In Australia, superannuation is a savings system for workplace pensions in retirement. It involves money earned by an employee being placed into an investment fund to be made legally available to members upon retirement. Employers make compulsory payments to these funds at a proportion of their employee's wages. Superannuation funds are not managed investment schemes. Managed investment schemes, also known as 'schemes' or 'pooled investments', are collective investments where multiple investors contribute money and get an interest in the scheme. The money is then pooled together and used in a common enterprise. A 'responsible entity' or 'fund manager' operates the scheme.

| Characteristics | Values |

|---|---|

| Type of scheme | A superannuation fund is not a managed investment scheme |

| Description | A superannuation fund is an Australian pension program created by a company to benefit its employees |

| Contributions | Employers make compulsory payments to these funds at a proportion of their employee's wages |

| Investments | Superannuation funds pool the contributions from multiple individuals and invest these funds in a wide range of assets such as stocks, bonds, real estate, and more |

| Tax | Contributions made to superannuation, either by an individual or on behalf of an individual, are taxed differently depending on whether that contribution was made from "pre-tax" or "post-tax" money |

| Management | Superannuation funds operate as trusts with trustees being responsible for the prudential operation of their funds and in formulating and implementing an investment strategy |

What You'll Learn

Superannuation funds are not managed investment schemes

Firstly, superannuation funds are a type of pension plan created by a company for its employees. These funds are mandatory in Australia and involve employers making compulsory contributions to the funds, typically a percentage of their employees' wages. On the other hand, managed investment schemes are not limited to employer-employee relationships and can include various investors who contribute money to gain an interest in the scheme.

Secondly, superannuation funds are designed to provide retirement income to employees upon reaching a certain age or due to infirmity. The benefit available to an eligible employee is defined by a set schedule and is not dependent on the performance of the investment. In contrast, managed investment schemes do not guarantee a fixed benefit and the returns generated by the scheme can vary based on market conditions and the performance of the investments.

Thirdly, superannuation funds are highly regulated by the Australian government, with specific laws and rules governing their operation, such as the Superannuation Industry (Supervision) Act 1993 and the Financial Services Reform Act 2002. These funds are also subject to taxation rules, with contributions taxed at a concessional rate. Managed investment schemes, on the other hand, are regulated by the Corporations Act, which sets out the conduct and disclosure obligations of financial service providers.

Finally, superannuation funds are often managed by boards composed of industry stakeholders or financial institutions, depending on whether they are industry funds or retail funds, respectively. In contrast, managed investment schemes are operated by a 'responsible entity' or 'fund manager', who is responsible for overseeing the operations of the scheme and managing the pooled funds on behalf of the investors.

In summary, while both superannuation funds and managed investment schemes involve pooling of funds, they differ in their purpose, structure, regulation, and management. Superannuation funds are a form of mandatory retirement savings for employees, with specific rules and tax benefits, while managed investment schemes offer investors a way to gain access to a diverse range of investment opportunities.

Smart Mutual Fund Investing: Strategies for Success

You may want to see also

Superannuation funds are pooled investments

The term "super" is more commonly used when referring to pension plans available in Australia. The U.S. equivalents to a superannuation plan are defined-benefit and defined-contribution plans. Australian superannuation funds are more commonly referred to as super funds. There are two types of superannuation funds: defined-benefit funds and accumulation funds. Accumulation fund distributions and total value are subject to market fluctuations. Defined-benefit plans are not subject to market fluctuations but can be mismanaged and run out of funding.

Both types of super funds have specific taxable conditions depending on the contribution and contributor's circumstances. Funds are added to the superannuation fund by employer (and potentially employee) contributions. This monetary fund pays out employee pension benefits as participating employees become eligible. An employee is deemed to be superannuated upon reaching the proper age or as a result of infirmity. At that point, the employee can draw benefits from the fund.

