Investing 20,000 rupees per month with the goal of reaching 1 crore can be a daunting task, but it is achievable with careful planning and consideration of factors such as age, existing portfolio, asset allocation, and market conditions. One popular strategy is to invest through a Systematic Investment Plan (SIP), which allows for regular, fixed contributions to mutual funds, benefiting from rupee cost averaging and the power of compounding. With an average annual interest rate of 12%, an investor can expect to generate approximately 46.5 lakh over 10 years. To reach the goal of 1 crore, a longer time horizon, such as 15 or 20 years, may be necessary. Starting early and maintaining investment discipline are key to success.

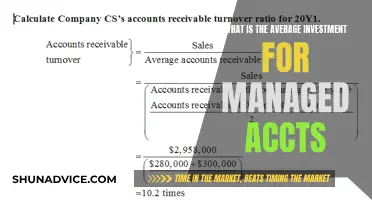

| Characteristics | Values |

|---|---|

| Timeframe | 5-30 years |

| Monthly Investment | INR 20,000 |

| Annual Return | 12-15% |

| Final Amount | INR 1 crore |

What You'll Learn

Start early and stay consistent

Starting early and staying consistent are key principles when it comes to investing. The power of compounding means that the earlier you start investing, the more time your money has to grow. This gives you a head start in working towards your financial goals. Consistency is also important – by staying invested for the long term, you maximise your returns and give your investments the best chance to grow.

When it comes to investing a small amount like Rs 20,000, consistency is especially important. Even though Rs 20,000 may not seem like a lot, it can add up to a substantial sum over time with compound interest. For example, investing Rs 20,000 per month for 10 years at a 12% interest rate could generate Rs 47 lakh, more than double the amount invested. Staying consistent with your investments also means continuing to invest even during market downturns. While it can be tempting to pull your money out during these times, staying invested will help you take advantage of the market's eventual recovery.

In addition to starting early and staying consistent, there are a few other things to keep in mind. First, establish your financial objectives. Are you investing for retirement, to buy a house, or to fund your child's education? Knowing your goals will help you create a plan to achieve them. Second, do your research and choose the right investments for your goals and risk tolerance. Mutual funds, stocks, and exchange-traded funds (ETFs) are all popular options, but it's important to understand the risks and potential returns of each. Finally, consider working with a financial advisor who can help you create a personalised investment plan and provide guidance along the way.

Is the Investment Management Certificate Worth the Effort?

You may want to see also

Choose the right investment options

There are several investment options available to help you reach your financial goal of Rs. 1 crore. Here are some of the best strategies and options to consider:

- Systematic Investment Plan (SIP): A SIP is one of the most preferred routes for investors, especially those who are looking to invest a fixed amount regularly. It offers flexibility in terms of frequency, ranging from monthly to annual instalments. SIPs provide good annual interest and are a proven option for small investors. By investing Rs. 20,000 per month in a SIP for 15 years, you can potentially generate Rs. 1 crore or more, depending on the interest rate.

- Mutual Funds: Mutual funds are a great way to achieve significant financial goals. You can invest in Equity Mutual Funds, which offer the potential for double-digit returns over the long term. When investing in mutual funds, you can choose from various options such as Large & Mid Cap, Flexi Cap, and ELSS. It is important to conduct thorough research or consult a financial advisor to find the best funds that align with your goals and risk tolerance.

- Lumpsum Investment: This strategy involves investing a large amount of money at once. If you have a substantial amount of savings, you can invest it all in a high-performing mutual fund to achieve your Rs. 1 crore goal faster. Lumpsum investments benefit from immediate market exposure, allowing your money to grow from the start.

- Step-up SIP: Step-up SIPs allow you to increase your SIP amount periodically, usually annually. This is beneficial for those who expect their income to rise over time, as it enables them to invest more progressively. By starting with a lower SIP amount and increasing it gradually, you can work towards your Rs. 1 crore goal while maintaining financial flexibility.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but are traded like stocks on an exchange. They offer diversification across specific indices, sectors, or commodities. ETFs have lower expense ratios than mutual funds and are highly liquid. Investing in high-growth ETFs can potentially lead to significant returns, making them suitable for investors seeking growth, diversification, and flexibility.

- Direct Stock Investment: Directly investing in stocks can offer high returns but comes with higher risk compared to mutual funds and ETFs. To mitigate this risk, it is crucial to conduct thorough research or consult a financial advisor to identify companies with strong fundamentals, growth prospects, and competitive advantages.

