Retirement of debt refers to the cancellation of stocks or bonds when they are bought back by the issuer, or when their maturity date has been reached. This is reflected in a company's cash flow statement, which shows the net flow of cash used to fund the company. When a company retires its debt, it is no longer burdened by dividend payments to shareholders or interest on bonds. This can be a positive sign for investors, as it indicates the company's financial strength and effective management of its capital structure. However, it is important to note that a loss on the retirement of debt is considered a non-operating loss and is added to net income when calculating operating cash flow. This is because no cash has exchanged hands in these transactions, and the adjustment ensures a more accurate representation of the company's cash position.

What You'll Learn

Retirement of debt is a non-operating loss

Non-operating losses are added to net income to derive operating cash flow. This is because, when calculating operating cash flow, any item on the income statement that doesn't involve cash or operations is removed from net income.

Non-operating expenses are distinct from operating expenses, which are the first costs displayed below revenue in a company's income statement. Operating expenses are subtracted from gross income to get the company's operating profit, or earnings before interest and tax (EBIT).

Operating profit is distinct from net income, which is calculated by subtracting taxes from earnings before taxes (EBT). EBT is calculated by subtracting non-operating expenses from operating profit.

Non-operating expenses include interest payments, costs from currency exchanges, and the costs of disposing of property or assets not related to operations.

Retirement Strategies: Navigating Investments with $140,000 in Savings

You may want to see also

Loss on debt retirement is added back to net income

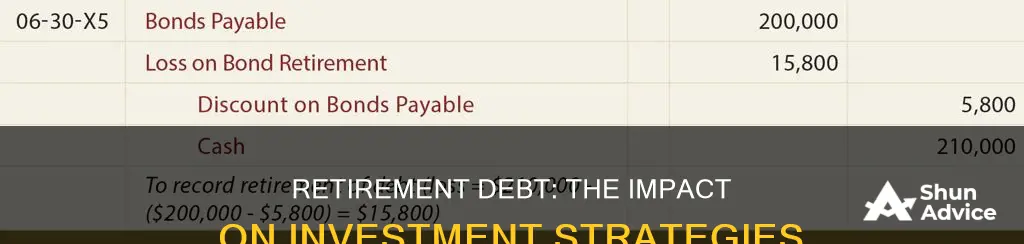

When a company retires its debt, it may incur a loss. This loss is considered a non-operating loss, and it is added back to net income when calculating operating cash flow. This is because no cash has changed hands in this transaction, so the effect of the loss must be removed from net income. Net income is the starting point when calculating operating cash flow through the indirect method.

The indirect method is used to calculate operating cash flow by adjusting net income for non-cash and non-operating transactions. This is in contrast to the direct method, which simply adds up all sources of cash inflow and all sources of cash outflow. The indirect method is more commonly used than the direct method.

When calculating operating cash flow, non-cash expenses such as depreciation and amortisation are added back to net income. This is because these expenses are deducted when calculating net income, but they do not represent an actual cash outflow. Similarly, losses on debt retirement are added back to net income because they are non-operating losses that do not involve any cash outflow.

On the other hand, gains on the sale of assets and decreases in deferred tax liability are subtracted from net income when calculating operating cash flow. This is because these transactions involve cash inflows that are added to net income but do not impact the company's operations.

The purpose of these adjustments is to arrive at a more accurate representation of the company's cash flows from operations. By adding back non-cash and non-operating losses and subtracting non-operating gains, investors and analysts can better understand the company's cash position and financial health.

Maximizing Your Retirement Investments: A Guide to Recording Payments

You may want to see also

Debt retirement is a cash outflow

The cash flow statement is one of the key financial statements that provide insights into a company's financial health and performance. It is usually divided into three main sections: cash flow from operating activities, investing activities, and financing activities. Debt retirement falls under the financing activities section.

Financing activities include transactions related to debt, equity, and dividends. In the case of debt retirement, the company is making payments to reduce or eliminate its debt obligations. This can include repaying principal amounts borrowed or making interest payments on the debt. These payments represent a cash outflow for the company, as they involve money flowing out of the business.

The impact of debt retirement on cash flow can be significant. For example, in Walmart's 2022 financial reports, the majority of their cash outflows were due to repayments of long-term debt, along with the purchase of company stock and dividend payments. This resulted in a net cash flow total that was negative for the period, which can be a cause for concern for investors.

However, it's important to note that debt retirement can also be viewed positively by investors and the market. Reducing long-term debt improves a company's financial flexibility and demonstrates its ability to manage its capital structure effectively. It also reduces the risk associated with a heavy debt burden, which could become problematic if coupled with an economic downturn.

