Inflation is a sustained increase in the price of goods and services over time, reducing the purchasing power of money. It can have a detrimental effect on investments, eroding their real value and diminishing returns. Inflation is currently outpacing interest rates, which means that cash savings are losing value. However, certain investments can act as a hedge against inflation, including stocks, commodities, real estate, and inflation-indexed securities.

| Characteristics | Values |

|---|---|

| Effect on purchasing power | Inflation erodes the value of cash savings over time, reducing purchasing power. |

| Effect on savings | Inflation can shrink savings, even in accounts with interest. |

| Effect on fixed income investments | Inflation can significantly reduce real returns on fixed income investments such as corporate or municipal bonds, treasuries, and CDs. |

| Effect on stocks | Inflation can negatively impact nominal returns on stocks. |

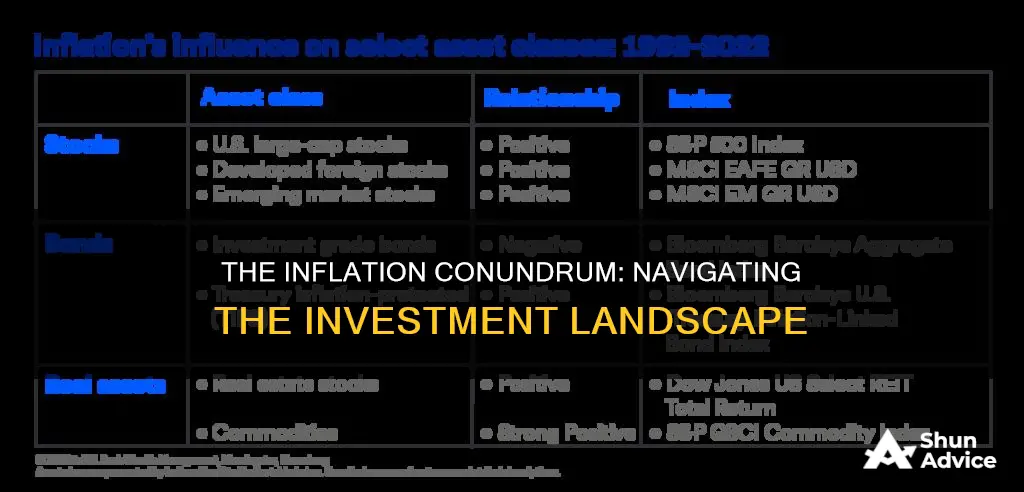

| Effect on real assets | Inflation has a positive relationship with real assets such as commodities and real estate. |

| Effect on interest rates | Inflation leads to higher interest rates, which can negatively impact fixed-income securities. |

| Effect on businesses | Inflation can make it difficult for businesses to sell products as prices change rapidly, affecting their ability to plan budgets. |

| Effect on wages | Inflation can lead to higher wages in the short term. |

| Effect on investments | Inflation impacts different investments differently; stocks, real assets, and commodities tend to perform better than cash or bonds during inflation. |

| Strategies to hedge against inflation | Diversification, investing in inflation-protected securities (e.g., TIPS), investing in high-quality companies selling essential goods and services, investing in safer government bonds. |

| Impact on economy | Inflation stimulates economic activity and drives growth in most sectors in the short term. |

| Measurement | Inflation is measured by the Consumer Price Index (CPI), which tracks the cost of goods such as food, fuel, and other services over time. |

| Normal range | The normal range of inflation in the US is 2-3%. |

| Recent trends | Inflation has been higher than normal recently, reaching a 40-year high of 9.1% in 2022 and remaining above average in 2023. |

What You'll Learn

How inflation affects stocks

Inflation can have a significant impact on stocks, and the relationship between the two is complex. While stocks can act as a hedge against inflation in the long run, the short-term dynamics are less favourable. Here's how inflation affects stocks:

Impact on Corporate Performance

Inflation increases the prices of raw materials, labour, and overhead, leading to higher input costs for companies. This, in turn, results in lower profit margins, which negatively impacts stock prices. Inflation also reduces consumers' purchasing power, decreasing the demand for goods and services sold by companies, which further lowers corporate revenue and net income.

Interest Rates and Borrowing

When inflation becomes acute and chronic, central banks typically intervene by raising interest rates, making borrowing more expensive. This reduces corporate willingness to take out loans, and they may face more costly debt services.

Investor Expectations

Inflation affects investor expectations, as the perceived present value of future cash flows from stocks decreases. Stock prices, especially in the short term, are largely influenced by these expectations. As a result, when investors perceive a lower present value of future cash flows, stock prices tend to drop.

Volatility

Stocks tend to be more volatile during periods of high inflation. This is because stock prices are based on investor expectations of a company's future earnings, and extreme inflation makes these predictions challenging.

