Pessimism about the future can have a significant impact on normal investment behaviour. By definition, pessimism is characterised by a negative outlook, a tendency to anticipate the worst, and a lack of hope or confidence in the future. This mindset can influence investment decisions and outcomes in various ways. From an individual investor's perspective, pessimism may lead to reduced risk tolerance, increased anxiety about market fluctuations, and a focus on short-term negative news, potentially resulting in imprudent investment choices. However, it is important to note that pessimism can also be healthy in moderation, serving as a counterbalance to excessive optimism. On a macroeconomic level, pessimism can drive households to save more and firms to hire less, leading to aggregate fluctuations in output, employment, and prices. Survey data reveals that investor expectations often deviate from rational predictions, with pessimism potentially playing a role in this divergence. Overall, understanding the impact of pessimism on investment is crucial for navigating market cycles and making informed decisions.

| Characteristics | Values |

|---|---|

| Investor expectations | Investors are just as likely to be optimistic as pessimistic. |

| Investor behaviour | Investors expect higher returns during boom times and lower returns during market contractions. |

| Investor psychology | Investors let their personal experiences play an oversized role in establishing risk tolerance and inflation expectations. |

| Investor decision-making | Pessimism can lead to imprudent investment decisions. |

| Investor outlook | A pessimistic outlook can lead to households saving more and firms hiring less. |

| Investor returns | Pessimism can detract from long-term returns. |

What You'll Learn

Investor pessimism can lead to reduced investment and increased savings

Investor pessimism can have a significant impact on investment decisions and savings behaviour. While it is natural for investors to experience pessimism and optimism in response to market conditions, it is important to understand how pessimism can influence their actions.

Firstly, investor pessimism can lead to reduced investment activity. When investors are pessimistic about the future, they may become risk-averse and less willing to allocate capital towards risky assets. This behaviour is driven by a fear of losses and a desire to preserve their current wealth. As a result, they may choose to hold off on investing or divert funds towards less risky investments, such as fixed-income securities or cash equivalents. In extreme cases, pessimism may trigger a flight to safety, causing investors to withdraw their money from the market and seek refuge in low-risk assets.

Secondly, investor pessimism can cause an increase in savings rates. Pessimistic investors tend to be more cautious and focus on building a financial cushion to prepare for potential downturns or adverse events. They may set aside a larger portion of their income into savings accounts, emergency funds, or conservative investment vehicles. This behaviour reflects a "save-like-a-pessimist" mindset, where individuals prioritize financial security and stability over risky investments. By saving more during pessimistic periods, investors aim to protect themselves from potential financial shocks and ensure they have sufficient resources to weather challenging economic conditions.

However, it is essential to balance pessimism with optimism when investing. While a healthy dose of pessimism can lead to prudent financial decisions, excessive pessimism can hinder investment opportunities and long-term growth. Investors should avoid letting their pessimism cloud their judgement entirely, as there are still opportunities for growth and profitability during pessimistic market conditions. It is crucial for investors to maintain a long-term perspective, stick to their financial plans, and make investment decisions based on thorough research and analysis rather than solely on their emotions.

Moreover, investor pessimism can have broader macroeconomic implications. When a significant portion of investors becomes pessimistic, it can lead to reduced demand, decreased investment in the stock market, and a slowdown in economic growth. This collective pessimism can influence firms' hiring decisions, investment strategies, and pricing policies, further impacting the overall economy. Therefore, investor sentiment and expectations play a crucial role in shaping economic outcomes.

In conclusion, investor pessimism can lead to reduced investment activity and increased savings rates. While pessimism can prompt prudent financial decisions, it is important for investors to maintain a balanced perspective and not let their pessimism deter them from potential investment opportunities. Striking a balance between pessimism and optimism is key to navigating the complexities of the investment landscape successfully.

People-Centric Investments: Key to Success

You may want to see also

Household pessimism can cause a decrease in current demand

This phenomenon is known as the "belief wedge", where households' forecasts for economic variables such as unemployment and inflation are biased upwards compared to statistical forecasts, especially during recessions. This pessimism can lead to a self-fulfilling prophecy, as these individual decisions collectively result in aggregate fluctuations in output, employment, and prices. For example, pessimistic households may reduce their current demand, causing firms to post fewer job vacancies, further increasing unemployment and dampening economic growth.

Additionally, household pessimism can influence firm behaviour. Firms may anticipate lower future productivity and higher marginal costs, reducing their incentive to lower prices despite lower demand from households. This can lead to a muted inflation response, with prices remaining relatively stable even during economic downturns.

The impact of household pessimism on the economy is particularly notable during periods of low GDP growth, such as during the dot-com boom and the Great Recession. During these times, an increase in pessimism was associated with a decrease in output and an increase in unemployment.

It is important to note that while household pessimism can influence economic outcomes, other factors also play a role. For instance, government policy choices, such as changes in government spending and taxes, can also impact aggregate demand and the overall economic landscape.

Investing: Why the Fear?

You may want to see also

Negative media coverage can fuel investor pessimism

Impact on Investor Confidence

Investor confidence is the bedrock of thriving economies. When investors are assured and optimistic, they are more likely to commit capital, driving growth and innovation. However, negative media coverage can easily disrupt this delicate balance. Reports of corporate scandals, economic downturns, or geopolitical tensions can create a pessimistic outlook, leading to reduced investment.