Overall, debt retirement is a critical aspect of a company's financial strategy, and its impact on cash flow is a key metric for assessing the company's financial health and stability.

Planning for Posterity: Investing Strategies for Your Child's Retirement

You may want to see also

Debt retirement can be positive or negative for CFF

Debt retirement can have both positive and negative impacts on CFF (Cash Flow from Financing Activities). CFF is a critical component of a company's cash flow statement, offering insights into its financial health and capital structure management.

Positive Impact on CFF:

- Increased Cash Reserves: Debt retirement can lead to a positive CFF when a company's cash outflows from debt repayment are lower than the cash inflows from other financing activities. This indicates that the company has expanded its cash reserves, which can be used for growth initiatives or navigating financial challenges.

- Improved Financial Stability: When a company retires debt, it reduces its financial obligations and improves its financial stability. Lower debt levels can make the company more attractive to investors and lenders, enhancing its access to capital.

- Enhanced Creditworthiness: Retiring debt can improve a company's creditworthiness. Lenders and creditors view debt retirement positively, as it demonstrates the company's ability to honour its financial commitments. This can lead to better terms and conditions for future financing.

Negative Impact on CFF:

- Reduced Cash Flow: In some cases, debt retirement can lead to a negative CFF if the company's cash outflows from debt repayment exceed its cash inflows from other sources. This situation may arise if the company has limited cash inflows or is facing challenges in generating sufficient revenue to cover its financial obligations.

- Impact on Operations: Retiring debt may require a company to divert funds from its operational activities, potentially impacting its short-term growth or ability to invest in new opportunities. Striking a balance between debt repayment and reinvesting in the business is crucial for long-term success.

- Limited Financial Flexibility: When a significant portion of cash flow is directed towards debt retirement, it can limit a company's financial flexibility. This may hinder its ability to adapt to changing market conditions, invest in innovative projects, or take advantage of growth opportunities.

In summary, debt retirement can have both positive and negative implications for CFF, depending on the specific financial circumstances of the company. A comprehensive analysis of the cash flow statement, including cash inflows and outflows, is necessary to assess the overall financial health and stability of a business.

Hedging Strategies: Protecting Other's Wealth

You may want to see also

Bond retirement can be advantageous or disadvantageous for investors

One advantage of bond retirement is that it can provide a steady income stream for investors, especially those in or near retirement. Bonds typically pay a fixed, periodic interest rate, which can be beneficial for investors seeking a consistent return. This can be particularly attractive for retirees who are no longer receiving employment paychecks and are looking for a reliable source of income.

Another advantage is that some bonds, such as Treasury bonds, are considered risk-free assets. Treasury bonds are guaranteed by the US government, meaning that investors who hold the bonds until maturity are assured of receiving their principal investment back. This can provide a level of security that other types of investments may not offer.

However, there are also disadvantages to bond retirement. One significant disadvantage is the lower rate of return compared to other investments, such as equities. The interest income earned from bonds may not keep up with the returns generated by stocks or other investments, potentially resulting in a lower overall return for investors.

Additionally, bonds are exposed to inflation and interest rate risk. Inflation can erode the purchasing power of the interest income received from bonds, reducing the overall return for investors. Similarly, rising interest rates can cause existing bonds with fixed interest rates to underperform newly issued bonds, leading to opportunity costs for investors.

It's important to note that the advantages and disadvantages of bond retirement can vary depending on the specific type of bond and the individual investor's circumstances. Investors should carefully consider their financial goals, risk tolerance, and time horizon before investing in bonds or any other type of security.

Apple: A Popular Investment Choice

You may want to see also

Frequently asked questions

Retirement of debt refers to when a company pays off its debt obligations, such as bonds or loans, either by buying them back or by paying them off in full when they reach maturity.

A loss on retirement of debt occurs when a company pays off its debt obligations but does not receive any cash inflows or gains from the transaction. This loss is considered a non-operating loss and is added to net income when calculating operating cash flow.

A loss on retirement of debt is reflected in the cash flow statement under the "Cash Flow from Financing Activities" (CFF) section. It indicates a negative cash flow from financing activities, which can be a result of the company retiring debt, making dividend payments, or repurchasing stock.

Investors analyse the cash flow statement to assess a company's financial health and stability. While a negative CFF can indicate that a company is servicing or retiring debt, it may also suggest that the company is not generating sufficient earnings to cover these obligations. Therefore, investors should examine the specific transactions contributing to the negative CFF.