Coca-Cola, a global beverage giant, has been a household name for over a century, but is it a wise long-term investment? This question delves into the company's financial health, market position, and potential for sustained growth. Despite its brand recognition and global presence, investors must consider various factors, including changing consumer preferences, competitive landscape, and economic trends, to determine if investing in Coca-Cola is a sound decision for the future.

What You'll Learn

- Financial Performance: Coca-Cola's consistent revenue growth and market share indicate long-term financial stability

- Brand Value: Strong brand recognition and loyalty provide a competitive edge, enhancing long-term investment appeal

- Global Expansion: Coca-Cola's global presence and expansion strategies offer diversification and long-term growth potential

- Innovation and Product Portfolio: Continuous innovation in products and marketing strategies drives long-term market relevance

- Sustainability and Corporate Responsibility: Coca-Cola's commitment to sustainability and social responsibility enhances its long-term brand image

Financial Performance: Coca-Cola's consistent revenue growth and market share indicate long-term financial stability

Coca-Cola, a global beverage giant, has demonstrated remarkable financial performance over the years, making it an attractive long-term investment opportunity. The company's consistent revenue growth and market share gains are key indicators of its financial stability and resilience in a highly competitive industry.

One of the primary reasons for Coca-Cola's success is its ability to innovate and adapt to changing consumer preferences. The company has successfully expanded its product portfolio beyond its iconic soft drinks, introducing new beverage options to cater to health-conscious consumers. By diversifying its offerings, Coca-Cola has been able to maintain its market leadership while also capturing new market segments. For instance, the introduction of low-calorie and sugar-free alternatives, such as Coca-Cola Life and Diet Coke, has appealed to health-conscious consumers without compromising the brand's reputation. This strategic move has not only boosted sales but also positioned Coca-Cola as a forward-thinking and adaptable company.

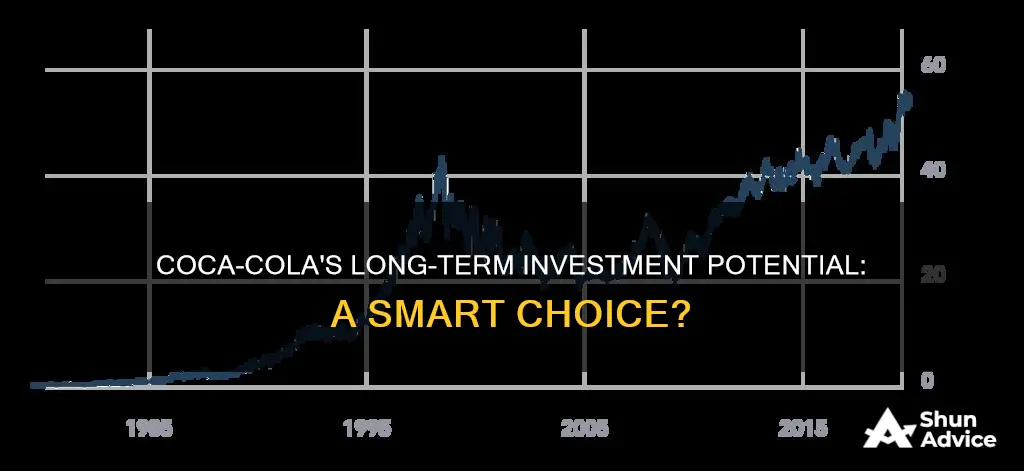

In terms of revenue growth, Coca-Cola has consistently outperformed industry averages. The company's annual revenue has shown steady growth over the past decade, with a compound annual growth rate (CAGR) of approximately 4%. This impressive growth rate can be attributed to several factors. Firstly, Coca-Cola's strong brand presence and global distribution network provide a solid foundation for revenue generation. The company's brand recognition is unparalleled, with Coca-Cola being one of the most valuable brands worldwide. This brand power allows Coca-Cola to command premium prices and maintain a loyal customer base. Secondly, strategic marketing campaigns and effective advertising have played a crucial role in driving sales. Coca-Cola's marketing team has consistently delivered innovative and engaging campaigns that resonate with consumers, ensuring that the brand remains top of mind.

