Target-date funds are a popular investment choice for those saving for retirement. They are designed to simplify the process of investing for retirement by automatically rebalancing and optimising asset allocation. The funds are named according to their target retirement year, and they gradually shift from riskier investments, such as stocks, to more conservative investments, such as bonds and cash, as the target date approaches. While target-date funds offer a convenient, hands-off approach to investing, there are some potential drawbacks to consider. In this article, we will explore the pros and cons of target-date funds and discuss whether they are a good choice for your investment portfolio.

| Characteristics | Values |

|---|---|

| Purpose | Retirement savings |

| Main Advantage | Simplicity |

| Other Advantages | Easy diversification, automatic rebalancing, good for young workers |

| Main Disadvantage | May be too conservative |

| Other Disadvantages | High fees, limited investment choices, no guaranteed earnings |

What You'll Learn

- Target-date funds are a set it and forget it option, removing the need to monitor and adjust your portfolio

- They automatically rebalance your portfolio, reducing the risk as you near retirement

- Target-date funds are a default option for many employer-backed retirement plans, such as 401(k) accounts

- They are a good option for those who want a hands-off approach to retirement investing

- Target-date funds are not bespoke, but they offer inexpensive, reasonable investment advice

Target-date funds are a set it and forget it option, removing the need to monitor and adjust your portfolio

Target-date funds are a "set it and forget it" option for investors. They are designed to be a low-maintenance investment strategy, removing the need to monitor and adjust your portfolio regularly.

These funds are built to simplify the process of investing for retirement. They are a one-stop investment shop with a diversified set of asset classes. With a target-date fund, investors pick the year they think they’ll need to access the funds, and the fund management company handles the rest.

