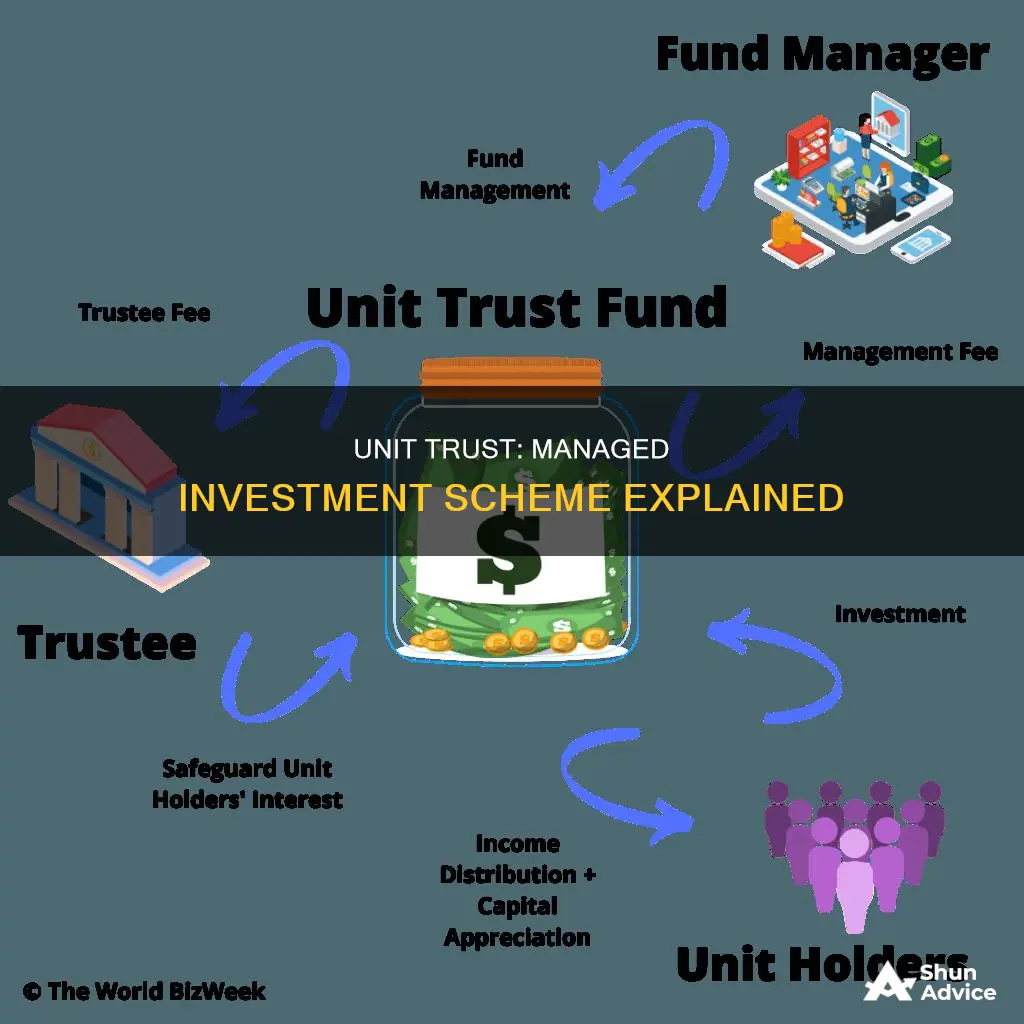

A unit trust is a type of investment scheme where multiple investors pool their money to purchase a larger asset, typically property, than they would be able to on their own. This type of scheme is known as a managed investment scheme (MIS) in Australia and is often structured as a unit trust. In a unit trust or MIS, investors hold units in the trust and rely on a managing party to invest the pooled funds for a profit, which is then distributed to the investors on a pro-rata basis.

| Characteristics | Values |

|---|---|

| Definition | A managed investment scheme is a scheme that enables a group of investors to contribute money that is pooled for investment to produce a financial benefit. |

| Investors | Multiple investors contribute money or money's worth and get an interest in the scheme. 'Interests' in a scheme are a type of financial product and are regulated by the Corporations Act. |

| Investor Control | Investors do not have day-to-day control over the operation of the scheme. |

| Investment Types | Managed investment schemes cover a wide variety of arrangements and underlying assets, including cash management trusts, equity schemes, agricultural schemes, mortgage schemes, and exchange-traded funds (ETFs). |

| Manager | A 'responsible entity' (also referred to as a 'fund manager') operates the scheme and makes major decisions related to property purchase, management, and investment. |

| Registration | A managed investment scheme can be either registered or unregistered. All schemes must be operated by a manager with an Australian Financial Services Licence (AFS Licence). |

| Unit Trust | These trust-based investment schemes can be structured as unit trusts, where investors hold units in the trust. |

What You'll Learn

Unit trusts are a type of managed investment scheme

Managed investment schemes, or MISs, are a popular investment arrangement in Australia, allowing investors to pool their money together to purchase larger property assets than they would otherwise be able to afford on their own. The ownership of the property, as well as the returns and outgoings generated from the investment, are shared among the investors in the scheme.

A managed investment scheme has three key features: firstly, investors contribute money to acquire rights or interests in the benefits produced by the scheme; secondly, all contributions are pooled together or used for a common purpose to produce benefits; and thirdly, the investors are not involved in the day-to-day control and operation of the scheme.

