Hedge funds are pooled investment funds that hold liquid assets and employ complex trading and risk management techniques to improve investment performance and insulate returns from market risk. They are considered alternative investments and are generally more aggressive, riskier, and more exclusive than mutual funds.

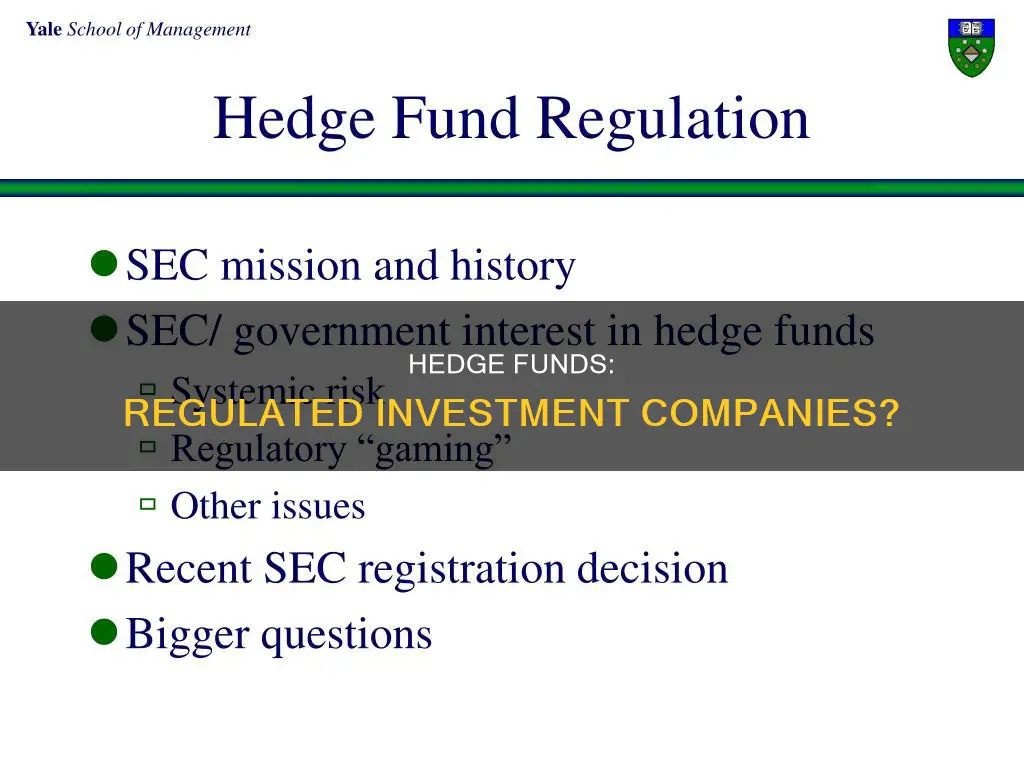

Hedge funds are subject to varying levels of regulation depending on the jurisdiction. In the United States, for example, hedge funds with regulatory assets under management exceeding $100 million are required to register with the Securities and Exchange Commission (SEC). However, hedge funds are typically less regulated than traditional investment vehicles such as mutual funds, and they operate with far less disclosure.

The term hedge fund comes from the investment strategy of hedging, which involves making investments to protect against losses in another investment. While some hedge funds employ hedging strategies, others do not.

| Characteristics | Values |

|---|---|

| Definition | Pooled investment vehicles that can invest in a wide variety of products, including derivatives, foreign exchange, and publicly traded securities. |

| Regulation | Relatively lightly regulated, especially in the US. |

| Investment type | Risky, alternative investments. |

| Investor type | Target wealthy, institutional, and accredited investors. |

| Minimum investment | Typically a high minimum investment or net worth. |

| Fees | Higher than conventional investment funds. |

| Strategies | Use leverage, invest in non-traditional assets, and employ risky strategies. |

What You'll Learn

- Hedge funds are lightly regulated in the US compared to mutual funds

- Hedge funds are not widely available to the public

- Hedge funds are risky, alternative investments

- Hedge funds are limited partnerships of private investors

- Hedge funds are subject to the same trading reporting and record-keeping requirements as other investors in publicly traded securities

Hedge funds are lightly regulated in the US compared to mutual funds

Hedge funds and mutual funds are both managed portfolios built from pooled funds with the goal of achieving returns through diversification. However, hedge funds are lightly regulated in the US compared to mutual funds.