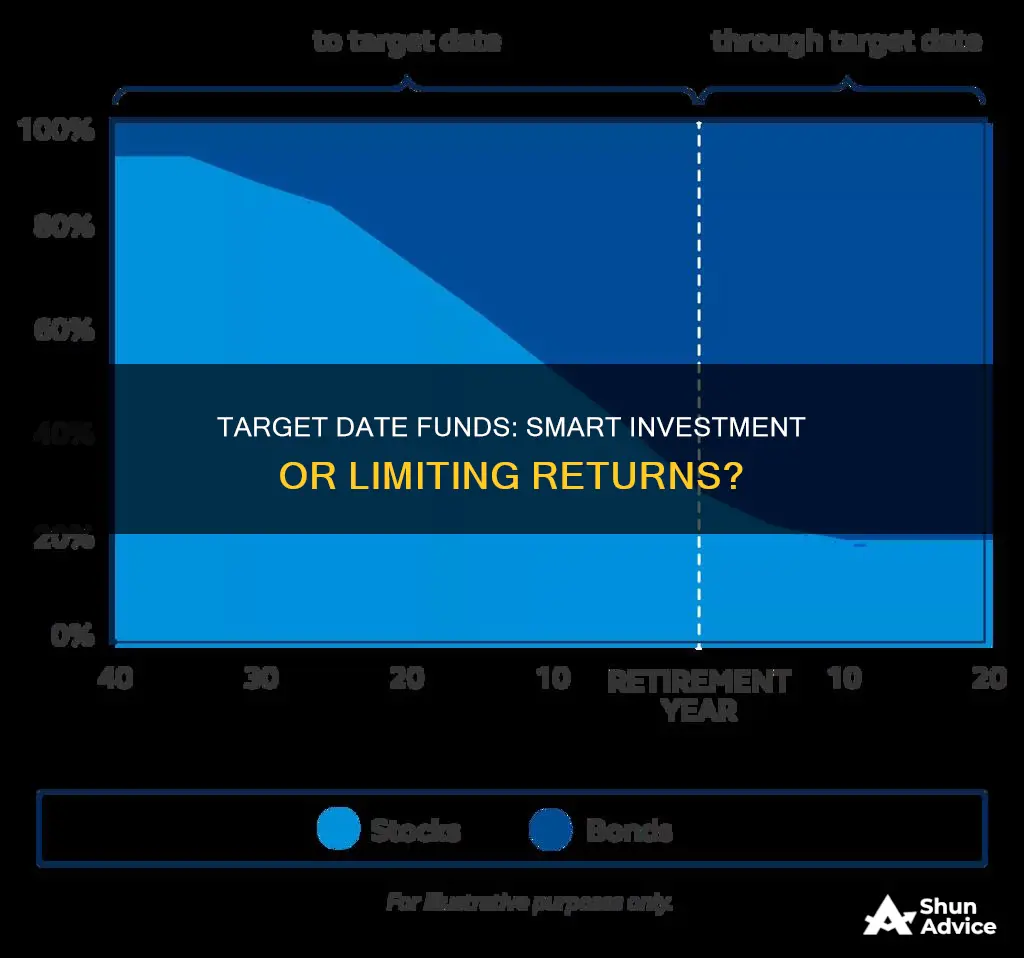

Target-date funds are a type of mutual fund or exchange-traded fund that automatically rebalances and reallocates assets as you get closer to retirement. They typically shift from riskier investments, such as stocks, to more conservative investments, such as bonds and cash. This shift is gradual and follows a "glide path", which is designed to ease the investor towards a safe financial destination at retirement.

The appeal of target-date funds lies in their simplicity and convenience. They are a good option for those who want a hands-off approach to their retirement investments and don't want to be actively involved in investment choices. These funds are also beneficial for those who are new to investing and may not have the knowledge to make informed choices.

While target-date funds offer a straightforward and stress-free investment strategy, it is important to remember that they are not a completely "forget it" option. Experts advise reviewing your fund's performance annually to ensure it still aligns with your goals and risk tolerance. Additionally, it is crucial to consider the fees associated with these funds and compare them with other investment options.

Norway Oil Fund: A Guide to Investing Wisely

You may want to see also

They automatically rebalance your portfolio, reducing the risk as you near retirement

Target-date funds are designed to automatically rebalance your portfolio as you near retirement, reducing the risk of your investments. This is achieved by gradually shifting the majority of assets from riskier investments, such as stocks, to more conservative investments, such as bonds and cash. This process is known as a "glide path", and it ensures that your portfolio becomes more conservative over time, preserving your wealth as you approach retirement.

The benefit of this automatic rebalancing is that it relieves you of the stress and hassle of constantly monitoring and adjusting your portfolio. The target-date fund will make your portfolio more conservative as you approach your target retirement date, helping to ensure that your money is there when you need it. This feature is especially useful for investors who want a hands-off approach to their retirement investments or those who are not well-versed in the intricacies of investing.

Additionally, target-date funds offer cost-effective advice by providing investors with a low-cost element of advice. The fees associated with target-date funds have been decreasing over time, making them a more attractive option for investors. According to Morningstar, the average asset-weighted fee for target-date funds was 0.32% in 2022, down from 0.46% in 2017.

While target-date funds offer many benefits, it is important to remember that they may not be suitable for everyone. Some critics argue that they are "one-size-fits-none" and can be too conservative near the retirement date. It is crucial to carefully consider your investment goals, risk tolerance, and other factors before deciding to invest in target-date funds.

Mutual Fund SIP: A Guide to Getting Started

You may want to see also

Target-date funds are a default option for many employer-backed retirement plans, such as 401(k) accounts

Target-date funds are a type of mutual fund (or exchange-traded fund) that gradually rebalances and reallocates assets as you get closer to retirement. They are named according to their target retirement year, for example, "2050 Fund". You pick a fund with a target year closest to your planned retirement year, and the fund promises to rebalance its investments accordingly.

The chief appeal of target-date funds is their simplicity. They offer investors a well-balanced mix of stocks and bonds, with an asset allocation that automatically rebalances towards more conservative investments as the investor ages. This is called a "glide path".

Target-date funds are popular because they simplify the process of building a well-diversified portfolio. They are also a good option for those who want to take a hands-off approach to their retirement investments.

