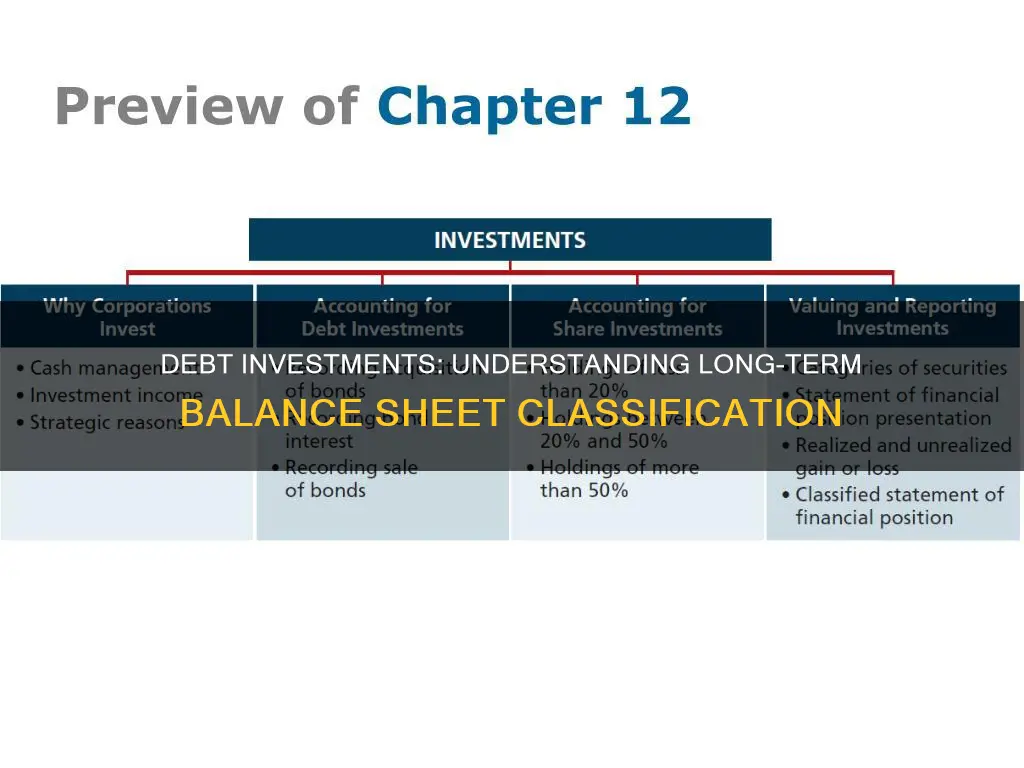

Debt investments are a crucial component of many financial portfolios, and their classification as long-term assets on a balance sheet is a topic of significant interest for investors and financial analysts. This classification is essential for understanding the financial health and investment strategy of a company. Long-term debt investments are typically those that mature or are expected to be sold after one year, and they play a vital role in diversifying investment portfolios. The classification of these investments is a critical aspect of financial reporting, as it impacts the accuracy of financial statements and the assessment of a company's liquidity and solvency. Understanding the criteria and implications of this classification is essential for making informed investment decisions and evaluating the financial stability of an organization.

What You'll Learn

- Debt vs. Equity: Distinguish between debt and equity investments for balance sheet classification

- Maturity Dates: Consider the timing of debt investments' maturity to determine long-term status

- Interest Payments: Analyze the frequency and amount of interest payments to assess investment nature

- Liquidity: Evaluate the ease of converting debt investments into cash within a reasonable timeframe

- Credit Risk: Assess the creditworthiness of the issuer to determine the investment's long-term classification

Debt vs. Equity: Distinguish between debt and equity investments for balance sheet classification

When it comes to classifying investments on a company's balance sheet, understanding the distinction between debt and equity is crucial. Debt investments and equity investments represent different financial relationships and have distinct implications for a company's financial health and operations.

Debt investments, also known as debt securities, are essentially loans made by investors to a company. These investments are typically classified as long-term assets on the balance sheet. When a company issues debt, it is essentially borrowing money from investors, promising to repay the principal amount along with interest over a specified period. This classification is important because it indicates the company's obligation to service the debt, which can impact its financial stability and cash flow. Long-term debt investments are a key component of a company's liabilities and are often used to finance various business activities, such as expansion projects or the purchase of assets.

Equity investments, on the other hand, represent ownership in a company. When an investor purchases equity, they are essentially buying a portion of the company's ownership, which is reflected as an investment in the company's equity. This type of investment is not a loan but rather a claim on the company's assets and earnings. Equity investments are typically classified as part of the company's shareholders' equity on the balance sheet. This classification signifies that the investors have a right to a portion of the company's profits and assets.

