Investing during a recession can be a daunting task, but there are several strategies that can help you navigate through it. Firstly, it is important to assess your financial situation and ensure you have sufficient emergency savings. If you have extra money to invest, consider investing in defensive stocks within non-cyclical sectors such as healthcare, utilities, and consumer staples. These sectors tend to be less vulnerable to economic downturns as people still need essential services and goods.

Another strategy is to focus on reliable dividend stocks. Look for companies with low debt-to-equity ratios and strong balance sheets. You can also consider investing in real estate, precious metals, or even yourself by gaining new skills or paying down debt.

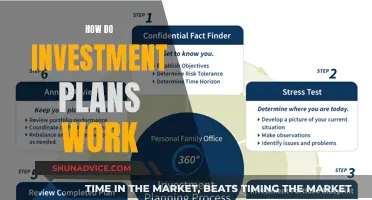

Remember, investing during a recession requires caution, and it is always recommended to consult a financial advisor to help you build a personalised plan that suits your risk tolerance and financial goals.

| Characteristics | Values |

|---|---|

| Stocks | Healthcare, utilities, consumer goods, consumer staples, defensive stocks, large-cap stocks, dividend stocks, Walmart, Abbott Laboratories, Synopsys Inc., T-Mobile US Inc., NextEra Energy Inc. |

| Funds | Exchange-traded funds, low-cost index funds, dividend ETFs |

| Bonds | Investment-grade bonds |

| Other | Precious metals, real estate, education |

What You'll Learn

- Defensive stocks, such as consumer staples, utilities, and healthcare

- Dividend-paying stocks, especially those with a long track record of payments

- Real estate investments, which can provide a steady income stream during a recession

- Precious metals, like gold and silver, which tend to perform well during market slowdowns

- Your own skills and knowledge, which can help you get a better job

Defensive stocks, such as consumer staples, utilities, and healthcare

Defensive stocks are stocks that tend to provide stable earnings and consistent returns, even during an economic downturn. They are considered more recession-proof than cyclical stocks, which are more prone to changes based on consumer demand and systemic shifts in the economy. Defensive stocks are nearly always in demand because they provide essential products and services.

The three main defensive sectors are utilities, consumer staples, and healthcare.

Utilities

Water, gas, and electric utilities are needed regardless of the phase of the business cycle. Even in a recession, consumer spending on utilities is less likely to drop, so the value of stocks in this sector remains relatively stable. Renewable energy sources like solar panels and wind turbines are also included in this sector.

Consumer Staples

Companies in the consumer staples sector produce everyday products that people continue to buy even during recessions. This includes food, beverages, tobacco products, personal and hygiene products, and non-durable household goods. People are unlikely or unable to cut these items from their budgets, regardless of their financial situation. As a result, stocks in consumer staples tend to hold steady when people reduce their spending during a recession.

Healthcare

The healthcare sector includes businesses that provide medical services and insurance, manufacture medical equipment or drugs, and manage patient healthcare in hospitals, clinics, labs, and nursing homes. Healthcare is considered a necessity, and medicine and medical equipment are always in demand, making this sector a strong defensive investment opportunity.

Defensive stocks offer stable and consistent earnings and dividends, making them a less risky investment option. They are a good choice for investors who want to protect their portfolios during economic downturns or periods of high volatility.

The Smart Money Move: Pay Off Debt, Then Invest

You may want to see also

Dividend-paying stocks, especially those with a long track record of payments

Dividend-paying stocks can be a good investment during a recession, as they provide a stable cash flow even when the economy is struggling. Dividend stocks are shares of a company that distributes a portion of its profits to shareholders based on the number of shares they own.

When considering which dividend-paying stocks to invest in, look for companies with a long track record of payments, as this indicates a commitment to returning value to investors. Additionally, seek out companies with a history of increasing their dividend payments over time. This demonstrates financial strength and discipline, as well as healthy balance sheets and consistent cash flow. These factors can help companies withstand recessions and signal their ability to continue making payments in the future.

It is also important to consider the overall health of the company. Look for companies with low debt, profitability, strong balance sheets, and positive cash flow, as these factors can help them navigate difficult economic times.

Some examples of companies with a strong track record of dividend payments include Altria, Target, Procter & Gamble, Starbucks, PepsiCo, Johnson & Johnson, Verizon, and CVS Health. These companies have consistently raised their dividends and are well-established in their respective industries.

By investing in dividend-paying stocks with a long history of payments, you can benefit from a steady income stream and potentially strong long-term returns, even during a recession.

Worthy Investing: Unlocking Monthly Dividend Potential

You may want to see also

Real estate investments, which can provide a steady income stream during a recession

Real estate can be a good investment during a recession, offering stability and the potential for income generation. Here are some reasons why real estate investments can be attractive during economic downturns:

Low Correlation to Stocks

Historically, real estate has had a low correlation to the stock market. This means that even if stocks become highly volatile due to a recession, there is minimal impact on the real estate market. This low correlation provides a diversification benefit to investors looking to protect their portfolios.

Housing Remains a Basic Necessity

Even during a recession, people still need a place to live. If demand for rental properties remains steady or increases and there is limited housing supply, property investors can benefit from a steady stream of rental income. This steady demand for housing makes it a good investment, especially when compared to commercial real estate, which may suffer from vacancies during tough economic times.

Recessions Create Bargains

While a recession does not always lead to a drop in home values, it can cause a previously hot housing market to cool off. This creates opportunities for investors to purchase rental properties at discounted rates. For example, during the Great Recession of 2007-2009, house prices dropped by nearly 20%, and it took years for the US housing market to recover.