Growth vs Value Stocks

Value stocks tend to outperform growth stocks during periods of high inflation. Value stocks are shares of mature companies with strong current cash flows that may diminish over time. During high inflation, investors prefer these stocks as they have a higher intrinsic value than their current trading price. On the other hand, growth stocks, which promise more distant returns, may suffer due to the impact of compounding the discount rate in the present value formula.

Real Returns

Inflation can lead to negative real returns on stocks. For example, if your stock portfolio has a return of 5% but the inflation rate is 6%, the real return is negative, indicating a loss in purchasing power.

In summary, while stocks can provide a hedge against inflation over the long run, the short-term impact of inflation on stocks is less favourable, with higher input costs, reduced consumer demand, increased borrowing costs, and negative investor sentiment affecting stock prices.

Strategic Retirement Planning: Navigating Wells Fargo's Investment Vehicle Options

You may want to see also

Inflation and savings

Inflation can have a detrimental effect on savings, eroding their value over time. This is especially true for savings with a fixed payout that may not keep up with rising prices. For example, if you need $45,000 per year to sustain your current lifestyle and the annual inflation rate is 3%, you will need around $109,000 to maintain that same purchasing power in 30 years.

Even savings accounts with average interest rates can be affected by inflation. While banks tend to pay higher interest rates during periods of high inflation, your savings may not grow fast enough to offset the loss in purchasing power. This is because banks will not raise their interest rates above inflation, so the real interest rate is always negative.

However, there are ways to protect your savings from the effects of inflation. One option is to invest in stocks, precious metals, or other commodities, which can potentially keep pace with or outperform inflation. For example, energy-related commodities like oil tend to have a strong relationship with inflation.

Another option is to invest in inflation-indexed securities such as Treasury Inflation-Protected Securities (TIPS). These investments are designed to protect against inflation risk by adjusting returns based on inflation rates. However, it is important to note that no investment is completely safe from inflation risk, and even these types of securities can lose value if inflation falls.

Additionally, diversifying your portfolio across different asset classes can help reduce the impact of inflation on your savings. By spreading your money across various types of investments, you can potentially reduce market risk and improve your chances of maintaining the real value of your wealth.

While it is impossible to completely avoid the effects of inflation, careful planning and a well-diversified investment strategy can help minimize its impact on your savings and long-term financial goals.

Cardano: Invest Now or Miss Out?

You may want to see also

Inflation-indexed investments

TIPS are sold for a term of 5, 10, or 30 years. Unlike other Treasury securities, where the principal is fixed, the principal of a TIPS can fluctuate over its term. When a TIPS matures, you get the increased (inflation-adjusted) price or the original principal, whichever is greater. You never get less than the original principal. The principal of a TIPS is adjusted using the Consumer Price Index (CPI) from the Bureau of Labor Statistics.

TIPS pay a fixed rate of interest every six months until maturity. The interest is paid on the adjusted principal, so the amount of the interest payment varies. For example, if you purchased $10,000 in TIPS in January that promised a 2% real return, and the inflation rate reaches 5% for the year, the principal of the bond would be increased to $10,500. At maturity, the bond would pay you interest equal to 2% of $10,500, or $210 in this case.

Pros of Inflation-Indexed Investments

- Fixed long-term yield: Inflation-indexed investments offer a fixed, long-term yield, providing stability for investors who are worried about the impact of inflation.

- Zero inflation risk: These investments have no inflation risk, meaning your investment is protected against rising prices.

- Returns are not linked to the market: The return on inflation-indexed investments is not correlated with the returns of the stock market, so they can provide a hedge against inflation and valuable diversification.

Cons of Inflation-Indexed Investments

- Less earning potential: Inflation-indexed investments have less earning potential than other securities, such as stocks, as they offer a fixed return.

- Uncertainty around inflation rate measures: Some experts warn that there is some uncertainty regarding how well inflation-indexed investments will protect your investment from price rises.

- Phantom income: In the U.S., phantom income is defined as unrealized gains on investments that are not subject to current taxes. With inflation-indexed investments, phantom income can occur when the CPI rises and the value of your investment increases.

Invest Now: Where to Put Your Money

You may want to see also

Real assets and inflation

Real assets, such as commodities, real estate, and infrastructure, tend to have a positive correlation with inflation. They are effective tools to combat inflation and are viewed as attractive additions to institutional portfolios. Here's how they work:

Commodities

Commodities, such as oil, natural gas, metals, and agricultural products, have historically been a reliable way to hedge against rising inflation. This is because inflation often leads to higher prices for raw materials. For example, during a period of inflation in the first half of 2022, crude oil prices jumped by 41%.