The key difference lies in the nature of the investment and the associated risks and returns. Debt investments carry a higher risk for the company, as they must be repaid with interest, which can impact their cash flow and financial flexibility. Equity investments, while providing ownership benefits, do not carry the same immediate financial obligation. Investors in equity have a claim on the company's profits and assets but do not expect repayment in the same way as debt investors.

In summary, the classification of debt and equity investments on a balance sheet is essential for understanding a company's financial structure and obligations. Debt investments are long-term liabilities, indicating borrowing and repayment obligations, while equity investments represent ownership and a claim on the company's assets and earnings. This distinction is vital for investors, creditors, and management to assess the financial health and risk profile of a company.

Coca-Cola's Long-Term Investment Potential: A Smart Choice?

You may want to see also

Maturity Dates: Consider the timing of debt investments' maturity to determine long-term status

When evaluating whether debt investments should be classified as long-term on a balance sheet, the maturity dates of these investments play a crucial role. The maturity date is the specific date when the principal amount of a debt investment is due to be repaid. This date is a critical factor in determining the investment's classification as either a current or long-term asset.

Debt investments with maturity dates within one year from the balance sheet date are typically classified as current assets. This classification is based on the principle of liquidity, where assets that can be readily converted into cash within a short period are considered more liquid. For example, if a company holds a bond with a maturity date of six months, it is generally classified as a current asset because the investment can be sold and the cash received within that timeframe.

On the other hand, debt investments with maturity dates beyond one year from the balance sheet date are generally classified as long-term investments. This classification reflects the longer-term nature of these investments, as they are not expected to be converted into cash in the near future. For instance, if a company purchases a bond with a maturity date of three years, it would be categorized as a long-term investment, indicating a longer-term commitment of funds.

The timing of maturity dates is essential for financial reporting and analysis. Investors and creditors rely on accurate classification to assess a company's financial health and liquidity. Misclassification of debt investments can lead to misleading financial statements, affecting investment decisions and credit assessments. Therefore, it is crucial for companies to carefully consider the maturity dates of their debt investments when determining their long-term status on the balance sheet.

In summary, the maturity dates of debt investments are a key determinant of their long-term classification on a balance sheet. Debt investments with short-term maturity dates are considered current assets, while those with longer maturity dates are classified as long-term investments. This classification is vital for maintaining accurate financial reporting and providing stakeholders with a clear understanding of a company's financial commitments.

Maximizing Short-Term Dividend Strategies: Unlocking Investment Potential

You may want to see also

Interest Payments: Analyze the frequency and amount of interest payments to assess investment nature

When evaluating debt investments for their long-term balance sheet classification, understanding the nature of interest payments is crucial. Interest payments provide valuable insights into the investment's characteristics and its potential impact on financial statements. Here's a detailed analysis of how to approach this:

Frequency of Interest Payments: The first step is to determine how often interest is paid. Debt investments typically generate interest payments at regular intervals, such as annually, semi-annually, quarterly, or monthly. For example, a bond might have semi-annual interest payments, meaning investors receive interest every six months. This frequency is essential because it indicates the investment's liquidity and the cash flow it provides. Regular interest payments suggest a more stable and predictable investment, which is often associated with long-term holdings.

Amount of Interest Payments: Analyzing the magnitude of interest payments is equally important. The amount paid can vary depending on the investment's face value, interest rate, and the time remaining until maturity. For instance, a bond with a higher face value and a longer maturity period will likely have substantial interest payments, especially if the interest rate is fixed. These large payments can significantly impact an investor's cash flow and overall investment strategy. Investors should compare the interest earned from different debt investments to make informed decisions, especially when considering tax implications and the potential for reinvestment.

To assess the investment's nature, one should consider the following: If the interest payments are substantial and consistent, it may indicate a secure and stable investment, often classified as a long-term asset. Conversely, smaller or infrequent interest payments might suggest a more volatile investment, potentially treated as a short-term asset. This analysis is particularly relevant for financial reporting, as it helps in accurately categorizing debt investments on the balance sheet.

Additionally, investors should be aware of any variable interest rates, as these can lead to fluctuations in interest payments over time. This volatility might require more frequent re-evaluation of the investment's classification and its impact on financial statements. By carefully examining the frequency and amount of interest payments, investors can make more informed decisions regarding the long-term classification of their debt investments.

Maximize Your Long-Term Investing: A Guide to Smart Strategies on Robinhood

You may want to see also

Liquidity: Evaluate the ease of converting debt investments into cash within a reasonable timeframe

When assessing the liquidity of debt investments, it is crucial to understand the concept of converting these investments into cash within a reasonable period. Liquidity is a critical factor in evaluating the risk associated with an investment, especially in the context of balance sheet classification. Debt investments, such as bonds or debt securities, are typically considered long-term assets on a company's balance sheet. However, the liquidity of these investments can vary significantly.

The ease of converting debt investments into cash is primarily determined by the terms and conditions of the investment itself. For instance, short-term debt investments with maturity dates within a year are generally considered more liquid compared to long-term bonds with maturity dates in several years. This is because short-term investments provide a quicker return on investment and are less exposed to potential market fluctuations. Investors can sell these short-term debt securities without incurring significant losses, making them more accessible and liquid.

