Ford Motor Company (NYSE: F) has been a disappointing investment in the past, but there are some signs that now might be a good time to buy. The company's share price has risen by 25% in the past couple of months, and it is still undervalued with a bright future outlook. Ford's stock is currently trading at US$12.14, but its intrinsic value is $16.45. The company's earnings growth is expected to be in the teens in the upcoming years, and its dividend yield is 5.1%.

However, there are some risks to investing in Ford. The company has a history of poor shareholder returns, and its EV ambitions have been disappointing. There are also concerns about its new labour contract, which will cost billions over the next few years, and its lack of economic moat.

| Characteristics | Values |

|---|---|

| Share price | $13.47 as of Jul 11, 2024 |

| Share price change | +2.28% on Jul 11, 2024 |

| 52-week high | $15.42 |

| 52-week low | $9.63 |

| Market capitalisation | $46.2 billion as of May 30, 2024 |

| Price-to-earnings ratio | 7.3, 7.6, 12.1 |

| Trailing 12-month revenue | $177.5 billion as of May 30, 2024 |

| Profit margin | 2.2% |

| Quarterly sales growth | 3.1% |

| Expected earnings | $1.995 per share for the current fiscal year |

| Dividend yield | 5.1%, 5.4%, 6.7% |

| Revenue growth | 14% YoY through the first nine months of 2023 |

| EV sales | 44% unit growth and 26% sales growth in Q3 2023 |

What You'll Learn

Ford's share price has risen 25% in the past couple of months

Ford Motor Company (NYSE: F) has seen its share price rise by 25% in the past couple of months. This is good news for shareholders, but the stock has traded much higher in the past year.

Ford's share price is currently undervalued, trading at US$12.14 on the share market, while its intrinsic value is $16.45. This presents an opportunity for investors to buy the stock at a bargain price. However, due to the volatility of Ford's share price, there is also a risk that the price could sink lower, providing another chance to buy in the future.

Ford's future outlook is positive, with expected earnings growth in the teens in the upcoming years, indicating a solid future ahead and robust cash flows. This should lead to a higher share value over time.

Despite facing challenges such as labour strikes, macro headwinds, and weaker-than-anticipated demand for its electric vehicle (EV) segment, Ford has several pros that make it an attractive investment option. The company has a long history of treating its employees fairly and providing attractive dividends to shareholders. Ford also has a popular product in the F-series pickup truck and is a leader in the mass-market automotive space.

However, there are also cons to consider before investing in Ford. The company has struggled to adapt to a changing automotive landscape, with a particular focus on its EV ambitions. Ford's EV battery technology is believed to lag behind competitors, and the company has delayed $12 billion in EV-related investments, which could cause it to fall behind in EV development. Additionally, Ford's operations require heavy capital investments, which can be a concern during inflationary periods.

In summary, while Ford Motor Company's share price has risen sharply in the past couple of months, it is still undervalued and presents a potential buying opportunity for investors. However, the company faces challenges in adapting to industry changes and keeping up with competitors in the EV space.

BlackRock: Investors' Choice

You may want to see also

Ford's stock is undervalued

Ford Motor Company (NYSE:F) is a popular automotive stock that has been undervalued by the market. Here are some reasons why Ford's stock is a good investment opportunity and why it is undervalued:

Strong Performance and Growth Trajectory

Despite facing supply chain issues and COVID-19 lockdowns, Ford has demonstrated robust performance and growth trajectory. In June 2022, Ford's US sales were up 31.5% year-over-year, outperforming the market. This strong performance extends beyond just one segment, with sales growth in their commercial vans, F-150 Lightning, and Lincoln SUV models.

Electric Vehicle (EV) Transition

Ford is well-positioned to benefit from the EV boom. Their EV versions of the iconic F-150 Lightning truck have received rave reviews, and Ford is ramping up production to meet strong demand. The F-150 Lightning has the potential to shift American preferences toward EVs and boost EV adoption rates in the US.