A superannuation fund differs from some other retirement investment mechanisms in that the benefit available to an eligible employee is defined by a set schedule and not by the performance of the investment. A superannuation is a type of managed fund, which is a 'registered managed investment scheme', a form of unit trust. By using a managed fund, investors' money is pooled together and is used by the investment manager to buy and manage investments on behalf of all investors in the fund. By pooling funds, investors can gain access to investment opportunities that may not be available if acting alone.

Fidelity Roth: Index Funds and Auto-Investing Strategies

You may want to see also

Superannuation funds are taxed differently

Tax on Contributions

Money paid into a superannuation fund by an employer is generally taxed at a flat rate of 15%. This includes compulsory Super Guarantee contributions and employer voluntary contributions. Salary-sacrificed contributions, also known as concessional contributions, are also taxed at 15%. However, there are some exceptions to this rule. If you earn £37,000 or less, the tax is refunded to your super account through the low-income super tax offset (LISTO). If your income and super contributions combined exceed £250,000, you pay an additional 15% tax, called Division 293 tax. On the other hand, non-concessional contributions, which are made from after-tax income, are not taxed.

Tax on Investment Earnings

Earnings on investments within superannuation funds are taxed at a flat rate of 15%. This includes interest and dividends. However, if you open a retirement income stream, your investment earnings are tax-free.

Tax on Withdrawals

The tax on withdrawals depends on your age and the type of withdrawal. If you are 60 or older, withdrawals are generally tax-free. However, if you are under 60, you may have to pay tax on your super income stream and lump-sum withdrawals. The tax rate depends on the amount withdrawn and whether it is below or above the low-rate cap, which is currently £235,000.

A Beginner's Guide to Mutual Fund Investing

You may want to see also

Superannuation funds are portable

The portability of superannuation funds is beneficial for employees as it allows them to maintain their benefits while retired, such as concessional tax on earnings. For example, individuals can access their superannuation funds early if they become permanently incapacitated, temporarily unable to work, or have a terminal medical condition. Additionally, superannuation funds can follow the employee throughout their career, rather than being tied to a specific employer. This is known as a stapled super fund.

The Australian government has also proposed mandating portability to encourage and support each Australian in holding a single account, which would remain portable. This proposal is intended to streamline the superannuation system and make it easier for individuals to manage their retirement savings.

It is important to note that while superannuation funds are portable, there are certain restrictions and conditions that must be met before an individual can access their funds. These include retirement, reaching a certain age, or meeting specific medical criteria. Additionally, there may be tax implications for accessing superannuation funds early or for consolidating multiple accounts.

Property Funds: A Smart Investment Strategy for Diversification

You may want to see also

Superannuation funds are compulsory

Federal law dictates minimum amounts that employers must contribute to the superannuation accounts of their employees, on top of standard wages or salaries. This is known as the "superannuation guarantee" (SG). The SG rate has been gradually increasing over the years, reaching 10.5% in 2022 and is set to continue rising by 0.5% each year until it hits 12% in 2025.