- Bonds: Bonds are fixed-income securities that offer lower risk and provide regular interest payments. While they generally offer lower returns than equities, bonds can contribute to the diversification of your portfolio. To achieve Rs. 1 crore, you may need to combine bonds with other higher-yielding investments.

- Unit Linked Insurance Plans (ULIPs): ULIPs combine investment and insurance, allocating a portion of the premium to life insurance while investing the rest in equity or debt funds. ULIPs offer tax benefits and the flexibility to switch between funds based on market conditions. They can be a good option for those seeking insurance coverage along with market-linked returns.

It is important to note that the choice of investment options depends on your financial goals, risk tolerance, and time horizon. Consulting a financial advisor can help you make informed decisions and enhance your investment strategy.

HNIs' Investment Strategies in India: Where Do They Invest?

You may want to see also

Diversify your portfolio

Diversifying your portfolio is a crucial step in optimising returns while managing risk. Here are some strategies to achieve a well-diversified portfolio:

Spread the Wealth

Diversification is about not putting all your eggs in one basket. Invest in a variety of asset classes, sectors, and companies. Consider investing in equities, commodities, exchange-traded funds (ETFs), and real estate investment trusts (REITs). Think globally to spread your risk and potentially reap bigger rewards. Limit yourself to a manageable number of investments, around 20 to 30, to effectively monitor and manage your portfolio.

Consider Index or Bond Funds

Index funds and fixed-income funds can be a great addition to your portfolio. These funds track various indexes or try to match the performance of broad indexes like the bond market. They offer long-term diversification and hedge your portfolio against market volatility. Index funds also tend to have low fees, putting more money back in your pocket. However, keep in mind that passive management in inefficient markets can be a drawback.

Keep Building Your Portfolio

Regularly add to your investments. If you have a lump sum to invest, consider using dollar-cost averaging to smooth out market volatility. This strategy involves investing the same amount of money over a period of time, buying more shares when prices are low and fewer when prices are high.

Know When to Get Out

Stay informed about your investments and overall market conditions. Keep an eye on the companies you invest in to know when it's time to cut your losses and move on to the next investment opportunity.

Keep an Eye on Commissions

Understand the fees you are paying to your broker or investment firm. Some charge monthly fees, while others charge per transaction. Be aware of any changes in fees, as these can eat into your returns. With the rise of online brokers, commission-free trading in certain assets is becoming more common.

Tips for Implementation

When diversifying your portfolio, consider the following:

- Consult a financial advisor to determine an asset allocation strategy that aligns with your risk tolerance and investment goals.

- Conduct thorough research before investing in new asset classes. Understand the expected returns and associated risks.

- Invest in a staggered manner. Don't allocate all your capital to new asset classes at once.

- Periodically rebalance your portfolio to maintain your desired asset allocation.

- Monitor your portfolio's performance using metrics like risk-adjusted returns and downside deviation.

- Stay updated on economic trends and adjust your asset allocation accordingly.

Smart Strategies to Turn $200K into $1 Million

You may want to see also

Leverage savings wisely

Leveraging your savings wisely is a crucial aspect of achieving your financial goals. Here are some strategies to make the most of your savings:

Establish Clear Financial Objectives:

Before you start investing, it is essential to define your financial objectives. Ask yourself, "What is the purpose of this money?" Do you want to save for retirement, your children's education, or perhaps the purchase of a new home? Setting clear goals will help you make informed decisions about your savings and investments.

Plan Your Investment Journey:

Once you have established your financial objectives, create a well-organised plan to achieve them. Focus on both short-term and long-term goals. For example, in the short term, you may want to reduce debt and establish an emergency fund, while in the long term, you aim to grow your wealth. Assess your progress regularly and make adjustments as needed to stay on track.

Explore Equity Mutual Funds:

Consider investing in equity mutual funds, which distribute money across a diverse range of stocks. This diversification reduces the risk of losses. Conduct thorough research and seek professional advice to choose the mutual fund that aligns with your investment goals and risk tolerance. Remember that investing in mutual funds requires a long-term commitment.

Optimise Your Existing Portfolio:

Review your existing portfolio to identify areas where you can optimise your investments. Look for opportunities to reallocate your funds to maximise returns. For example, you may consider selling underperforming assets and investing the proceeds in higher-growth opportunities. Diversifying your portfolio can also help manage risk and improve returns.

