of tenants can help to smooth out cash flow and provide a more reliable rental income over time.

Additionally, a varied tenant base can enhance the overall desirability of the property. Different industries often have unique requirements, and by accommodating these diverse needs, the investment property becomes more attractive to a broader range of potential tenants. This can lead to easier leasing, faster vacancy turnover, and potentially higher rental rates, further strengthening the investment's financial performance.

In summary, diversifying tenants across multiple industries is a strategic move for triple net investors, offering risk mitigation, consistent income, and a more resilient investment portfolio. It requires careful tenant selection and an understanding of various industries' dynamics, but the benefits can be significant in the long term.

Planning Your Investment Legacy: Strategies for Longevity

You may want to see also

Capitalization Rate: NNN properties are valued based on net operating income, offering higher capitalization rates than traditional investments

The capitalization rate, often referred to as the cap rate, is a crucial metric in the valuation of real estate, especially for triple net (NNN) properties. This rate is a powerful tool for investors to assess the profitability and value of an investment property. When it comes to NNN investments, the cap rate is calculated using the net operating income (NOI) of the property.

In the context of NNN investments, the NOI is the net income generated by the property after all expenses, including taxes, insurance, and maintenance, have been deducted. This metric provides a clear picture of the property's cash flow and its ability to generate returns. By dividing the NOI by the property's purchase price or value, investors can determine the capitalization rate.

NNN properties, such as shopping centers, office buildings, or industrial complexes, typically have higher capitalization rates compared to traditional real estate investments. This is primarily because these properties generate consistent and stable income streams due to the triple net lease structure. In an NNN lease, the tenant is responsible for paying all the property expenses, including taxes, insurance, and maintenance, which are then passed on to the investor as net income. As a result, the NOI of an NNN property is often higher, leading to a more attractive cap rate.

For example, if an investor purchases an NNN property for $1 million and the net operating income is $100,000 annually, the capitalization rate would be 10% (100,000 / 1,000,000). This indicates that the property is expected to generate a 10% return on investment based on its net operating income. Higher cap rates are often sought after by investors as they represent a more significant potential return for their capital.

Understanding the capitalization rate is essential for investors to make informed decisions when evaluating NNN properties. It allows them to compare the profitability of different investments and assess the potential for long-term capital appreciation. Additionally, the cap rate can provide insights into the market's perception of risk and the expected rate of return for a particular property type. By analyzing cap rates, investors can identify opportunities and make strategic choices in the triple net investment space.

The Ultimate Guide to Buying a Home as an Investment: What You Need to Know

You may want to see also

Management: Professional management companies handle day-to-day operations, reducing owner burden and ensuring property upkeep

Professional management companies play a crucial role in the success of triple net investments, offering a range of services that benefit both the property owner and tenants. These companies are responsible for the day-to-day operations and maintenance of the property, ensuring that it remains well-managed and attractive to potential tenants. By hiring a management company, investors can significantly reduce their workload and focus on other aspects of their business or personal life.

The primary goal of a management company is to provide efficient and effective property management, which includes a variety of tasks. Firstly, they handle the leasing process, finding and screening potential tenants to ensure they meet the property's criteria. This involves advertising the property, scheduling viewings, and conducting thorough background checks to minimize the risk of bad tenants. Once a tenant is selected, the management company takes care of lease agreements, rent collection, and regular communication with the tenant to address any concerns or issues promptly.

Maintenance and upkeep are another critical aspect of their role. Management companies employ skilled technicians and maintenance staff to handle any property-related issues promptly. This includes routine inspections to identify and fix potential problems before they become major issues, ensuring the property remains in good condition. They also coordinate with specialized contractors for more complex repairs, such as HVAC system maintenance or plumbing issues, ensuring that the property's infrastructure is well-maintained.

In addition to these operational tasks, management companies also provide financial reporting and budgeting. They prepare detailed financial statements, outlining income and expenses, which are essential for investors to track the property's performance. These reports help investors make informed decisions regarding their investment and provide transparency regarding the property's financial health. Management companies also assist in budgeting for maintenance and other expenses, ensuring that the property's finances are managed efficiently.

By engaging professional management companies, triple net investors can benefit from their expertise and efficiency. These companies have the resources and knowledge to handle various aspects of property management, from tenant screening to maintenance coordination. This not only reduces the burden on the property owner but also ensures that the investment is well-maintained and managed, leading to higher tenant satisfaction and potentially increased property value over time. Effective management is a key factor in the long-term success of triple net investments.

Your Guide to Choosing the Right Investment

You may want to see also

Frequently asked questions

A triple net lease is a type of commercial real estate investment where the tenant is responsible for paying all the property expenses, including net rent, net taxes, and net operating expenses. This structure is common in retail, office, and industrial properties, providing investors with a steady and predictable income stream.

Income from triple net investments comes from the rent paid by the tenant, which covers the property's operating costs. The tenant also pays any additional expenses, ensuring that the landlord's costs are covered. This arrangement allows investors to benefit from regular cash flow without the burden of maintenance and management.

Triple net investments offer several benefits. Firstly, the tenant's responsibility for expenses provides a stable and secure income, often with long-term lease agreements. This reduces the landlord's risk and provides a consistent cash flow. Additionally, these properties typically have lower vacancy rates compared to other commercial real estate, as tenants are attracted to the convenience of covered expenses.

In a triple net lease, 'net' refers to the tenant's obligation to pay a fixed amount of rent, which is then used to cover the property's net expenses. This means the tenant's rent payment is the net amount after accounting for all necessary costs. For example, if the net rent is $10,000, the tenant pays this amount, and it covers the property's taxes, insurance, maintenance, and other operating costs.

Lease terms for triple net properties can vary, but they often include long-term agreements, sometimes extending over 10 to 20 years or more. These extended lease terms provide investors with a higher level of security and predictability in their income. Additionally, lease structures may include options for the tenant to renew the lease or even purchase the property, offering flexibility and potential for further investment.