When interest rates fall, borrowing costs for businesses decrease, making it cheaper for them to finance their investment projects. This can encourage businesses to increase their planned investment spending on projects such as expansions, new machinery, or research and development. However, it's important to note that other factors, such as government regulations and business optimism, can also influence planned investment spending.

| Characteristics | Values |

|---|---|

| Interest rates fall | Borrowing costs for businesses decrease |

| It becomes cheaper for businesses to finance their investment projects | |

| Planned investment spending increases | |

| Interest rates rise | Borrowing costs for businesses increase |

| It becomes more expensive for businesses to finance their investment projects | |

| Planned investment spending decreases |

What You'll Learn

- Borrowing costs for businesses decrease, making it cheaper for them to finance their investment projects

- The Federal Reserve is responsible for setting the interest rates, which will have an impact on businesses' borrowing costs and, consequently, their investment spending

- The Fed can influence economic activity by adjusting interest rates, which affects both consumption and investment spending

- EPA regulations requiring upgrades or replacements of machinery to reduce emissions will likely lead to an increase in planned investment spending as companies invest in compliance

- Higher interest rates resulting from retiring baby boomers and decreased savings can lead to a decrease in planned investment spending as businesses face higher borrowing costs

Borrowing costs for businesses decrease, making it cheaper for them to finance their investment projects

When interest rates fall, borrowing costs for businesses decrease, making it cheaper for them to finance their investment projects. This is because when interest rates are low, the cost of funds is very low. As a result, businesses are encouraged to increase their planned investment spending.

The Federal Reserve is responsible for setting the interest rates, which will have an impact on businesses' borrowing costs and, consequently, their investment spending. When the Fed lowers interest rates as part of its policy strategy, it makes borrowing cheaper, potentially boosting investment by businesses. This is because reduced interest rates lower the cost of taking loans for expenses like expansion or new technology.

Businesses may also be encouraged to increase their planned investment spending on projects such as expansions, new machinery, or research and development. This is because lower interest rates make borrowing cheaper for businesses.

However, it is important to note that the relationship between interest rates and investment spending is not always straightforward. For example, if firms become more optimistic about the profitability of investment and planned investment spending rises, while consumers become more pessimistic and autonomous consumer spending falls, the impact on aggregate output may be mixed.

Argentina's Interest Rates: A Guide to Investing Wisely

You may want to see also

The Federal Reserve is responsible for setting the interest rates, which will have an impact on businesses' borrowing costs and, consequently, their investment spending

The Federal Reserve is responsible for setting interest rates, which will have an impact on businesses' borrowing costs and, consequently, their investment spending. When interest rates fall, borrowing costs for businesses decrease, making it cheaper for them to finance their investment projects. This can encourage businesses to increase their planned investment spending on projects such as expansions, new machinery, or research and development.

One of the main ways the Fed influences the economy is by setting the federal funds rate, the interest rate at which banks lend to each other overnight. Changes to this rate affect other interest rates, including those for loans and mortgages. When the Fed lowers interest rates as a part of its policy strategy, it makes borrowing cheaper, potentially boosting investment by businesses. This is because reduced interest rates lower the cost of taking loans for expenses like expansion or new technology.

However, it is important to note that the relationship between interest rates and investment spending is not always linear. As the real interest rate rises, the return on planned investments may exceed the cost of funds, leading to an increase in planned investment spending. On the other hand, if firms become more optimistic about the profitability of investment and increase their planned investment spending, it can have a positive impact on aggregate output.

Understanding Investment Interest Expense: What Investors Need to Know

You may want to see also

The Fed can influence economic activity by adjusting interest rates, which affects both consumption and investment spending

The Federal Reserve is responsible for setting interest rates, which impacts businesses' borrowing costs and, consequently, their investment spending. For example, when interest rates fall, businesses can borrow more money at a lower cost, making it cheaper for them to finance their investment projects. This can include projects such as expansions, new machinery, or research and development.

In addition to interest rates, other factors can also influence planned investment spending. For instance, the U.S. Environmental Protection Agency (EPA) may enforce regulations that require corporations to upgrade or replace their machinery to reduce emissions. Compliance with these regulations can lead to an increase in planned investment spending as companies invest in new equipment or upgrades.

Understanding Investment Interest: Compounding Effects Explained

You may want to see also

EPA regulations requiring upgrades or replacements of machinery to reduce emissions will likely lead to an increase in planned investment spending as companies invest in compliance

When interest rates fall, borrowing costs for businesses decrease, making it cheaper for them to finance their investment projects. This encourages businesses to increase their planned investment spending on projects such as expansions, new machinery, or research and development.

On the other hand, EPA regulations requiring upgrades or replacements of machinery to reduce emissions will likely lead to an increase in planned investment spending as companies invest in compliance. The U.S. Environmental Protection Agency (EPA) is a federal agency tasked with protecting human health and the environment. To fulfill its mission, the EPA enacts regulations that can have significant effects on corporate behaviour and investment. For instance, regulations requiring the reduction of emissions, such as sulfur dioxide, compel corporations to make necessary adjustments to their machinery and processes. Such regulatory requirements typically involve significant capital expenditure. Businesses need to invest in advanced machinery or retrofit existing systems to reduce harmful emissions. This creates a demand for innovation and adaptation, often leading to an increase in planned investment spending.

The EPA's decree essentially requires companies to invest in new equipment or upgrade their current machinery to be in compliance with the new regulations. As corporations are required to make investments to comply with the EPA regulations, we can expect an increase in planned investment spending due to this event.

Interest Rates: Saving vs Investing

You may want to see also

Higher interest rates resulting from retiring baby boomers and decreased savings can lead to a decrease in planned investment spending as businesses face higher borrowing costs

On the other hand, when interest rates fall, borrowing costs for businesses decrease, making it cheaper for them to finance their investment projects. This can encourage businesses to increase their planned investment spending on projects such as expansions, new machinery, or research and development. For example, if interest rates fall due to Federal Reserve policy, it can lower borrowing costs for businesses, encouraging them to increase their planned investment spending.

The Federal Reserve's actions can also influence other interest rates, including those for loans and mortgages. This, in turn, can affect both consumption and investment spending. When the Federal Reserve lowers interest rates, it makes borrowing cheaper, potentially boosting investment by businesses.

Additionally, other factors can also influence planned investment spending. For instance, regulations requiring upgrades or replacements of machinery to reduce emissions will likely lead to an increase in planned investment spending as companies invest in compliance.

Investments: Do They Earn Interest?

You may want to see also

Frequently asked questions

A fall in interest rates makes borrowing cheaper for businesses, which encourages them to increase their planned investment spending.

The Federal Reserve is responsible for setting interest rates, which impacts businesses' borrowing costs and, consequently, their investment spending.

EPA regulations requiring upgrades or replacements of machinery to reduce emissions will likely lead to an increase in planned investment spending as companies invest in compliance.

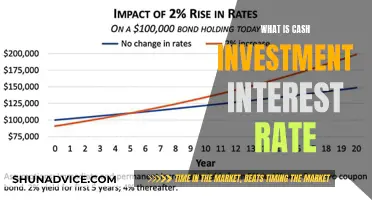

As the real interest rate rises, the return on more and more planned investments will exceed the cost of funds, leading to an increase in planned investment spending.