Unit trusts are a type of trust-based investment scheme, where investors hold units in the trust and rely on a managing party to invest the pooled funds for a profit. This profit is then distributed to the members of the scheme on a pro-rata basis.

Investing vs. Saving: Which is Riskier?

You may want to see also

Managed investment schemes are also known as 'pooled investments'

Managed investment schemes, also known as pooled investments, enable a group of investors to contribute money that is collectively invested to produce a financial benefit. These trust-based investment schemes, also referred to as managed funds or collective investments, are typically structured as unit trusts.

In a managed investment scheme, multiple investors contribute money or money's worth and obtain an interest in the scheme. These "interests" are a type of financial product regulated by the Corporations Act. The money from different investors is then pooled together and used for a common enterprise.

The key feature of a managed investment scheme is that investors are not actively involved in the day-to-day operations of the scheme. Instead, a "responsible entity", also known as a fund manager, is responsible for operating the scheme and making major decisions.

Managed investment schemes cover a wide range of arrangements and underlying assets, including cash management trusts, equity schemes, agricultural schemes, exchange-traded funds, and more. These schemes provide investors with access to a diversified portfolio of assets that may otherwise be inaccessible to individual investors.

By participating in a managed investment scheme, investors can benefit from the collective pooling of funds to invest in larger assets, such as commercial real estate, and enjoy the convenience of having a professional manager handle the major decisions and operations of the scheme.

Stable Investment Portfolios: Strategies for Long-Term Success

You may want to see also

Investors contribute money to gain interests in the scheme

A managed investment scheme (MIS) is a type of financial product that enables multiple investors to pool their money together to purchase larger assets, such as property, that they would not be able to acquire on their own. This collective investment structure is often referred to as a "pooled investment".

In a managed investment scheme, investors contribute money to gain interests in the scheme. This contribution serves as consideration to acquire rights (interests) to benefits produced by the scheme. These "interests" are a type of financial product and are regulated by the Corporations Act. The investors' money is then pooled together to further produce benefits, which may be financial or consist of rights or interests in property.

For example, in the context of a managed investment scheme offering commercial or residential property investment, ownership of the property is shared among the investors, and so are the returns (and outgoings) generated from the investment.

Managed investment schemes are popular as they provide investors with access to assets and asset classes that may otherwise be inaccessible, allowing for portfolio diversification. These schemes are typically structured as unit trusts, where investors hold units in the trust and rely on a managing party to invest the pooled funds for profit, which is then distributed to members on a pro-rata basis.

It is important to note that only 'collective' investments are considered managed investment schemes. Some examples of investments that do not fall under this category include regulated superannuation funds, approved deposit funds, and direct purchases of shares or equities.

ESG Portfolios: Worthy Investment or Passing Fad?

You may want to see also

A 'responsible entity' operates the scheme

A responsible entity (also called a fund manager) operates a managed investment scheme. The role of a responsible entity was introduced by the Managed Investments Act 1998, which replaced the two-tiered trustee/management company regime with a single responsible entity.

The responsible entity holds scheme property on trust for scheme members and has the power to appoint an agent to act on its behalf in connection with a scheme. This may include the appointment of a custodian to hold scheme property.

A responsible entity must be an Australian public company with certain levels of net tangible assets, depending on the value of the scheme's assets. The entity must also hold an Australian Financial Services Licence (AFS Licence) and meet minimum net tangible asset requirements.

When acting on behalf of an investment scheme, the responsible entity must exercise a reasonable degree of care and diligence, act in the best interest of members, and treat all members equally.

A responsible entity can be either "internal" or "external". An internal responsible entity is owned by the same group as the fund manager, while an external responsible entity is run separately from the fund manager. In the case of an external responsible entity, a management agreement is typically entered into with the fund manager.

Partnership Investment Strategies: Portfolios Over $10 Million

You may want to see also

Managed investment schemes cover a wide variety of arrangements

Managed investment schemes (MISs) cover a diverse range of arrangements, catering to various investor preferences and objectives. MISs are a popular investment structure in Australia, allowing multiple investors to pool their funds for purchasing larger assets, particularly property. The ownership and resulting returns and expenses are shared among the investors.

The types of managed investment schemes available include cash management trusts, Australian equity (share) schemes, international equity schemes, exchange-traded funds (ETFs), and agricultural schemes. These schemes can provide investors with access to assets such as commercial real estate or residential property investments.

Direct property funds, for instance, are a type of MIS where investors collectively purchase a larger property asset than they could individually afford. The fund manager, typically a Pty Ltd business or public company, oversees the major decisions regarding property purchases, management, and investment strategies.

Another example is Australian equity (share) schemes, where investors pool their funds to invest in Australian shares. These schemes often have a large number of participants, sometimes in the thousands, and the funds are collectivelysection = managed by a fund manager.

Additionally, exchange-traded funds (ETFs) are MISs that trade on stock exchanges, combining the diversification of mutual funds with the trading flexibility of stocks. ETFs can invest in various assets, including equities, bonds, commodities, and derivatives, providing investors with a diverse range of options.

The wide variety of managed investment schemes available offers investors numerous opportunities to build their wealth and access a range of assets and asset classes that may otherwise be inaccessible through individual investments.

National Savings and Investments: A Secure Financial Future

You may want to see also