Buying securities can be considered an investment or consumption depending on the context and the type of security. Securities refer to various investments such as stocks, bonds, investment contracts, notes, and derivatives. They are financial instruments used to raise capital and can be categorised as equity, debt, or hybrids.

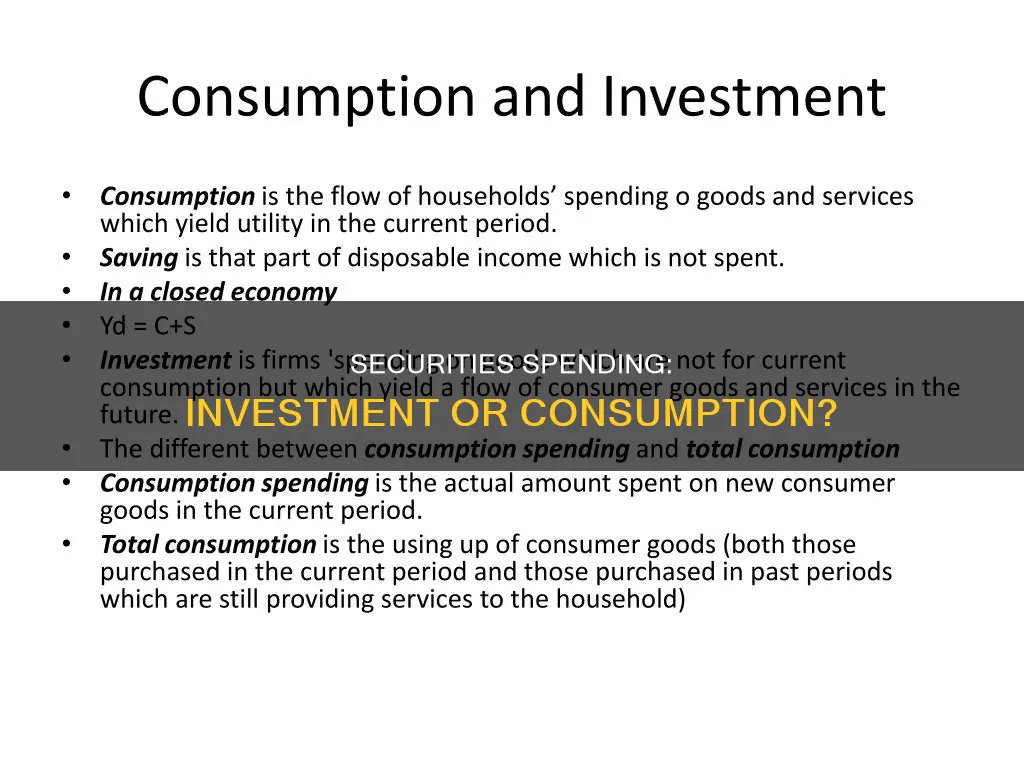

From an economic perspective, consumption refers to the purchase of goods and services for current utility, leading to higher living standards in the short term. On the other hand, investment involves spending on capital goods to acquire future utility, increasing the capital stock.

For example, purchasing stocks or mutual funds is considered an investment as it involves using funds to generate long-term profits. However, buying securities to satisfy immediate needs or desires could be considered consumption. Ultimately, the distinction between investment and consumption depends on the specific circumstances and the intention behind the purchase of securities.

| Characteristics | Values |

|---|---|

| Definition | Investment is expenditure on capital goods for the acquisition of future utility. Consumption is the purchase of goods and services for the acquisition of current utility. |

| Purpose | Investment is for future growth and to meet financial objectives. Consumption is for immediate gratification. |

| Returns | Investment provides returns in the form of profits or dividends. Consumption does not provide returns. |

| Risk | Investment carries a certain level of risk. Consumption does not carry risk. |

| Impact on GDP | Consumption increases GDP in the short run. Investment may not have an immediate impact on GDP but can lead to higher GDP in the long run. |

| Role in the economy | Consumption is the ultimate goal of economic activity and is a factor in determining GDP. Investment is necessary to grow the economy. |

| Examples | Buying a car for personal use is consumption. Buying a van for business deliveries is investment. |

What You'll Learn

Securities as an investment vehicle

Securities are a type of investment vehicle. They are fungible and tradable financial instruments used to raise capital in public and private markets. The term "security" refers to a multitude of different investments, such as stocks, bonds, investment contracts, notes, and derivatives.

There are three main types of securities: equity, debt, and hybrids. Equity securities provide ownership rights to shareholders, who are typically able to profit from capital gains when they sell the securities (assuming they have increased in value). Debt securities represent borrowed money that must be repaid, with terms stipulating the loan size, interest rate, and maturity or renewal date. Hybrid securities combine aspects of both debt and equity.

Securities are a common investment vehicle for retirement savings, and they are also important for companies looking to raise capital. For example, companies can generate large amounts of money by going public and selling stock in an initial public offering (IPO).

When considering the difference between consumption and investment, it is important to note that consumption is the purchase of goods and services for current utility, while investment is expenditure on capital goods for future utility. Investment increases the capital stock and can lead to higher living standards in the long term, although it may require less consumption in the short term.

Ford: A Smart Investment Move

You may want to see also

The immediate gratification of consumption

Consumption is the purchase of goods and services for immediate utility. It increases current utility and leads to higher living standards in the short term.

