Chase Bank offers a variety of investment services through J.P. Morgan Wealth Management. One of the investment options available is mutual funds, which are professionally managed portfolios of securities such as stocks, bonds, and other assets. Mutual funds are a convenient and cost-effective way for investors to diversify their investments across multiple securities. Chase offers access to thousands of different securities through mutual funds from a variety of public companies. Additionally, Chase provides a Self-Directed Investing account option, allowing investors to build their investment portfolios with unlimited $0 commission online trades.

| Characteristics | Values |

|---|---|

| Investment Options | Money Market Funds, Stocks, ETFs, Options, Mutual Funds, Treasuries, Brokered CDs, etc. |

| Yields | 4.82% average yield on money market funds |

| Bonuses | Up to $700 cash bonus |

| Commission | $0 commission online trades |

| Management | Professionally managed investment strategy |

| Accessibility | Chase Mobile app |

| Liquidity | Money market funds can be used to earn income on short-term cash |

What You'll Learn

Money market funds

There are several types of money market funds, including:

- Government money market funds: These invest in government securities, such as US Treasuries, and government-sponsored enterprises (GSEs).

- Municipal money market funds: These funds are often called tax-exempt funds because interest on municipal securities is generally exempt from federal income tax.

- Prime money market funds: Also called general-purpose money market funds, these invest in any of the security types listed above.

It is important to note that money market funds are not the same as money market accounts (MMAs). Money market funds are investment products that are not FDIC-insured, while money market accounts are a type of savings account that is FDIC-insured.

Invest Your 401k: Index Funds for Secure Retirement

You may want to see also

$0 commission online trades

Chase Bank offers $0 commission online trades with its J.P. Morgan Self-Directed Investing account. This allows you to build your own investment portfolio with access to thousands of investment options, including stocks, ETFs, options, mutual funds, treasuries, and brokered CDs.

With the Self-Directed Investing account, you can take control of your investments with unlimited commission-free online trades. The account offers transparent pricing, helping you keep more of your money in your portfolio.

You can open a J.P. Morgan Self-Directed Investing account with as little as $1 and start trading with unlimited $0 commission online trades. The account provides access to various investment options, including stocks, ETFs, options, mutual funds, and fixed income.

The Self-Directed Investing account also offers a wide range of money market funds with low minimum investment requirements. Money market funds are a type of mutual fund that can provide a convenient option for excess cash, offering potentially higher yields, stability, and capital preservation.

Additionally, Chase's You Invest platform offers 100 commission-free online stock and ETF trades for one year, with the opportunity to earn unlimited commission-free trading. You Invest is available within the Chase and J.P. Morgan mobile apps and websites, providing an easy-to-use platform for new and experienced investors.

Liquid Fund Investment Strategies: Where to Invest?

You may want to see also

Self-directed investing

You can choose from a wide range of money market funds with low minimum investment. Money market funds are a type of mutual fund that can provide a convenient option for excess cash. While they are not FDIC-insured like a savings account, they provide potentially higher yields, stability, and capital preservation. They are considered one of the lowest-risk investments as they commonly invest in short-term government securities, tax-exempt municipal securities, and corporate and bank debt securities with low credit risk.

With a J.P. Morgan Self-Directed Investing account, you can choose from thousands of other investments, including stocks, ETFs, options, mutual funds, treasuries, and brokered CDs. You can manage all your banking, investing, and borrowing in one place and make instant transfers online and in the Chase Mobile® app.

To get started, you can move cash instantly from a Chase checking or savings account to your J.P. Morgan Wealth Management account as often as you want. You can also transfer your investments from another financial institution with their simple online tool.

With fractional shares, you can trade with as little as $5. You can also take advantage of J.P. Morgan research, stock ratings, and price targets to back up your investments with their expertise.

Invest in Your Child's Future: Index Funds for College

You may want to see also

Capital gains

Chase Bank offers a range of investment services and wealth management options, including mutual funds. Mutual funds are a type of investment where multiple investors pool their money together to purchase stocks, bonds, or other securities. This allows individual investors to benefit from the expertise of a professional fund manager and gain access to a diversified portfolio.

