The principal of an investment is the original sum of money that is placed into an investment. It is the foundation for calculating the returns on an investment. The principal is the initial amount invested, separate from any earnings or interest accrued. For example, if you invest $5,000 into a high-interest savings account and, over the course of 10 years, the account balance grows to $7,000, the $5,000 you initially deposited is the principal amount, and the additional $2,000 is the interest earned from that principal.

| Characteristics | Values |

|---|---|

| Definition | The original sum of money borrowed or placed into an investment |

| Basis for | Calculating returns, interest, and fees |

| Types | Initial Principal, Outstanding Principal |

| Calculation | ROI = (Final Investment Value - Initial Principal) / (Initial Principal) x 100 |

What You'll Learn

The original sum of money

For example, if you take out a car loan of $20,000, your principal is $20,000. As you make payments on the loan, a portion of each payment goes towards reducing the principal, while the rest is applied towards the interest on the loan. Over time, your outstanding principal decreases, and you pay interest on this new, lower amount.

In the context of investing, the principal is the original amount of money put into an investment account. This includes the initial deposit used to open the account, as well as any additional money deposited subsequently. For instance, if you open an investment account with $1,000, and it grows to $3,500 over 10 years, the principal remains $1,000, while the remaining $2,500 is considered your earnings or return.

The principal is crucial for understanding your costs and potential financial returns, whether you are taking out a loan or investing. It is the basis for calculating returns, interest, and fees.

Dividend ETFs: Smart Investment for Young People?

You may want to see also

The face value of a bond

Most bonds are issued in $1,000 denominations, so typically, the face value of a bond is $1,000. However, you might also see bonds with face values of $100, $5,000, or $10,000. The face value of a bond is fixed and does not change, even if the price you pay for the bond is different.

For example, if a bond has a face value of $1,000, the holder of the bond will receive $1,000 when it matures at the end of its term. The price of a bond can fluctuate in the market due to changes in interest rates, but the face value remains the same.

Bonds are considered safer investments than equity investments (stocks). However, as with any investment, there are risks involved. Bond investors need to consider the risk of the issuing government or corporation going bankrupt and defaulting on its loan obligations, as well as the risk of interest rate changes lowering the value of the bond.

Oil: Invest Now for Future Gains

You may want to see also

The owner of a private company

As the owner of a private company, you are considered the principal. Principals are responsible for understanding the costs and potential financial returns of their investments.

The principal is the original sum of money that is borrowed in a loan or placed into an investment. It is the foundation for calculating interest on a loan or the returns on an investment.

For example, if you invest $5,000 into a high-interest savings account and over the course of 10 years, the account balance grows to $7,000, In this case, the $5,000 you initially deposited is the principal amount, and the additional $2,000 is the interest earned from that principal.

The principal of a loan can refer to the original value of the loan or the amount you still owe. For example, if you take out a $100,000 mortgage loan, the principal is $100,000. If you pay off $60,000 of that mortgage, the remaining $40,000 is also referred to as the principal.

The initial principal of a loan determines the amount of interest paid. A higher principal will result in higher interest payments over the life of the loan, assuming the interest rate and loan term remain constant.

