The Putnam Short Duration Fund is an investment strategy that seeks to preserve capital and provide a higher rate of current income. The fund invests in a diversified portfolio of short-duration, investment-grade fixed-income securities, including money market instruments and other debt securities. While the fund aims to provide capital preservation, it is important to understand that all investments carry some level of risk. The fund is subject to various risks, including interest-rate risk, credit risk, and the potential impact of derivatives investments. The performance of the fund may be influenced by economic, political, and market conditions, as well as the investment strategies employed. Investors should carefully consider these risks and conduct their own due diligence before making any investment decisions.

| Characteristics | Values |

|---|---|

| Investment Objective | Capital preservation and a higher rate of current income |

| Investment Type | Fixed income securities, money market securities, other fixed income securities, U.S. dollar-denominated foreign securities |

| Risk | Above average |

| Expense Ratio | 0.32% |

| Net Assets | $9,690.66M |

| Dividend Frequency | Monthly |

| Number of Issuers | 245 |

| Fiscal Year End | July |

| Inception Date | 10/17/11 |

| Category | Taxable Income |

| Open to New Investors | Yes |

What You'll Learn

The fund's investment goals

The Putnam Ultra Short Duration Income Fund seeks to provide capital preservation and a higher rate of current income than U.S. Treasury bills. The fund aims to achieve this by investing in a diversified portfolio of short-duration, investment-grade money market and other fixed-income securities. This includes corporate credit, sovereign debt, and securitized assets.

The fund's managers actively manage risk in today's complex bond market, with the goal of superior risk-adjusted performance over time. The fund may also invest in U.S. dollar-denominated foreign securities.

The fund has a broad opportunity set, providing access to a wider range of income opportunities than other short-term investments. This means the fund may offer higher income potential than its peers.

The fund's effective duration will generally not be greater than one year under normal circumstances.

Putnam Investments has been serving investors outside of the United States for nearly five decades, offering a range of innovative and customised solutions, as well as traditional equity and bond investments.

Invest HSA Funds: TD Ameritrade Guide

You may want to see also

Risk factors

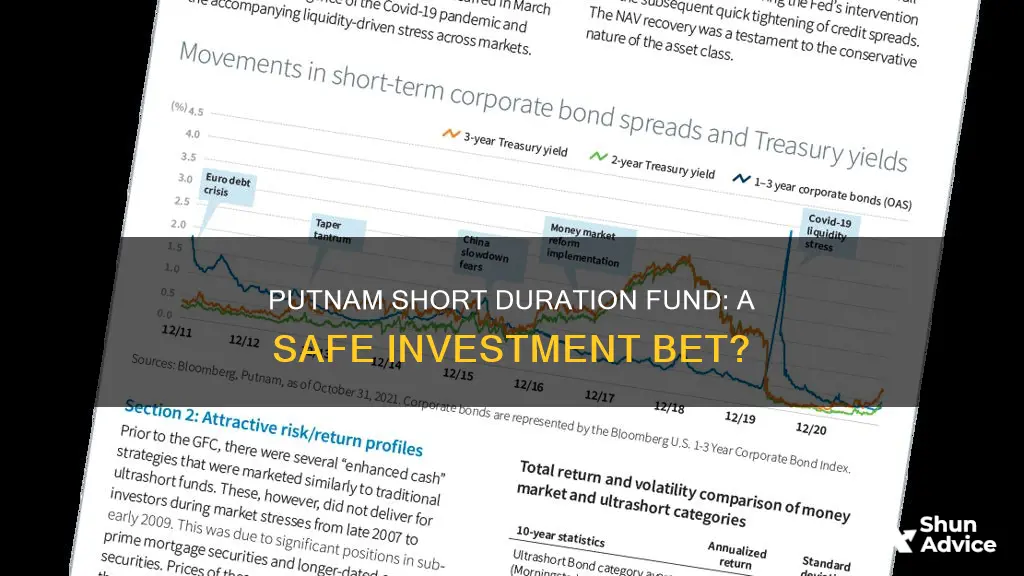

The Putnam Ultra Short Duration Income Fund is not a money market fund. The effects of inflation may erode the value of your investment over time. Funds that invest in government securities are not guaranteed. Mortgage-backed investments, unlike traditional debt investments, are also subject to prepayment risk, which means that they may increase in value less than other bonds when interest rates decline and decline in value more than other bonds when interest rates rise. The fund may have to invest the proceeds from prepaid investments, including mortgage-backed investments, in other investments with less attractive terms and yields.

The value of investments in the fund's portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political, or financial market conditions; investor sentiment and market perceptions; government actions; geopolitical events or changes; and factors related to a specific issuer, geography, industry, or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund's portfolio holdings.

