When it comes to retirement investments, the general rule is to shift towards more conservative investments, as you will no longer have an active income to replace any losses. However, it is important to find a balance, as you will need this money for several decades.

It is recommended to have a financial plan in place that takes into account your life expectancy, lifestyle, and spending needs. As you age, you should adjust your asset allocation accordingly, moving from aggressive to conservative strategies.

1. Set clear goals: Determine how much money you will need to maintain your desired lifestyle during retirement, taking into account factors such as travel plans, healthcare expenses, and leisure activities.

2. Diversify your portfolio: Include a mix of stocks, bonds, and cash investments to balance growth potential and risk management.

3. Manage risk: As you get closer to retirement, shift your assets towards more conservative options to protect against short-term risks.

4. Plan for growth: Even in retirement, a portion of your portfolio should focus on growth to keep up with inflation and taxes.

5. Seek professional advice: Consider consulting a financial advisor to create a personalised plan that aligns with your retirement goals and risk tolerance.

By following these guidelines and adapting his investment strategy over time, Ragnar can work towards a comfortable retirement that meets his financial needs.

| Characteristics | Values |

|---|---|

| Life expectancy | Plan for at least 30 years' worth of money after retirement |

| Lifestyle | More money needed for travel and adventures than for a more sedentary retirement |

| Health | More money needed for healthcare expenses |

| Risk tolerance | Higher-risk investments when younger, lower-risk when older |

| Growth | Focus on growth investments when younger, then shift to income and capital preservation |

| Diversification | Diversification can help maintain more stable and reliable investment returns |

| Active vs. passive portfolio management | Active management results in higher investment returns but higher transaction fees |

| Savings | Save 15% of annual income, including any workplace plan company match |

| Tax | Withdrawals from Roth IRA and Roth 401(k) accounts are tax-free in retirement |

| Stocks | An important part of a retirement portfolio regardless of age |

| Bonds | Consider adding a meaningful allocation to bonds in your 50s |

| Social Security | Social Security can be factored in to justify owning a larger portion of assets in stocks |

What You'll Learn

Conservative investments

Once you retire and no longer have an active income, it is generally recommended to shift towards more conservative investments to protect your retirement money. This means adopting a more conservative investment strategy to reduce the risk of loss.

- Certificates of Deposit (CDs): CDs are low-risk, low-return products offered by banks. You deposit money with the bank and agree not to withdraw it for a minimum period. In return, the bank pays you a higher interest rate than normal. CDs are considered safer than simply holding your money in cash, as they typically pay interest rates that keep your money consistent with inflation.

- Money Market Accounts: These accounts may feel like standard savings accounts, but they often require a higher minimum deposit and offer higher interest rates. They also usually come with a debit card and are protected by the FDIC up to $250,000 per depositor per bank.

- Bonds: Bonds are corporate or municipal government debt notes. They provide a return based on the interest payments made by the borrowing entity. Most bonds tend to be relatively secure investment products, as large institutions generally pay their debts. Bonds give you a better return than CDs but retain some element of risk.

- Treasury Bills, Notes, and Bonds: These are highly liquid securities issued by the US Treasury. Treasury bills mature in one year or less, while notes stretch up to 10 years and bonds mature up to 30 years. They are considered highly secure investments.

- Treasury Inflation-Protected Securities (TIPS): TIPS are a type of bond that increases in par value when inflation increases. They are low-risk assets that can be advantageous in an inflationary environment.

- High-Yield Savings Accounts: While not technically an investment, savings accounts offer a modest and safe return on your money. Accounts are typically government-insured up to $250,000 per account type per bank.

Renaissance Investment: Is It Worth the Risk?

You may want to see also

Growth-oriented positions

When it comes to growth-oriented positions, there are a few key strategies that Ragnar should consider. Firstly, focusing on growth investments as a young investor and then gradually shifting towards income and capital preservation as retirement approaches is a common strategy. This means prioritising stocks, which have historically posted the best returns over time compared to other asset classes. While stocks are more volatile, younger investors like Ragnar have more time to recover from market downturns and take advantage of long-term growth potential.

As Ragnar gets closer to retirement, he should consider reducing his exposure to stocks and increasing his allocation of bonds and cash. This will help him mitigate risk while still allowing for some growth potential. By the time he enters retirement, Ragnar should shift his assets towards more conservative investments, such as certificates of deposit and bonds, which offer lower returns but also carry less risk.

- Age 65-70: 50%-60% of the portfolio in growth assets.

- Age 70-75: 40%-50% of the portfolio in growth assets, with a focus on funds rather than individual stocks to mitigate risk.