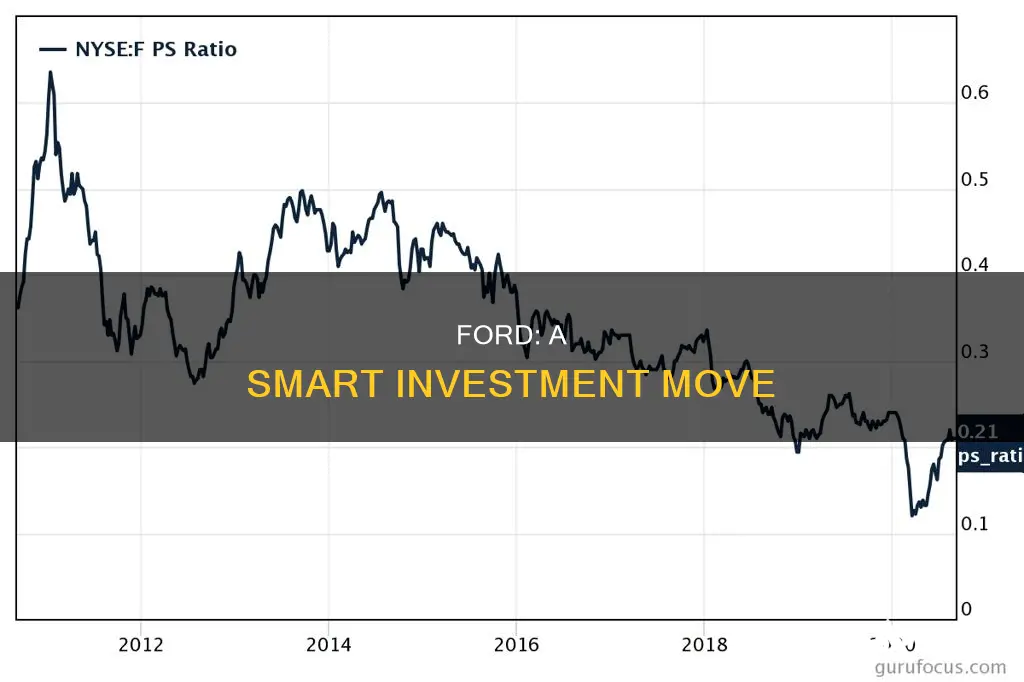

Undervalued by the Market

Ford's stock is currently undervalued by the market. Its share price of US$12.14 is lower than its intrinsic value of US$16.45, suggesting a potential buying opportunity. Additionally, Ford's P/E ratio of 3.93x is considered too low for a company with strong growth prospects in both its traditional and EV line-ups.

Dividend Yield and Financial Stability

Ford has a history of treating its shareholders well, with a forward dividend yield of 6.7%. The company has a stable financial position, with sufficient cash runway for more than three years based on current free cash flows. While Ford carries a high debt level of $135 billion, its high covered ratio of 5.7x indicates it is well-managed and not in financial distress.

Strong Brand and Economic Moat

Ford has a well-established brand and a clear economic moat defined by its long history of success and technological expertise. Some of its models, such as the F-150 and Mustang, have a loyal customer base. Additionally, Ford's ambitious goals toward the EV transition and its manufacturing, distribution, and marketing expertise further strengthen its position.

In summary, Ford Motor Company's stock is undervalued and presents a great investment opportunity. With its strong performance, EV transition prospects, undervalued share price, stable financials, and strong brand, Ford is positioned for substantial gains in the future.

Who Invests and Why?

You may want to see also

Ford's dividend yield is attractive

Ford Motor Company (NYSE: F) has a long history of paying dividends to its shareholders, dating back to at least 1972. The company's dividend yield, or the amount of annual dividend payments relative to its share price, is an attractive feature for potential investors.

As of July 2024, Ford's dividend yield stands at 6.01%, with a payout ratio of 41.27%. This means that the company is paying out $0.78 per share in annual dividends, which is well-covered by its earnings per share of $0.97. A payout ratio of less than 50% is generally considered sustainable and attractive to income-seeking investors.

In addition, Ford's dividend yield compares favourably to its forward P/E ratio, which is currently 6.1. This means that Ford's dividend yield is higher than what an investor would expect based on its share price and earnings multiple. This makes Ford a compelling investment choice for those seeking regular income from their investments.

However, it is important to note that Ford's dividend coverage has been a concern in the past. In 2018, for example, the company's free cash flow did not cover the dividend payout. As of 2024, Ford's payout ratio remains above 100%, which could be a cause for concern for potential investors.

While there are risks and challenges associated with investing in any company, Ford's dividend yield and history of dividend payments are attractive features that may entice income-seeking investors.

Food Startups: Invest in Your People

You may want to see also

Ford's EV (electric vehicle) ambitions

Ford Motor Company has been making significant strides in the electric vehicle (EV) market, demonstrating its commitment to innovation and sustainability. Here are some key aspects of Ford's EV ambitions:

- Electric Vehicle Strategy: Ford has recognised the importance of the electric era and is implementing a comprehensive plan to facilitate the transition to electric vehicles for both individual consumers and commercial fleets. The company is investing $22 billion in electrification through 2025, reflecting its ambition to lead the electrification trend.