Moreover, Coca-Cola's focus on market share expansion has been a significant contributor to its financial success. The company has consistently targeted new markets and demographics, ensuring that its growth is not limited to a few regions or consumer groups. By expanding its distribution channels and introducing localized products, Coca-Cola has been able to tap into untapped markets, resulting in increased market share. This strategic approach has allowed the company to diversify its revenue streams and reduce reliance on a single market, making it more resilient to economic fluctuations.

In conclusion, Coca-Cola's consistent revenue growth and market share gains are strong indicators of its long-term financial stability. The company's ability to innovate, adapt to changing consumer trends, and maintain a strong brand presence has positioned it as a market leader. With a diverse product portfolio, effective marketing strategies, and a global distribution network, Coca-Cola is well-equipped to continue its financial success and provide investors with a smart long-term investment opportunity. As the company continues to navigate the dynamic beverage industry, its financial performance is likely to remain robust, making it a compelling choice for investors seeking stability and growth.

Unraveling Intangible Assets: Are Long-Term Investments a Wise Choice?

You may want to see also

Brand Value: Strong brand recognition and loyalty provide a competitive edge, enhancing long-term investment appeal

Coca-Cola, a household name and one of the most recognizable brands globally, has built an incredibly strong brand value over the years. This brand recognition and loyalty are significant assets that contribute to the company's long-term investment appeal. Here's how:

Market Leadership and Competitive Advantage: Coca-Cola's brand value is a powerful tool that sets it apart from its competitors. The brand's strong presence in the market and high customer loyalty create a competitive edge. Consumers worldwide trust the Coca-Cola name, ensuring a consistent demand for its products. This loyalty is especially valuable in a highly competitive beverage industry, where consumer preferences can shift rapidly. By maintaining a strong brand image, Coca-Cola can influence consumer choices and stay ahead of the competition.

Long-Term Brand Equity: Brand recognition provides a solid foundation for long-term investments. When a brand is well-established and trusted, it becomes an asset that can generate value over time. Coca-Cola's brand equity allows the company to command premium pricing, attract new customers, and maintain a loyal customer base. This equity is particularly important in the beverage industry, where product differentiation can be challenging. A strong brand ensures that Coca-Cola can adapt to changing market trends and consumer preferences while maintaining its market position.

Customer Loyalty and Engagement: Loyalty programs and customer engagement strategies further enhance the brand's value. Coca-Cola has successfully implemented various initiatives to build and maintain customer relationships. These programs encourage repeat purchases and create a sense of exclusivity and community among consumers. By fostering loyalty, the company ensures a steady stream of revenue and a dedicated fan base, which is crucial for long-term growth and stability.

Global Reach and Expansion Opportunities: The brand's global presence opens doors to expansion and diversification. Coca-Cola's international recognition allows the company to enter new markets and diversify its product offerings. This global reach provides opportunities for growth and market share expansion, especially in regions with high consumer demand. As the brand continues to adapt to local tastes and cultural preferences, it can further solidify its long-term investment potential.

In summary, Coca-Cola's strong brand recognition and loyalty are significant advantages in the beverage industry. These factors contribute to the company's ability to maintain a competitive edge, adapt to market changes, and generate long-term value. For investors, Coca-Cola's brand equity and global presence make it an attractive prospect, offering stability and growth potential in a dynamic market.

Unlocking Long-Term Wealth: The Power of Share Investing

You may want to see also

Global Expansion: Coca-Cola's global presence and expansion strategies offer diversification and long-term growth potential

Coca-Cola, a global icon and one of the most recognizable brands worldwide, has a long history of expansion and diversification, which has significantly contributed to its long-term success and investment appeal. The company's global presence and strategic expansion initiatives have played a pivotal role in its ability to navigate market dynamics and maintain a strong position in the highly competitive beverage industry.

The company's global expansion strategy is multifaceted and centered around several key principles. Firstly, Coca-Cola aims to capitalize on its brand power and equity by leveraging its iconic status in numerous markets. By utilizing its brand recognition, the company can introduce new products and enter new territories with a strong foundation, ensuring a faster and more effective market penetration. This approach has been particularly successful in emerging markets where brand awareness is often lower, allowing Coca-Cola to establish a strong local presence.