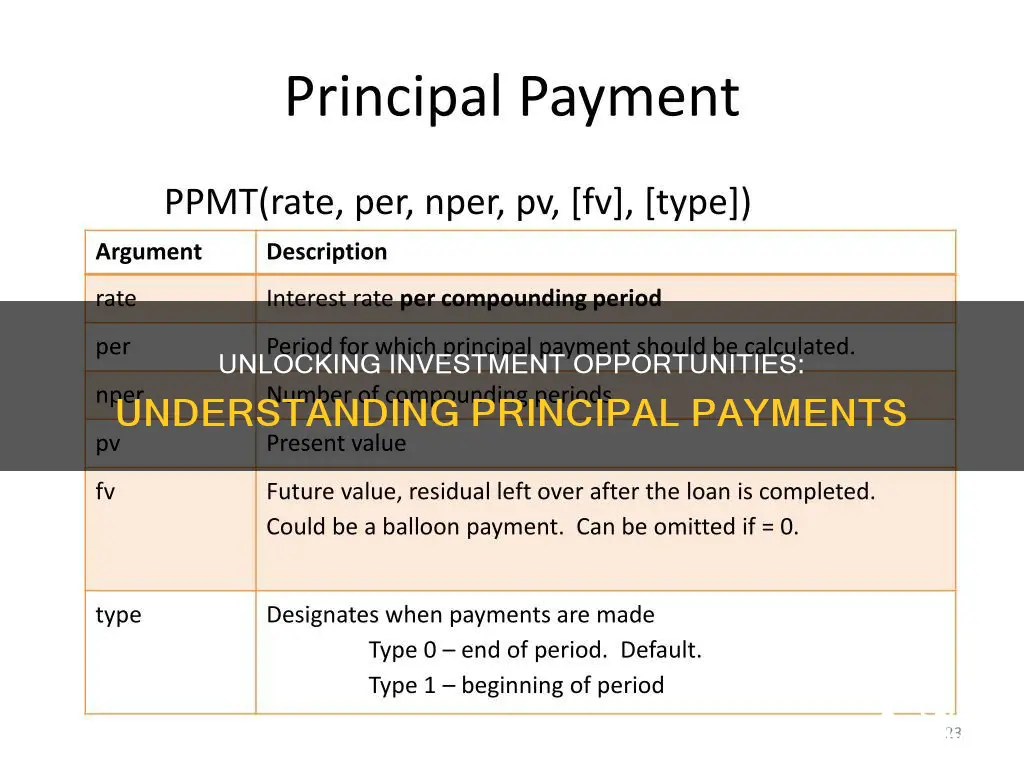

A typical loan payment consists of two parts: the principal amount and the interest on the loan. The only way to reduce the loan is by making principal payments. The bank will first deduct the interest amount, and then the rest of the payment will go towards the principal loan amount. By reducing the loan amount, the interest will decrease.

It's important to note that interest is calculated as a percentage of the principal amount when it's compounded or simple. Simple interest is calculated only on the original principal, while compound interest is calculated on the principal and any accumulated interest.

Understanding the concept of the principal is crucial for determining how interest accrues for loans and investments, as well as for assessing the financial health of your company.

Sports Fandom: Why the Obsession?

You may want to see also

The party that can transact

The principal is the party that can transact on behalf of an organisation or account and takes on the attendant risk. The principal can be an individual, a corporation, a partnership, a government agency, or a nonprofit organisation. Principals may elect to appoint agents to operate on their behalf.

A principal could be involved in transactions ranging from a corporate acquisition to a mortgage. The principals are usually listed in the transaction's legal documents. They include everyone who signed the agreement and therefore has rights, duties, and obligations for the transaction.

An individual who hires a financial advisor is considered to be a principal. The advisor is the agent. The agent follows the instructions given by the principal and may act on their behalf under specified conditions and terms. The advisor is often bound by a fiduciary duty to act in the principal's best interests. The principal is at risk for any action or inaction on the agent's part. The principal takes the loss if the agent makes a bad investment.

A problem with the principal/agent relationship can arise when there is a conflict in priorities between a person or group and the representative authorised to act on their behalf. An agent may act contrary to the principal's best interests. This can occur in many situations, from the relationship between a client and a lawyer to the relationship between stockholders and a CEO.

Smart Ways to Invest $10,000

You may want to see also

The initial capital amount

For example, if you take out a $20,000 car loan, your outstanding principal may be reduced to $16,000 after a year of making payments. The interest for future payments is then calculated based on this new outstanding principal. Understanding the principal amount is essential for determining whether a loan is within your budget, as a higher principal will result in higher interest payments over the loan's life, assuming a constant interest rate and loan term.

In the context of investing, the principal is the initial amount of money you put into an investment account or fund, with the goal of making a profit. This initial capital amount serves as the foundation for any returns on your investment. For example, if you invest $5,000 in a high-interest savings account, and it grows to $7,765 over ten years, the principal remains the original $5,000, and the additional $2,765 is attributed to earnings or interest.

The principal of a bond is the amount the issuer agrees to pay back to the investor when the bond matures and is also known as the par value or face value. For instance, if you have a $10,000 bond with $50 in semi-annual coupon payments, the principal remains $10,000, excluding the $1,000 in coupon payments made over the bond's life.

The principal amount is crucial in understanding your financial costs and returns, whether it is related to taking out a loan or making an investment.

HSA Investors: Who and How Many?

You may want to see also

Frequently asked questions

The principal is the original sum of money that is borrowed from a lender or the initial amount invested.

Paying the principal can decrease the outstanding principal amount, saving you money in interest payments. It can also reduce the time required to pay off the loan, build equity in the investment or property, and improve your credit score.

The formula for calculating the principal amount (P) when there is simple interest is: P = I x 100 x (future value / present value).

Yes, you can pay off the principal amount before interest. This will decrease the amount of money required to pay off the loan.

The principal of a loan can be paid off by making regular payments towards the principal amount.