In contrast, long-term debt investments may have longer maturity periods, making them less liquid. These investments often carry higher interest rates and are less flexible in terms of selling without incurring penalties or significant losses. Investors might face challenges in finding buyers willing to purchase these long-term bonds at a fair price, especially in a volatile market. As a result, the conversion of long-term debt investments into cash can be more complex and time-consuming.

To evaluate liquidity, investors and analysts should consider factors such as the investment's maturity date, market demand, and the company's financial health. A company with a strong financial position and a history of timely debt repayments may have more liquid debt investments. This is because such companies often have better access to credit markets and can attract investors seeking secure and liquid assets.

In summary, liquidity is a critical aspect of debt investments, especially when determining their long-term balance sheet classification. Investors should carefully analyze the terms, maturity dates, and market conditions to assess the ease of converting these investments into cash. Understanding liquidity helps in making informed decisions regarding investment strategies and risk management.

Understanding Enterprise Value: Short-Term Investments and Their Impact

You may want to see also

Credit Risk: Assess the creditworthiness of the issuer to determine the investment's long-term classification

When evaluating the credit risk associated with debt investments, assessing the creditworthiness of the issuer is a critical step in determining their long-term classification. This process involves a comprehensive analysis of the issuer's financial health, reputation, and ability to meet their financial obligations. Here's a detailed breakdown of how to approach this assessment:

Financial Analysis: Begin by examining the issuer's financial statements, including the balance sheet, income statement, and cash flow statement. Look for key financial ratios such as debt-to-equity, current ratio, and quick ratio. These ratios provide insights into the issuer's financial leverage, liquidity, and ability to cover short-term obligations. A higher debt-to-equity ratio, for instance, may indicate increased financial risk, while a strong current ratio suggests the issuer can meet its short-term liabilities comfortably.

Credit Ratings and Assessments: Utilize credit rating agencies and financial analysts' assessments to gauge the issuer's creditworthiness. These ratings provide an independent evaluation of the issuer's ability to repay debt. Standard & Poor's, Moody's, and Fitch are well-known credit rating agencies that assign ratings such as AAA, AA, A, BBB, etc. Higher ratings generally indicate a lower credit risk. However, it's essential to consider the specific rating agency's methodology and the context of the issuer's industry and market position.

Industry and Market Position: Consider the issuer's industry and market standing. Is the issuer a market leader or a smaller player? Larger, more established companies often have better access to capital markets and may have more resources to manage financial risks. Assess the stability and growth prospects of the industry in which the issuer operates, as this can impact their financial health and ability to meet debt obligations.

Management and Business Strategy: Evaluate the issuer's management team and their strategic decisions. A competent and experienced management team can make informed choices to mitigate financial risks. Analyze their business strategies, including expansion plans, diversification efforts, and their ability to adapt to market changes. A well-defined and executed business strategy can contribute to the issuer's long-term financial stability.

Historical Performance and Track Record: Review the issuer's historical financial performance and track record. Assess their consistency in meeting financial obligations and paying interest and principal on time. A consistent payment history and a strong track record of financial management can enhance the issuer's creditworthiness.

By thoroughly assessing the creditworthiness of the issuer, investors can make informed decisions regarding the long-term classification of debt investments. This process ensures that investments are aligned with the risk appetite of the investor and provides a more accurate representation of the financial health of the debt instrument.

Axie Infinity: A Long-Term Investment Strategy?

You may want to see also

Frequently asked questions

Debt investments, also known as fixed-income securities, are financial assets that represent a loan made by an investor to a borrower, typically a government, municipality, or corporation. These investments are classified as long-term assets on a company's balance sheet and are considered a form of debt financing.

In accounting, debt investments are classified as "Available-for-Sale" (AFS) or "Held to Maturity" (HTM). AFS investments are those that the company intends to hold and sell in the near future, while HTM investments are expected to be held until maturity. Both categories are considered long-term assets.

The primary difference lies in the company's intention and ability to sell the investment before maturity. Held to Maturity investments are expected to be held until maturity, and any changes in value are not recognized in profit or loss but are reported in other comprehensive income. In contrast, Available-for-Sale investments can be sold at any time, and any unrealized gains or losses are recognized in profit or loss.

The classification of debt investments as HTM or AFS has significant implications for financial reporting. HTM investments provide a stable source of income through interest payments, which are recognized in the income statement. AFS investments, on the other hand, can result in fluctuations in the balance sheet due to market value adjustments, which are reported in other comprehensive income.

Yes, the classification of debt investments as long-term is based on certain criteria. Investments are typically classified as long-term if they have a maturity date beyond one year or if the company has no current intention to sell them. This classification is essential for providing a clear picture of a company's financial position and liquidity.