Mutual funds are regulated investment products offered to the public and available for daily trading. They are comprehensively regulated by the Securities and Exchange Commission (SEC) through two regulatory directives: The Securities Act of 1933 and the Investment Company Act of 1940. The 1933 Act requires a documented prospectus for investor education and transparency, while the 1940 Act provides the framework for mutual fund structuring, which can be either open-ended or closed-ended.

On the other hand, hedge funds are private investments that are only available to accredited investors, who are deemed to have advanced knowledge of financial market investing and a higher risk tolerance than standard investors. They are not subject to the same extensive regulations as mutual funds and are instead governed by the Investment Advisers Act of 1940. This allows them to employ a wider variety of financial instruments and risk management techniques, such as short selling, leverage, and derivative instruments.

The Dodd-Frank Act of 2010 introduced additional reporting requirements for hedge funds, but they remain more opaque and lightly regulated than traditional investment vehicles like mutual funds. Hedge funds are required to register with the SEC if they maintain investor assets of more than $100 million, or $150 million if all assets are from private accredited investors. This is in contrast to mutual funds, which are available to everyday investors and traded daily on financial market exchanges.

The private nature of hedge funds allows them greater flexibility in their investing provisions and investor terms. They often charge much higher fees and may offer less liquidity due to varying lock-up periods and redemption allowances. Hedge fund investors typically need to keep their money in the fund for at least a year, whereas mutual fund investors can redeem their units on any given business day.

Strategies for Series A Funding: A Guide for Investors

You may want to see also

Hedge funds are not widely available to the public

Hedge funds are not as strictly regulated as mutual funds. In the US, hedge funds with regulatory assets under management in excess of $100 million are required to register with the Securities and Exchange Commission (SEC). Advisors with regulatory capital under management of less than $150 million and who qualify for the private fund advisor exemption do not have to register with the SEC.

Hedge funds are often considered a risky, alternative investment choice. They are loosely regulated and employ a variety of risky investment strategies, such as investing in non-traditional assets, using leverage, and taking big positions in alternative investments. Hedge funds also require a high minimum investment or net worth, and they charge higher fees than conventional investment funds.

Hedge funds are financial partnerships that employ various strategies to maximise returns for their investors. They are often limited partnerships of private investors whose money is pooled and managed by professional fund managers. Hedge fund managers have free rein to invest in non-traditional assets and employ risky strategies. They are rewarded with much higher fees than mutual funds charge.

Hedge funds are not suitable for small or retail investors, who typically lack the means to fully understand the nature and risks of investing in hedge funds. They are generally suited to sophisticated and/or institutional investors who have the means, expertise, and capacity to obtain a full appreciation of the risks.

Launching an Investment Fund: Training for Beginners

You may want to see also

Hedge funds are risky, alternative investments

Hedge funds are generally more aggressive and riskier than mutual funds. They are not subject to the same strict regulations as mutual funds and are not available to the general public. Instead, they target wealthy, institutional investors and require high minimum investments or high net worth.

Hedge funds are able to take greater risks because they are pursuing higher profits for their investors. They invest in a wide variety of assets, including land, real estate, stocks, derivatives, and currencies. They also employ riskier investment strategies, such as leveraging and short-selling.

Because of the higher risks involved, hedge funds are required to have extensive risk management practices in place. They are also required to register with the Securities and Exchange Commission (SEC) if they have more than $100 million in private funds and manage one or more funds.