Bond investments are subject to interest-rate risk (the risk of bond prices falling if interest rates rise) and credit risk (the risk of an issuer defaulting on interest or principal payments). Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds. Credit risk is generally greater for debt not backed by the full faith and credit of the US government.

Risks associated with derivatives include increased investment exposure (which may be considered leverage) and, in the case of over-the-counter instruments, the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Unlike bonds, funds that invest in bonds have fees and expenses.

Our investment techniques, analyses, and judgments may not produce the intended outcome. The investments we select for the fund may not perform as well as other securities that we do not select for the fund. We, or the fund's other service providers, may experience disruptions or operating errors that could have a negative effect on the fund. You can lose money by investing in the fund.

Invest Wisely: American Funds Strategies for Long-Term Growth

You may want to see also

Performance and fees

The Putnam Ultra Short Duration Income Fund has returned 5.39% over the past year, 1.90% over the past three years, 2.01% over the past five years, and 1.54% over the past decade. The fund's performance is consistent over five years, with positive and negative periods. The fund's total net assets are $9,690.66M as of 05/31/24, with a dividend frequency of monthly.

The fund's fees are below average compared to other funds in the same category. The expense ratio is 0.32%, compared to a category average of 0.46% for funds with loads and 0.27% for funds with no loads. The fund's risk is above average compared to other funds in the same category, according to Morningstar.

The fund's investment strategies include investing in a diversified portfolio of fixed-income securities, including short-duration, investment-grade money market securities, and other fixed-income securities. The fund may also invest in U.S. dollar-denominated foreign securities. The fund's effective duration will generally not be greater than one year.

The fund's top 10 issuers as of 04/30/24 include Mitsubishi UFJ Financial, Royal Bank of Canada, and Bank of America Corp. The fund's portfolio composition includes investment-grade corporate bonds, short-term asset-backed securities, certificates of deposit, residential MBS (non-agency), and asset-backed securities (ABS).

Pension Investment Funds: Choosing the Right Option for You

You may want to see also

Investment capabilities

Putnam's global network of investment professionals manages a broad spectrum of active strategies in custom segregated accounts, pooled vehicles, and hedge funds. Putnam Investments has been serving investors outside of the United States for nearly five decades, offering a range of innovative and customised solutions as well as traditional equity and bond investments.

The Putnam Ultra Short Duration Income Fund seeks as high a rate of current income as Putnam Investment Management, LLC believes is consistent with the preservation of capital and maintenance of liquidity. The fund invests in a diversified portfolio of fixed-income securities, including short-duration, investment-grade money market, and other fixed-income securities. It may also invest in U.S. dollar-denominated foreign securities.

The fund's experienced managers actively manage risk in today's complex bond market, with the goal of superior risk-adjusted performance over time. The fund offers access to a wider range of income opportunities, which means it may offer higher income potential than other short-term investments.

The fund has a broad opportunity set, investing in investment-grade corporate bonds, residential MBS (non-agency), certificates of deposit, asset-backed securities (ABS), short-term asset-backed securities, and U.S. Treasury/agency securities.

The fund's total net assets are over $9,600 million, with a turnover rate of 35% and a monthly dividend frequency. It has an inception date of 17 October 2011 and is open to new investors.

Mutual Funds: Safe Investment Haven Amidst Market Turbulence?

You may want to see also

Inflation and other economic factors

The effects of inflation may erode the value of your investment in the Putnam Ultra Short Duration Income Fund over time. The fund is not a money market fund, and it does not guarantee protection against inflation. Therefore, it is important to consider the potential impact of inflation on your investment returns.

In addition to inflation, there are other economic factors that can affect the performance of the fund. For example, the value of investments in the fund's portfolio may be influenced by general economic, political, or financial market conditions. This includes investor sentiment, market perceptions, government actions, and geopolitical events or changes. These factors can lead to increased volatility and reduced liquidity in the fund's portfolio holdings.

Bond investments, which are a significant part of the fund's portfolio, are subject to interest rate risk. When interest rates rise, bond prices tend to fall, and this can negatively impact the fund's performance. Credit risk is another factor, as there is a possibility of an issuer defaulting on interest or principal payments. Longer-term bonds and below-investment-grade bonds typically carry higher interest rate and credit risks, respectively.

It is also worth noting that the fund's investment strategies and sector allocations may impact its performance. The fund may invest in government securities, which are not guaranteed, and mortgage-backed securities, which are subject to prepayment risk. The fund's exposure to these types of investments can affect its returns, especially in changing economic and market conditions.

Overall, while the fund seeks capital preservation and a higher rate of current income, it is important to consider the potential impact of inflation and other economic factors on its performance. The value of investments can be influenced by a range of economic and market variables, and it is essential for investors to carefully evaluate these factors before making any investment decisions.

Banks' Investment Strategies: Where Do They Invest Deposits?

You may want to see also