Secondly, Coca-Cola's expansion involves a focus on localizing its products and marketing strategies to cater to diverse consumer preferences. The company has been investing in research and development to create region-specific product lines, ensuring cultural relevance and appeal. For instance, Coca-Cola has introduced unique flavors and variations in different markets, such as the popular Coca-Cola Life in Latin America and the Coca-Cola Zero Sugar in Europe, which have helped the company capture a broader consumer base. This localized approach not only increases market share but also fosters a deeper connection with consumers, leading to long-term loyalty.

Furthermore, Coca-Cola's global expansion is underpinned by a robust distribution network and strategic partnerships. The company has been investing in building and optimizing its supply chain infrastructure, ensuring efficient product delivery to consumers worldwide. By partnering with local distributors and retailers, Coca-Cola gains a deeper understanding of regional market dynamics and can adapt its strategies accordingly. These partnerships also enable the company to navigate local regulations and cultural nuances, which are essential for successful market entry and expansion.

The long-term growth potential of Coca-Cola's global expansion is evident through its ability to diversify revenue streams and reduce market concentration risk. By operating in numerous countries, the company can mitigate the impact of any single market's performance, ensuring a more stable and consistent financial outlook. Additionally, Coca-Cola's expansion into emerging markets provides opportunities for significant growth, as these regions often have a higher growth rate and a large, untapped consumer base. This diversification strategy not only enhances the company's resilience but also positions it to capitalize on future market trends and consumer behavior shifts.

In conclusion, Coca-Cola's global presence and expansion strategies are integral to its long-term investment appeal. The company's ability to leverage its brand power, localize its offerings, and establish robust distribution networks has led to successful market penetration and diversification. By continuing to invest in global expansion, Coca-Cola is well-positioned to sustain its growth trajectory, providing a smart long-term investment opportunity for shareholders and investors alike.

RMDs: Long-Term Investing's Hidden Costs and Benefits

You may want to see also

Innovation and Product Portfolio: Continuous innovation in products and marketing strategies drives long-term market relevance

Coca-Cola, a global beverage icon, has long understood that innovation is the cornerstone of its long-term success and market leadership. The company's commitment to continuous innovation in products and marketing strategies has been a key driver of its resilience and growth over the decades. This approach is particularly crucial in an ever-evolving market where consumer preferences and trends are in a constant state of flux.

In the realm of product innovation, Coca-Cola has consistently introduced new variations of its iconic cola while also expanding its portfolio to cater to a diverse range of consumer tastes and dietary needs. The introduction of Diet Coke and Coca-Cola Zero Sugar, for instance, addressed the growing demand for low-calorie and sugar-free alternatives without compromising the brand's core identity. Similarly, the company has launched innovative flavors like Coca-Cola Life, which combines the sweetness of sugar with the health benefits of stevia, thus appealing to health-conscious consumers. These strategic product innovations not only maintain Coca-Cola's relevance in the market but also provide a competitive edge by offering a comprehensive range of choices to consumers.

Marketing strategies have also played a pivotal role in Coca-Cola's long-term success. The company has consistently evolved its marketing approach to stay ahead of the curve. For instance, Coca-Cola's iconic brand image, built over decades, has been leveraged to create powerful and memorable campaigns that resonate with global audiences. The 'Share a Coke' campaign, which personalized the brand by printing popular names on bottles, was a brilliant example of this strategy, fostering a deeper connection with consumers. Additionally, Coca-Cola's collaborations with popular culture icons and its active presence in social media have helped maintain a strong brand presence and engage with a younger, more tech-savvy audience.

The continuous innovation in products and marketing has not only helped Coca-Cola adapt to changing market dynamics but has also contributed to its ability to anticipate and meet consumer needs. By staying ahead of trends and being responsive to market shifts, the company ensures that its products and campaigns remain fresh and relevant. This proactive approach is essential for maintaining a strong market position and driving long-term growth, especially in a highly competitive industry.