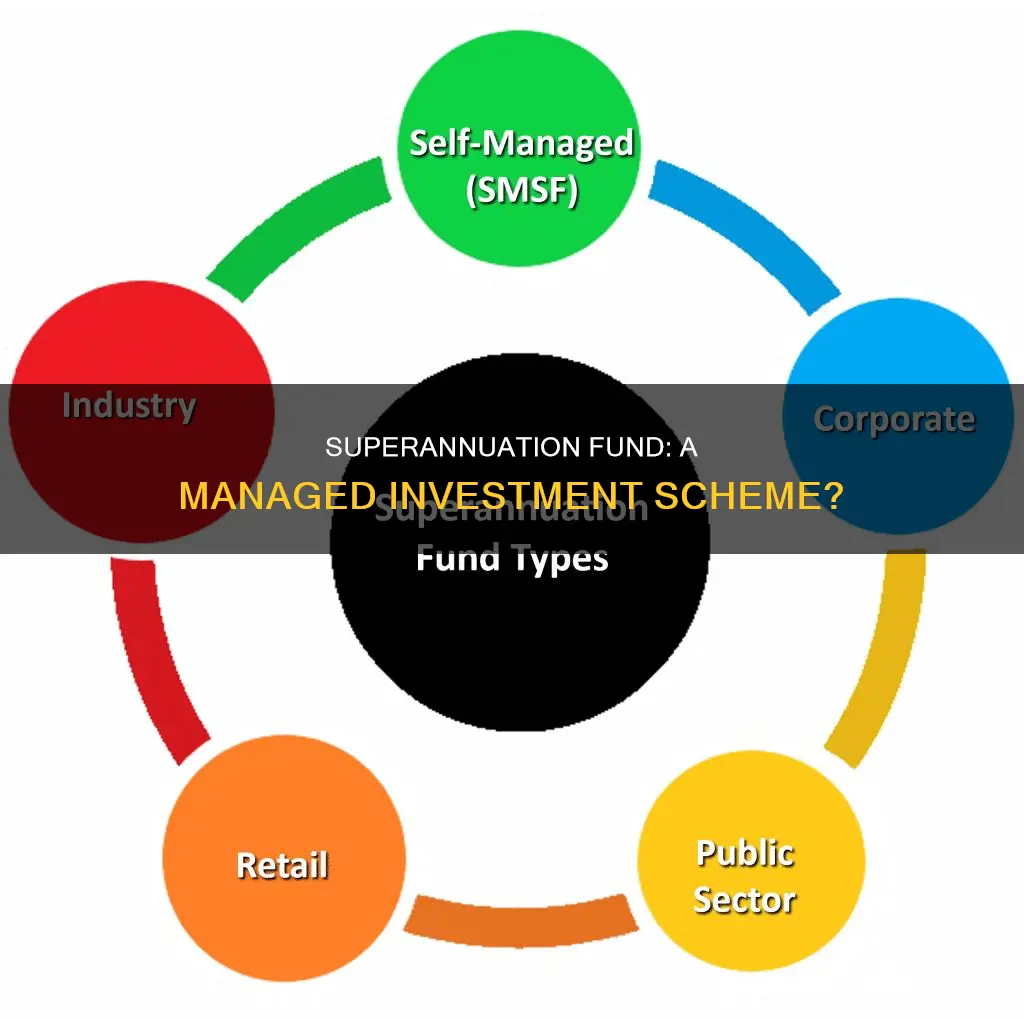

Most employees have their superannuation contributed to large funds, either industry funds or retail funds. Industry funds are not-for-profit mutual funds, managed by boards composed of industry stakeholders. Retail funds, on the other hand, are for-profit commercial funds, principally managed by financial institutions. However, some Australians can have their superannuation deposited into self-managed superannuation funds.

Employees are also encouraged to supplement these compulsory superannuation contributions with voluntary contributions, including diverting their wages or salary income into superannuation under salary sacrifice arrangements. It is important to note that contributions to superannuation accounts are subject to a concessional income tax rate of 15%.

Superannuation is a compulsory, tax-advantaged method of saving for retirement in Australia. While there was resistance to its introduction, particularly from small business groups, it now has widespread support.

Emergency Fund Strategies: Philippines Investment Options

You may want to see also

Frequently asked questions

A superannuation fund is an Australian pension program created by a company to benefit its employees. Funds deposited in a superannuation account will grow through appreciation and contributions until retirement.

A managed investment scheme, also known as a 'scheme' or 'pooled investment', involves multiple investors contributing money to gain an interest in the scheme. The money is then pooled together and used in a common enterprise, with a fund manager overseeing the operation of the scheme.

No, superannuation products such as regulated superannuation funds and approved deposit funds are not managed investment schemes.

Examples of managed investment schemes include cash management trusts, Australian equity schemes, international equity schemes, exchange-traded funds (ETFs), and agricultural schemes.

Superannuation funds offer lower fee structures, simple features, and investment choices. They can also follow you throughout your career, be accessed early in certain circumstances, and provide a guaranteed income throughout retirement.