Now, when it comes to capital gains in the context of mutual funds, there are a few key points to understand:

Understanding Capital Gains:

Types of Capital Gains:

There are typically two types of capital gains: long-term and short-term. Long-term capital gains refer to profits from the sale of assets held for more than a year, while short-term capital gains are from assets held for one year or less. The tax treatment of these gains can vary, with long-term capital gains often being taxed at lower rates than short-term gains.

Taxation of Capital Gains Distributions:

When a mutual fund realizes capital gains from the sale of assets, those gains are typically distributed to the fund's shareholders. These capital gains distributions are taxable, and the taxes are generally due in the same tax year the distribution is received. However, if the mutual fund is held in a tax-deferred retirement account, such as an IRA or 401(k), the taxes may be deferred until withdrawal during retirement.

Reinvesting Capital Gains:

Shareholders have the option to take capital gains distributions as immediate payments or reinvest them in additional fund shares. Reinvesting capital gains can impact the timing and amount of taxes owed. When reinvested, the distribution increases the cost basis and the number of shares owned.

Reporting Capital Gains:

In the United States, capital gains distributions from mutual funds are generally reported on Schedule D (Form 1040), Capital Gains and Losses. Shareholders are required to pay taxes on these distributions, regardless of whether they choose to take the distributions as cash or reinvest them in the fund.

Mutual Funds and Gun Investments: Where Does Your Money Go?

You may want to see also

Passive and active funds

Chase Bank offers a range of investment services and wealth management options, including access to money market funds, stocks, ETFs, options, mutual funds, treasuries, and brokered CDs. While the bank itself does not explicitly state whether it is a mutual fund investment, it does provide its customers with investment opportunities and wealth management advice.

Now, let's discuss the differences between passive and active funds in 4 to 6 paragraphs.

Passive investing involves buying and holding investments with minimal portfolio turnover. It is a long-term strategy where investors buy a basket of stocks and continue to do so regularly, regardless of the market's performance. This approach requires investors to disregard the market's short-term fluctuations and maintain a buy-and-hold mentality. Passive investors often invest in index funds, which track a major index like the S&P 500 or Dow Jones Industrial Average. The benefits of passive investing include ultra-low fees, transparency of assets, and tax efficiency due to the lack of frequent trading. However, passive investing may result in small returns as it rarely beats the market, and investors have limited control over their specific investments.

On the other hand, active investing involves a fund manager or investor actively buying and selling investments based on their short-term performance, with the goal of outperforming the average market returns. Active investors research and closely follow companies, making investment decisions based on their analysis. This approach requires a hands-on, active participant or portfolio manager. The advantages of active investing include flexibility in investment choices, hedging capabilities, and risk management strategies. Active investing also allows for tailored tax management strategies for individual investors. However, it tends to be more expensive due to transaction costs and analyst team salaries.

While both strategies have their advantages, passive investing has historically earned more money than active investing. Passive investing is more prevalent among retail investors due to its low fees and long-term focus. In contrast, active investing is more suitable for those who want to actively manage their portfolio and attempt to beat the market returns.

Ultimately, the choice between passive and active investing depends on an investor's goals, risk tolerance, and time horizon. Some investors even choose to blend the two strategies to take advantage of the strengths of both.

In conclusion, passive investing is generally recommended for most investors due to its low costs and strong long-term performance. However, active investing can be useful for specific portions of a portfolio or for investors with access to elite advisers who can provide valuable insights.

Bond Fund Basics: Strategies for Investing Wisely

You may want to see also

Frequently asked questions

Mutual funds allow you to diversify your portfolio quickly and easily across many different securities, which can help reduce risk. They have low maintenance fees and require small initial investments, so you get cost-effective portfolio management and can start investing with as little as $1.