However, target-date funds do have some disadvantages. They may be too conservative, especially for those who plan to work beyond the retirement age. Additionally, fund expenses can add up, and there are no guaranteed earnings. It is important to compare the fees and strategies of different funds before selecting one.

Setting Up an Investment Fund: Hong Kong Guide

You may want to see also

They are a good option for those who want a hands-off approach to retirement investing

Target-date funds are a good option for those who want a hands-off approach to retirement investing. They are designed to be a "set it and forget it" investment option, where investors pick the year they think they'll need to access the funds, and then the fund management company handles the rest. This type of fund works best for those who can estimate their retirement age and year.

Target-date funds offer a passively indexed portfolio that automatically rebalances based on an investor's time until retirement. The fund's holdings periodically adjust to reflect the investor's risk tolerance over time. This means that as investors age, their portfolios will typically shift from riskier investments, such as stocks, to more conservative investments, such as bonds and cash. This is known as a glide path.

The chief advantage of target-date funds is their simplicity. They take the stress and complexity out of retirement investing by handling the challenging task of optimising asset allocation and rebalancing investments. This makes them particularly appealing to those who want a hands-off approach.

Target-date funds are also popular due to their low fees. In 2022, the average asset-weighted fee for target-date funds was just 0.32%, down from 0.46% five years earlier and half of what it was in 2009. This makes them a cost-effective way to get investment advice.

Finally, target-date funds are associated with good outcomes for their investors. Research has shown that they have helped ensure that investors who have purchased them have enjoyed a healthy share of their funds' returns. This is likely because investors are less inclined to be bothered by dramatic performance gyrations that stand-alone equity funds can experience, and so they stay put.

Diversifying 401k: One Fund or Many?

You may want to see also

Target-date funds are not bespoke, but they offer inexpensive, reasonable investment advice

Target-date funds are a popular choice for investors saving for retirement. They are designed to help manage investment risk and create a passively indexed portfolio that automatically rebalances based on an investor's time until retirement.

These funds are not tailored to individual investors, but they do offer inexpensive, reasonable investment advice. They are a "set it and forget it" investment option, which means investors can put their investing activities on autopilot. This is a significant advantage for those who want a hands-off approach to their retirement investments.

Target-date funds are also convenient and simple. They are a one-stop investment shop with a diversified set of asset classes. They remove the headache of deciding on a mix of assets and rebalancing those investments over time. They also handle the challenging task of optimising your asset allocation.

The funds are designed to be well-balanced and are instantly accessible to investors. They are a good default option for new investors, especially those who are just starting out and may not have the time or knowledge to make investment decisions.

However, target-date funds are not without their drawbacks. They may be too conservative and limit investment choices and decisions. They are also not tailored to individual investors and their specific needs and goals. While they are inexpensive, fees can add up over time, and there is no guarantee of earnings.

Senior Living Fund: A Smart Investment for Your Future

You may want to see also

Frequently asked questions

A target date fund is a mutual fund (or exchange-traded fund) that automatically rebalances and reallocates assets as you get closer to retirement. Typically, it shifts the majority of assets from riskier investments, such as stocks, to more conservative investments, such as bonds and cash.

Target date funds offer a simple, "set it and forget it" approach to investing for retirement. They automatically adjust your asset allocation over time, reducing the need for constant monitoring and adjustments. They can also provide diversification and improve investment returns.

Target date funds may have higher fees compared to individual index funds, and they may become too conservative too quickly, reducing your potential returns. Additionally, they may not be tailored to your specific financial situation and goals.

When choosing a target date fund, consider the fund's fees, investment strategy, and asset allocation to ensure it aligns with your risk tolerance and investment goals. Compare different funds with similar target dates to find the one that best matches your needs.

It is generally recommended to make a target date fund your only investment in a 401(k) or similar retirement plan. However, you can choose to invest a portion of your retirement savings in a target date fund while actively managing other types of investments with the help of a financial advisor.