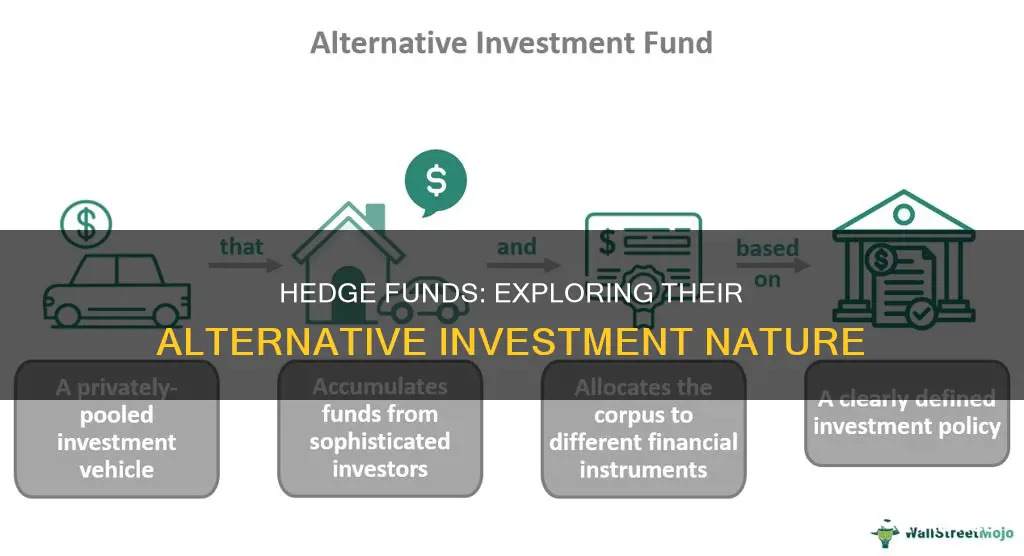

Hedge funds are a type of alternative investment. Alternative investments are asset classes that are not stocks, bonds, or cash. They are distinguished from traditional investments by their illiquidity and the fact that they are not easily sold or converted into cash. Hedge funds are investment funds that trade liquid assets and employ various investing strategies with the goal of earning high returns. They are exclusive investment opportunities, available only to institutional investors and high-net-worth individuals.

| Characteristics | Values |

|---|---|

| Definition | Hedge funds are pooled investment funds that trade relatively liquid assets and can be used as a diversification tool. |

| Investment strategies | Hedge funds employ a wide range of investment strategies, including long-short equity, market neutral, volatility arbitrage, and quantitative strategies. |

| Investors | Hedge funds are exclusive to institutional investors, such as endowments, pension funds, mutual funds, and high-net-worth individuals. |

| Management | Hedge funds are actively managed by professional fund managers. |

| Risk | Hedge funds are considered risky, alternative investments. |

| Returns | Hedge funds aim to generate high returns for their investors. |

| Fees | Hedge funds charge higher fees than conventional investment funds, typically following a <co: 1>"2 and 20" fee system. |

| Liquidity | Hedge funds are illiquid, with lock-up periods that restrict investors from selling shares or withdrawing funds for at least a year. |

| Regulation | Hedge funds are more lightly regulated by the SEC compared to traditional investments. |

What You'll Learn

Hedge funds are a proven type of alternative investment

Hedge funds are exclusive and are usually only available to institutional investors, such as endowments, pension funds, and mutual funds, as well as high-net-worth individuals. They are often considered a risky choice and require a high minimum investment or net worth, targeting wealthy investors. The strategies used by hedge funds depend on the fund manager and can include equity, fixed-income, and event-driven investment goals.

Hedge funds charge higher fees than conventional investment funds, typically following a "`2 and 20`" fee structure, with a 2% management fee and a 20% performance fee. They are also less regulated than traditional investments, providing more flexibility to fund managers.

Hedge funds are often used by institutional investors to diversify their portfolios, manage risk, and deliver reliable returns over time. They are attractive to investors because of the potential for portfolio diversification, leading to higher risk-adjusted returns.

Hedge funds use a range of strategies, such as long-short equity, market neutral, volatility arbitrage, and quantitative approaches. They can invest in various assets, including land, real estate, stocks, derivatives, currencies, debt, equity securities, commodities, and more.

Mutual Fund Investment: Benefits and Your Financial Growth

You may want to see also

Hedge funds are exclusive and risky

Hedge funds are exclusive investment vehicles that employ a range of strategies, including risky techniques, to generate high returns for their investors. They are generally only available to institutional investors and high-net-worth individuals due to their high minimum investment requirements and the level of risk involved.

Hedge funds are alternative investment funds that pool investors' capital to purchase a diverse portfolio of assets. They are considered exclusive because they typically target wealthy investors and require a high minimum investment or net worth. These funds are often structured as limited partnerships, with professional fund managers employing a variety of strategies to achieve above-average returns. The managers have flexibility in their investment approaches and can use derivatives, leverage, and short-selling to generate profits.

The exclusive nature of hedge funds is further emphasised by the fact that they are not as strictly regulated as mutual funds, allowing them to take on more risk. This lack of stringent regulation makes them less accessible to the general public. Hedge funds are considered risky investments due to the strategies employed, which can include leveraging and investing in illiquid or non-traditional assets. Additionally, hedge funds often have lock-up periods, where investors' funds are locked in for a certain period, typically a year, before they can sell shares and withdraw their money.