The desire for immediate gratification can be explained by both psychological and evolutionary factors. Psychologically, there is discomfort associated with self-denial, and resisting this instinct is challenging. From an evolutionary perspective, the availability of food was uncertain in prehistoric times, so humans with a strong tendency to grab immediate rewards were more likely to survive and reproduce.

The impact of immediate gratification on savings and investing behaviour is significant. People with a higher "rate of time preference", or a stronger focus on the present, tend to avoid or delay investment behaviours. This is because investment is about spending money on capital goods for future utility, which requires giving up some consumption in the present.

However, it is important to note that consumption is not always at odds with investment. For example, a firm may purchase a van to make deliveries to consumers, which is an investment that enables consumption.

Who Manages Your Money?

You may want to see also

Investment as capital preservation

Investors employing this strategy seek out safe, short-term investment instruments with minimal risk, such as Treasury bills, certificates of deposit (CDs), savings accounts, and money market funds. These investments are often insured by the Federal Deposit Insurance Corporation (FDIC) up to a certain amount, providing an additional layer of security.

While capital preservation prioritises the protection of existing wealth over aggressive growth, it is important to consider the potential drawbacks. The primary disadvantage is the impact of inflation on the returns of these "safe" investments over time. Inflation can erode the real value of an investment, resulting in a loss of purchasing power. For example, a moderate annual inflation rate of 3% can halve the real value of an investment in 24 years. Therefore, investors employing a capital preservation strategy may consider inflation-adjusted investments, such as Treasury Inflation-Protected Securities (TIPS), to mitigate this risk.

It is worth noting that capital preservation and growth as unified investment goals are not compatible in the short run. True capital preservation implies eliminating any volatility, including both negative and positive fluctuations. However, in the stock market, volatility is predominantly upward-trending. By removing the downside, the upside potential is also forfeited. Therefore, investors seeking growth should be prepared for short-term volatility, as it is inherent to the pursuit of higher returns.

In summary, investment as capital preservation is a prudent strategy for individuals who prioritise safeguarding their existing wealth over aggressive growth, particularly those with a shorter investment time horizon. While this approach offers stability, it may result in lower returns and is susceptible to the erosive effects of inflation. Investors should carefully consider their risk tolerance, time horizon, and financial goals when determining whether to adopt a capital preservation strategy.

Strategic Retirement: Navigating the Best Investment Options for Your $450,000

You may want to see also

Consumption as an economic driver

Consumption is the purchase of goods and services for immediate utility, and it increases current utility and leads to higher living standards in the short term. It is often regarded as the "'engine' of the economy, making up 70% of GDP. Consumption is seen as a key economic driver, with the belief that an increase in consumption leads to economic growth.

However, this is a misconception. Consumption is usually the result of growth rather than the cause. An exception occurs when central bank policy causes an excessive expansion of credit, creating an artificial sense of prosperity that eventually leads to inflation or an overexpansion that results in a collapse in profitability. In most cases, consumption follows economic growth, and consumer spending is not a reliable indicator of economic health.

For example, during the 2001 recession in the US, consumption spending increased, even as employment and investment fell. This was fuelled by easy credit, which can create an illusion of economic growth. Similarly, in China, consumption has been increasing at a global rate of 10% annually for a decade, despite a decline in GDP growth. This can be attributed to successful urbanization and industrialization processes, which have led to higher incomes and a rising savings rate.

Thus, while consumption can lead to short-term gains, it is not a sustainable driver of long-term economic growth. Instead, investment in productive activities, especially manufacturing, is necessary for sustained boosts to an economy.

Mortgage and Market: Navigating the Investment Dilemma

You may want to see also

Securities as a means to raise capital

Securities are a crucial means for businesses to raise capital, particularly when they have exhausted other options such as owner's capital, gifts from friends and family, and lines of credit or loans. This is especially true for small businesses, which often require capital to sustain themselves before becoming profitable.

There are two primary ways for companies to raise capital through securities: equity financing and debt financing. Equity financing involves selling ownership in a business, often in the form of stocks, partnership interests, or limited liability company interests. In contrast, debt financing entails selling debt instruments, such as bonds or notes, with the promise to repay the investors at a later date.

When issuing securities, companies must comply with federal and state securities laws, which are designed to protect investors while facilitating capital formation and economic growth. In the United States, securities offerings must be registered or exempt from registration under federal and state laws. Small businesses often qualify for exemptions from federal registration with the Securities and Exchange Commission (SEC) and may also be exempt from state registration, depending on the state.

The process of issuing securities can be complex and typically requires the assistance of legal and financial professionals. Companies must carefully prepare offering materials, ensuring full disclosure of all material information to prospective investors. This includes details such as the terms of the offering, the company's business, how the funds will be used, financial information, and any risks associated with the investment.

Securities offerings provide businesses with access to capital, enabling them to fund their operations, expansion plans, and future projects. They also offer investors the opportunity to gain ownership in a business or receive fixed returns through debt instruments. However, it is important to note that investing in securities carries risks, and investors should carefully consider all information before making investment decisions.

Investing in People: A Guide

You may want to see also

Frequently asked questions

Consumption is the purchase of goods and services for immediate utility, while investment is expenditure on capital goods for future utility. An example of consumption is a householder buying a car for their daily use. An example of investment is a firm buying a van to make deliveries.

Consumption is the start and end of all economic activity. It is what fuels production and modern economists highly value the amount of consumption in society.

Securities are a multitude of different investments, such as stocks, bonds, investment contracts, notes, and derivatives. They are fungible and tradable financial instruments used to raise capital in public and private markets.