Real Estate is More Stable Compared to Other Investments

Compared to stocks, bonds, and other traditional investments, real estate is generally more stable in the long run. Stocks, for instance, are more volatile and susceptible to economic crises. In contrast, real estate is a physical and tangible asset that can still be utilised even if its value decreases.

Other Benefits of Real Estate Investments During a Recession

- Student and senior housing maintain steady demand, even in economic downturns, as students still need accommodation while attending school, and the aging population demands senior housing.

- Commercial properties like warehouses and farmland can also be good investments during a recession, as people still need basic commodities like wheat and corn, and these properties are used to produce them.

- Rental income from tenants can remain consistent during a recession, providing a healthy return on investment over the long term.

Tips for Real Estate Investing During a Recession

When considering real estate investments during a recession, here are some tips to keep in mind:

- Location is crucial. Look for areas with high rental demand and rates that allow you to maintain a healthy profit margin.

- Weigh cash flow carefully. During a recession, it is important to maintain larger cash reserves to cover expenses, especially with high inflation.

- Compare financing options and interest rates. At the beginning of a recession, rates may be higher, but they may drop as the Federal Reserve adjusts rate policies to encourage spending and borrowing.

In conclusion, real estate investments can provide a steady income stream during a recession due to the essential nature of housing and the stability of this asset class compared to others. However, it is important to conduct thorough research and due diligence before investing, as there are also risks associated with real estate during economic downturns.

Young and Investing: Strategies for an Early Retirement

You may want to see also

Precious metals, like gold and silver, which tend to perform well during market slowdowns

Precious metals such as gold and silver are a good investment during a recession as their demand and price usually go up during market slowdowns. This is because they are seen as safe-haven investments that limit exposure during market turbulence.

There are a few ways to invest in precious metals. One straightforward route is to buy coins or bars from a seller or coin dealer. Alternatively, you can buy precious metal securities, such as exchange-traded funds (ETFs). These funds are collections of investments within the precious metal market. A third option is to purchase a gold IRA if you're saving specifically for retirement.

It's important to note that while precious metals can be a good investment during a recession, there is no such thing as a "recession-proof" investment. All investments carry some level of risk, and it's important to do your own research or consult with a financial advisor before making any investment decisions.

Understanding New Residential Investments: Unlocking the Average Dividend Mystery

You may want to see also

Your own skills and knowledge, which can help you get a better job

While there is no such thing as a "recession-proof" investment, some stocks, funds, and strategies can help your portfolio weather an economic downturn. During a recession, stock values often decline, and lower stock values offer an opportunity to invest in the market at a lower cost.

- Health care and consumer staples stocks: During a recession, some sectors of the economy tend to outperform others as consumer needs shift. The health care and consumer staples sectors typically don't see rapid growth but are more stable during volatile economic conditions.

- Healthy large-cap stocks: Large-cap stocks are shares of larger, more established companies that tend to be more stable and have a lower risk of going out of business during a recession.

- Funds that track specific sectors: Investing in exchange-traded funds and low-cost index funds can be less risky than investing in individual stocks, providing exposure to specific baskets of securities.

- Fixed-income and dividend-yielding investments: These investments, such as bonds and dividend stocks, offer routine cash payments, which can be attractive during recessions.

Now, let's shift our focus to your own skills and knowledge, which can be a valuable asset during a recession and help you get a better job. Here are four to six paragraphs on this topic:

Your skills and knowledge are valuable assets that can help you stand out in today's competitive job market, especially during a recession. Here are some ways to develop and leverage your skills to improve your career prospects:

- Develop In-Demand Skills: Identify the skills that are in high demand in your industry or the job market in general. For example, basic coding skills, data analysis, digital literacy, foreign language proficiency, and project management skills are highly sought after by employers. You can take courses, attend workshops, or learn online to develop these skills and make yourself more marketable.

- Continuous Learning and Professional Development: Create a professional development plan to set goals and stay motivated. Enroll in professional development courses, attend webinars and industry events, and take advantage of online resources to expand your knowledge. This demonstrates your commitment to growth and ensures your skills remain relevant and up-to-date.

- Adaptability and Flexibility: Employers value employees who can adapt to new technologies, people, and ideas. Embrace change and be willing to learn new skills or take on new roles. This adaptability will make you a valuable asset to any organization, especially during a recession when businesses need to be agile.

- Communication and Public Speaking: Effective communication skills are essential in the workplace. Develop your written and verbal communication skills, as well as your ability to listen and tailor your message to different audiences. Additionally, work on your public speaking skills, as you may be required to present your ideas or speak about your work in front of an audience.

- Creative and Innovative Thinking: Creativity is highly valued by employers, as it can lead to innovations that set your company apart from competitors. Think outside the box and apply creative solutions to common challenges. This will help you stand out as a problem solver and a valuable contributor to your organization.

- Leadership and Teamwork: Leadership skills are crucial for career advancement. Seek opportunities to lead and motivate others, delegate tasks, and set a positive example for your team. Additionally, showcase your ability to work collaboratively as a team player, build positive working relationships, and help achieve shared goals.

Remember, investing in your skills and knowledge is a long-term commitment that will pay dividends throughout your career. By continuously learning, adapting, and refining your abilities, you'll be well-equipped to navigate a recession and position yourself for better job opportunities.

The Cost of Investing: Unraveling the Fees

You may want to see also

Frequently asked questions

Some good investments to buy going into a recession include stocks in the healthcare, utilities, and consumer goods sectors, reliable dividend stocks, real estate, and precious metal investments.

It's important to have plenty of emergency savings, not touch your portfolio for at least seven years, and avoid obsessively checking your portfolio.

It's best to avoid highly leveraged, cyclical, and speculative companies, as well as growth stocks.