Take Advantage of Tax Benefits:

Taxes can significantly impact your wealth accumulation. Stay informed about tax obligations and explore tax-saving investment schemes. For instance, consider investing in the Public Provident Fund (PPF), Equity Linked Saving Scheme (ELSS), or National Pension System (NPS), which offer tax exemptions and deductions. By minimising taxes, you can retain more of your investment returns.

Consult a Financial Adviser:

Leveraging your savings wisely often involves complex decisions. Consider consulting a qualified financial adviser who can provide personalised guidance based on your unique circumstances. They can help you assess your risk tolerance, create a comprehensive financial plan, and make informed investment choices to achieve your financial objectives.

Strategies to Optimize Your Investment Portfolio Performance

You may want to see also

Consult a financial advisor

Consulting a financial advisor is a crucial step when considering how to make 1 crore by investing 20,000. Here are some reasons why:

Expert Knowledge

Financial advisors are professionals who possess extensive knowledge of the investment landscape, including various investment vehicles, market trends, and risk management strategies. They can provide valuable insights and guidance to help you make informed decisions about your investments.

Goal Setting and Planning

A financial advisor will work with you to clearly understand your financial goals, risk tolerance, and time horizon. They will help you set realistic and measurable financial goals, creating a comprehensive financial plan tailored to your needs. This plan will outline the specific investment strategies, products, and milestones to help you achieve your target of making 1 crore.

Investment Strategy

Based on your financial situation and goals, a financial advisor will devise an investment strategy that aligns with your risk profile and time horizon. They can recommend a diverse range of investment options, such as mutual funds, exchange-traded funds (ETFs), stocks, bonds, or Unit Linked Insurance Plans (ULIPs). The advisor will guide you on the most suitable investment vehicles, taking into account their potential returns, risks, and liquidity.

Market Analysis and Monitoring

Financial advisors continuously monitor the market and stay updated with economic trends, industry developments, and investment performance. They will help you navigate the complexities of the market, making data-driven decisions to maximise returns and minimise risks. Regular portfolio reviews and rebalancing will be conducted to ensure your investments remain aligned with your goals.

Tax Efficiency

Taxes can significantly impact your investment returns. A financial advisor will help you understand the tax implications of your investments and employ tax-efficient strategies. They can guide you on tax-saving investment schemes, such as the Public Provident Fund (PPF), Equity Linked Saving Scheme (ELSS), and National Pension System (NPS), which offer tax exemptions and deductions.

Discipline and Behavioural Coaching

Sticking to an investment plan requires discipline and behavioural coaching, which a financial advisor can provide. They will help you maintain a long-term perspective, avoid emotional decision-making, and ensure you remain committed to your investment strategy, especially during market volatility.

Risk Management

A crucial aspect of investing is managing risk. Financial advisors are adept at assessing and mitigating investment risks. They will help you understand the risks associated with different investment options and ensure that your portfolio is appropriately diversified to minimise potential losses.

Ongoing Support and Review

Financial advisors provide ongoing support and regularly review your investment portfolio to ensure it remains aligned with your financial goals. They will help you navigate life changes, such as career transitions, marriage, or having children, and adjust your investment strategy accordingly.

Access to Resources and Tools

Financial advisors have access to sophisticated resources, tools, and research that may not be readily available to individual investors. These resources enable them to conduct in-depth analysis, identify suitable investment opportunities, and make more informed decisions.

Peace of Mind

Investing can be complex and overwhelming, especially when aiming for a substantial financial goal like making 1 crore. A financial advisor provides peace of mind by offering personalised advice, answering your questions, and addressing your concerns throughout your investment journey.

While it is possible to make 1 crore by investing 20,000, consulting a financial advisor can significantly enhance your investment strategy, increase your chances of success, and provide valuable guidance and support along the way.

Savings, Investments, and the Economy's Vital Balance

You may want to see also

Frequently asked questions

A Systematic Investment Plan (SIP) is one of the most popular ways to invest 20,000 per month for 10 years or more.

By investing 20,000 per month for 10 years at a 12% interest rate, you can generate approximately 47 lakhs, which is more than double the amount invested.

It will take approximately 15 years to make 1 crore by investing 20,000 per month, assuming an average interest rate of 12%.

Creating a budget, reducing unnecessary expenditures, adopting cost-saving habits, and tackling high-interest debt are some essential strategies to enhance your financial stability and achieve your long-term goals.

You can choose from systematic investment plans (SIPs), lumpsum investments, or step-up SIPs in mutual funds. Investing in high-growth assets like stocks, exchange-traded funds (ETFs), or a combination of different investment vehicles can maximize returns.