Investing in natural resource equities is generally preferred over commodity futures contracts. This is because it avoids the need to roll over futures contracts, which can hurt long-term performance, and it allows for investment in commodities with limited futures coverage, such as water and timber. Additionally, many natural resource companies pay dividends, providing an income generation that commodities futures typically do not offer.

However, investors should be cautious of the potential impact of inflationary pressures on the input costs for companies involved in the processing, transportation, or distribution of finished products. To mitigate this risk, investors can focus on the upstream portion of the natural resources supply chain, where companies are involved in the extraction of commodities before higher prices are passed on to downstream producers.

Real Estate

Real estate investments, both commercial and residential, can also offer benefits during inflationary periods. While some types of real estate stocks are sensitive to rising interest rates, the sector has historically paid higher dividend yields than other equity classes, providing an alternative source of income.

During inflation, the increasing cost of raw materials and supply chain bottlenecks can delay the completion of new residential real estate projects, leading to reduced supply and higher prices for existing properties. On the commercial side, businesses may seek to protect themselves from goods shortages by increasing inventories near major sales hubs, resulting in strong demand for warehouses and industrial real estate.

Infrastructure

Infrastructure securities, such as access to water and waste services, can be considered a longer-term defensive play during inflation. These assets tend to be highly stable and less sensitive to shifts in the broader economy. They often operate in pseudo-monopolistic environments with large barriers to entry and inelastic demand, allowing them to pass on increased costs to customers and maintain stable cash flows.

Infrastructure investments also offer significant income potential for investors. Over the past decade, a substantial portion of the total return of global real estate and infrastructure investments has come from dividend income.

However, it is important to note that changes in regulatory environments and government policies can impact the operating environment for infrastructure projects. Therefore, a globally diversified approach to infrastructure investing, covering various types of assets, can help mitigate this risk.

Combining Real Assets

While each of these real asset classes can effectively combat inflation on its own, combining them can be particularly powerful. This is because each asset class tends to perform well at different points in the economic cycle. By diversifying across natural resources, infrastructure, and real estate, investors can create a flexible and agile portfolio that is well-suited to their specific needs and provides both the potential for attractive returns and a hedge against inflation.

Starbucks: A Brew Worth Betting On

You may want to see also

Protecting investments against inflation

Inflation can have a detrimental effect on investments, but there are ways to protect your portfolio. Here are some strategies to help shield your investments against inflation:

Diversify Your Portfolio

Diversification is a key strategy to protect your investments. Spread your investments across different asset types, with a focus on inflation-resistant assets.

Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS) are a good option to protect against inflation. TIPS are government bonds that are indexed to inflation, meaning their value and interest rates adjust with the inflation rate. This makes them a safe investment that can balance out your portfolio.

Real Estate

Real estate investments, such as REITs, can be a good hedge against inflation. As inflation rises, property values and rental income tend to increase, helping to keep pace with inflation.

Stocks

Stocks can be a good long-term hedge against inflation, especially those with pricing power, which can raise prices to match rising costs. However, stocks can be volatile during inflationary periods, so a well-diversified portfolio is important.

Floating-Rate Bonds

Bonds with floating interest rates can be a good option, as their payouts rise with interest rates, which tend to increase during inflation.

Commodities

Commodities such as precious metals, oil, and agricultural products tend to increase in price with inflation, making them a potential hedge. However, they can be volatile and are subject to supply and demand fluctuations.

Short-Term Investments

During inflationary periods, consider focusing on short-term bonds, CDs, and cash holdings. These are less affected by rising interest rates and provide a safe haven for your money.

While there is no guaranteed way to protect your investments from inflation, these strategies can help mitigate the impact and potentially preserve the value of your portfolio.

Retirement Reinvented: Exploring Post-Retirement Investment Opportunities

You may want to see also

Frequently asked questions

Inflation is a rise in the average cost of goods and services over time. It erodes the purchasing power of money, meaning your money won't go as far. Inflation can negatively impact your investments by reducing their real value and returns.

Inflation can affect different types of investments in various ways. It's important to understand the relationship between inflation and different asset classes. Diversifying your portfolio across asset classes, such as stocks, bonds, real estate, and commodities, can help mitigate the impact of inflation.

Inflation can eat away at the returns of fixed-income investments, such as bonds, as the purchasing power of interest payments declines. It can also impact stocks, especially during periods of high inflation, as it becomes difficult to gauge future earnings. Inflation can devalue cash savings over time, especially if the interest earned doesn't keep up with the inflation rate.

Consider investing in assets that can act as inflation hedges, such as Treasury Inflation-Protected Securities (TIPS), commodities, real estate, and stocks of companies selling essential goods and services. Diversification is key to reducing market risk. Additionally, look for investments with returns that adjust for inflation changes, such as inflation-indexed bonds.