Hedge funds are often considered a speculative luxury for the rich. They charge higher fees than conventional investment funds, typically following a "2-and-20" rule, with a 2% management fee and a 20% performance fee.

Overall, hedge funds are risky, alternative investments that offer the potential for higher returns but also come with greater volatility and risk.

Mutual Funds: Investing Outside of an IRA

You may want to see also

Hedge funds are limited partnerships of private investors

Hedge funds are generally structured as limited partnerships, with a limited liability company (LLC) acting as the general partner. In this structure, the hedge fund managers are provided with limited personal liability in their position as member-managers of the general partner LLC. Individual investors in the hedge fund are limited partners and purchase limited partnership interests.

The limited partnership structure provides hedge funds with the advantage of limited liability for investors and managers, as well as "pass-through taxation", where all income is passed through to the partners, avoiding the double taxation characteristic of corporate structures.

Hedge funds are considered alternative investments due to their ability to use leverage and more complex investment techniques. They are also considered riskier investments than regulated investment funds available to the retail market, such as mutual funds and ETFs.

Hedge funds are subject to less regulatory oversight than other investment vehicles, such as mutual funds. In the United States, hedge funds are only required to register with the Securities and Exchange Commission (SEC) if they have more than $150 million in private funds and manage one or more funds.

Hedge funds are typically available only to institutional investors and high-net-worth individuals, as they require a high minimum investment or net worth. The standard compensation structure for hedge fund managers is the "2-and-20" rule, which includes a 2% management fee and a 20% performance fee.

Invest Wisely: Fidelity New Millennium Fund Offers Diverse Opportunities

You may want to see also

Hedge funds are subject to the same trading reporting and record-keeping requirements as other investors in publicly traded securities

Hedge funds are often limited partnerships of private investors whose money is pooled and managed by professional fund managers. These managers employ a wide range of strategies, including the use of leverage and the trading of non-traditional assets, to pursue higher profits. The use of leverage and more complex investment techniques distinguishes hedge funds from regulated investment funds available to the retail market, such as mutual funds and ETFs.

In the United States, financial regulations require that hedge funds be marketed only to institutional investors and high-net-worth individuals. Hedge funds are considered alternative investments, and their ability to employ leverage and riskier strategies makes them riskier compared to most mutual funds or exchange-traded funds.

Hedge funds are required to register with the SEC if they maintain investor assets of more than $100 million. If all assets managed are from private accredited investors, this limit is raised to $150 million. The 2010 Dodd-Frank Act also introduced additional reporting requirements for hedge funds, with managers needing to report information on their size, services offered, investors, employees, and potential conflicts of interest.

Hedge funds are extremely diverse in structure and employ a variety of investment strategies. They may concentrate their investments, use leverage, or engage in other strategies that offer the potential for higher returns but also pose additional risks.

Hedge funds are not widely available to the public directly and are generally targeted towards wealthy investors. They typically require accredited investors and have high minimum investment or net worth requirements, often in the range of $100,000 to over $1 million.

Hedge funds charge higher fees than conventional investment funds, typically following a "2-and-20" rule, which includes a 2% management fee and a 20% performance fee.

Malabar Value Fund: A Guide to Investing Wisely

You may want to see also

Frequently asked questions

A hedge fund is a pool of money from various investors that is used to invest in stocks and other assets. Hedge funds are generally more aggressive, riskier, and more exclusive than mutual funds.

Hedge funds are subject to less regulatory scrutiny by the Securities and Exchange Commission (SEC) compared to other investment vehicles like mutual funds. In the US, hedge funds with regulatory assets under management in excess of $100 million are required to register with the SEC.

Hedge funds typically target wealthy investors. In the US, investors are required to be accredited, which means they must have a certain level of income or assets. For example, individuals must have an annual income exceeding $200,000 or a net worth exceeding $1 million.

Disclaimer: This response is for informational purposes only and should not be construed as financial advice. Please consult a qualified financial advisor before making any decisions about investing.