Hedge funds are also known for charging higher fees than conventional investment funds, typically following a "2 and 20" fee structure. This means they charge a 2% management fee based on the net asset value of each investor's shares and a 20% performance fee on the profits generated.

While hedge funds offer the potential for high returns, they also carry a significant level of risk. Investors in hedge funds are often regarded as accredited investors, meeting a minimum level of income or assets. Before investing in hedge funds, it is crucial to conduct thorough research and understand the level of risk involved, the investment strategies employed, and the restrictions on redeeming shares.

A Beginner's Guide to Investing in Vanguard Index Funds UK

You may want to see also

Hedge funds are loosely regulated

Hedge funds are limited partnerships of private investors whose money is pooled and managed by professional fund managers. These managers employ a wide range of strategies, including risky investment strategies, to earn above-average investment returns. They can invest in options and derivatives, as well as esoteric investments that mutual funds cannot invest in.

Hedge funds are exclusive and are only available to institutional investors, such as endowments, pension funds, and mutual funds, as well as high-net-worth individuals. They are considered risky, alternative investment choices and require a high minimum investment or net worth.

Hedge funds are not as strictly regulated by the U.S. Securities and Exchange Commission (SEC) as mutual funds. They charge higher fees than conventional investment funds, typically employing a "2 and 20" fee system, with a 2% management fee and a 20% performance fee.

Hedge funds are attractive to investors because they offer the potential for portfolio diversification and higher risk-adjusted returns. However, they are subject to less regulation and transparency, and investments are considered illiquid due to lock-up periods and restrictions on redemptions.

Bridgewater Flagship Fund: A Guide to Investing

You may want to see also

Hedge funds use a variety of strategies

Hedge funds are a type of alternative investment that pools capital from qualified investors to purchase a diverse portfolio of assets. They are considered risky and require a high minimum investment or net worth. Hedge funds are actively managed funds that focus on alternative investments and employ risky investment strategies. They use a wide range of strategies, including leverage and the trading of non-traditional assets, to earn above-average investment returns.

Hedge fund managers can specialize in a variety of skills to execute their strategies, such as long-short equity, market neutral, volatility arbitrage, and quantitative strategies. They also use derivatives and leverage to make investments in illiquid assets and to take short positions.

- Long/short equity: This strategy involves buying and selling stocks based on fundamental valuations. An example is "paired trades", where a fund takes a long position in a large bank and a short position in a small bank, resulting in low/zero exposure to banks and a profit if the large bank outperforms and the small bank underperforms.

- Event-driven: These strategies aim to capitalize on corporate events such as mergers, restructurings, bankruptcies, or takeovers. They can include special situations, opportunistic approaches, or other sub-strategies.

- Multi-strategy: This approach involves applying various strategies and implementing diversification to smooth returns, reduce volatility, and decrease asset-class and single-strategy risks.

- Equity hedge: These funds may be global or specific to one country. They invest in lucrative stocks while hedging against downturns in equity markets by shorting overvalued stocks or stock indices.

- Relative value: These funds seek to exploit temporary differences in the prices of related securities, taking advantage of price or spread inefficiencies.

- Activist: These funds invest in businesses and take actions to boost the stock price, such as demanding cost-cutting, restructuring assets, or changing the board of directors.

- Fixed-income: This strategy provides solid returns with minimal monthly volatility and aims for capital preservation. It involves taking both long and short positions in fixed-income securities.

Hedge funds use a diverse range of strategies to achieve their investment goals and manage risk. These strategies involve investing in a wide range of assets, including debt and equity securities, commodities, currencies, derivatives, and real estate.

A Guide to Investing in BDO Mutual Funds

You may want to see also

Hedge funds are pooled investment funds

Hedge funds are actively managed by professional managers who employ a wide range of strategies, including risky and non-traditional approaches, to seek high returns. These strategies include the use of leverage, derivatives, and short-selling. The fund managers aim to outperform average market returns and protect the fund's positions from market risk by investing in securities that move in the opposite direction of the fund's core holdings.

Hedge funds are often considered risky investments due to the complex and speculative nature of their strategies. They typically require accredited investors with a high minimum investment or net worth. Additionally, hedge funds charge higher fees than conventional investment funds, usually following a “2 and 20” fee structure, which includes a 2% management fee and a 20% performance fee.

Hedge funds provide investors with access to a diverse range of assets and sophisticated investment strategies. They are a tool for diversification, risk management, and the pursuit of reliable returns over time.

Floating Rate Funds: A Smart Investment Strategy

You may want to see also

Frequently asked questions

Alternative investments are asset classes that aren't stocks, bonds, or cash. They are considered alternative as they differ from traditional investment types because they aren't easily sold or converted into cash.

Examples of alternative investments include private equity, private debt, hedge funds, real assets (e.g. real estate, land, timberland, and farmland), commodities, and collectibles.

Hedge funds are a type of alternative investment. They are investment funds that pool investors' money and employ various investing strategies with the goal of earning high returns.

Alternative investments can help diversify your portfolio and reduce your exposure to the stock market. They can also be a good way to generate passive income and build wealth.

Alternative investments tend to be less liquid and have higher risks compared to traditional investments. They also require more due diligence as the performance of alternative investments is usually non-public information.