- Age 75+: 30%-40% of the portfolio in growth assets, with a preference for funds over individual stocks.

It is important to note that these allocations can be adjusted based on Ragnar's personal needs, spending habits, and risk tolerance. For example, if Ragnar plans to travel and have a more active lifestyle during retirement, he may need a higher allocation of growth assets to generate more income. On the other hand, if he anticipates higher healthcare expenses or a more conservative lifestyle, he may opt for a lower allocation of growth assets.

Additionally, Ragnar should consider taking advantage of tax-efficient investment vehicles, such as Roth IRAs or 401(k)s, which can provide tax benefits and help maximise his returns. Seeking advice from a financial advisor can also help Ragnar create a personalised plan that takes into account his specific retirement goals and risk tolerance.

TFSA Dividend-Paying Investments: Maximizing Tax-Free Returns

You may want to see also

Risk tolerance

An investor's risk tolerance is classified as aggressive, moderate, or conservative. An aggressive investor has a higher risk tolerance and is willing to risk more money for potentially better, yet unknown, returns. Their investments emphasize capital appreciation rather than income or preserving their principal investment. This investor's asset allocation commonly includes stocks and little to no allocation to bonds or cash. A conservative investor, on the other hand, has a lower risk tolerance and seeks investments with guaranteed returns. They are willing to accept little to no volatility in their investment portfolios and target vehicles that are guaranteed and highly liquid, such as bank certificates of deposit (CDs), money markets, or U.S. Treasuries. A moderate investor wants to grow their money without losing too much and develops a portfolio that includes a mixture of stocks and bonds.

An investor's risk tolerance changes throughout their lifetime. When an individual is younger, they can take on more risk as they have more time to replace any losses. As they get older and closer to retirement, their risk tolerance often changes, and they may need to focus less on growth and more on capital preservation and income. Therefore, it is important to rebalance an investment portfolio as an individual ages and their investment goals, risk tolerance, and time horizon change.

When determining risk tolerance, it is essential to consider investment objectives, time horizon, and reaction to potential losses. It is also crucial to understand the difference between risk tolerance and risk capacity. While risk tolerance refers to an investor's willingness to take risks, risk capacity measures their financial ability to do so. These two components should be aligned when making investment decisions.

American Airlines: Invest or Avoid?

You may want to see also

Retirement age

- Shift to more conservative investments: As you enter retirement, it is advisable to move your assets towards more conservative options such as certificates of deposit, bonds, and cash-like products. These investments are typically lower-risk and can help protect your savings.

- Maintain some growth-oriented positions: While conservatism is important, you should not completely abandon growth-oriented positions. Retirement can last for decades, and you need your portfolio to continue generating returns. Stocks, mutual funds, and exchange-traded funds (ETFs) can provide growth potential to help keep up with inflation and taxes.

- Consider your risk tolerance: Risk tolerance is an individual preference. As you age, your tolerance for risk may decrease, and you may want to reduce your exposure to volatile investments. However, if you have a higher risk tolerance, you may want to maintain a larger portion of your portfolio in stocks or other higher-expected-return assets.

- Review and adjust your portfolio: It is important to regularly review and adjust your portfolio as you age. This may include rebalancing your asset allocation to maintain your target allocation and making adjustments based on market conditions and your financial goals.

- Seek professional advice: Consider consulting a financial advisor or planner to help create a personalized retirement plan that takes into account your risk tolerance, financial goals, and spending needs. They can assist in determining the appropriate mix of investments for your portfolio.

- Plan for the long term: Retirement can span decades, so it is crucial to plan for the long term. This includes considering your life expectancy, lifestyle choices, and potential healthcare expenses. Ensure you have sufficient funds to cover your expenses and maintain your desired standard of living throughout your retirement.

Remember, the specific allocation of your investments will depend on various factors, including your age, risk tolerance, financial goals, and market conditions. It is important to stay informed, be adaptable, and make adjustments as necessary to ensure a comfortable retirement.