- Iconic Product Electrification: Ford is electrifying some of its most iconic products, including the Mustang, F-150, and Transit. The all-electric Mustang Mach-E SUV, offering both performance and technological advancements, is already being delivered to customers. The F-150 Lightning, an innovative electric version of America's best-selling truck, will be released in spring 2022.

- Commercial Focus: A key part of Ford's EV strategy is targeting the large market for fully electric commercial vans and pickups. The company aims to make electric vehicles more accessible to these customers by offering improved productivity, lower ownership costs, and an affordable price point.

- Charging Infrastructure: Ford understands the importance of convenient charging options for EV owners. In North America, the company boasts the largest public charging network, with over 63,000 charging plugs and growing. Ford also offers a range of home charging solutions, ensuring that customers have easy access to charging their vehicles.

- Global Manufacturing Footprint: Ford's electric vehicle manufacturing presence extends worldwide, including four plants in North America alone. The company is investing $700 million in the Rouge Electric Vehicle Center in Michigan, creating 500 new jobs and employing advanced sustainable manufacturing technology to build the F-150 Lightning and F-150 PowerBoost Hybrid.

- Battery Technology Investments: Ford is committed to accelerating research and development in battery technology. The company has established the Ford Ion Park global battery center in Michigan to pilot new manufacturing techniques and scale breakthrough battery cell designs. Ford has also increased its investment in Solid Power, a producer of all-solid-state batteries, which promise longer-range and lower-cost electric vehicles.

- Chief Executive Ambition: Ford's leadership has set a bold ambition to be number one in electric vehicles. This indicates a strong commitment from the top, positioning the company to compete in the rapidly growing EV market and potentially capture a significant share.

While Ford's EV ambitions are impressive, it's important to recognise that the company faces challenges, including the impact of labour strikes, macro headwinds, and competition from rivals in the EV space. However, with its iconic brands, global manufacturing presence, and focus on battery technology, Ford is positioning itself to be a significant player in the electric vehicle revolution.

Investments: Vanguard's Guide to Choosing Wisely

You may want to see also

Ford's stock is a strong buy candidate

Ford Stock: A Strong Buy Candidate

Overview

Ford Motor Company (NYSE: F) has been a household name in the automotive industry for decades, but is it a good investment? In this analysis, we will explore why Ford's stock is a strong buy candidate and present the bullish case for investors considering adding it to their portfolio.

Recent Performance

Ford's stock has seen a significant rise in the past couple of months, trading 25% higher. While the share price is still below its year-ago level, the recent momentum is a positive sign for investors. The stock is currently trading at around $12-13, presenting a potential buying opportunity.

Valuation and Intrinsic Value

Ford's current market price is lower than its intrinsic value, which is estimated to be around $16.45. This indicates that the stock may be undervalued, and investors could potentially see capital appreciation if the market corrects and the stock price moves closer to its intrinsic value.

Growth Prospects

Ford is expected to deliver solid earnings growth in the teens in the upcoming years, outpacing many of its rivals. This robust future outlook, combined with its low share price, makes Ford an attractive investment opportunity. The company's electric vehicle (EV) segment, Model e, also shows promise with recent revenue growth of 26%.

Dividend Yield

Ford has a history of treating its shareholders well. Since June 1972, shareholders have seen a return of 31 times their initial investment. The company offers an impressive dividend yield of 6.7%, which is higher than its forward P/E ratio, making it one of the few stocks with such compelling qualities.

Technical Analysis

From a technical perspective, Ford's stock holds several positive signals. It has buy signals from both short and long-term moving averages, indicating a positive forecast. The stock is also considered a potential runner, as it is turning up in the middle of a horizontal trend.

Ford Motor Company's stock exhibits strong buy signals based on its valuation, growth prospects, dividend yield, and technical analysis. While there are challenges and risks associated with the automotive industry, the current data suggests that Ford is a strong buy candidate for investors.

Smart Investment Vehicle Choices

You may want to see also

Frequently asked questions

Ford has been making strides in the electric vehicle (EV) market, with sales driven largely by their electric vehicle range, which saw an increase of 74% year on year. Their sales in China have also been impressive, with total sales up more than 70% and the company on track for five consecutive quarters of growth in the region.

Ford has committed to spending at least $30 billion on EVs by 2025, up from $22 billion in its most recent forecast. They are also boosting their commercial vehicle business under a new sub-brand, "Ford Pro", and working to bring new products and services (including software) to their commercial and government fleet customers.

Ford's stock performance has been underwhelming in recent years. Analysts expect 2020 revenues to fall 0.9%, which is worse than their competitors General Motors Co. and Fiat Chrysler. There are also concerns about their EV battery technology lagging behind competitors like Tesla.