A hedge fund is a type of investment partnership that pools funds from private investors to invest in financial instruments with complex portfolios. Hedge funds are often considered alternative investment choices due to their risky nature and typically require high minimum investments. They are not as strictly regulated as mutual funds and can employ a range of strategies, including leverage and trading non-traditional assets, to achieve above-average returns. The term hedge refers to the fund manager's strategy of hedging the fund's positions to protect against market risk. These funds are designed to generate high returns for investors, with the understanding that higher returns come with higher risks.

What You'll Learn

Hedge funds are risky, alternative investments

A hedge fund is an investment vehicle with pooled funds, actively managed by professionals who buy and sell certain investments with the stated goal of exceeding the returns of the markets, or some sector or index of the markets. They are considered alternative investments and are often regarded as risky.

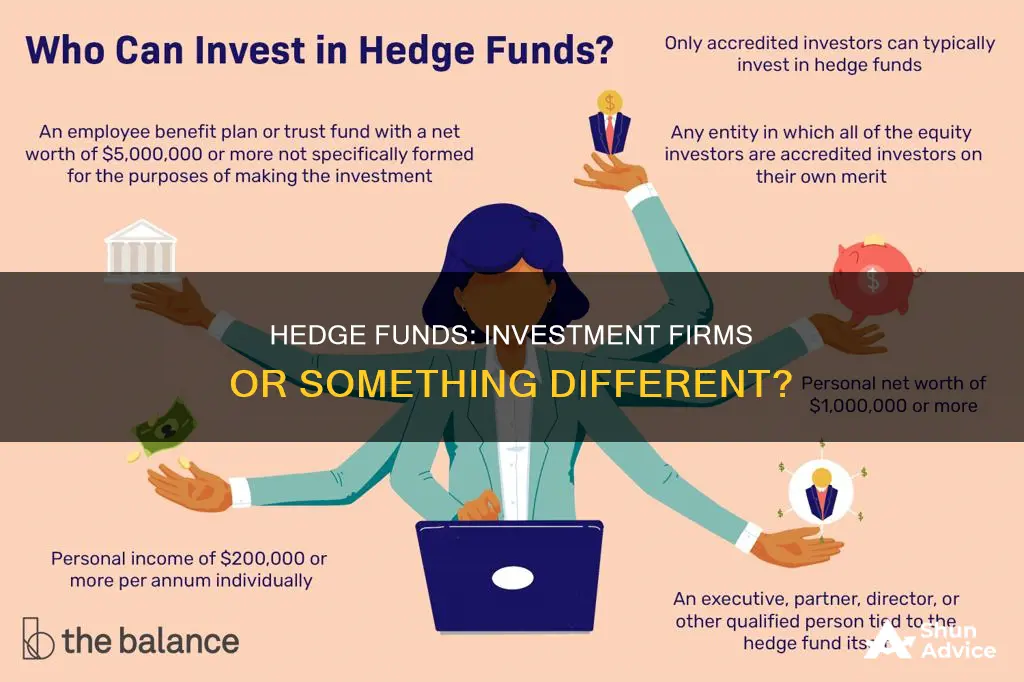

Hedge funds are only available to accredited investors, who must meet a required minimum level of income or assets. They are typically institutional investors, such as pension funds and insurance companies, and wealthy individuals.

Hedge funds use a range of strategies, including leverage and the trading of non-traditional assets, to achieve above-average investment returns. They are known for their aggressive and unique strategies, which can be a positive or a negative. For example, they can sell (or 'short') stocks, meaning they make money if a stock declines in value. They also utilise derivatives and leverage to boost performance.

The use of leverage is a highly risky proposition. For example, a fund manager may borrow money to increase their investment in a stock they believe will rise. If the stock does indeed rise, they will make a large gain. However, if the stock price drops, they will face a margin call, and their losses will be amplified by the borrowed money.

Hedge funds are also known for their lack of transparency. As private entities, they have relatively less public disclosure, which can expose them to fraudulent activities and faulty operations. Additionally, their performance can be fabricated, as the offering documents are not reviewed by state or federal authorities.

Another risk to consider is the concentration risk, where a fund focuses on a particular strategy or sector. If the fund puts 'all its eggs in one basket', its performance will be directly linked to that strategy or sector. Diversification across multiple sectors can help neutralise this risk.

Hedge funds also have high investment minimums, traditionally ranging from $100,000 to millions, which limits the pool of available investors. They also employ the notorious "2 and 20" fee structure, with a 2% management fee and a 20% performance fee.

Overall, hedge funds are considered risky, alternative investments due to their aggressive strategies, lack of transparency, concentration risk, high investment minimums, and fee structure.

A Simple Guide to Investing in the Nasdaq 100 Index Fund

You may want to see also

They require high minimum investments

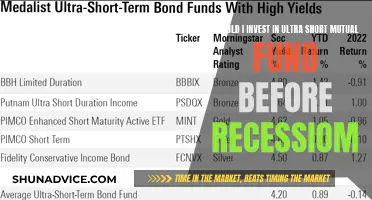

Hedge funds are considered a risky investment choice and require high minimum investments. The US Securities and Exchange Commission (SEC) classifies investors as accredited if they have a net worth of at least $1 million or an annual income of over $200,000 ($300,000 for married couples). These accredited investors are presumed to understand the unique risks associated with hedge funds and are therefore allowed to invest in them.

The high minimum investment requirements are set by hedge fund general partners and managers. It is not uncommon for a hedge fund to require at least $100,000, and some may even require up to $1 million or more to participate. These high minimum investments are due to the complex and aggressive investment strategies employed by hedge funds, which often involve short-selling, leverage, derivatives, and alternative asset classes.