In conclusion, Coca-Cola's commitment to innovation in products and marketing strategies is a key factor in its long-term success and market leadership. This approach enables the company to stay connected with consumers, adapt to changing preferences, and maintain a competitive edge. As the beverage industry continues to evolve, Coca-Cola's ability to innovate will remain a critical aspect of its investment story, making it a smart long-term choice for investors seeking a resilient and adaptable brand.

Debt Investments: Short-Term Impact on Balance Sheet

You may want to see also

Sustainability and Corporate Responsibility: Coca-Cola's commitment to sustainability and social responsibility enhances its long-term brand image

Coca-Cola, one of the world's most recognizable brands, has made significant strides in sustainability and corporate responsibility, which has undoubtedly contributed to its long-term brand image and investment appeal. The company's commitment to these principles is multifaceted and has been a key strategy in maintaining its relevance and appeal to consumers, investors, and stakeholders.

In recent years, Coca-Cola has been actively addressing environmental concerns by implementing various initiatives. One of its primary focuses is reducing its environmental footprint. The company has set ambitious targets to achieve carbon neutrality across its value chain by 2040, which includes reducing greenhouse gas emissions, promoting recycling, and adopting more sustainable packaging solutions. For instance, Coca-Cola has been working on enhancing the recyclability of its packaging, such as introducing new bottle designs that are easier to recycle and reducing the use of virgin plastic. These efforts have not only aligned with global sustainability goals but have also resonated with environmentally conscious consumers, who increasingly value brands that demonstrate a commitment to eco-friendly practices.

Social responsibility is another critical aspect of Coca-Cola's long-term strategy. The company has been actively involved in community development, health, and wellness initiatives. For example, Coca-Cola has launched programs to improve access to clean water in underserved communities, which is a significant global issue. By addressing this basic human need, the company has not only contributed to social welfare but also built a positive brand association. Additionally, Coca-Cola has been promoting healthy lifestyles through its marketing campaigns and has committed to reducing the sugar content in its products, which is a response to growing health concerns related to sugary drinks. These social and health-focused initiatives have helped Coca-Cola build a more positive and responsible brand image.

Furthermore, Coca-Cola's sustainability and social responsibility efforts have been recognized and rewarded by investors. The company's commitment to these principles has been a key factor in attracting impact investors and those seeking long-term, sustainable investments. By integrating sustainability into its core business strategy, Coca-Cola has demonstrated its ability to adapt to changing market demands and consumer preferences, which is essential for long-term success and resilience. This approach has likely contributed to the company's financial stability and growth, making it an attractive investment opportunity.

In summary, Coca-Cola's dedication to sustainability and corporate responsibility is a strategic move that has significantly enhanced its brand image and long-term investment prospects. By addressing environmental and social issues, the company has not only contributed to global causes but has also built a more resilient and appealing brand. This commitment to sustainability and social responsibility is likely to continue driving Coca-Cola's success and making it a smart long-term investment for those seeking a socially and environmentally conscious portfolio.

Are NFTs a Long-Term Investment? Exploring the Future of Digital Art

You may want to see also

Frequently asked questions

Coca-Cola is a well-known and trusted brand with a long history of success. The company has a strong market position and a diverse product portfolio, which includes a wide range of beverages, including its iconic Coca-Cola brand. While the beverage industry can be competitive, Coca-Cola's brand recognition, global presence, and ability to innovate and adapt to changing consumer trends make it a relatively stable long-term investment. The company's consistent dividend payments and steady revenue growth over the years further support its stability.

Like any investment, there are risks involved. One significant risk is the highly competitive nature of the beverage industry. Coca-Cola faces competition from various local and international brands, and changing consumer preferences could impact its sales. Additionally, the company's reliance on sugar and other ingredients may raise health concerns, potentially affecting its market standing. Another risk is the economic and political climate, as Coca-Cola operates globally and is subject to the fluctuations of different markets.

Coca-Cola's financial performance has been strong, with consistent revenue growth and a solid market share. The company's global presence and diverse product range provide a competitive advantage. However, when compared to some of its direct competitors, such as PepsiCo or local craft beverage brands, Coca-Cola's market share and growth rate may vary. It's essential to analyze the company's financial reports and compare them with industry benchmarks to make an informed investment decision.