Smart Investment Vehicle Choices

You may want to see also

Asset allocation

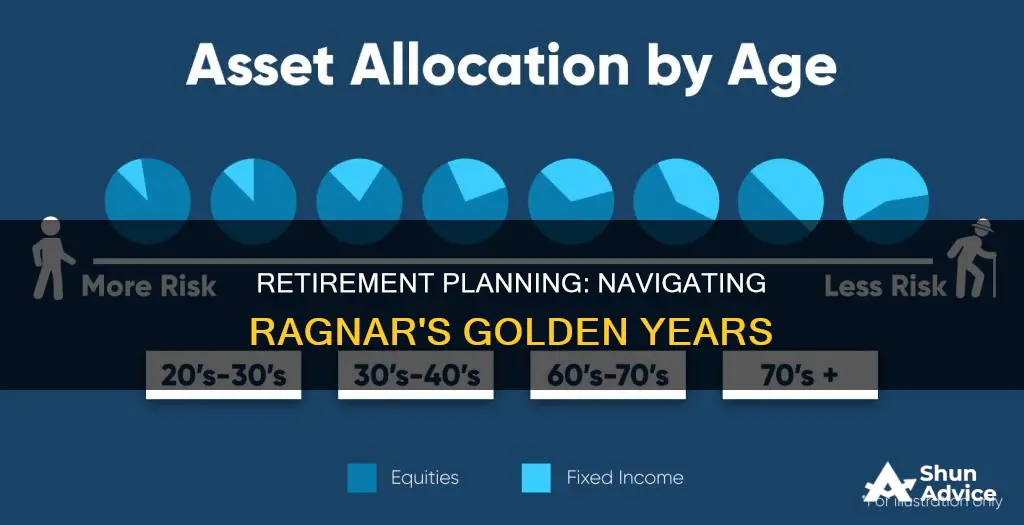

- Time Horizon and Risk Tolerance: The first step in determining your asset allocation is understanding your time horizon, which is the number of years until retirement. Generally, younger investors with a longer time horizon can tolerate more risk and focus on growth investments like stocks. As you approach retirement age, it's advisable to shift towards more conservative investments like bonds and cash to preserve capital.

- Diversification: Diversification is a key tenet of investing, and it's important to spread your investments across different asset classes, sectors, and geographic regions. Diversification helps to reduce the overall risk of your portfolio and smoothen out returns. Consider a mix of stocks, bonds, real estate, and alternative investments like precious metals or commodities.

- Risk Tolerance: Everyone has a different appetite for risk. As a rule of thumb, if you're risk-averse, you may want to allocate a larger portion of your portfolio to conservative investments like bonds and cash. On the other hand, if you're comfortable with higher risk, you can allocate more to stocks and other volatile assets.

- Income Needs: Your asset allocation should also consider your income needs during retirement. If you plan to rely solely on your retirement savings, you may need a larger allocation of growth-oriented investments to generate higher returns. However, if you have additional income sources like rental properties or Social Security, you may be able to take on less risk.

- Inflation and Taxes: Inflation can erode the purchasing power of your savings over time. Include assets that have the potential to outperform inflation, such as stocks, real estate, or Treasury Inflation-Protected Securities (TIPS). Additionally, consider the tax implications of your investments and opt for tax-efficient vehicles like Roth IRAs or tax-efficient index funds.

- Rebalancing: Periodically review and rebalance your portfolio to maintain your desired asset allocation. Over time, different investments will perform differently, causing your allocation to shift. By rebalancing, you buy and sell assets to return your portfolio to its intended allocation.

Here's an example of how Ragnar's asset allocation might change over time:

- In their 20s and 30s: Focus on growth potential with a higher allocation to stocks (60-75%) and a smaller portion in bonds and cash (25-40%).

- In their 40s and 50s: Start transitioning towards more conservative investments. Increase bond allocation to 10-30% and consider adding Treasury securities or certificates of deposit (CDs). Maintain a healthy exposure to stocks (50-60%) for continued growth.

- In their 60s and beyond: As Ragnar enters retirement, further reduce risk by allocating 40-50% to stocks and increasing bonds and cash to 30-40% each. Emphasize capital preservation and income generation.

Remember, these are general guidelines, and Ragnar should tailor his asset allocation based on his unique circumstances, risk tolerance, and retirement goals. Consulting a financial advisor can help him create a personalized plan that considers all aspects of his financial situation.

Collective Investment Trusts: Unraveling the Dividend Distribution Mystery

You may want to see also

Frequently asked questions

Ragnar should consider his age and risk appetite when balancing risk and reward. Generally, younger investors can tolerate more risk, as they have more time to recover from market downturns, while older investors should adopt a more conservative approach to preserve their capital. Ragnar should also assess his risk tolerance, which is specific to each individual.

Ragnar should aim for a mix of stocks, bonds, and cash investments that align with his goals and risk tolerance. Stocks provide growth potential, while bonds and cash offer income and capital preservation. The specific allocation will depend on Ragnar's age, income needs, financial goals, time horizon, and comfort with risk.

Ragnar should regularly review and adjust his investment portfolio as his circumstances change. As he ages, he may need to shift more assets towards conservative investments, such as bonds and cash, to reduce risk. Additionally, he should consider rebalancing his portfolio at least once a year to maintain his target allocation.