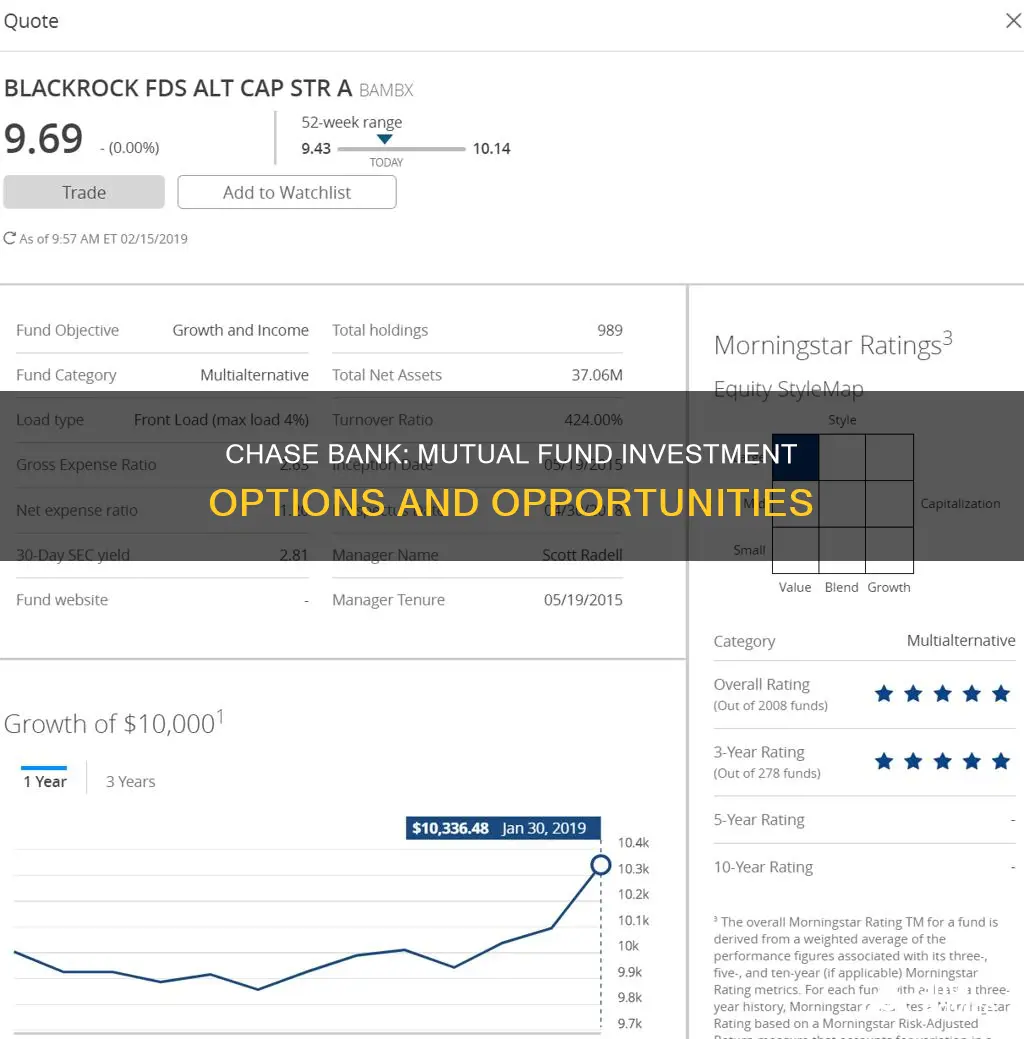

Mutual fund managers combine several securities into one investment portfolio. Investors buy shares of the fund and managers use that capital to invest according to the fund’s objective. The value of the fund increases or decreases over time based on the performance of the underlying investments, affecting the investor's capital.

The most common mutual funds are stock or equity funds and bond or fixed-income funds, which target one type of asset. Balanced funds invest in a mixture of stocks and bonds, while money market funds focus on short-term investments issued by the U.S. government or U.S. corporations with high credit ratings.

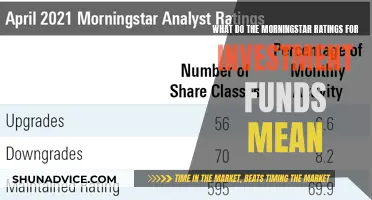

Passively managed mutual funds aim to provide returns that closely match the performance of a market index like the S&P 500. Actively managed funds, on the other hand, attempt to outperform an index. This investment approach requires more research and trading than passive management, typically resulting in higher fees.

You can start by opening an IRA or general investment account. To invest in a mutual fund, you can either work with a J.P. Morgan Advisor or use the Self-Directed Investing tool.