The large sums of money required to invest in hedge funds are not accessible to the ordinary investor. In fact, according to the United States Census Bureau, only about 4% of households earned more than the $300,000 necessary for a family to reach accredited investor status in 2019. As a result, many individuals are forced to find indirect methods of investing in hedge funds or give up trying altogether.

One way for ordinary individuals to gain indirect access to hedge funds is by investing in the stock of a financial company that operates hedge funds. For example, Blackrock, a publicly traded investment advisor, has a large alternative investments segment that operates much like a hedge fund and handles billions of dollars for ultra-wealthy clients. By investing in Blackrock, individuals can capture some of the performance of its alternative investments segment without directly investing in a hedge fund.

In summary, the high minimum investment requirements of hedge funds are due to the complex and risky nature of their investment strategies, and they serve to exclude the vast majority of the investing public.

Lump Sum Mutual Fund Investing: Strategies for Success

You may want to see also

Hedge funds are loosely regulated

While regulations have been implemented in the U.S. and Europe following the 2007-2008 financial crisis to increase oversight and eliminate regulatory gaps, hedge funds remain more loosely regulated than competing investments. This allows them to invest in options, derivatives, and esoteric investments that mutual funds cannot access. The lack of strict regulation contributes to the perception of hedge funds as risky investment choices.

Hedge funds are required to be marketed only to institutional investors and high-net-worth individuals. Investors in hedge funds are typically qualified investors who are aware of and accept the potential risks and returns. The funds themselves are structured as offshore corporations, limited partnerships, or limited liability companies, further contributing to their loosely regulated nature.

Despite the limited regulations, hedge funds must abide by national, federal, and state regulatory laws in their respective locations. Additionally, they fall under the jurisdiction of the Commodity Futures Trading Commission and are subject to the rules and provisions of the 1922 Commodity Exchange Act, which prohibits fraud and manipulation. While hedge funds may operate with more flexibility than other investment options, they are still subject to certain legal and compliance requirements.

Invest Wisely: Municipal Bond Dividends

You may want to see also

They use a 2 and 20 fee system

Hedge funds are investment firms that employ a variety of strategies to generate returns for their clients. One of the defining characteristics of hedge funds is their fee structure, often referred to as "2 and 20". This fee arrangement is standard in the hedge fund industry and is also common in venture capital and private equity.

The "2 and 20" fee structure consists of a management fee and a performance fee. The "2" represents a 2% annual fee charged on the total assets under management (AUM), regardless of the fund's performance. This fee is used to cover operational expenses such as staff salaries, administrative costs, and office expenses. Even if the fund performs poorly, the 2% fee ensures that the fund can continue to operate and cover its costs.

The "20" refers to a 20% performance or incentive fee charged on the profits generated by the fund beyond a specified minimum threshold, also known as the hurdle rate. This fee is used to reward the hedge fund's key executives and portfolio managers. The hurdle rate could be a preset percentage or based on a benchmark such as the return on an equity or bond index. For example, if a fund has an 8% threshold and generates a 15% return, the 20% performance fee will be charged on the incremental 7% profit above the threshold.

The "2 and 20" fee structure has come under scrutiny in recent years due to underperformance and high fees. While it has resulted in many hedge fund managers becoming extremely wealthy, investors and politicians have criticised the structure. As a result, there has been a push for lower fees and for performance fees to be taxed as ordinary income rather than at the lower capital gains rate.

Some hedge funds have started to offer alternative fee structures, such as "1.5 and 10" or providing discounts for investors who are willing to lock up their investments for longer periods. Additionally, some funds include a high watermark clause, which states that the fund manager can only charge performance fees after the fund has generated new profits, ensuring that any losses are made up before performance fees are paid out.

Despite the criticism and alternative structures, the "2 and 20" fee system remains prevalent in the hedge fund industry, contributing to the significant profits generated by these firms.

Mutual Fund Investment Guide for NRIs in India

You may want to see also

Hedge funds are limited liability corporations

A hedge fund is a limited partnership of private investors whose money is pooled and actively managed to pursue high-return, alternative investments. These funds are often considered risky and require a high minimum investment, targeting wealthy investors.

Hedge funds are structured to provide limited personal liability for the fund managers and partners. In the US, this is typically achieved through a limited partnership, with a limited liability company (LLC) as the general partner. In this structure, the LLC acts as the fund's general partner, providing limited liability for the fund managers in their position as member-managers.

The limited partnership business structure is commonly used for hedge funds to protect investors from financial losses in the event of a failed venture. In this structure, the general partner has full management control and unlimited financial liability, while the limited partners have restricted involvement in management and their liability is limited to the size of their investment.

By utilising a limited liability company as the general partner, the hedge fund can benefit from the "pass-through taxation" treatment, where all income is passed through to the partners and members, avoiding the double taxation associated with corporate structures.

It is important to note that the specific regulations and structures may vary depending on the jurisdiction and the tax status of investors.

A Guide to Investing in Vanguard Funds from South Africa

You may want to see also

Frequently asked questions

A hedge fund is a limited partnership of private investors whose money is pooled and managed by professional fund managers. These managers use a wide range of strategies, including leverage and the trading of non-traditional assets, to earn above-average investment returns.

A hedge fund is a type of investment firm, but not all investment firms are hedge funds. Hedge funds are formed as limited liability corporations, whereas investment firms can take various legal structures. Hedge funds are also typically focused on alternative and riskier investments, while investment firms may offer a broader range of services and investment strategies.

Hedge fund investments are considered risky due to the aggressive investment strategies employed, which may include leverage, derivative securities, and investing in non-traditional assets. There is also a high degree of risk associated with the illiquidity of hedge fund investments, as funds often require investors to keep their money in the fund for at least a year (known as the lock-up period) and may impose restrictions on share redemption.