Amplifying Negative News

Media outlets can amplify market trends by repeatedly covering certain stories, creating a feedback loop where initial market reactions are intensified by continuous media attention. During the 1987 stock market crash, for instance, media outlets focused on reporting the most extreme stories of financial ruin, intensifying investor fear and contributing to a deeper market decline.

Emotional Responses and Panic Selling

Media coverage can evoke emotional responses from investors, leading to panic selling and irrational decision-making. For example, news of a significant negative event like a terrorist attack or a natural disaster may trigger investors to sell their securities, causing a sharp decline in prices.

Confirmation Bias

Media coverage can also reinforce investors' preconceived notions and biases, leading them to ignore contradictory information. If an investor believes a particular asset is overvalued, they may only pay attention to negative news, disregarding any positive developments.

The Bandwagon Effect

Media can create a bandwagon effect, causing investors to blindly follow a trend without conducting proper due diligence. For instance, if the media portrays a stock as the next big thing, investors may flock to buy it without analyzing its long-term growth prospects.

Adverse Media Screening

Adverse media screening, which involves monitoring news sources and social media for negative information, is a proactive approach used by investors and financial institutions to identify potential risks and red flags that could impact investment decisions. It helps in early risk detection, informed decision-making, and reputation management for financial institutions.

Tips for Investors

- Diversify sources: Seek information from various reputable sources to gain a balanced perspective.

- Avoid emotional decision-making: Refrain from letting sensational headlines dictate investment choices.

- Focus on long-term trends: Understand that market downturns are often temporary, and a long-term perspective can help mitigate the impact of short-term volatility.

- Consult professionals: Seek advice from financial advisors or experienced investors for guidance.

Uncovering Lost Retirement Investments: A Comprehensive Guide to Locating Your Funds

You may want to see also

Pessimism can cause investors to miss out on high returns

Pessimism about the future can lead to a self-fulfilling prophecy of poor investment outcomes. This is because pessimistic expectations can influence investor behaviour in ways that negatively impact their investment returns.

Firstly, a pessimistic outlook can cause households to save more and firms to hire less, leading to aggregate fluctuations in output, employment and prices. For example, firms may post fewer job vacancies and reduce current demand, which can lead to an economic contraction.

Secondly, pessimism can cause investors to be overly risk-averse, leading them to hold onto losing investments in the hope of recovering losses, or to miss out on valuable investment opportunities. This can result in suboptimal portfolio performance and a failure to reallocate funds to more profitable ventures.

Thirdly, pessimism can lead to confirmation bias, where investors seek out and favour information that confirms their pessimistic outlook. This can cause them to ignore or downplay contradictory information, potentially blinding them to the full spectrum of risks and rewards, and leading to ill-informed investment decisions.

Finally, pessimism can cause investors to act irrationally, such as by selling during market downturns and buying during booms, which can result in buying high and selling low – the opposite of what investors should be doing to maximise returns.

In summary, while a healthy dose of pessimism can be beneficial for investors, excessive pessimism can lead to missed opportunities and suboptimal investment returns. Therefore, it is important for investors to be aware of their biases and strive for a balanced and informed approach to investing.

Smart Ways to Invest $2,500 Today

You may want to see also

Optimism and pessimism fluctuate with market performance

Optimism and pessimism are two opposing outlooks that investors may hold, and these outlooks can indeed fluctuate with market performance. While optimism is characterised by hopefulness and confidence in a positive outcome, pessimism tends to focus on the negative aspects and anticipates the worst.

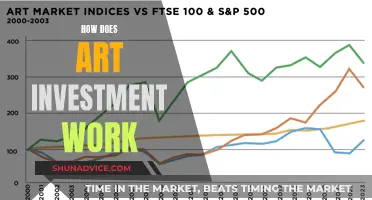

Research suggests that investors' expectations often deviate from the rational expectations set by financial models. This deviation can be attributed to investors' personal experiences and risk tolerance, which shape their expectations of market returns. During boom times in the stock market, investors may exhibit excessive optimism, while periods following crashes can lead to heightened pessimism.

The level of optimism or pessimism can impact investment decisions. Optimism about the future, backed by historical data showing overall progress, can help investors remain invested during market downturns. On the other hand, pessimism may cause investors to be overly cautious and miss out on potential gains. For example, if an investor had missed the top trading days of a year due to pessimism, their returns would be significantly lower than if they had remained invested throughout.

However, it is important to note that a healthy dose of pessimism or caution can be beneficial. A pessimistic outlook may prompt investors to re-evaluate their portfolio and make more balanced decisions. Additionally, independent and balanced thinking is crucial to avoiding the echo chambers of negative news that can influence investment decisions.

In conclusion, investors' optimism and pessimism tend to fluctuate with market performance, and finding a balance between these outlooks is essential for making prudent investment choices. While optimism can fuel long-term investments, a measured degree of pessimism can help manage risks and ensure a more robust investment strategy.

Maximizing Social Security Retirement Benefits: Strategic Investment Avenues

You may want to see also

Frequently asked questions

Pessimism can lead to reduced investment and increased saving. This can cause a decrease in output and an increase in unemployment.

The relationship between pessimism and optimism in investors is complex and dynamic. While some investors may lean towards pessimism or optimism, it is important to maintain a balanced outlook and make investment decisions based on a comprehensive analysis of market trends and financial goals.

Pessimism can have significant effects on the aggregate economy, particularly the labour market. Household pessimism can lead to reduced demand and decreased spending, which in turn can result in firms hiring fewer employees and posting fewer job vacancies.